Mexico Animal Feed Market Size, Share, Trends and Forecast by Form, Animal Type, Ingredient, and Region, 2025-2033

Mexico Animal Feed Market Overview:

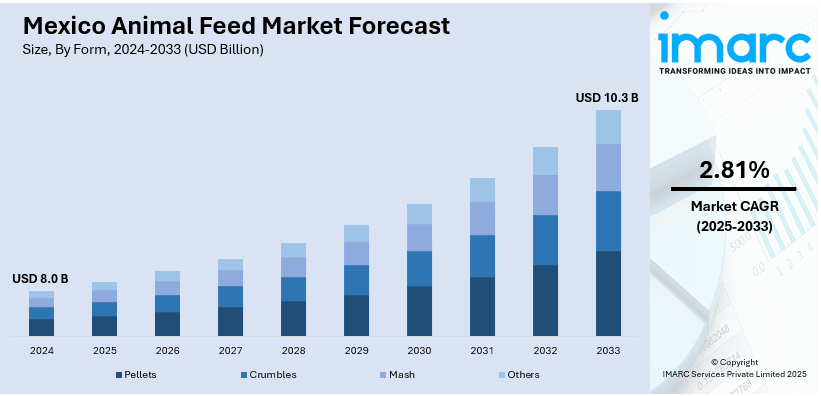

The Mexico animal feed market size reached USD 8.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 10.3 Billion by 2033, exhibiting a growth rate (CAGR) of 2.81% during 2025-2033. The market share is expanding, driven by the increasing poultry production, which is encouraging feed manufacturers to innovate and offer specialized solutions, along with the growing exports of animal products, creating the need for chemical-free feed options.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.0 Billion |

| Market Forecast in 2033 | USD 10.3 Billion |

| Market Growth Rate 2025-2033 | 2.81% |

Mexico Animal Feed Market Trends:

Increasing poultry production

The rising poultry production is fueling the Mexico animal feed market growth. According to the US Department of Agriculture, as of September 2024, Mexico ranked as the sixth biggest poultry producer and the fifth largest consumer in the world. As poultry farming expands, there is a greater need for high-quality animal feed to ensure enhanced productivity and disease prevention in birds. Feed plays a critical role in supporting the overall health of poultry, providing essential nutrients, such as proteins, vitamins, and minerals necessary for optimal development. This increase in poultry production is encouraging feed manufacturers to innovate and offer specialized feed solutions tailored to the specific needs of poultry like broiler feed, layer feed, and breeder feed. Additionally, the demand for sustainable and cost-effective feed is promoting the use of locally sourced ingredients, as well as the creation of alternative feed formulations that reduce reliance on imported raw materials. With more poultry farmers adopting advanced farming techniques to improve productivity, there is a growing emphasis on the employment of feed additives, probiotics, and other health-boosting components that lead to better feed conversion ratios and offer bird immunity. As poultry production continues to rise in Mexico, the market is experiencing steady growth, driven by the high requirement for nutritious and economical animal feed solutions.

Rising exports of animal products

The growing exports of animal products are offering a favorable Mexico animal feed market outlook. As per the information provided on the official website of the USDA, by June 2024, 92% of Mexico's beef exports were directed to the United States. With international markets seeking high-quality animal items, Mexican farmers and livestock producers are focusing on improving animal nutrition to enhance growth rates, health, and overall product quality. This is leading to a higher demand for nutrient-rich animal feed that supports optimal meat yield, milk production, and egg quality. As more countries import Mexican beef, pork, poultry, and dairy products, livestock farmers are investing in better feed formulations to comply with export standards and refine efficiency. Additionally, the increasing emphasis on organic animal items is encouraging Mexican producers to adopt reliable chemical-free feed alternatives. With trade agreements and partnerships expanding Mexico’s reach in the international market, feed manufacturers are scaling up development and introducing advanced formulations to cater to the needs of livestock producers aiming to enhance exports while maintaining high-quality standards.

Mexico Animal Feed Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on form, animal type, and ingredient.

Form Insights:

- Pellets

- Crumbles

- Mash

- Others

The report has provided a detailed breakup and analysis of the market based on the form. This includes pellets, crumbles, mash, and others.

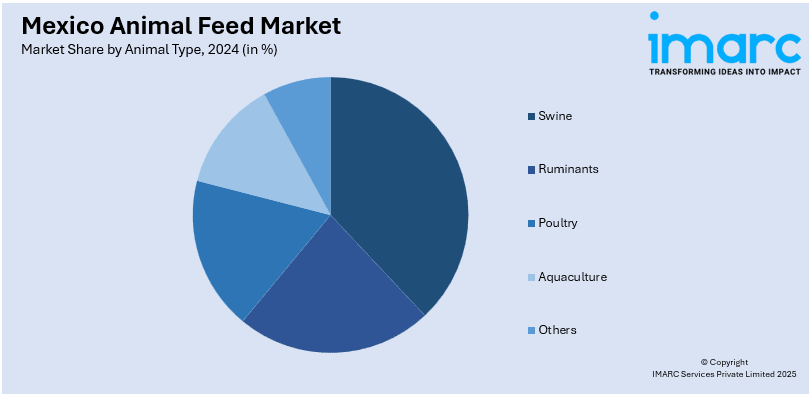

Animal Type Insights:

- Swine

- Starter

- Finisher

- Grower

- Ruminants

- Calves

- Dairy Cattle

- Beef Cattle

- Others

- Poultry

- Broilers

- Layers

- Turkeys

- Others

- Aquaculture

- Carps

- Crustaceans

- Mackeral

- Milkfish

- Mollusks

- Salmon

- Others

- Others

A detailed breakup and analysis of the market based on the animal type have also been provided in the report. This includes swine (starter, finisher, and grower), ruminants (calves, dairy cattle, beef cattle, and others), poultry (broilers, layers, turkeys, and others), aquaculture (carps, crustaceans, mackeral, milkfish, mollusks, salmon, and others), and others.

Ingredient Insights:

- Cereals

- Oilseed Meal

- Molasses

- Fish Oil and Fish Meal

- Additives

- Antibiotics

- Vitamins

- Antioxidants

- Amino Acids

- Feed Enzymes

- Feed Acidifiers

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the ingredient. This includes cereals, oilseed meal, molasses, fish oil and fish meal, additives (antibiotics, vitamins, antioxidants, amino acids, feed enzymes, feed acidifiers, and others), and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Animal Feed Market News:

- In March 2025, Trouw Nutrition México launched its new premix and ‘Young Animal Feed (YAF)’ facility, named the ‘Aguila Project’, in Colón, Mexico. The plant, with an investment of 1000 Million Mexican pesos, boasted an annual production capacity of up to 100,000 Tons, enhancing the livestock sector's competitiveness.

- In November 2023, the Government of Mexico revealed important updates to its rules concerning animal feed and pet food items with the launch of NOM-012-SAG/ZOO-2020. A key modification was the addition of more precise and detailed definitions. Terms like "medicated feed with balance" and "verification and quality control" were clearly defined.

Mexico Animal Feed Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Pellets, Crumbles, Mash, Others |

| Animal Types Covered |

|

| Ingredients Covered |

|

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico animal feed market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico animal feed market on the basis of form?

- What is the breakup of the Mexico animal feed market on the basis of animal type?

- What is the breakup of the Mexico animal feed market on the basis of ingredient?

- What is the breakup of the Mexico animal feed market on the basis of region?

- What are the various stages in the value chain of the Mexico animal feed market?

- What are the key driving factors and challenges in the Mexico animal feed market?

- What is the structure of the Mexico animal feed market and who are the key players?

- What is the degree of competition in the Mexico animal feed market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico animal feed market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico animal feed market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico animal feed industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)