Mexico Animal Health Market Size, Share, Trends and Forecast by Animal Type, Product Type, and Region, 2025-2033

Mexico Animal Health Market Overview:

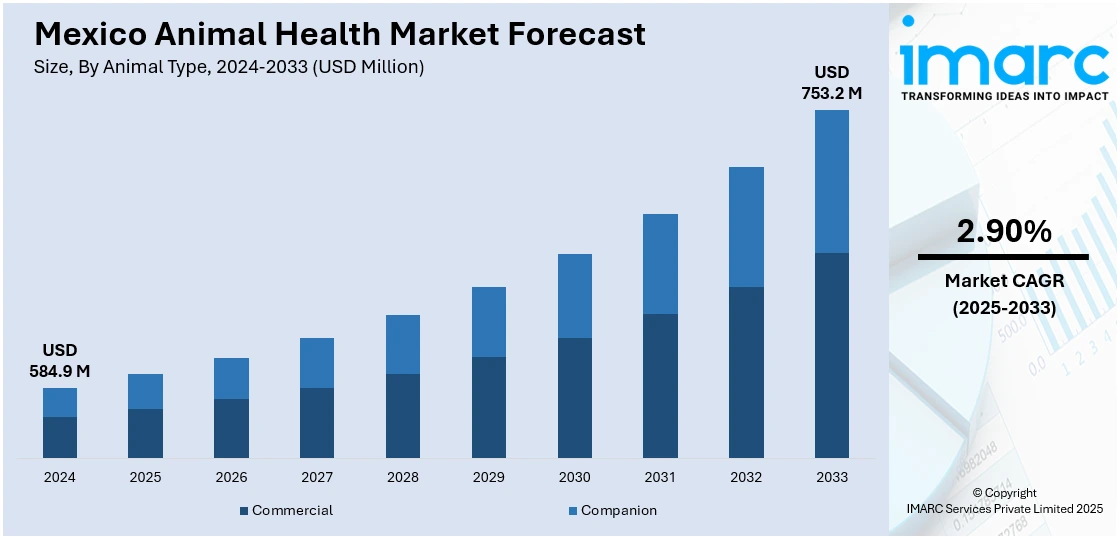

The Mexico animal health market size reached USD 584.9 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 753.2 Million by 2033, exhibiting a growth rate (CAGR) of 2.90% during 2025-2033. The market share is expanding, driven by the growing pet adoption, which is encouraging investments in well-being products, along with the rising implementation of government initiatives that promote stricter animal disease control measures.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 584.9 Million |

| Market Forecast in 2033 | USD 753.2 Million |

| Market Growth Rate 2025-2033 | 2.90% |

Mexico Animal Health Market Trends:

Rising pet adoption

The increasing pet adoption is impelling the Mexico animal health market growth. As per industry reports, in 2024, 79% of Mexicans had pets, highlighting an exceptionally high rate of pet adoption. As the country's pet adoption rises, the demand for veterinary services, pharmaceuticals, and preventive care goods, including immunizations, flea and tick treatments, and nutritional supplements, is growing. Pet parents are becoming more aware about the need for regular health check-ups and disease prevention, increasing the use of pet health products. This shift is encouraging the employment of innovative healthcare solutions like customized food items and therapies for specific ailments. Furthermore, the growing trend of treating pets as family members is promoting the usage of high-quality products and services, which is catalyzing the demand for premium pet healthcare. With an increased pet adoption rate, there is also a rise in the need for professional veterinary clinics, animal hospitals, and emergency care services. Furthermore, companies are offering a wider range of items designed to meet the evolving requirements of pet parents.

Increasing implementation of government initiatives

The rising execution of government initiatives are offering a favorable Mexico animal health market outlook. Authorities are implementing policies to ensure animal welfare, food item safety, and biosecurity, leading to increased demand for vaccines, diagnostics, and medications. In August 2024, the Ministry of Agriculture and Rural Development in Mexico initiated a fresh veterinary pharmacovigilance system to improve the safety, quality, and effectiveness of veterinary drugs. The system, created by the National Service for Health, Safety, and Agri-Food Quality (SENASICA), was intended to recognize, evaluate, and reduce risks linked to veterinary medications available in the country. Apart from this, stricter import and export regulations on livestock and animal-based products are encouraging farmers to adopt better health management strategies and meet international standards. Additionally, government-backed disease surveillance initiatives are helping to prevent outbreaks, creating the need for high-quality veterinary pharmaceuticals. Investments in research and development (R&D) activities for new treatments and preventive care solutions are also increasing, as authorities focus on improving productivity in the livestock sector. Funding and subsidies for small and medium-sized farmers are enabling them to access better healthcare services and nutritional products for their animals. Moreover, regulatory frameworks supporting sustainable and ethical animal farming are promoting the employment of probiotics, organic feed additives, and advanced healthcare solutions. As the government continues to strengthen policies related to animal welfare and food security, the animal health market in Mexico is experiencing significant growth, leading to innovations in veterinary biologics and healthcare technologies.

Mexico Animal Health Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on animal type and product type.

Animal Type Insights:

- Commercial

- Companion

The report has provided a detailed breakup and analysis of the market based on the animal type. This includes commercial and companion.

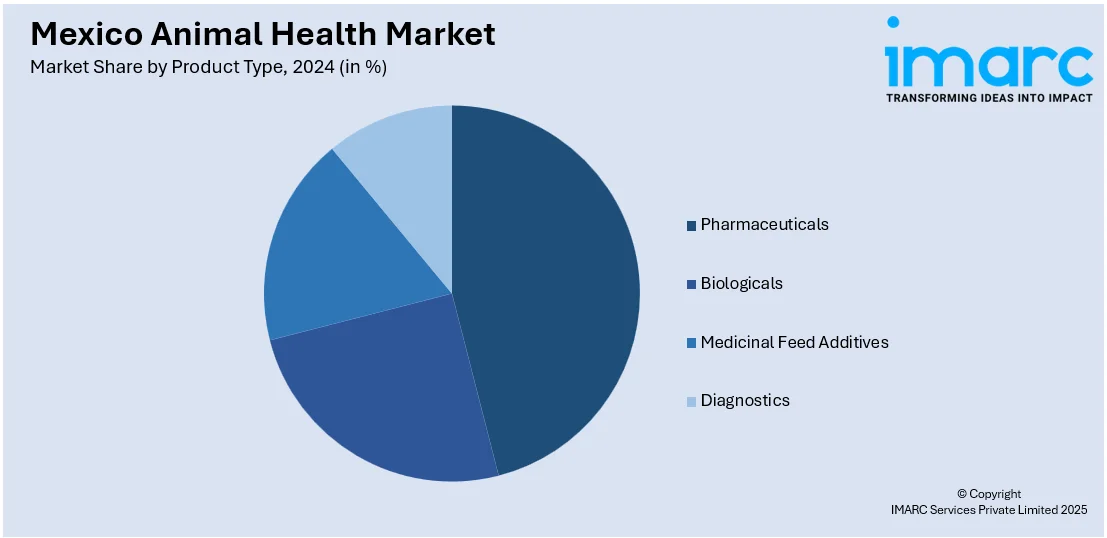

Product Type Insights:

- Pharmaceuticals

- Biologicals

- Medicinal Feed Additives

- Diagnostics

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes pharmaceuticals, biologicals, medicinal feed additives, and diagnostics.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Animal Health Market News:

- In November 2024, the Mexican Senate approved a law that incorporated animal welfare into the Constitution. The reform sought to safeguard animals, ensure their welfare, offer them care, proper treatment, and upkeep, and prevent abuse, cruelty, suffering, zoophilia, and the alteration of their physical traits, while also assuring the health of the animal.

- In April 2024, Nuproxa Mexico, a premier supplier of nature-inspired solutions aimed at enhancing animal nutrition and health, formed an exclusive alliance with Innovad and Herbonis. This partnership broadened the firm's portfolio in the Mexican market, featuring innovations like Panbonis, a natural and bioactive vitamin D3 source, along with the complete ‘Innovad Solution Platform’ range.

Mexico Animal Health Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Animal Types Covered | Commercial, Companion |

| Product Types Covered | Pharmaceuticals, Biologicals, Medicinal Feed Additives, Diagnostics |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico animal health market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico animal health market on the basis of animal type?

- What is the breakup of the Mexico animal health market on the basis of product type?

- What is the breakup of the Mexico animal health market on the basis of region?

- What are the various stages in the value chain of the Mexico animal health market?

- What are the key driving factors and challenges in the Mexico animal health market?

- What is the structure of the Mexico animal health market and who are the key players?

- What is the degree of competition in the Mexico animal health market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico animal health market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico animal health market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico animal health industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)