Mexico Animal Husbandry Market Size, Share, Trends and Forecast by Segment and Region, 2025-2033

Mexico Animal Husbandry Market Overview:

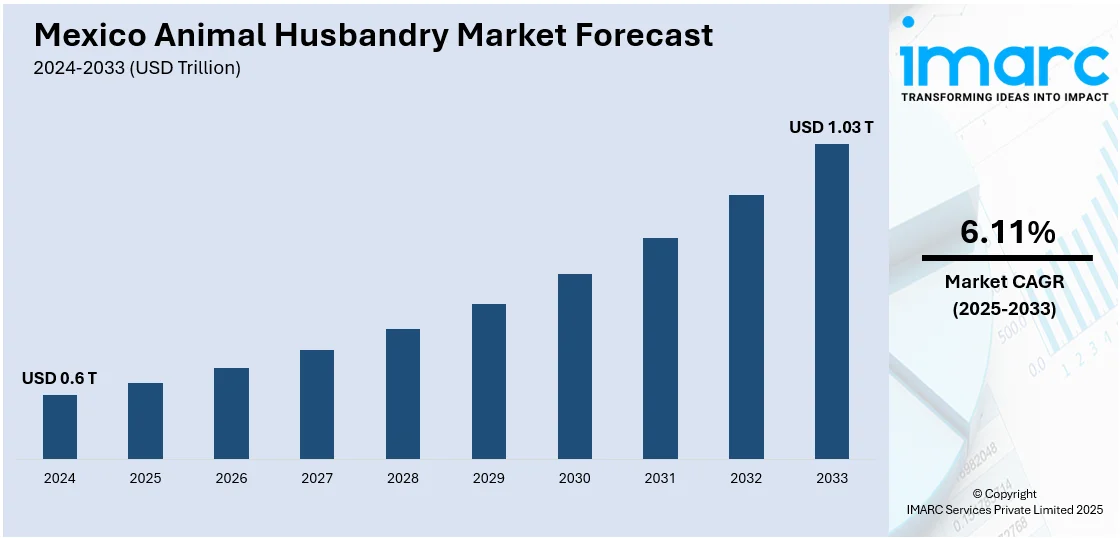

The Mexico animal husbandry market size reached USD 0.6 Trillion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.03 Trillion by 2033, exhibiting a growth rate (CAGR) of 6.11% during 2025-2033. Rising domestic meat consumption, export growth, government livestock programs, increased feed production, technological advancements in breeding and disease control, and growing investments in commercial dairy and poultry farms to meet demand for animal protein and processed products are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.6 Trillion |

| Market Forecast in 2033 | USD 1.03 Trillion |

| Market Growth Rate 2025-2033 | 6.11% |

Mexico Animal Husbandry Market Trends:

Growth in Livestock Feed Production Supporting Sector Expansion

Animal farming in Mexico is increasingly backed by robust feed manufacturing capabilities. Production levels have seen consistent growth, with a substantial portion dedicated to meeting the needs of livestock operations. This reflects a broader shift toward improving animal health, productivity, and overall farm efficiency. As consumption of meat and dairy rises, producers are focusing on balanced feed formulations and reliable supply chains to support intensified rearing practices. The country’s position as a key contributor to global feed output underscores the importance of animal nutrition in driving agricultural performance. Investments in feed quality and infrastructure are becoming more prominent, pointing to a sustained rise in livestock activity across regions. This development is closely tied to the need for dependable input systems that align with evolving demands in food production, creating stronger linkages between feed efficiency and livestock outcomes. For example, in May 2024, Mexico's feed industry was recognized as one of the five largest globally, producing over 40 million tons of food annually, with 36.7 million tons allocated to the livestock sector.

Expansion of Protein Production and Export-Oriented Livestock Activity

Animal husbandry in Mexico is witnessing a shift toward higher protein output and export-driven practices. The sector covers a vast land area, supporting diverse production streams including poultry, beef, pork, and eggs. With substantial volumes generated across these categories, the country has positioned itself among the leading global producers. This growth is supported by both domestic consumption and international demand, prompting increased focus on quality, processing standards, and supply consistency. Livestock operations are evolving to align with global trade opportunities, with exports contributing significantly to the market’s value. The combination of large-scale production and a growing export base is encouraging greater investment in breeding practices, biosecurity, and infrastructure to ensure sustained performance across all animal protein segments. According to industry reports, as of September 2024, Mexico ranks as the world's seventh-largest animal protein producer, with an annual output of 9.3 million tons, comprising 2.8 million tons of eggs, 3.2 million tons of poultry meat, 1.9 million tons of beef, and 1.4 million tons of pork. Livestock activities occupy 109.8 million hectares, generating USD 3.5 Billion in exports.

Mexico Animal Husbandry Market Segmentation:

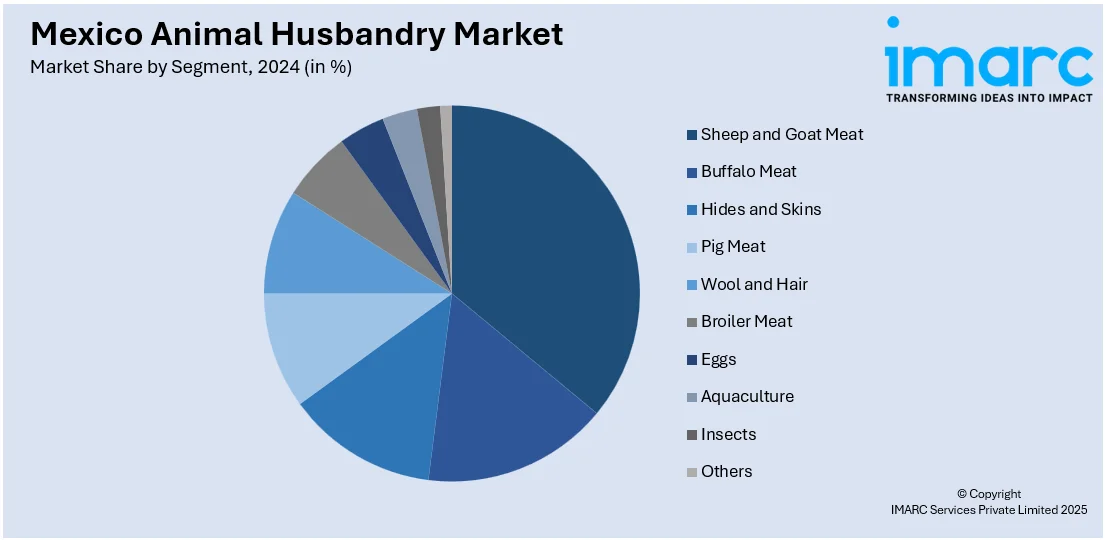

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on segment.

Segment Insights:

- Sheep and Goat Meat

- Buffalo Meat

- Hides and Skins

- Pig Meat

- Wool and Hair

- Broiler Meat

- Eggs

- Aquaculture

- Insects

- Others

The report has provided a detailed breakup and analysis of the market based on the segment. This includes sheep and goat meat, buffalo meat, hides and skins, pig meat, wool and hair, broiler meat, eggs, aquaculture, insects, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Animal Husbandry Market News:

- In February 2024, Mexico and the United States reaffirmed their commitment to animal health in the region during the 41st Meeting of Commissioners, highlighting coordinated efforts to prevent exotic diseases.

Mexico Animal Husbandry Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Trillion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Segments Covered | Sheep and Goat Meat, Buffalo Meat, Hides and Skins, Pig Meat, Wool and Hair, Broiler Meat, Eggs, Aquaculture, Insects, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico animal husbandry market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico animal husbandry market on the basis of segment?

- What is the breakup of the Mexico animal husbandry market on the basis of region?

- What are the various stages in the value chain of the Mexico animal husbandry market?

- What are the key driving factors and challenges in the Mexico animal husbandry?

- What is the structure of the Mexico animal husbandry market and who are the key players?

- What is the degree of competition in the Mexico animal husbandry market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico animal husbandry market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico animal husbandry market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico animal husbandry industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)