Mexico Anti Corrosion Coatings Market Size, Share, Trends and Forecast by Technology, Material, Application, and Region, 2025-2033

Mexico Anti Corrosion Coatings Market Overview:

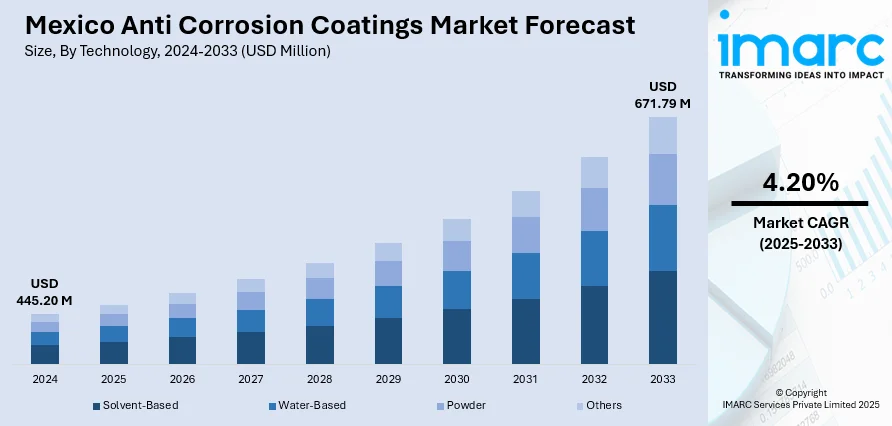

The Mexico anti corrosion coatings market size reached USD 445.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 671.79 Million by 2033, exhibiting a growth rate (CAGR) of 4.20% during 2025-2033. The growing automotive and construction sectors in Mexico are catalyzing the demand for anti-corrosion coatings. In automotive manufacturing, increased vehicle production for export markets requires coatings to protect parts from environmental damage. Additionally, expanding infrastructure projects necessitate coatings to preserve buildings, roads, and bridges against harsh conditions. The Mexico anti corrosion coatings market share is growing as both the automotive and construction industries continue to expand, driving further adoption of protective coatings for enhanced durability and longevity.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 445.20 Million |

| Market Forecast in 2033 | USD 671.79 Million |

| Market Growth Rate 2025-2033 | 4.20% |

Mexico Anti Corrosion Coatings Market Analysis:

- Major Market Drivers: Mexican anti corrosion coatings market trends are largely influenced by fast-paced industrialization, growing construction activity, and rising automotive manufacturing. Growing demand for corrosion protection in the infrastructure, marine, and oil & gas industries, as well as government policies encouraging durability, further drives market growth.

- Key Market Trends: The market is experiencing growing demand for environment-friendly, water-based, and high-performance coatings. Technological advancements like smart coatings, UV-resistance formulations, and tailored solutions are gaining popularity in industrial, automotive, and marine markets, improving operational efficiency and sustainability and contributing to long-term protective performance.

- Competitive Landscape: Market competition is defined by strategic mergers, acquisitions, and collaborations among prominent players. Organizations invest in creating innovative, eco-friendly solutions, enhancing Mexico anti corrosion coatings market demand. Such a strategy enhances their presence in automotive, construction, and industrial segments while catering to changing customer needs.

- Challenges and Opportunities: Differing raw material prices, regulatory issues, and technical constraints are challenges. Increasing infrastructure spending, renewable energy initiatives, and awareness of asset lifespan represent great opportunities for market growth, product development, and strategic differentiation in the Mexico anti corrosion coatings market.

Mexico Anti Corrosion Coatings Market Trends:

Rising Employment in Automotive Sector

The automotive industry in Mexico is seeing substantial expansion, fueled by domestic demand and the nation's role as a key global manufacturing center. The rise in vehicle manufacturing, especially aimed at export markets, is resulting in a higher demand for anti-corrosion coatings to safeguard automotive parts from rust, abrasion, and various environmental elements, such as moisture, road salts, and elevated temperatures. These coatings contribute to the durability of vehicles and their components, particularly in areas where harsh conditions are more common. The Mexican Automotive Industry Association (AMIA) forecasts that by the conclusion of 2025, Mexico will be the fifth-largest producer of vehicles globally. In 2024, car manufacturing totaled 3,989,403 units, representing a 5.56% rise from 2023. An additional 2.7% increase is expected in 2025, highlighting the ongoing growth of the sector. This increase in production is closely linked to Mexico's expanding position as an important contributor in vehicle assembly and parts production. With the industry's growth, the need for superior anti-corrosion coatings is projected to rise, as producers emphasize high-performance options capable of enduring the demands of contemporary automotive conditions. The ongoing growth of vehicle production and manufacturing plants across Mexico is catalyzing the demand for protective coatings that enhance vehicle longevity and lower maintenance expenses, positively impacting the Mexico anti corrosion coatings market share.

To get more information on this market, Request Sample

Growing Demand from Construction and Infrastructure Sector

The swift rise of the construction and infrastructure industries is a crucial factor bolstering the Mexico anti corrosion coatings market growth. This expansion is driven by the necessity to safeguard essential infrastructure, including buildings, bridges, roads, and other endeavors, from the severe impacts of environmental elements like high humidity, temperature variations, and severe weather conditions. With Mexico's ongoing investment in extensive urbanization and infrastructure improvements, protective coatings play a critical part in maintaining the durability and lifespan of these assets. A notable illustration is the 2025 National Highway Infrastructure Program revealed by Mexico's Secretariat of Infrastructure, Communications, and Transportation (SICT), detailing an investment of MX$173 billion to improve more than 4,000 km of roads throughout the nation. The initiative features essential projects, such as priority corridors spanning 3,000 km and major bridge advancements. An essential aspect of this initiative is the emphasis on upkeep and modernization, utilizing a novel public-private partnership approach intended to enhance the nation’s infrastructure system. Anti-corrosion coatings are vital in protecting these assets from environmental factors, guaranteeing their functionality and durability against damage. As government-led initiatives like this expand, the need for high-quality anti-corrosion coatings will increase, reinforcing their significance in preserving the nation’s infrastructure and aiding ongoing economic development. These trends are reflected in the latest Mexico anti corrosion coatings market analysis, highlighting rising demand across automotive, construction, and infrastructure sectors.

Mexico Anti Corrosion Coatings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on technology, material, and application.

Technology Insights:

- Solvent-Based

- Water-Based

- Powder

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes solvent-based, water-based, powder, and others.

Material Insights:

- Acrylic

- Alkyd

- Polyurethane

- Epoxy

- Zinc

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes acrylic, alkyd, polyurethane, epoxy, zinc, and others.

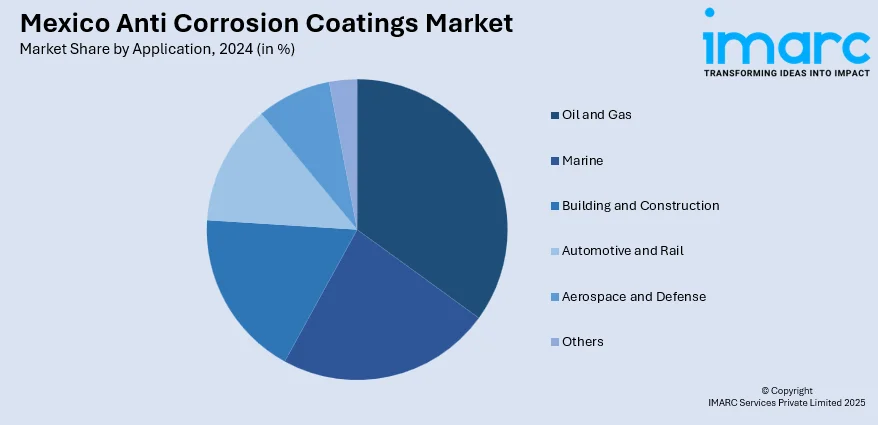

Application Insights:

- Oil and Gas

- Marine

- Building and Construction

- Automotive and Rail

- Aerospace and Defense

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes oil and gas, marine, building and construction, automotive and rail, aerospace and defense, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Anti Corrosion Coatings Market News:

- In September 2024, PPG added its STEELGUARD 951 epoxy intumescent fire protection coating to the Americas, including Mexico, bolstering the Mexico anti corrosion coatings market. The elastic epoxy coating provides up to four hours of fire protection, increased corrosion resistance, and durability for next-generation manufacturing facilities, data centers, EV battery plants, and commercial infrastructure, backing industrial and infrastructure growth.

Mexico Anti Corrosion Coatings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Solvent-Based, Water-Based, Powder, Others |

| Materials Covered | Acrylic, Alkyd, Polyurethane, Epoxy, Zinc, Others |

| Applications Covered | Oil and Gas, Marine, Building and Construction, Automotive and Rail, Aerospace and Defense, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico anti corrosion coatings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico anti corrosion coatings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico anti corrosion coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The anti corrosion coatings market in Mexico was valued at USD 445.20 Million in 2024.

The Mexico anti corrosion coatings market is projected to exhibit a CAGR of 4.20% during 2025-2033, reaching a value of USD 671.79 Million by 2033.

Mexico anti-corrosion coatings market is fueled by swift growth in automotive and construction industries, rising infrastructure development, and growing industrialization. Demand for long-lasting, weather-resistant coatings to shield vehicles, bridges, and buildings from rust, abrasion, and environmental factors is on the rise. Government policies, export-based manufacturing, and compliance with high-performance, eco-friendly coatings further fuel market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)