Mexico Application Processor Market Size, Share, Trends and Forecast by Device Type, Core Type, and Region, 2025-2033

Mexico Application Processor Market Overview:

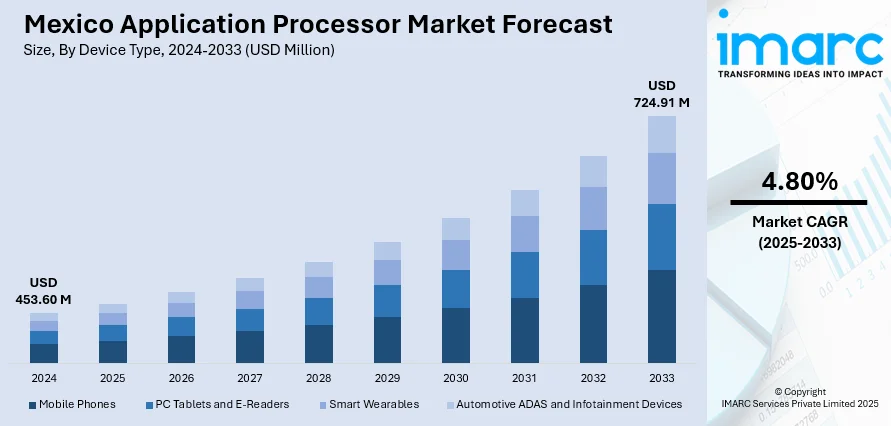

The Mexico application processor market size reached USD 453.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 724.91 Million by 2033, exhibiting a growth rate (CAGR) of 4.80% during 2025-2033. The market is driven by rising demand for 5G-enabled smartphones, fueled by expanding telecom infrastructure. Growth in IoT and smart devices further enhances the need for high-performance processors. Additionally, local semiconductor manufacturing is expanding due to nearshoring trends and government support, reducing import reliance. Strategic partnerships with global chipmakers are enhancing domestic production, expanding the Mexico application processor market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 453.60 Million |

| Market Forecast in 2033 | USD 724.91 Million |

| Market Growth Rate 2025-2033 | 4.80% |

Mexico Application Processor Market Trends:

Rising Demand for 5G-Capable Application Processors

The market is experiencing a rise in demand for 5G-capable chips, driven by the rapid expansion of 5G networks across the country. As per industry reports, Mexico has reached 5G adoption with 6.6 million customers, representing 51% of the overall mobile subscriptions within the country in 2024. Industries such as logistics and transportation show strong interest. Over 70% of Mexico's executives plan to adopt 5G technology in 2024, driven by the promise of higher revenues and improved efficiency of operations. Telecom operators are aggressively rolling out 5G infrastructure, prompting smartphone manufacturers to integrate advanced application processors that support high-speed connectivity. Consumers are increasingly opting for mid-range and premium smartphones with 5G capabilities, pushing brands to incorporate Qualcomm Snapdragon and MediaTek Dimensity processors in their devices. Additionally, the growing popularity of IoT and smart devices in Mexico further fuels the need for energy-efficient, high-performance processors. As 5G adoption accelerates, local OEMs and global chipset vendors are expected to strengthen their partnerships to cater to this demand, making 5G-enabled processors a key growth driver in the Mexican market.

Rise of Local Manufacturing and Semiconductor Partnerships

The increasing focus on local semiconductor manufacturing and strategic partnerships is significantly supporting the Mexico application processor market growth. The Mexican government and private sector are investing in domestic electronics production to reduce dependency on imports and strengthen supply chain resilience. The Mexican electronics manufacturing sector represents over 2.5% of the country's GDP and employs 400,000 individuals, with consumer electronics revenue projected to hit USD 17.4 Billion in 2024. The key market players are driving growth in key regions such as Chihuahua and central Mexico. This growth is increasing demand for advanced application processors as domestic production increases to meet global technological demands. In addition to this, major global semiconductor companies are expanding their operations in Mexico, collaborating with local manufacturers to produce application processors for automotive, industrial, and consumer electronics. Additionally, the nearshoring trend, driven by US-China trade tensions, is encouraging more tech firms to establish manufacturing hubs in Mexico. This shift is expected to improve the availability of cost-effective processors for smartphones, tablets, and IoT devices while fostering innovation in chip design. As a result, Mexico is emerging as a competitive player in the regional semiconductor market, attracting further investments in application processor development.

Mexico Application Processor Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on device type and core type.

Device Type Insights:

- Mobile Phones

- PC Tablets and E-Readers

- Smart Wearables

- Automotive ADAS and Infotainment Devices

The report has provided a detailed breakup and analysis of the market based on the device type. This includes mobile phones, PC tablets and e-readers, smart wearables, and automotive ADAS and infotainment devices.

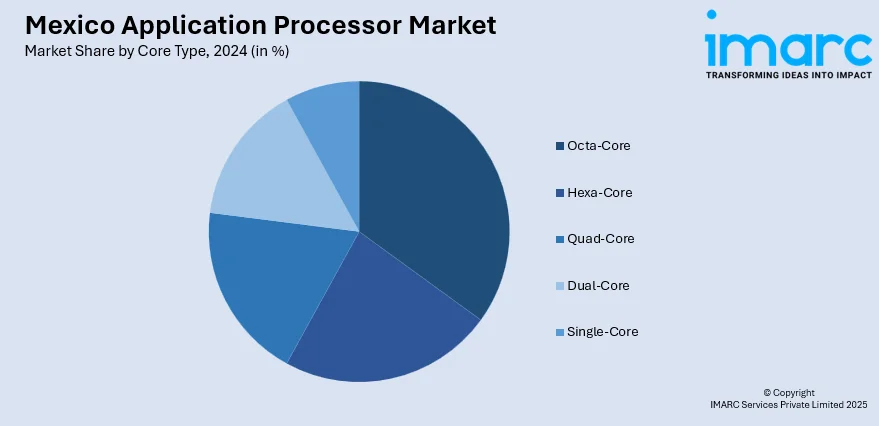

Core Type Insights:

- Octa-Core

- Hexa-Core

- Quad-Core

- Dual-Core

- Single-Core

A detailed breakup and analysis of the market based on the core type have also been provided in the report. This includes octa-core, hexa-core, quad-core, dual-core, and single-core.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Application Processor Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered | Mobile Phones, PC Tablets and E-Readers, Smart Wearables, Automotive ADAS and Infotainment Devices |

| Core Types Covered | Octa-Core, Hexa-Core, Quad-Core, Dual-Core, Single-Core |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico application processor market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico application processor market on the basis of device type?

- What is the breakup of the Mexico application processor market on the basis of core type?

- What is the breakup of the Mexico application processor market on the basis of region?

- What are the various stages in the value chain of the Mexico application processor market?

- What are the key driving factors and challenges in the Mexico application processor?

- What is the structure of the Mexico application processor market and who are the key players?

- What is the degree of competition in the Mexico application processor market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico application processor market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico application processor market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico application processor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)