Mexico ATM Market Size, Share, Trends and Forecast by Solution, Screen Size, Application, ATM Type, and Region, 2025-2033

Mexico ATM Market Overview:

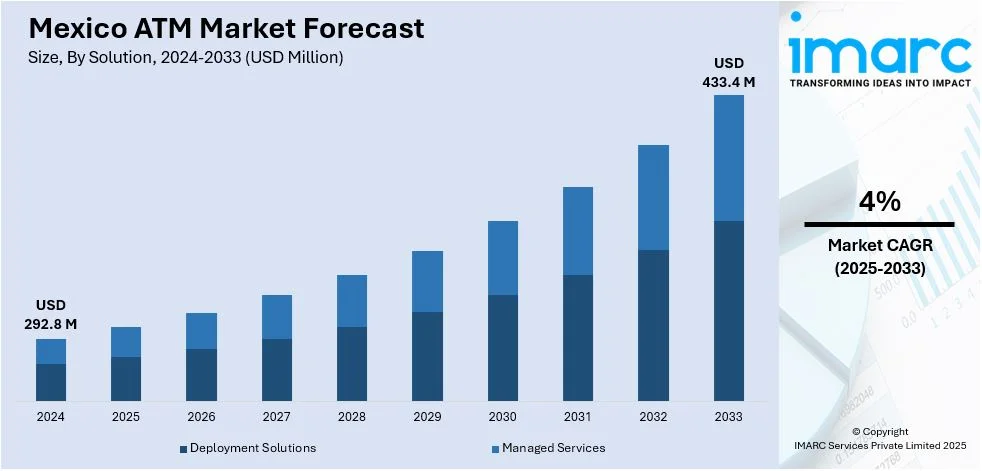

The Mexico ATM market size reached USD 292.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 433.4 Million by 2033, exhibiting a growth rate (CAGR) of 4% during 2025-2033. Increasing financial inclusion, rising demand for convenient banking services, expanding urbanization, technological advancements in ATM software, and deployment in rural areas are some of the factors propelling the growth of the market. Government initiatives and partnerships with fintechs also support greater ATM penetration and usage across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 292.8 Million |

| Market Forecast in 2033 | USD 433.4 Million |

| Market Growth Rate 2025-2033 | 4% |

Mexico ATM Market Trends:

Retail-Driven Banking Access Rises

Mexico is experiencing a shift in how consumers use financial services, with retail chains offering virtual alternatives to traditional ATMs. A large convenience store chain has developed a technology in some locations that allows customers to withdraw cash and do basic banking transactions without using physical equipment. This system takes advantage of the retailer's network to enable quicker access to financial services, particularly in regions with few regular ATMs or bank locations. The concept promotes financial inclusion by combining ordinary shopping with basic banking. It also improves the customer experience by lowering wait times and removing the need for multiple banking trips. This concept indicates an increasing trend for integrated, technologically enabled financial access points in high-traffic, conveniently accessible areas. For example, in August 2024, OXXO introduced a virtual ATM system in select stores across Mexico, enabling customers to perform cash withdrawals and other banking transactions without traditional ATM hardware. This initiative aims to enhance financial inclusion and improve customer experience by leveraging OXXO's extensive retail network.

Independent ATM Networks Enter the Mexico Market

The ATM landscape in Mexico is changing as new competitors enter the market with the goal of building independent networks. A major financial services firm has begun deploying its own ATMs around the country, indicating a growing interest in serving areas with limited banking infrastructure. Unlike bank-owned machines, these privately run ATMs have more flexible placements and can reach underserved areas, such as rural and semi-urban populations. This development promotes greater access to cash and financial services without necessitating large-scale physical locations. It also increases competition, which can result in higher service quality and reduced rates for customers. Independent networks are altering how Mexicans engage with cash services and increasing consumer choice across varied areas by tapping into a market with a rising demand for simple, decentralized financial access. For instance, in February 2024, Euronet Worldwide announced the expansion of its independent ATM network into Mexico, marking its entry into the Latin American market. This initiative aims to enhance financial accessibility across the country.

Mexico ATM Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on solution, screen size, application, and ATM type.

Solution Insights:

- Deployment Solutions

- Onsite ATMs

- Offsite ATMs

- Work Site ATMs

- Mobile ATMs

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the solution. This includes deployment solutions (onsite ATMs, offsite ATMs, work site ATMs, mobile ATMs) and managed services.

Screen Size Insights:

- 15" and Below

- Above 15"

A detailed breakup and analysis of the market based on the screen size have also been provided in the report. This includes 15" and below and above 15".

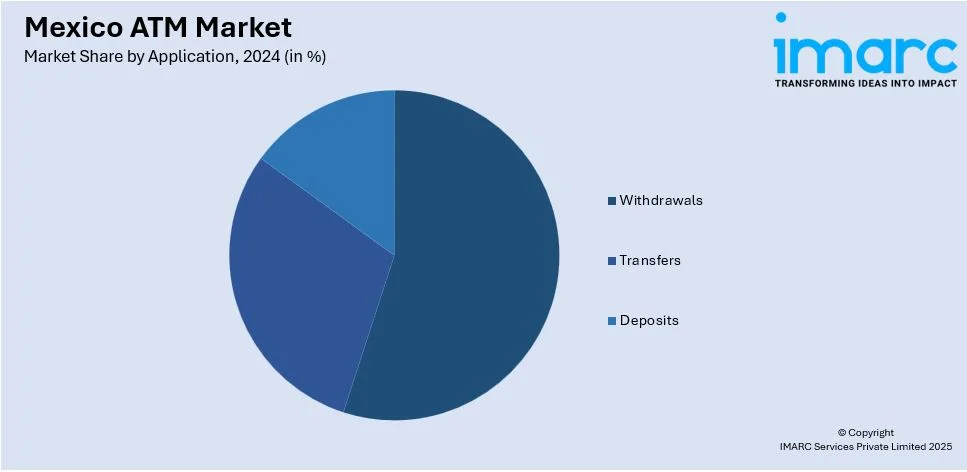

Application Insights:

- Withdrawals

- Transfers

- Deposits

The report has provided a detailed breakup and analysis of the market based on the application. This includes withdrawals, transfers, and deposits.

ATM Type Insights:

- Conventional/Bank ATMs

- Brown Label ATMs

- White Label ATMs

- Smart ATMs

- Cash Dispensers

A detailed breakup and analysis of the market based on the ATM type have also been provided in the report. This includes conventional/bank ATMs, brown label ATMs, white label ATMs, smart ATMs, and cash dispensers.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico ATM Market News:

- In January 2025, Brazilian digital lender Nubank partnered with Mexican convenience store chain OXXO to expand its cash deposit and withdrawal network in Mexico. This collaboration provides Nubank's customers access to OXXO's extensive network of over 22,000 stores nationwide.

Mexico ATM Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered |

|

| Screen Sizes Covered | 15" and Below, Above 15" |

| Applications Covered | Withdrawals, Transfers, Deposits |

| ATM Types Covered | Conventional/Bank ATMs, Brown Label ATMs, White Label ATMs, Smart ATMs, Cash Dispensers |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico ATM market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico ATM market on the basis of solution?

- What is the breakup of the Mexico ATM market on the basis of screen size?

- What is the breakup of the Mexico ATM market on the basis of application?

- What is the breakup of the Mexico ATM market on the basis of ATM type?

- What are the various stages in the value chain of the Mexico ATM market?

- What are the key driving factors and challenges in the Mexico ATM?

- What is the structure of the Mexico ATM market and who are the key players?

- What is the degree of competition in the Mexico ATM market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico ATM market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico ATM market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico ATM industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)