Mexico Auto Financing Market Size, Share, Trends and Forecast by Type, Source Type, Vehicle Type, and Region, 2025-2033

Mexico Auto Financing Market Overview:

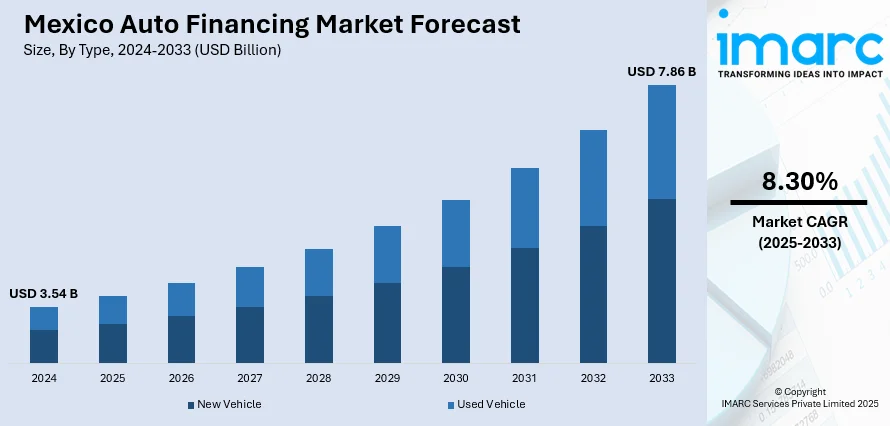

The Mexico auto financing market size reached USD 3.54 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.86 Billion by 2033, exhibiting a growth rate (CAGR) of 8.30% during 2025-2033. The growth of the auto financing market in Mexico is attributed to the rising demand for personal mobility, government policies, and user preferences for personal mobility. Shift towards vehicle ownership, eco-friendly options, and urban living are impelling the market growth. Additionally, government incentives, inclusive lending practices, and support for local production further contribute to the expansion of the Mexico auto financing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.54 Billion |

| Market Forecast in 2033 | USD 7.86 Billion |

| Market Growth Rate 2025-2033 | 8.30% |

Mexico Auto Financing Market Analysis:

- Major Market Drivers: Mexico auto financing market analysis identifies robust growth driven by growing vehicle ownership, availability of credit, and supportive government policies. Growing disposable income, urbanization, and consumer need for flexible repayment are also propelling financing penetration in both new and used vehicles.

- Key Market Trends: The market is moving towards online lending, mobile applications, and tailored loan packages. Fintech companies are collaborating with banks and automakers to provide quicker approvals and transparency. Customer-friendly, flexible products demand keeps on increasing, defining the future of Mexico's auto finance space.

- Competitive Landscape: Mexico auto financing market share is controlled by banks, non-banking institutions, and fintech startups. Established lenders are going digital to improve efficiency, whereas fintechs focus on speed and convenience. Competition becomes fiercer as providers differentiate on the basis of innovation, customized financing products, and better customer services.

- Challenges and Opportunities: Economic instability, high lending rates, and credit risk are still difficulties for lenders. Yet, there are opportunities in auto ownership aspirations, untapped rural areas, and digital growth. Providers who use technology, financial inclusion, and creative loan structures are well-placed to take market share in Mexico.

Mexico Auto Financing Market Trends:

Growing Demand for Personal Mobility

As demand for personal mobility increases due to lifestyle shifts, a rising number of people are opting for vehicle ownership, particularly in cities where public transportation may not fully meet their needs. Many individuals are opting for vehicles that cater to their evolving needs for family-oriented transportation or personal convenience. Moreover, the growing demand for environment-friendly alternatives, such as electric vehicles (EVs) and small cars tailored for urban lifestyles, are transforming the types of cars being funded. These changes are directly shaping Mexico auto financing market trends, as financing institutions adapt to evolving consumer expectations. As user preferences evolve, automotive manufacturers and financing companies are adjusting by providing vehicles and financing options that more closely meet these needs. For example, between January and May 2024, 59.4% of light vehicles acquired in Mexico were financed by automotive loans, as reported by the Mexican Association of Automotive Distributors (AMDA) and JATO Dynamics. This totals 407,380 vehicles, representing a 19.1% increase from the same period in 2023 and contributing 59,192 units to the market. This information highlights the Mexico auto financing market demand, driven by more affordable financing options, reflecting the evolving preferences of individuals. As a result, auto financing is gaining popularity among individuals seeking cars that meet their personal and family needs, thereby supporting the Mexico auto financing market growth.

To get more information of this market, Request Sample

Government Policies and Incentives

Government policies and incentives are playing a notable role in propelling the auto financing market in Mexico. Efforts to boost local automotive manufacturing and offer incentives for buyers to choose domestically produced cars are offering a positive environment for increasing vehicle sales. For instance, the governing body launched several initiatives aimed at financing eco-friendly vehicles, including electric cars, by providing tax incentives or subsidies. These actions enhance vehicle ownership accessibility, especially for buyers who may otherwise face difficulties with initial expenses. Furthermore, the government is implementing rules encouraging financial institutions to adopt more inclusive lending methods, ensuring that people with diverse credit histories are eligible for auto loans. These regulatory initiatives are making funding more accessible for a wider variety of individuals. As a result, the government's policies are both fostering the industry's growth and enabling a larger number of individuals to engage in the auto financing market. Anticipating the future, the effects of these policies are predicted to keep influencing the Mexico auto financing market forecast, with the Mexican Automotive Industry Association estimating that Mexico will rank as the fifth-largest global vehicle manufacturer by late 2025. This growing production capability, along with favorable financial policies, positions the country for further growth in both car sales and auto financing.

Mexico Auto Financing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, source type, and vehicle type.

Type Insights:

- New Vehicle

- Used Vehicle

The report has provided a detailed breakup and analysis of the market based on the type. This includes new vehicle and used vehicle.

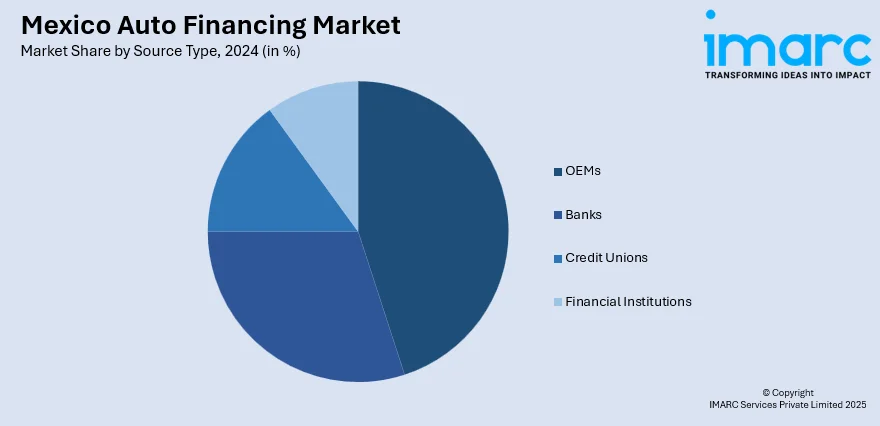

Source Type Insights:

- OEMs

- Banks

- Credit Unions

- Financial Institutions

A detailed breakup and analysis of the market based on the source type have also been provided in the report. This includes OEMs, banks, credit unions, and financial institutions.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars and commercial vehicles.

Regional Insights

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also detailed profiles of all major companies have been provided.

Mexico Auto Financing Market News:

- In July 2024, Spanish bank BBVA México provided Chinese carmaker Changan with financing to expand its vehicle distribution business in Mexico. The money will be re-lent to automobile buyers, facilitating affordable auto financing and showcasing increased cooperation among international carmakers and regional banks in Mexico's car finance market.

- In February 2024, Ride-hailing app inDrive introduced loan and credit card offerings for Mexican drivers, with the help of R2, Mastercard, Giro, and Galileo. Starting in Monterrey, the development adds greater financial access to gig workers, according to shifting trends in the Mexico auto finance market.

Mexico Auto Financing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | New Vehicle, Used Vehicle |

| Source Types Covered | OEMs, Banks, Credit Unions, Financial Institutions |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico auto financing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico auto financing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico auto financing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The auto financing market in Mexico was valued at USD 3.54 Billion in 2024.

The Mexico auto financing market is projected to exhibit a (CAGR) of 8.30% during 2025-2033, reaching a value of USD 7.86 Billion by 2033.

The Mexican auto financing market is led by growing consumer demand for personal mobility, higher disposable incomes, and increased availability of credit facilities. Incentives by the government favoring car purchases, such as environmentally friendly automobiles, also promote the adoption of financing. Besides this, growth in digital lending platforms and fintech solutions is improving convenience, transparency, and accessibility, driving consistent expansion in both new and used cars.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)