Mexico Auto Parts Aftermarket Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Mexico Auto Parts Aftermarket Market Overview:

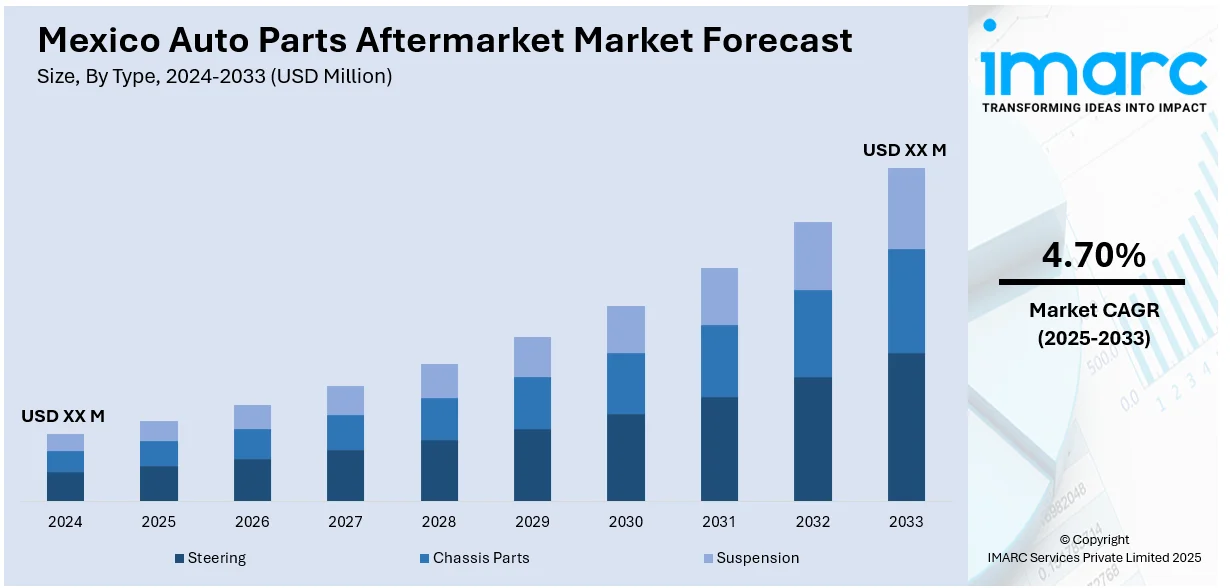

The Mexico auto parts aftermarket market size is projected to exhibit a growth rate (CAGR) of 4.70% during 2025-2033. The market is expanding with higher vehicle manufacturing and a growing need for replacement parts. The industry is supplemented by the nation's robust manufacturing base and position as a major driver of the global automobile industry. The move towards electric and hybrid cars is also stimulating innovation, presenting new avenues for aftermarket business. But companies need to adjust to new regulations and standards in order to stay competitive and achieve long-term rise in Mexico auto parts aftermarket market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 4.70% |

Mexico Auto Parts AfterMarket Market Analysis:

- Major Market Drivers: Mexico auto parts aftermarket is driven by growing vehicle ownership, aging fleet, and demand for economical replacement parts. Gains in cross-border commerce and alignment with North American supply chains support availability, while Mexico auto parts aftermarket analysis emphasizes consumer demand for low-cost yet durable solutions sustaining steady demand.

- Key Market Trends: Mexico auto parts aftermarket is being reshaped by digitalization with increases in e-commerce websites and online channels of distribution. Evolution in telematics, diagnostic equipment, and access to customized parts is influencing consumer behavior, while sustainability programs are prompting use of remanufactured and green aftermarket parts.

- Competitive Landscape: Mexico auto parts aftermarket consists of varied players such as OEM-associated service networks and independent distributors. Consolidation is rising as suppliers make investments in state-of-the-art logistics and technology-based inventory management. Regional integration and cross-border exports play a vital role in influencing Mexico auto parts aftermarket demand and opportunity in this competitive marketplace.

- Opportunities and Challenges: While uneven quality control and counterfeit parts continue to be issues, opportunity in the Mexico auto parts aftermarket stems from electric vehicle parts, sophisticated diagnostics, and environmentally friendly product offerings. Increased use of digital platforms and government support for local manufacturing additionally create opportunities for long-term aftermarket growth.

Mexico Auto Parts Aftermarket Market Trends:

Electromobility Driving Market Growth

With the growing popularity of electric and hybrid vehicles (EVs), Mexico's automotive aftermarket is changing. The need for specialized parts like batteries, charging systems, and electronics is growing as the demand for electromobility rises globally. The change is stimulating innovation and opening up new doors for companies in the aftermarket, particularly in EV maintenance, repair, and enhancement fields traditionally centered on traditional vehicles. As increasingly more consumers and producers turn towards green alternatives, demand for EV parts and services will increase. In 2024, electric and plug-in hybrid vehicle sales in Mexico jumped by 83.8% to 69,713 units, highlighting Mexico's transition towards clean, efficient transportation. This shift is becoming a major driver of Mexico auto parts aftermarket share, reinforcing the role of EV adoption in shaping future demand.

To get more information on this market, Request Sample

Technological Advancements and Digitalization

Mexico's automotive aftermarket is seeing growth as a result of technology development that enhances both product quality and customer experience. Light alloys and durable composites are examples of high-performance materials that are improving the durability and quality of aftermarket goods. The materials improve vehicles' performance and efficiency, increasing their customer appeal. E-commerce and online platforms are also altering how consumers engage with aftermarket goods and services. Online sales platforms provide customers with ease of access to view and buy parts from anywhere, with a wider variety of products compared to physical brick-and-mortar stores. Such technological advancements simplify the buying process and make it convenient, thus driving the market. These dynamics are contributing to the expansion of Mexico auto parts aftermarket size, as innovation and digital accessibility fuel greater participation across consumer segments.

Regulatory Challenges and Adaptation

The Mexico automotive aftermarket business is faced with regulatory issues that involve complying with environmental regulations and product certification. Businesses must continue to adhere to more stringent safety, waste management, and emissions laws as their operations grow. Companies have to change fast with changing rules while still keeping high-quality products and customer safety. Failure to comply may lead to fines, legal trouble, and a loss of a company's reputation. Companies must therefore make an investment in continuously monitoring regulatory revisions and putting procedures in place that ensure compliance without compromising efficiency. By surmounting these regulatory challenges, companies can preserve a competitive advantage, prevent possible disruptions, and gain consumer trust. Adjusting to these challenges is not only essential for remaining within legal limits but also for ensuring long-term growth and stability in the industry, particularly given the rising Mexico Auto Parts Aftermarket demand.

Mexico Auto Parts Aftermarket Market Segmentation:

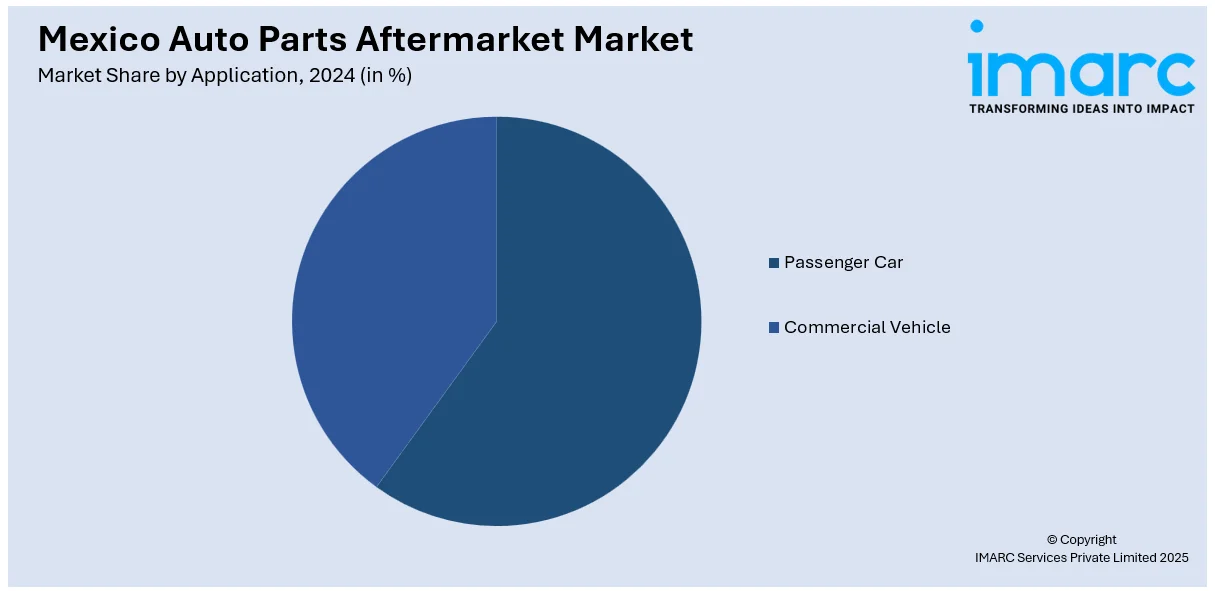

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and application.

Types Insights:

- Steering

- Chassis Parts

- Suspension

The report has provided a detailed breakup and analysis of the market based on the type. This includes steering, chassis parts, and suspension.

Application Insights:

- Passenger Car

- Commercial Vehicle

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes passenger car, and commercial vehicle.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern, Central, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Auto Parts Aftermarket Market News:

- In January 2025, GiPA launched the "Pulso del Aftermarket en Marcas Chinas" in Mexico to examine the rapidly expanding availability of Chinese vehicles, currently at 9% of overall sales. The tool provides information on drivers' behavior, aftermarket potential, and OEM value propositions, assisting strategists with reaching this growing marketplace.

- In August 2024, Ciosa AutoTodo emerged through the merger of Grupo Ciosa, AutoTodo Mexicana, and Jetz App. The new company is positioned to expand Mexico's auto parts aftermarket by building stronger nationwide distribution, increasing product availability, and enhancing customer support to address the rising replacement parts demand in the country.

- In February 2024, Stellantis' aftermarket business bproauto launched its newly redesigned site, bproautoparts.com, with an improved catalog search, dealer locator, and regional tools specific to the U.S., Canada, and Mexico. This launch aids Mexico's auto parts aftermarket by providing OE-backed, affordable components with a two-year/unlimited-mile warranty.

Mexico Auto Parts Aftermarket Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Steering, Chassis Parts, Suspension |

| Applications Covered | Passenger Car, Commercial Vehicle |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico auto parts aftermarket market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico auto parts aftermarket market on the basis of type?

- What is the breakup of the Mexico auto parts aftermarket market on the basis of application?

- What is the breakup of the Mexico auto parts aftermarket market on the basis of region?

- What are the various stages in the value chain of the Mexico auto parts aftermarket market?

- What are the key driving factors and challenges in the Mexico auto parts aftermarket?

- What is the structure of the Mexico auto parts aftermarket market and who are the key players?

- What is the degree of competition in the Mexico auto parts aftermarket market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico auto parts aftermarket market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico auto parts aftermarket market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico auto parts aftermarket industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)