Mexico Automated Assembly Line Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Mexico Automated Assembly Line Market Overview:

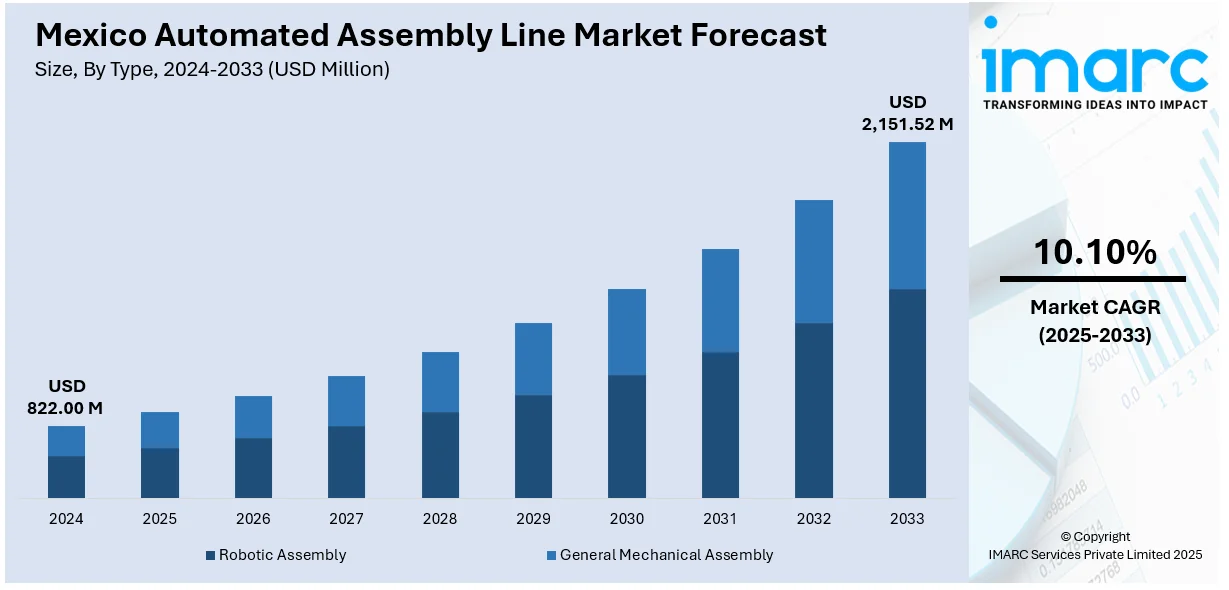

The Mexico automated assembly line market size reached USD 822.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,151.52 Million by 2033, exhibiting a growth rate (CAGR) of 10.10% during 2025-2033. Foreign direct investment (FDI) and Mexico's strategic position are fueling the market and increasing the adoption of automated assembly lines in various industries. Furthermore, efficiency of labor cost and skill acquisition are propelling automation forward, decreasing dependency on manual labor. Moreover, extensive implementation of Industry 4.0 technologies, such as IoT and AI, is making production processes and efficiency better. The synergy of low-cost automation, availability of skilled labor, and technological progress is further augmenting the Mexico automated assembly line market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 822.00 Million |

| Market Forecast in 2033 | USD 2,151.52 Million |

| Market Growth Rate 2025-2033 | 10.10% |

Mexico Automated Assembly Line Market Analysis:

- Major Market Drivers: Mexico's strong manufacturing base, positive FDI inflows, and use of high-end robotics are major drivers. Industry 4.0 integration, cost reduction and efficiency gains in automobile, electronics, and consumer goods manufacturing are driving increasing Mexico automated assembly line market demand, indirectly promoting vehicle and industrial equipment financing.

- Key Market Trends: Growing implementation of AI-enabled robots, IoT devices-based sensors, and cloud-based production monitoring is revolutionizing assembly lines into smart connected networks. Predictive maintenance, real-time analysis, and adaptive automation solutions are increasingly being adopted to achieve higher throughput, quality, and operational efficiency in Mexico's industrial manufacturing ecosystem.

- Competitive Landscape: Global and local operators, such as Continental, Celestica, and Luminar Technologies, are increasing automated assembly capacity in Mexico. Strategic investments, technology alliances, and Industry 4.0 implementation add up to manufacturing accuracy while underpinning the Mexico automated assembly line market forecast, with rising industrial output creating demand for financed vehicles and machinery.

- Challenges and Opportunities: Exorbitant capital cost, technological intricacy, and shortage of skilled workers hinder market development. Smart factory growth, robotics integration, and green manufacturing solutions are opportunities in the market. Growing interest from auto, electronics, and consumer goods industries promotes innovation and uptake of advanced assembly systems in Mexico.

Mexico Automated Assembly Line Market Trends:

Manufacturing Sector Growth and Foreign Direct Investment

Mexico has increasingly become a manufacturing hub due to its strategic geographical location, competitive labor costs, and favorable trade agreements such as the United States-Mexico-Canada Agreement (USMCA). This has led to a robust inflow of foreign direct investment (FDI) from multinational corporations seeking to establish or expand their production capacities in Mexico. The adoption of automated assembly line technologies has been central to this transformation, as it helps manufacturers improve efficiency, reduce operational costs, and maintain high levels of product quality. These industrial developments are indirectly supporting consumer purchasing power and vehicle ownership, contributing to the evolving Mexico automated assembly line market analysis. Moreover, automated systems are especially valuable in the automotive, electronics, and consumer goods sectors, where demand for precision and high throughput has grown significantly. As companies look to optimize their production processes, automation solutions are being incorporated to handle repetitive tasks, reduce errors, and speed up production cycles. On January 26, 2024, Continental announced a USD 90 million investment to construct a hydraulic hose production plant in Aguascalientes, Mexico, its 22nd facility in the country. Expected to begin operations in late 2025, the plant will feature smart factory technologies, solar panels, and water reuse systems while creating over 200 jobs. These expansions help maintain industrial growth and indirectly influence consumer financing behavior, supporting Mexico automated assembly line market share. Further, the automation-focused expansion underscores rising industrial demand and strengthens the market growth. These advancements also help manufacturers meet increasingly stringent environmental and safety regulations while remaining competitive in a globalized market. Additionally, the integration of robotics and artificial intelligence (AI) into assembly lines is facilitating smarter, more adaptable production systems that can quickly adjust to changing demands. The rapid shift toward automation in response to FDI influxes is a key driver of Mexico automated assembly line market growth, ensuring the country’s ongoing position as a critical manufacturing powerhouse.

To get more information on this market, Request Sample

Industry 4.0 Adoption and Technological Advancements

As part of the broader trend of digital transformation, Mexico’s manufacturing sector is witnessing the widespread adoption of Industry 4.0 technologies, which include Internet of Things (IoT) devices, big data analytics, and advanced robotics. The integration of these technologies with automated assembly lines has resulted in smarter, more connected production processes. IoT-enabled sensors and devices monitor production in real-time, providing actionable insights that help manufacturers improve efficiency, prevent downtime, and reduce costs. The increased deployment of AI-powered robots also allows assembly lines to optimize themselves without human intervention, adjusting to varying production requirements and performing tasks with a high degree of precision. These shifts are also shaping consumer behavior and funding patterns in the automotive sector, reflecting evolving Mexico automated assembly line market trends. Additionally, cloud-based systems facilitate seamless communication across different stages of the production process, ensuring smooth coordination between design, manufacturing, and logistics. On April 13, 2023, Luminar Technologies announced the successful launch of its highly automated sensor manufacturing facility in Monterrey, Mexico, a key step towards scaling production for the automotive industry. The facility, operated by Celestica, is designed to produce Luminar Iris sensors at high volume, initially targeting up to 250,000 sensors per year, with plans for further expansion to meet increasing demand. As Mexican manufacturers continue to embrace digitalization and smart manufacturing technologies, they are gaining the ability to enhance their competitiveness in both domestic and global markets. The growing influence of Industry 4.0 technologies is further accelerating the adoption of automated assembly lines, bolstering Mexico’s standing as a global manufacturing leader.

Mexico Automated Assembly Line Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Robotic Assembly

- General Mechanical Assembly

The report has provided a detailed breakup and analysis of the market based on the type. This includes robotic assembly and general mechanical assembly.

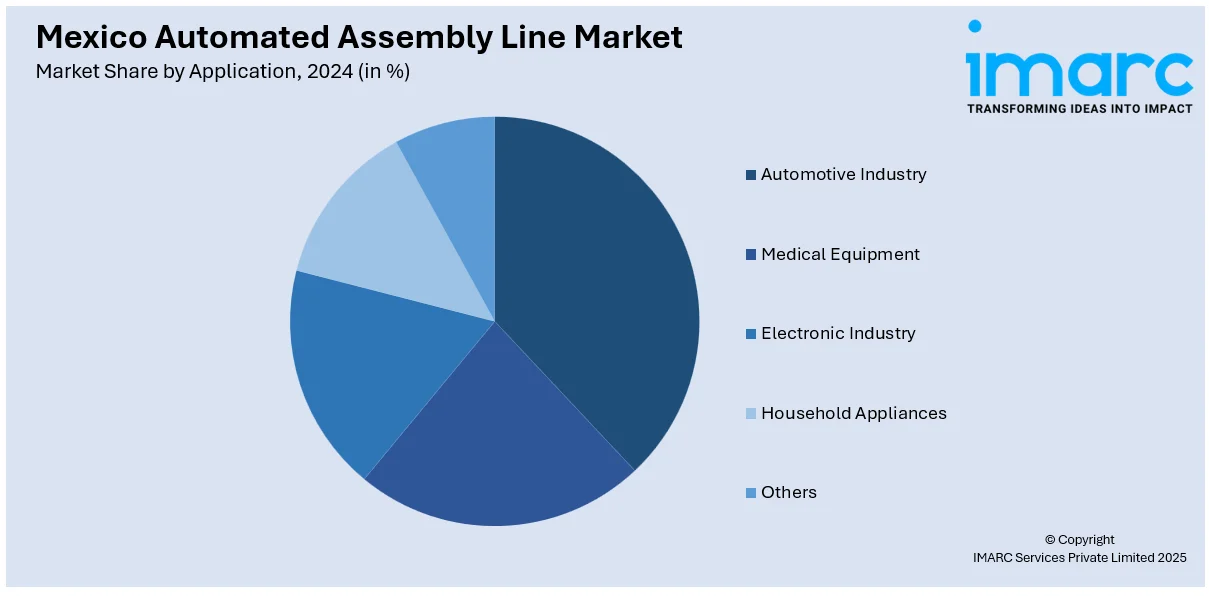

Application Insights:

- Automotive Industry

- Medical Equipment

- Electronic Industry

- Household Appliances

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes automotive industry, medical equipment, electronic industry, household appliances, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has provided a comprehensive analysis of all major regional markets. This includes Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In April 2025, Yicheng Automation formally inaugurated its Mexican branch, raising the service capability in the Americas. The Mexican factory will offer local services, cutting-edge automation solutions, and intelligent production line technologies to help local businesses maximize efficiency, minimize costs, and enhance competitiveness, a crucial move towards Yicheng's global strategy.

- In July 2024, Dongfeng (DFAC), a Chinese automaker, released plans to establish an assembly plant in Mexico by 2025. The plant would cater to national and Latin American markets, have a production capacity of up to 20,000 units, and launch commercial electric vehicles, bolstering DFAC's distribution network as well as regional strategic footprint.

Mexico Automated Assembly Line Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Robotic Assembly, General Mechanical Assembly |

| Applications Covered | Automotive Industry, Medical Equipment, Electronic Industry, Household Appliances, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico automated assembly line market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico automated assembly line market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico automated assembly line industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automated assembly line market in Mexico was valued at USD 822.00 Million in 2024.

The Mexico automated assembly line market is projected to exhibit a CAGR of 10.10% during 2025-2033, reaching a value of USD 2,151.52 Million by 2033.

Some of the major drivers of the Mexico automated assembly line market are growing foreign direct investment in manufacturing, growth of the automotive and electronics industry, and implementation of Industry 4.0 technologies. Automation of production with the integration of robotics, AI, and IoT-enabled systems allows for increased production efficiency, accuracy, and flexibility, whereas government incentives and nearshoring tendencies motivate manufacturers to automate assembly processes, which supports market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)