Mexico Automotive Cooling Systems Market Size, Share, Trends and Forecast by Vehicle Type, Engine Type, and Region, 2025-2033

Mexico Automotive Cooling Systems Market Overview:

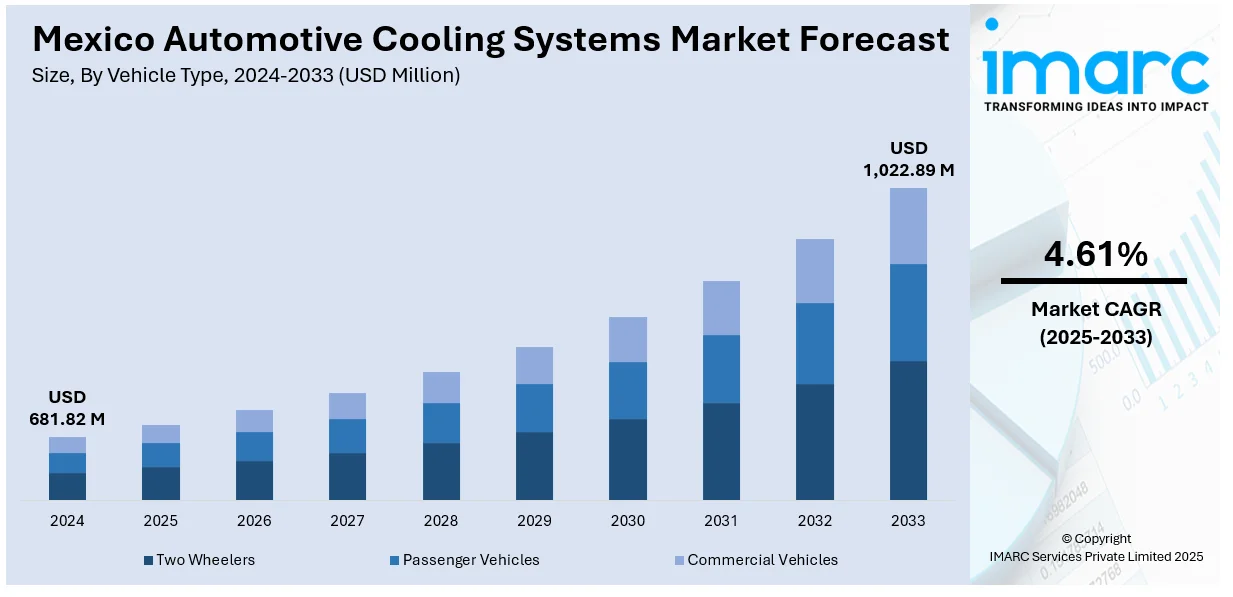

The Mexico automotive cooling systems market size reached USD 681.82 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,022.89 Million by 2033, exhibiting a growth rate (CAGR) of 4.61% during 2025-2033. The market is surged by the growing demand for energy-efficient vehicles and the increasing shift toward electric and hybrid models. As vehicle technology evolves, there’s a rising need for advanced thermal management to maintain performance and safety. Additionally, Mexico's strong manufacturing base, skilled labor force, and proximity to make it an attractive hub for production. Government support for sustainable mobility also encourages innovation in cooling system technologies thus increasing Mexico automotive cooling systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 681.82 Million |

| Market Forecast in 2033 | USD 1,022.89 Million |

| Market Growth Rate 2025-2033 | 4.61% |

Mexico Automotive Cooling Systems Market Analysis:

- Key Drivers: Mexico's expanding automotive manufacturing platform, paced by foreign OEM investments and trade agreements, spurs demand for sophisticated cooling systems. Growing vehicle ownership rates, rising heat-management needs in small engines, and more stringent emission laws further spur adoption. Hybrid and electric vehicle growth also underpins innovation in energy-efficient thermal management technologies.

- Major Market Trends: Slim designs and lightweight materials lead the way for cooling system technology to enhance fuel economy. Electronic cooling modules and intelligent sensors integrate to improve engine performance. Thermal management of EV batteries are becoming increasingly popular. Green practices like recyclable materials and low-GWP refrigerants determine upcoming usage among suppliers and manufacturers in Mexico automotive cooling systems market analysis.

- Market Opportunities: Increased production of EVs and hybrids in Mexico provides opportunities for high-technology cooling solutions designed for battery packs and power electronics. Tie-ups with foreign automakers and Tier-1 suppliers facilitate technology transfer. Domestic manufacturing clusters and fiscal incentives to invest in R&D make it an attractive location for export hub cooling systems.

- Market Challenges: High upfront costs of sophisticated cooling technologies restrict their usage in low-budget vehicles, a dominant segment, as indicated by Mexico automotive cooling systems market analysis. Raw material cost fluctuations, supply chain breakdowns, and dependence on imports are risks. Moreover, technological sophistication in EV cooling systems requires skilled labor, which draws attention to training gaps in the workforce and enhances competitive pressure from international players.

Mexico Automotive Cooling Systems Market Trends:

Shift Toward Electrification and Smart Cooling Technologies

The Mexico automotive industry is steadily adapting to the global move toward electric vehicles (EVs), which demand more precise and advanced cooling systems. Traditional combustion engine cooling methods are no longer sufficient for modern EVs, where batteries, motors, and inverters require specific thermal management. As a result, automakers and suppliers are developing smarter, more compact, and energy-efficient cooling technologies. These systems are designed not only to maintain optimal operating temperatures but also to enhance the vehicle’s performance and longevity. Innovation is key, with companies investing in next-generation materials and integrated system designs. This trend is also fueled by environmental goals and policy changes pushing for cleaner transportation solutions. Mexico's strategic manufacturing capabilities and proximity to North American markets make it a growing hub for the development and export of these modern cooling solutions.

To get more information on this market, Request Sample

Focus on Sustainability and Lightweight Engineering

In response to global demand for cleaner, more efficient vehicles, Mexico’s automotive cooling systems industry is embracing environmentally friendly innovations. The shift to lightweight materials like aluminum and other alloys is helping reduce vehicle weight and improve energy efficiency, without compromising performance. At the same time, manufacturers are refining production processes to be cleaner and more cost-effective, supporting broader industry goals of reducing emissions and enhancing sustainability. This integration of eco-friendly practices is becoming standard. Additionally, Mexico’s government is supporting this transformation by adjusting its tariff policies, including the revocation of the 35% tariff on unwrought unalloyed aluminum and 20% on unwrought alloyed aluminum in May 2024. These changes are aimed at boosting key sectors like automotive manufacturing and providing new opportunities for Mexican firms to export green technology, aligning with global automakers committed to environmental responsibility.

Regional Manufacturing Hubs and Supplier Collaboration

Mexico’s automotive cooling systems market is being shaped by regional development and strong collaborations between manufacturers and global suppliers. Key industrial regions in the country are emerging as specialized hubs, where automotive production is supported by skilled labor, efficient logistics, and strong government backing. These zones attract major international players who partner with local firms to enhance capabilities and streamline production. As supply chains become more integrated, there is a greater emphasis on co-developing systems that meet both domestic and international quality standards. Collaborative engineering efforts are leading to more innovative, tailored solutions for a wide range of vehicles, from compact cars to heavy-duty trucks. This ecosystem fosters Mexico automotive cooling systems market growth, along with resilience and agility in meeting evolving industry demands. The strength of these regional hubs ensures Mexico’s competitiveness in the global automotive supply chain.

Mexico Automotive Cooling Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on vehicle type and engine type.

Vehicle Type Insights:

- Two Wheelers

- Passenger Vehicles

- Commercial Vehicles

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes two wheelers, passenger vehicles, and commercial vehicles.

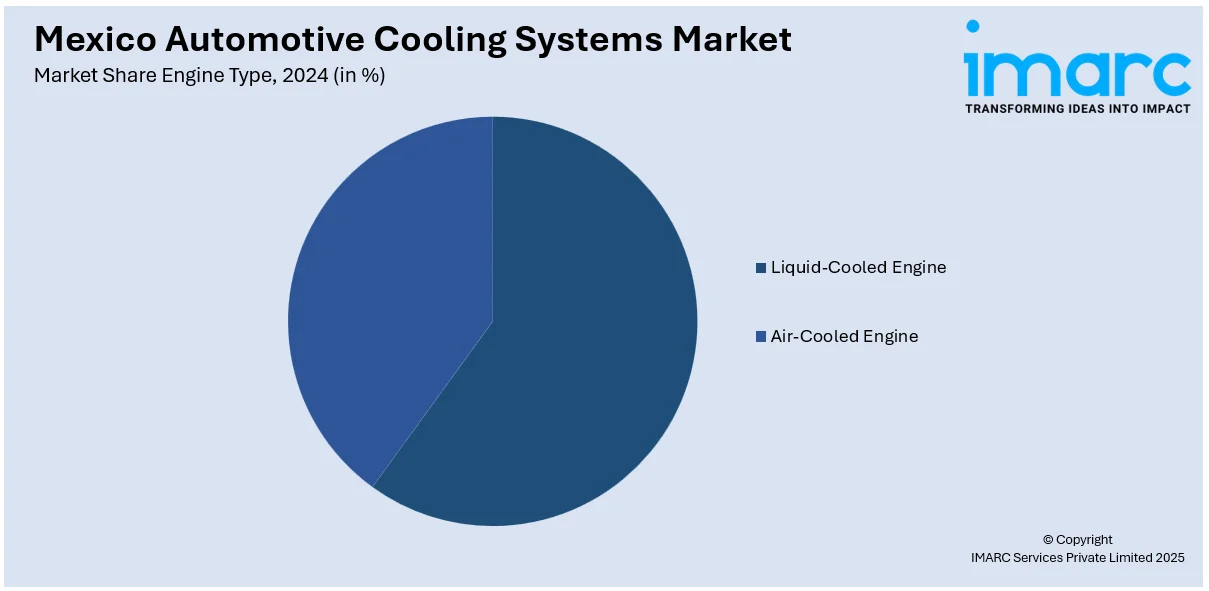

Engine Type Insights:

- Liquid-Cooled Engine

- Air-Cooled Engine

A detailed breakup and analysis of the market based on the engine type have also been provided in the report. This includes liquid-cooled engine and air-cooled engine.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern, Central, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Automotive Cooling Systems Market News:

- In May 2025, Mahle introduced the E-CARE Fluid service unit in Europe, designed to streamline vehicle cooling system maintenance, particularly for EVs. The device automates draining and refilling of coolant circuits during battery repairs or part replacements. It includes leak detection through vacuum and pressure testing, and features two tanks—one for collecting used coolant and another for mixing and refilling per OEM specs. It ensures clean, efficient cooling system servicing for all vehicle types.

- In December 2024, Ampere, formed by Renault and STMicroelectronics, will begin a 2026 collaboration to supply SiC power modules for its EV powertrains. The jointly developed powerbox integrates three SiC modules, an excitation module, and a cooling baseplate to streamline heat management and improve efficiency. Supporting both 400V and 800V systems, this solution enhances EV performance, range, and charging speed, aligning with Ampere’s goal to control its power electronics value chain.

- In July 2024, FORVIA HELLA launched the Coolant Control Hub max (CCH max), an advanced thermal management system for EVs. It integrates battery, drivetrain, and interior cooling into one unit, improving efficiency, reducing complexity, and enabling eco-friendly refrigerants like CO₂ or propane. The system cuts component count and weight by 20%, enhancing range and lowering emissions. Initial rollout is planned in Mexico, highlighting its role in next-gen EV innovation.

Mexico Automotive Cooling Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Two Wheelers, Passenger Vehicles, Commercial Vehicles |

| Engine Types Covered | Liquid-Cooled Engine, Air-Cooled Engine |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico automotive cooling systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico automotive cooling systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico automotive cooling systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive cooling systems market in Mexico was valued at USD 681.82 Million in 2024.

The Mexico automotive cooling systems market is projected to exhibit a CAGR of 4.61% during 2025-2033, reaching a value of USD 1,022.89 Million by 2033.

Key factors driving Mexico automotive cooling systems market include expanding automotive production, rising consumer demand for vehicles, stricter emission norms, and the need for efficient heat management in downsized engines. Additionally, the growth of hybrid and electric vehicles boosts demand for advanced thermal management solutions, supporting technological innovation and adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)