Mexico Automotive Electric Actuators Market Size, Share, Trends and Forecast by Product, Vehicle Type, and Region, 2026-2034

Mexico Automotive Electric Actuators Market Overview:

The Mexico automotive electric actuators market size reached USD 304.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 458.3 Million by 2034, exhibiting a growth rate (CAGR) of 4.66% during 2026-2034. The rising EV adoption and ADAS integration and the growing demand for fuel efficiency are propelling the growth of the market. Automobile manufacturers are transitioning to smart actuators for automated features. Increased industrial localization, as well as government electrification incentives, further encourage market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 304.3 Million |

| Market Forecast in 2034 | USD 458.3 Million |

| Market Growth Rate (2026-2034) | 4.66% |

Access the full market insights report Request Sample

Mexico Automotive Electric Actuators Market Trends:

Advancing Energy-Efficient Actuation in Automotive Electrification

Manufacturers are prioritizing sustainability and performance, boosting the need for energy-efficient actuation systems. Advanced testing solutions improve the reliability and durability of electric actuators, assuring compliance with changing industry requirements. Companies are switching from hydraulic to servo-electric technologies because they consume less energy, need less maintenance, and are more environmentally friendly. With the automobile industry focused on electrification and automation, testing procedures are evolving to accommodate next-generation actuators in crucial applications like ADAS and EVs. Engineering expertise and regional development are propelling innovation, enhancing quality control, and shortening the time to market for new actuator technologies. Investment in cutting-edge evaluation technologies strengthens the automotive supply chain, improves production processes, and reinforces the transition to more efficient and sustainable transportation options. For example, in April 2024, eMpulse Test Systems, a producer of servo-electric road simulators, partnered with Sitec to bring advanced testing solutions to Mexico. The collaboration uses eMpulse's servoelectric actuation (SEA) technology for durability testing and end-of-life assessment, increasing energy-efficient actuator development and promoting sustainability in Mexico's automotive sector.

Evolving Actuation Technologies for Expanding EV Market

Rising EV usage is increasing the demand for innovative electrical components, such as efficient actuation systems. Vehicles now require precise control methods for battery management, drive-by-wire capabilities, and improved driver-assistance features. As demand develops, improvements in servomechanical and electromechanical actuation prioritize energy economy, lightweight design, and improved performance. Automakers are using smart actuators to minimize power usage, decrease mechanical complexity, and increase system dependability. The transition to electrification is also driving manufacturers to improve actuator durability and response times for crucial vehicle operations. Investing in research and localized production strengthens supply chains, ensures quality control, and allows for speedier deployment of next-generation actuation systems. These breakthroughs are defining the future of vehicle transportation by prioritizing efficiency and sustainability. As per industry reports, the EV industry in Mexico is expected to grow at a CAGR of 9.02% to USD 53.4 Billion by 2029, boosting demand for automotive electric actuators. As the adoption of electric vehicles grows, vehicles will require additional electronic components, such as battery management actuators, drive-by-wire systems, ADAS, and thermal management. This expansion drives the demand for energy-efficient, lightweight, and high-performance actuators, hastening advances in servomechanical and electromechanical actuation technologies.

Mexico Automotive Electric Actuators Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product and vehicle type.

Product Insights:

To get detailed segment analysis of this market Request Sample

- Throttle Actuator

- Seat Adjustment Actuator

- Brake Actuator

- Closure Actuator

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes a throttle actuator, seat adjustment actuator, brake actuator, closure actuator, and others.

Vehicle Type Insights:

- Passenger Vehicle

- Commercial Vehicle

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger vehicle and commercial vehicle.

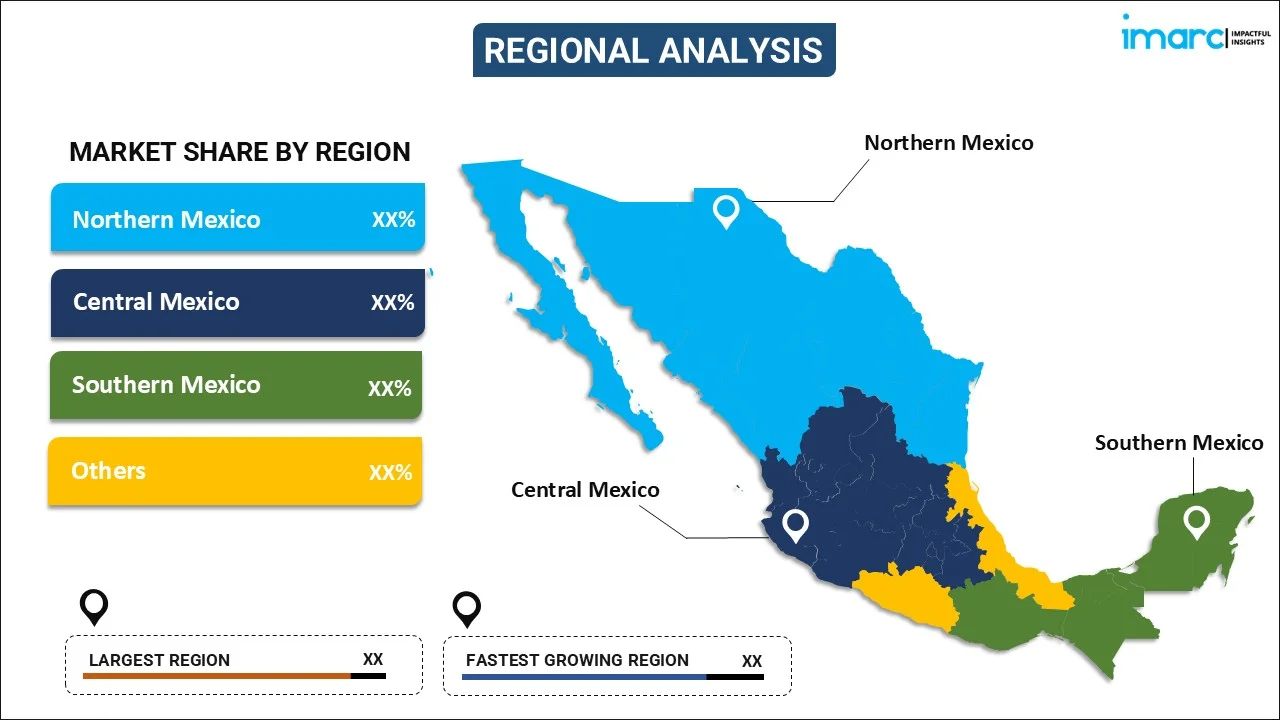

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Automotive Electric Actuators Market News:

- In November 2024, an Automotive Logistics & Supply Chain Mexico conference was held that focused on how nearshoring investments enhanced supply chains for electrical actuators. Industry leaders claimed greater regional production, lower import dependency, and higher manufacturing efficiency for actuator components utilized in electric cars and innovative automotive systems.

- In August 2024, SCHUNK launched a new 5,000-square-meter facility in Santiago de Querétaro, expanding its assembly and engineering capabilities for automation components. This development meets the increased need for electric actuators in Mexico's automotive sector, resulting in quicker deliveries with customized solutions for regional manufacturers in North and South America.

Mexico Automotive Electric Actuators Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Throttle Actuator, Seat Adjustment Actuator, Brake Actuator, Closure Actuator, Others |

| Vehicle Types Covered | Passenger Vehicle, Commercial Vehicle |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico automotive electric actuators market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico automotive electric actuators market on the basis of product?

- What is the breakup of the Mexico automotive electric actuators market on the basis of vehicle type?

- What are the various stages in the value chain of the Mexico automotive electric actuators market?

- What are the key driving factors and challenges in the Mexico automotive electric actuators market?

- What is the structure of the Mexico automotive electric actuators market and who are the key players?

- What is the degree of competition in the Mexico automotive electric actuators market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico automotive electric actuators market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico automotive electric actuators market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico automotive electric actuators industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)