Mexico Automotive Glass for Windshield Market Size, Share, Trends and Forecast by Glass Type, Vehicle Type, Distribution Channel, Product Type, Technology, and Region, 2025-2033

Mexico Automotive Glass for Windshield Market Overview:

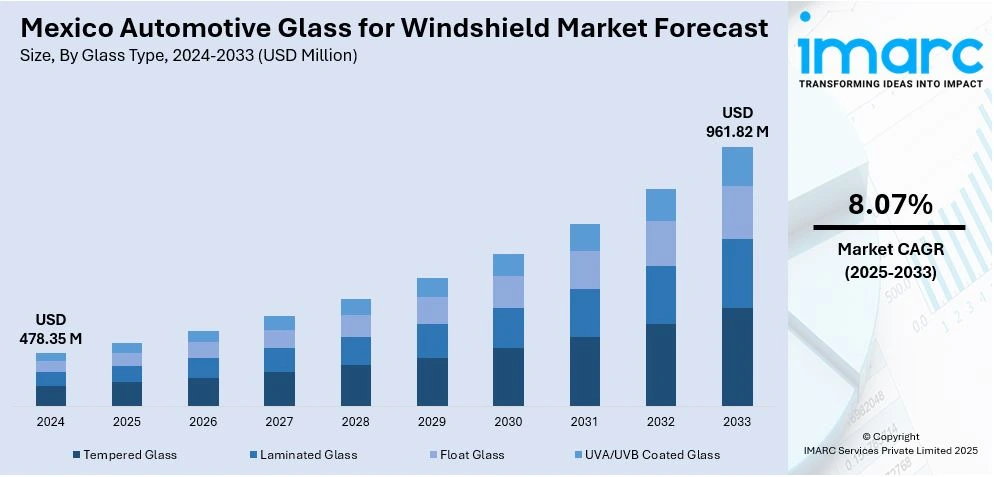

The Mexico automotive glass for windshield market size reached USD 478.35 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 961.82 Million by 2033, exhibiting a growth rate (CAGR) of 8.07% during 2025-2033. The expansion of automotive production, increasing adoption of electric vehicles (EVs), and the growth of the luxury car market in Mexico are pivotal factors driving the demand for advanced automotive glass. These developments necessitate the use of high-performance, durable, and energy-efficient windshields to meet the evolving requirements of the automotive industry, thereby contributing to the Mexico automotive glass for windshield market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 478.35 Million |

| Market Forecast in 2033 | USD 961.82 Million |

| Market Growth Rate 2025-2033 | 8.07% |

Mexico Automotive Glass for Windshield Market Analysis:

- Major Drivers: Market growth is driven by the increasing automotive industry and increasing vehicle manufacturing. Demand from consumers for safety, durability, and beauty promotes investment in sophisticated windshield technologies thereby bolstering Mexico automotive glass for windshield market growth. Developments such as laminated and tempered glass and higher safety requirements also drive the market's growth and shape manufacturer decisions.

- Key Market Trends: Lighter, more energy-efficient materials are being used in windshield designs. The integration of smart features like heads-up displays and augmented reality functionalities is driving the market. Advanced driver-assistance systems necessitate specialized glass, impacting manufacturing processes. Environmental considerations and sustainability are leading manufacturers to use eco-friendly materials and manufacturing techniques.

- Market Opportunities: The aftermarket market has potential because of vehicle replacements and improvements. Autonomous and electric cars generate demand for high-tech glass solutions. Improved manufacturing technologies enable manufacturers to produce high-performance and affordable windshields. Partnerships with OEMs and development of smart glass products have great growth opportunities for Mexican companies.

- Market Challenges: Based on the Mexico automotive glass for windshield market analysis, the increasing raw material price and supply chain uncertainty are production challenges. The demand for sustainable manufacturing techniques is added complexity. Increased technological growth calls for innovation, research, and skilled labor on a continuous basis. Imports and substitute material competition also put pressure on domestic manufacturers, necessitating strategic planning and investment to sustain market share.

Mexico Automotive Glass for Windshield Market Trends:

Rise in Automotive Production and Ownership

The ongoing increase in car production and ownership is a key factor influencing the Mexico windshield glass market growth. Mexico, as a prominent center for vehicle manufacturing in North America, integrates significant domestic demand with a strong export-focused production framework. The escalating demand for personal and commercial vehicles is driving the need for original equipment manufacturer (OEM) windshields. Increasing access to credit and an expanding middle class are making vehicle ownership more attainable, broadening the market base. Additionally, the transition to electric and hybrid vehicles, many of which need cutting-edge windshield technologies, is catalyzing the demand for high-performance glass. The Mexican Automotive Industry Association (AMIA) reports that in 2024, automobile production totaled 3,989,403 units, marking a 5.56% rise compared to 2023. As Mexico is anticipated to rank as the world’s fifth-largest vehicle manufacturer by 2025, with an additional 2.7% growth forecasted, the necessity for high-quality, long-lasting, and technologically sophisticated windshield glass will increase considerably.

To get more information on this market, Request Sample

Increasing Popularity of EVs

The swift expansion of the EV sector in Mexico is greatly influencing the automotive glass market for windshields. According to the National Institute of Statistics and Geography (INEGI) stated that from January to November 2024, 108,943 hybrid, plug-in hybrid, and EVs were sold in Mexico, showing a 70.2% rise compared to 2023. This increase is catalyzing the demand for specialized automotive glass solutions. As the adoption of EVs rises, manufacturers are creating vehicles that require particular kinds of windshields to enhance performance. EVs need light, energy-saving glass to improve their range and overall performance. Additionally, bigger windshields are frequently included to enhance aerodynamics and decrease energy use. This transition to electric transportation is driving the need for innovative glass technologies, such as low-emissivity coatings, that manage cabin temperature while maintaining vehicle efficiency.

Growth of Luxury Car

The rise of the luxury vehicle market in Mexico is a key factor influencing the automotive glass for windshields market. With the growing demand for premium automobiles, especially in the luxury sector, the requirement for specialized, high-performance windshields is on a rise. Luxury cars generally need sophisticated glass options that provide enhanced durability, appearance, and functionality, such as heat-resistant and soundproof windshields. These vehicles frequently come with expansive, panoramic windshields that improve the driving experience and necessitate sophisticated manufacturing methods and high-quality materials. The expanding luxury car market in Mexico, valued at USD 7.0 billion in 2024 and projected to grow at a CAGR of 4.0% to attain USD 10.0 billion by 2033, as per the data provided by the IMARC Group. This is directly influencing the need for automotive glass that adheres to the high standards of luxury car manufacturers. This expansion, in turn, catalyzes the demand for superior, high-quality windshields.

Mexico Automotive Glass for Windshield Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on glass type, vehicle type, distribution channel, product type, and technology.

Glass Type Insights:

- Tempered Glass

- Laminated Glass

- Float Glass

- UVA/UVB Coated Glass

The report has provided a detailed breakup and analysis of the market based on the glass type. This includes tempered glass, laminated glass, float glass, and UVA/UVB coated glass.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers

- Heavy-Duty Vehicles

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger cars, commercial vehicles, two-wheelers, and heavy-duty vehicles.

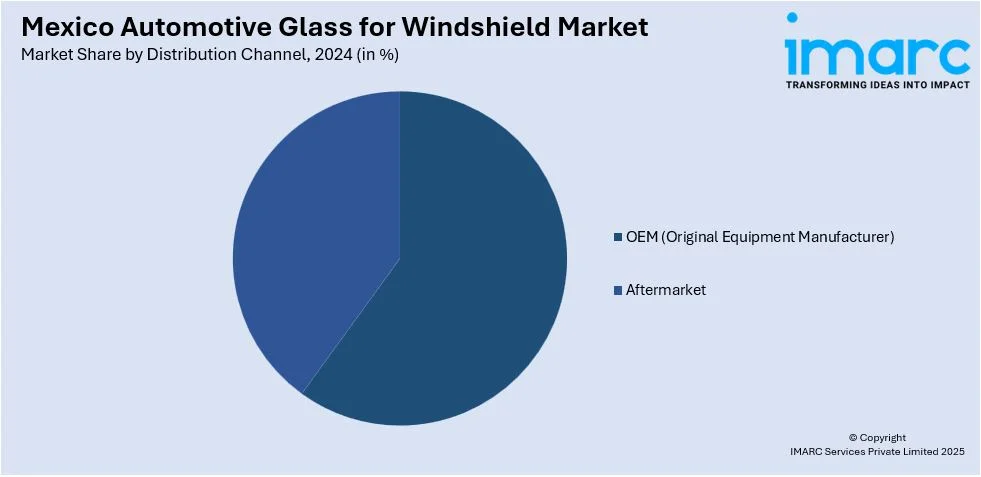

Distribution Channel Insights:

- OEM (Original Equipment Manufacturer)

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes OEM (original equipment manufacturer) and aftermarket.

Product Type Insights:

- Windshield Glass

- Sidelite Glass

- Backlite Glass

- Sunroof Glass

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes windshield glass, sidelite glass, backlite glass, and sunroof glass.

Technology Insights:

- Traditional Glass Processing

- Advanced Glass Processing

- Smart Glass Technology

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes traditional glass processing, advanced glass processing, and smart glass technology.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In May 2025, Fuyao Glass Industry Group Co., Ltd. introduced the Zhimou front windshield glass, featuring an in-cockpit hidden LiDAR design, debuting on the Cadillac Vistiq. This innovative windshield enhances vehicle aesthetics with sleeker body lines, reduces drag, improves range, and supports advanced driver-assistance systems. The solution integrates cutting-edge technology without compromising design, reflecting Fuyao Group’s focus on automotive innovation and smart, performance-driven glass solutions for modern vehicles.

Mexico Automotive Glass for Windshield Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Glass Types Covered | Tempered Glass, Laminated Glass, Float Glass, UVA/UVB Coated Glass |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles, Two-Wheelers, Heavy-Duty Vehicles |

| Distribution Channels Covered | OEM (Original Equipment Manufacturer), Aftermarket |

| Product Types Covered | Windshield Glass, Sidelite Glass, Backlite Glass, Sunroof Glass |

| Technologies Covered | Traditional Glass Processing, Advanced Glass Processing, Smart Glass Technology |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico automotive glass for windshield market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico automotive glass for windshield market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico automotive glass for windshield industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive glass for windshield market in Mexico was valued at USD 478.35 Million in 2024.

The Mexico automotive glass for windshield market is projected to exhibit a CAGR of 8.07% during 2025-2033, reaching a value of USD 961.82 Million by 2033.

The Mexico automotive glass windshield market is primarily driven by the nation's strong automotive manufacturing base, bolstered by trade agreements like the USMCA. Rising consumer demand for vehicle safety and comfort features, such as advanced driver-assistance systems (ADAS), fuels the adoption of specialized glass technologies. Additionally, government initiatives promoting electric vehicle production and technological advancements in glass processing further contribute to market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)