Mexico Automotive HVAC Market Size, Share, Trends and Forecast by Component, Technology, Vehicle Type, and Region, 2025-2033

Mexico Automotive HVAC Market Overview:

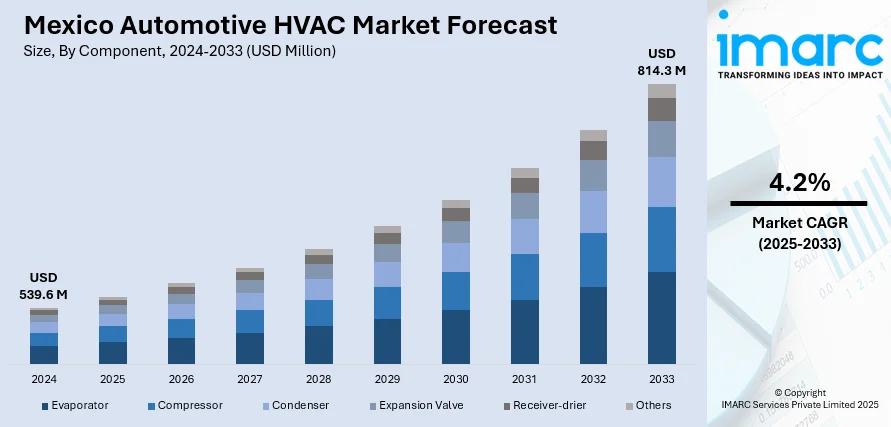

The Mexico automotive HVAC market size reached USD 539.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 814.3 Million by 2033, exhibiting a growth rate (CAGR) of 4.2% during 2025-2033. The market is driven by rising demand for energy-efficient systems, stricter emission regulations, and the growth of electric vehicles. Increasing consumer preference for smart, connected climate control solutions and health-conscious features such as air purification also fuels market expansion. Additionally, continual technological advancements and the integration of AI and IoT in HVAC systems are further expanding the Mexico automotive HVAC market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 539.6 Million |

| Market Forecast in 2033 | USD 814.3 Million |

| Market Growth Rate 2025-2033 | 4.2% |

Mexico Automotive HVAC Market Trends:

Rising Demand for Energy-Efficient HVAC Systems

The market is witnessing a growing demand for energy-efficient systems due to increasing fuel prices and stringent environmental regulations. In April 2025, the price of gasoline in Mexico rose to USD 1.21 per liter from USD 1.16 in March, nearing the record price of USD 1.41 in 2024, according to industry reports. The rising costs are pushing the need for energy-efficient car HVAC systems. As a result, Mexican manufacturers are under pressure to develop climate control technologies that minimize fuel consumption and enhance vehicle efficiency. Automotive and consumer companies are interested in HVAC technologies to achieve energy savings and improved comfort inside the cabin. Value-added emerging technologies, including variable displacement compressors, electrically driven compressors, and smart climate control systems, lower the engine loading, thereby increasing fuel efficiency, lowering emissions, and presenting an opportunity for Mexico, which has committed to sustainability at a worldwide level. The expansion of hybrid and EVs will also enable manufacturers to embrace these technologies towards their evolution of more eco-friendly HVAC technologies since both technologies can utilize battery power instead of engine-driven accessory components. Manufacturers are now investing a portion of their research and development (R&D) activities to create lightweight, highest-efficiency systems that can be utilized for conventional and electric vehicles. Moreover, increased consumer consciousness of their impact on the environment will drive the adoption of energy-efficient HVAC technology and grow this part of the market.

To get more information of this market, Request Sample

Integration of Advanced Smart HVAC Technologies

The rise in smart technology integration, driven by the increasing demand for enhanced passenger comfort and connectivity, is facilitating the Mexico automotive HVAC market growth. Modern HVAC systems now feature automated temperature control, air quality sensors, and smartphone-enabled adjustments, offering a personalized driving experience. The adoption of internet of things (IoT) and artificial intelligence (AI) in automotive HVAC allows for predictive climate control, where the system adjusts settings based on external weather conditions and passenger preferences. As per industry reports, US imports from Mexico totaled USD 475 Billion in 2023, exceeding those of China for the first time in two decades, as over 830 foreign firms established operations in Mexican industrial parks between 2018 and 2023. Another 450 firms are projected by 2025, making Mexico a hub for auto HVAC and climate control production, driven by low labor costs, geographic proximity to the US, and benefits of the USMCA free trade pact. As a reaction to the growing demand, major companies have established extensive manufacturing facilities in Monterrey. Furthermore, cabin air purification systems with HEPA filters and UV sterilization are gaining popularity due to accelerated health concerns post-pandemic. Automakers are also incorporating voice-activated controls and seamless integration with infotainment systems, enhancing user convenience. As vehicles become more connected and autonomous, the demand for intelligent HVAC solutions will continue to rise, positioning Mexico as a key market for advanced automotive climate control technologies.

Mexico Automotive HVAC Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, technology, and vehicle type.

Component Insights:

- Evaporator

- Compressor

- Condenser

- Expansion Valve

- Receiver-drier

- Others

The report has provided a detailed breakup and analysis of the market based on the component. This includes evaporator, compressor, condenser, expansion valve, receiver-drier, and others.

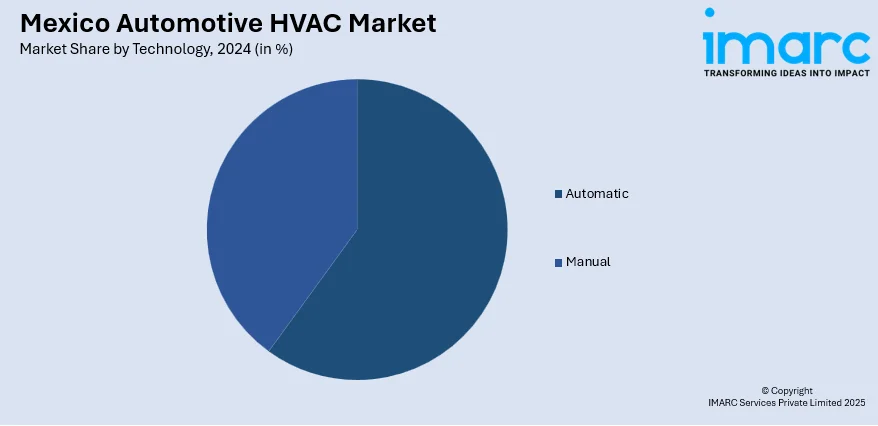

Technology Insights:

- Automatic

- Manual

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes automatic and manual.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicle

- Electric Vehicle

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars, commercial vehicle, and electric vehicle.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Automotive HVAC Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Evaporator, Compressor, Condenser, Expansion Valve, Receiver-Drier, Others |

| Technologies Covered | Automatic, Manual |

| Vehicle Types Covered | Passenger Car, Commercial Vehicle, Electric Vehicle |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico automotive HVAC market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico automotive HVAC market on the basis of component?

- What is the breakup of the Mexico automotive HVAC market on the basis of technology?

- What is the breakup of the Mexico automotive HVAC market on the basis of vehicle type?

- What is the breakup of the Mexico automotive HVAC market on the basis of region?

- What are the various stages in the value chain of the Mexico automotive HVAC market?

- What are the key driving factors and challenges in the Mexico automotive HVAC?

- What is the structure of the Mexico automotive HVAC market and who are the key players?

- What is the degree of competition in the Mexico automotive HVAC market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico automotive HVAC market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico automotive HVAC market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico automotive HVAC industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)