Mexico Automotive Infotainment Market Size, Share, Trends and Forecast by Product Type, Vehicle Type, Operating System, Installation Type, Sales Channel, Technology, Connectivity, and Region, 2025-2033

Mexico Automotive Infotainment Market Overview:

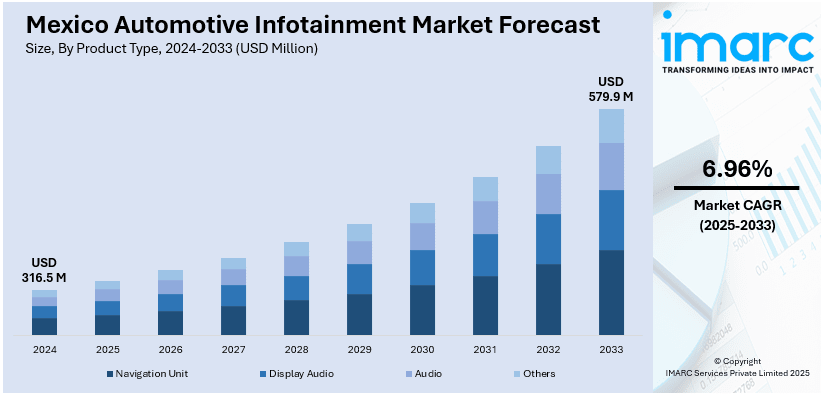

The Mexico automotive infotainment market size reached USD 316.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 579.9 Million by 2033, exhibiting a growth rate (CAGR) of 6.96% during 2025-2033. The market is witnessing significant growth driven by rising demand for connected vehicles, AI integration, and EV expansion. Advancements in real-time data analytics, cloud-based services, and smartphone connectivity are driving adoption, ensuring a strong market outlook with increasing technological innovations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 316.5 Million |

| Market Forecast in 2033 | USD 579.9 Million |

| Market Growth Rate 2025-2033 | 6.96% |

Mexico Automotive Infotainment Market Trends:

Rising Demand for Connected Vehicles

Demand for connected cars in Mexico is increasing as customers look for in-car connectivity without interruption for better driving experiences. Mexico automotive infotainment market share is increasing because of the rising usage of advanced infotainment systems with Wi-Fi, GPS navigation and smartphone connectivity. Auto manufacturers are integrating cars with technologies like Android Auto and Apple CarPlay, enabling drivers to access real-time traffic information, entertainment applications and voice commands. For instance, in November 2023, Geely Mexico officially began operations, introducing the Geely Coolray 2024 SUV, which features a sporty design and an advanced infotainment system with Apple CarPlay alongside the electric Geely Geometry C 2024. The company aims to establish 100 distributors nationwide by 2025 to enhance market presence. Moreover, the development of 5G networks is further increasing vehicle connectivity, facilitating high-speed data transmission and cloud services. Car manufacturers are also turning their attention to over-the-air (OTA) software updates to enhance system performance and security. As smart and electric cars become more popular, infotainment systems will further develop playing a central role in vehicle intelligence and user experience. With these advancements, a strong Mexico automotive infotainment market outlook is expected in the coming years.

Growth of Electric and Autonomous Vehicles

The expansion of electric vehicles (EVs) and autonomous driving technologies is significantly influencing the demand for advanced automotive infotainment systems in Mexico. According to the industry reports, in 2024, Mexico witnessed an 84% rise in electric vehicle (EV) sales totaling 69,713 units, with hybrid sales up 155%. The zero-emission vehicle fleet reached 107,633, comprising 50.3% electric and 49.7% hybrid. Charging infrastructure grew by 5% totaling 45,055 connectors by year-end, highlighting significant advancements in sustainable mobility. With increased EV adoption, manufacturers are incorporating advanced infotainment solutions that provide real-time data analytics, cloud services and AI-based interfaces to improve driving. Autonomous vehicles are dependent on advanced infotainment solutions for hassle-free navigation, voice recognition capabilities and driver assistance features. Additionally, connectivity solutions such as 5G integration and over-the-air (OTA) updates are becoming essential for improving system efficiency and keeping software up to date. The shift toward digital cockpits featuring large touchscreen displays and AI-powered assistants is further enhancing user engagement. As vehicle electrification and automation continue to grow, the demand for cutting-edge infotainment technology is expected to increase, driving Mexico automotive infotainment market growth in the coming years.

Mexico Automotive Infotainment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, vehicle type, operating system, installation type, sales channel, technology, and connectivity.

Product Type Insights:

- Navigation Unit

- Display Audio

- Audio

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes navigation unit, display audio, audio and others.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger cars, and commercial vehicles.

Operating System Insights:

- QNX

- LINUX

- Microsoft

- Others

A detailed breakup and analysis of the market based on the operating system have also been provided in the report. This includes QNX, LINUX, Microsoft, and others.

Installation Type Insights:

- In-Dash Infotainment

- Rear Seat Infotainment

A detailed breakup and analysis of the market based on the installation type have also been provided in the report. This includes in-dash infotainment and rear seat infotainment.

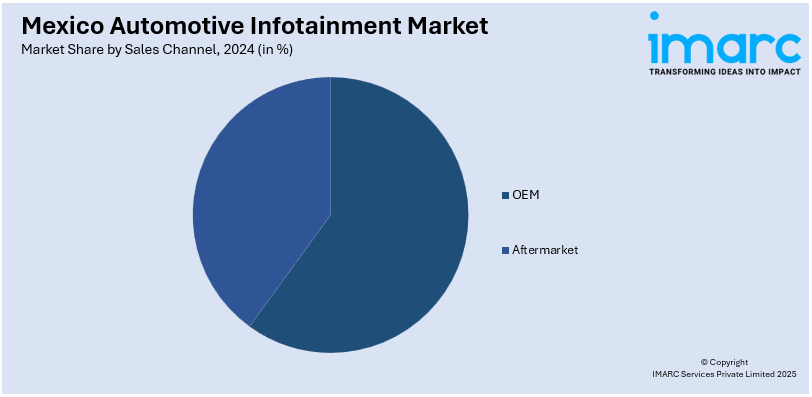

Sales Channel Insights:

- OEM

- Aftermarket

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes OEM and aftermarket.

Technology Insights:

- Integrated

- Embedded

- Tethered

A detailed breakup and analysis of the market based on technology have also been provided in the report. This includes integrated, embedded, and tethered.

Connectivity Insights:

- Bluetooth

- Wi-Fi

- 3G

- 4G

- 5G

A detailed breakup and analysis of the market based on connectivity have also been provided in the report. This includes Bluetooth, Wi-Fi, 3G, 4G, and 5G.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Automotive Infotainment Market News:

- In February 2025, Chevrolet announced the launch of the 2026 Spark EUV in Mexico, marking the evolution of the iconic nameplate into an all-electric crossover. Featuring a boxy design, zero-emission technology, and an 8.8-inch infotainment system, it aims to capture the entry-level market in Latin America, enhancing Chevrolet's competitiveness against Chinese EV rivals.

- In March 2023, CARIAD announced the launch of a new application store for Volkswagen Group brands, which debuted at the Mobile World Congress. Audi will be the first to integrate this application store into selected models by July 2023 enhancing the infotainment systems. The rollout will include models in Mexico allowing access to third-party apps and improving the in-car digital experience for customers.

Mexico Automotive Infotainment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Navigation Unit, Display Audio, Audio, Others |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Operating Systems Covered | QNX, LINUX, Microsoft, Others |

| Installation Types Covered | In-Dash Infotainment, Rear Seat Infotainment |

| Sales Channels Covered | OEM, aftermarket |

| Technologies Covered | Integrated, Embedded, Tethered |

| Connectivity Covered | Bluetooth, Wi-Fi, 3G, 4G, 5G |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico automotive infotainment market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico automotive infotainment market on the basis of product type?

- What is the breakup of the Mexico automotive infotainment market on the basis of vehicle type?

- What is the breakup of the Mexico automotive infotainment market on the basis of operating system?

- What is the breakup of the Mexico automotive infotainment market on the basis of installation type?

- What is the breakup of the Mexico automotive infotainment market on the basis of sales channel?

- What is the breakup of the Mexico automotive infotainment market on the basis of technology?

- What is the breakup of the Mexico automotive infotainment market on the basis of connectivity?

- What is the breakup of the Mexico automotive infotainment market on the basis of region?

- What are the various stages in the value chain of the Mexico automotive infotainment market?

- What are the key driving factors and challenges in the Mexico automotive infotainment?

- What is the structure of the Mexico automotive infotainment market and who are the key players?

- What is the degree of competition in the Mexico automotive infotainment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico automotive infotainment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico automotive infotainment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico automotive infotainment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)