Mexico Automotive Interior Materials Market Size, Share, Trends and Forecast by Component, Material, Vehicle Type, and Region, 2025-2033

Mexico Automotive Interior Materials Market Overview:

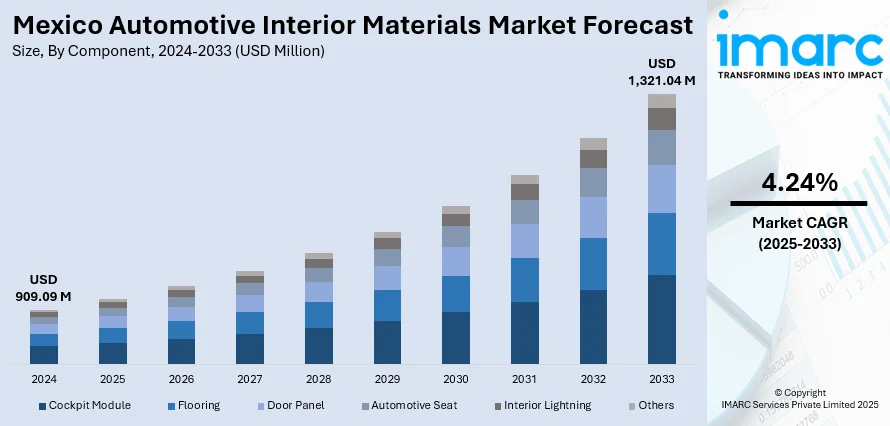

The Mexico automotive interior materials market size reached USD 909.09 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,321.04 Million by 2033, exhibiting a growth rate (CAGR) of 4.24% during 2025-2033. The market is driven by the growing automotive manufacturing sector, rising vehicle production, and increasing demand for premium materials. Additionally, the expanding aftermarket segment fueled by vehicle customization and electric vehicle (EV) growth further contribute to the increase in Mexico automotive interior materials market share, with higher demand for personalized and advanced interior materials.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 909.09 Million |

| Market Forecast in 2033 | USD 1,321.04 Million |

| Market Growth Rate 2025-2033 | 4.24% |

Mexico Automotive Interior Materials Market Analysis:

- Key Drivers: Mexico's robust automotive production market, US proximity, and domestic vehicle demand growth drive Mexico automotive interior materials market demand. Growing consumer trend towards comfort, safety, and personalization compels car manufacturers to implement sophisticated polymers, leather, and fabrics. Foreign investment support by the government further enhances production capability and supply chain resilience.

- Key Market Trends: Light, sustainable interior materials are on the rise as OEMs prioritize fuel economy and emissions reduction. High-end finishes, intelligent textiles, and antimicrobial surfaces become the norm. Electrification spurs pace of noise-dampening material adoption. Digitization incorporates touch-sensitive surfaces to improve user experience. Recycling efforts and circular economy business practices shape design and sourcing.

- Market Opportunities: Increased electric vehicle (EV) manufacturing in Mexico creates opportunities for advanced interior materials with enhanced energy efficiency. Environmental concerns, recyclability, and bio-based solutions offer opportunities for innovation. Tier-1 suppliers can capitalize on local production to minimize import dependence. Expanding middle-class demand for premium features propels investments into luxury and comfort solutions.

- Market Challenges: According to Mexico automotive interior materials market forecast, unpredictability in raw material prices, particularly petrochemical-based inputs, tests profitability. Regulated sustainability standards call for expensive research and development (R&D) expenditure. Price rivalry from low-cost Asian suppliers tests local competition. Supply chain breakdowns due to global uncertainty impact timely delivery. Finding a harmony between affordability and sophisticated features continues to be challenging, especially in price-sensitive Mexican market led by compact and mid-size vehicles.

Mexico Automotive Interior Materials Market Trends:

Growing Automotive Production in Mexico

The automotive interior materials market in Mexico is notably propelled by the flourishing automotive manufacturing industry, which is expanding in both size and complexity. As a prominent worldwide center for vehicle manufacturing, particularly for original equipment manufacturers (OEMs) and suppliers, the need for top-notch interior materials is increasing significantly. This demand is mainly driven by the rising output of light vehicles, commercial vehicles, and high-end models. For example, the Mexican Automotive Industry Association (AMIA) predicts that by 2025, Mexico will rank as the fifth-largest vehicle manufacturer globally. In 2024, Mexico's car production approached 4 million units, reflecting a 5.56% increase compared to the prior year, with an anticipated 2.7% growth in 2025. This increase in output is catalyzing the demand for essential automotive interior materials, such as plastics, upholstery, and composites, as producers aim to satisfy both aesthetic and functional needs for contemporary car interiors. Mexico’s importance as a significant participant in the North American Free Trade Agreement (NAFTA) area enhances its standing, providing automotive producers with access to affordable labor and advantageous trade terms. As a result, both local and global suppliers are progressively investing in advanced materials, contributing to the Mexico automotive interior materials market growth.

To get more information on this market, Request Sample

Increase in Aftermarket Demand

With the rising number of vehicles on the road, the demand for interior enhancements, replacements, and customizations is also growing. Individuals are progressively pursuing tailored, high-end enhancements for their vehicle interiors, which consist of elements, such as bespoke seat covers, floor mats, improved dashboards, multimedia systems, and elegant trim features. The rising trend of vehicle customization is motivated not only by the aim to enhance comfort and practicality but also by the desires of the users to set their vehicles apart with distinctive, luxurious interiors. Suppliers are reacting by providing a broader selection of premium materials designed for customization requirements. The trend is boosted additionally by the expansion of the EV aftermarket in Mexico, which hit USD 1.2 million in 2024. Based on forecasts by IMARC Group, the market is anticipated to grow considerably, hitting USD 6.6 million by 2033, with a compound annual growth rate (CAGR) of 20.59% from 2025 to 2033. This swift growth emphasizes the rising significance of aftermarket interior items, as a greater number of individuals focus on improving their EV interiors. The need for items like personalized upholstery, high-tech trim components, and ornamental features is increasing, further driving expansion in both OEM and aftermarket markets.

Mexico Automotive Interior Materials Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, material, and vehicle type.

Component Insights:

- Cockpit Module

- Flooring

- Door Panel

- Automotive Seat

- Interior Lightning

- Others

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes cockpit module, flooring, door panel, automotive seat, interior lightning, and others.

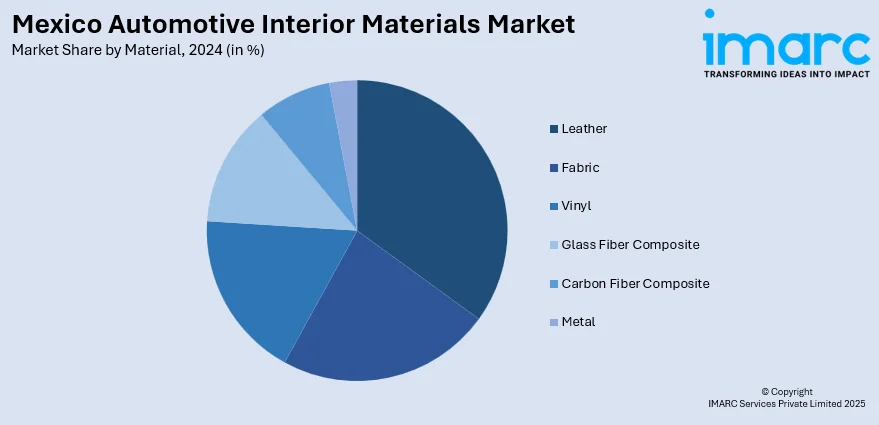

Material Insights:

- Leather

- Fabric

- Vinyl

- Glass Fiber Composite

- Carbon Fiber Composite

- Metal

The report has provided a detailed breakup and analysis of the market based on the material. This includes leather, fabric, vinyl, glass fiber composite, carbon fiber composite, and metal.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger cars and commercial vehicles.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In August 2025, General Motors and Hyundai Motor Company confirmed plans to jointly develop five vehicles, following a 2024 MoU. Four models—a compact SUV, compact car, and two pickups—will target Central and South America, while an electric commercial van will serve North America. Production is set for 2028, with expected sales exceeding 800,000 units annually. Both firms will share platforms but design unique interiors and exteriors, highlighting their distinct brand identities.

- In April 2025, At Hannover Messe 2025, German firm Novem Car Interior Design announced a MXN 306 million investment to expand its Querétaro, Mexico plant. The project will generate 150 high-skilled jobs, strengthening the state’s automotive supply chain. The decision was confirmed in a meeting between Novem executives and a Querétaro delegation led by Marco Antonio, highlighting Mexico’s growing role in advanced automotive interior manufacturing.

- In May 2025, Katcon Global and Tata AutoComp Systems formed a joint venture in Monterrey to produce advanced composite materials for the automotive industry. Katcon, a Mexican leader in exhaust systems and thermal insulation, operates 11 plants and five R&D centers worldwide. Tata AutoComp, part of India’s Tata Group, supplies components for next-generation EVs across 61 factories globally. The partnership will support innovative solutions for future vehicles and industrial applications.

Mexico Automotive Interior Materials Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Cockpit Module, Flooring, Door Panel, Automotive Seat, Interior Lightning, Others |

| Materials Covered | Leather, Fabric, Vinyl, Glass Fiber Composite, Carbon Fiber Composite, Metal |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico automotive interior materials market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico automotive interior materials market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico automotive interior materials industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive interior materials market in Mexico was valued at USD 909.09 Million in 2024.

The Mexico automotive interior materials market is projected to exhibit a CAGR of 4.24% during 2025-2033, reaching a value of USD 1,321.04 Million by 2033.

The Mexico automotive interior materials market is driven by rising vehicle production, consumer demand for comfort and aesthetics, lightweight materials for fuel efficiency, and growth in electric vehicles. Technological advancements, sustainability trends, stringent safety standards, and increasing disposable income further boost demand for premium, durable, and eco-friendly interior materials.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)