Mexico Automotive Lighting Market Size, Share, Trends and Forecast by Technology, Vehicle Type, Sales Channel, Application, and Region, 2025-2033

Mexico Automotive Lighting Market Overview:

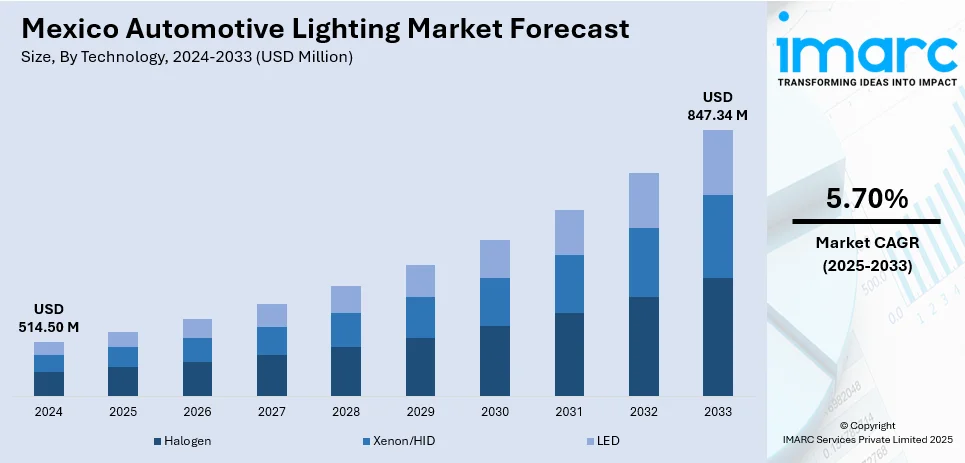

The Mexico automotive lighting market size reached USD 514.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 847.34 Million by 2033, exhibiting a growth rate (CAGR) of 5.70% during 2025-2033. Increasing vehicle production, rising adoption of light-emitting diode (LED) technology, stricter government road safety regulations, the expansion of electric vehicle manufacturing, original equipment manufacturer (OEM) collaborations, export-focused production strategies, growing aftermarket demand, consumer interest in advanced lighting aesthetics, and continuous innovations in smart and adaptive lighting technologies are factors fostering the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 514.50 Million |

| Market Forecast in 2033 | USD 847.34 Million |

| Market Growth Rate 2025-2033 | 5.70% |

Mexico Automotive Lighting Market Trends:

Strength of Mexico’s Automotive Manufacturing Base

Mexico ranks among the top vehicle manufacturing hubs globally, housing production plants of leading automakers such as General Motors, Volkswagen, Nissan, and Ford. This established industrial infrastructure serves as a critical demand engine for automotive lighting systems, as every vehicle model requires tailored lighting components. The maturity of OEM assembly lines ensures consistent procurement of lighting parts, benefiting both local manufacturers and international suppliers operating in the country. Additionally, automotive clusters in states like Puebla, Guanajuato, and Nuevo León facilitate streamlined logistics and vertical integration of components, including lighting assemblies, which is boosting the Mexico automotive lighting market share. Furthermore, the lighting industry benefits from this deep-rooted ecosystem and collaborations in product innovation, modular design improvements, and testing within proximity to assembly plants.

Accelerated Adoption of LED Lighting Technologies

As per the Mexico automotive lighting market forecast, there is a notable shift across the automotive industry towards energy-efficient lighting solutions, particularly LED-based systems. LED lights offer several operational advantages, including lower energy consumption, longer service life, and enhanced design flexibility. These features are particularly relevant for electric and hybrid vehicles, which benefit from improved battery efficiency due to reduced power draw from lighting systems. For instance, Mexico has also updated its standards for LED lighting to improve safety and efficiency. The standard NMX-I-J-324-NYCE-ANCE-2022, effective from September 13, 2022, outlines safety requirements and test methods for self-ballasted LED lamps used in general lighting. This standard applies to household LED lamps with rated wattage up to 150 W and voltage between 50 V and 277 V. Additionally, LEDs enhance safety by offering better illumination and faster response times in indicators and brake lights. In line with this, automakers and tier-1 suppliers are increasingly integrating LEDs into both premium and economy vehicle segments, which is accelerating the Mexico automotive lighting market growth. Domestic component makers are also upgrading their capabilities to produce LED-compatible assemblies, supported by government incentives for energy-efficient technologies.

Regulatory Push for Safety and Sustainability

The government is progressively aligning its transportation policies with global safety and environmental benchmarks, which is providing a positive Mexico automotive lighting market outlook. Stricter lighting standards are being enforced in vehicle inspections, focusing on luminance, beam range, and reliability. Regulatory agencies are also mandating the use of daytime running lights (DRLs) and automatic lighting systems in new vehicles to reduce road accidents. These mandates increase demand for advanced lighting technologies that meet higher safety thresholds. On the sustainability front, policymakers are encouraging the adoption of low-emission vehicles, which is boosting demand for energy-efficient lighting systems such as LEDs. Compliance with standards similar to United Nations Economic Commission for Europe (UNECE) or Federal Motor Vehicle Safety Standards (FMVSS) has also become more common among manufacturers operating in Mexico, ensuring product compatibility for exports and cross-border assembly.

Mexico Automotive Lighting Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on technology, vehicle type, sales channel, and application.

Technology Insights:

- Halogen

- Xenon/HID

- LED

The report has provided a detailed breakup and analysis of the market based on the technology. This includes halogen, xenon/HID, and LED.

Vehicle Type Insights:

- Passenger Vehicle

- Commercial Vehicle

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger vehicle and commercial vehicle.

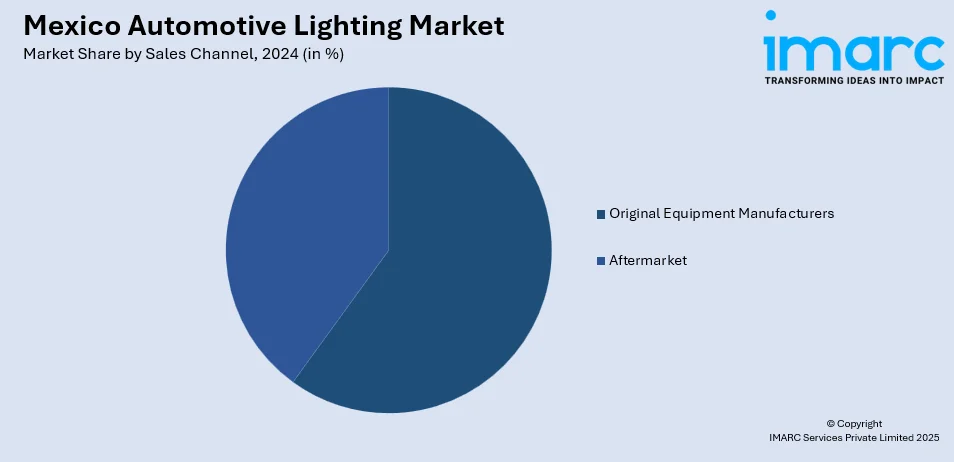

Sales Channel Insights:

- Original Equipment Manufacturers

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes original equipment manufacturers and aftermarket.

Application Insights:

- Front Lighting/Headlamps

- Rear Lighting

- Side Lighting

- Interior Lighting

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes front lighting/headlamps, rear lighting, side lighting, and interior lighting.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Automotive Lighting Market News:

- In 2024, LUXIT Group, a leading manufacturer of automotive lighting components, has opened a new manufacturing facility in Juárez, Mexico. The facility will primarily focus on producing automotive lighting solutions for OEMs and Tier 1 suppliers, catering to both regional and global markets.

- In 2023, Magna International, a prominent Canadian automotive supplier, invested $17 million in expanding its lighting division in Querétaro, Mexico. The company aims to enhance its manufacturing capabilities for rear lighting systems, specifically for major automotive brands like Ford and GM.

Mexico Automotive Lighting Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Halogen, Xenon/HID, LED |

| Vehicle Types Covered | Passenger Vehicle, Commercial Vehicle |

| Sales Channels Covered | Original Equipment Manufacturers, Aftermarket |

| Applications Covered | Front Lighting/Headlamps, Rear Lighting, Side Lighting, Interior Lighting |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico automotive lighting market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico automotive lighting market on the basis of technology?

- What is the breakup of the Mexico automotive lighting market on the basis of vehicle type?

- What is the breakup of the Mexico automotive lighting market on the basis of sales channel?

- What is the breakup of the Mexico automotive lighting market on the basis of application?

- What is the breakup of the Mexico automotive lighting market on the basis of region?

- What are the various stages in the value chain of the Mexico automotive lighting market?

- What are the key driving factors and challenges in the Mexico automotive lighting market?

- What is the structure of the Mexico automotive lighting market and who are the key players?

- What is the degree of competition in the Mexico automotive lighting market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico automotive lighting market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico automotive lighting market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico automotive lighting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)