Mexico Automotive Lubricants Market Size, Share, Trends and Forecast by Product, Vehicle Type, and Region, 2025-2033

Mexico Automotive Lubricants Market Overview:

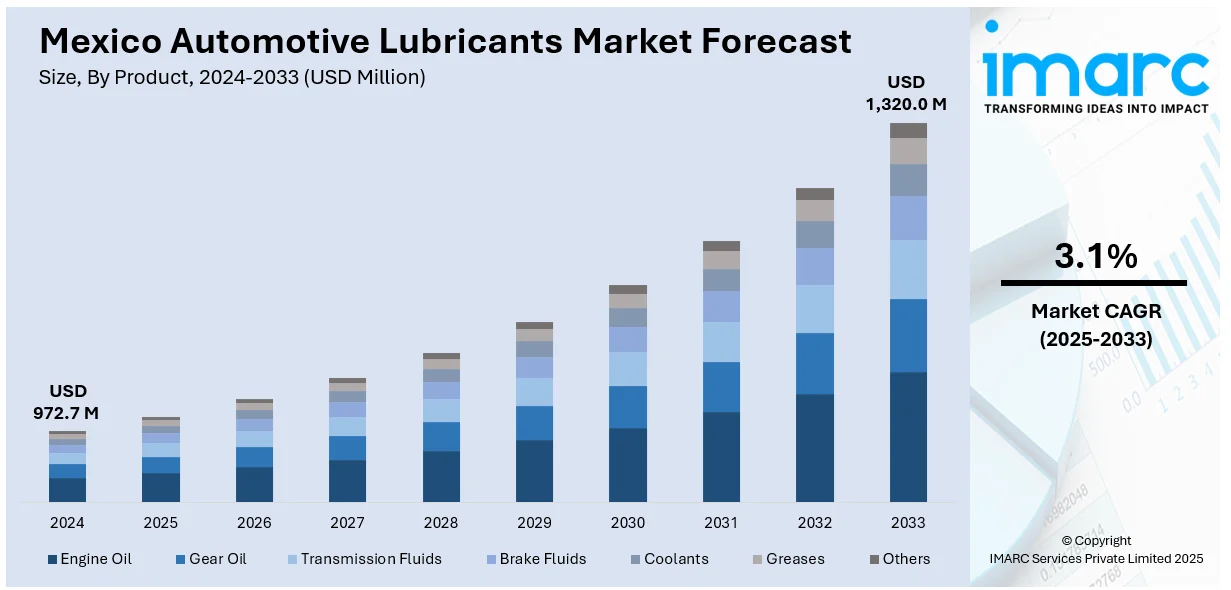

The Mexico automotive lubricants market size reached USD 972.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,320.0 Million by 2033, exhibiting a growth rate (CAGR) of 3.1% during 2025-2033. The market is being driven by rising vehicle ownership and fleet expansion, rapid growth of digital sales channels, and a growing shift toward electric and hybrid automobiles, all of which are reshaping demand, distribution, and product innovation across the sector.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 972.7 Million |

| Market Forecast in 2033 | USD 1,320.0 Million |

| Market Growth Rate 2025-2033 | 3.1% |

Mexico Automotive Lubricants Market Trends:

Growing Vehicle Ownership and Fleet Expansion

The steady increase in personal and business vehicle ownership continues to be a key factor influencing the automotive lubricants market in Mexico. With the enhancement of economic stability and the growth of the middle class, an increasing number of people are acquiring vehicles for personal use, while companies are investing in fleets to facilitate transportation and logistics functions. This growth in the number of vehicles is driving the need for regular maintenance products, particularly lubricants that are vital for engine efficiency and durability. In terms of commerce, Mexico’s crucial position in regional logistics and manufacturing continues to draw significant automotive investments. A significant instance is Volvo’s announcement in 2025 regarding advancements on its US$700 million truck facility in Monterrey, which is set to commence operations by 2026. Aimed at catering to both North and Latin American markets, the facility will boost Volvo’s competitiveness and greatly aid in fleet expansion and regional vehicle density. As these operations grow, the demand for regular maintenance increases, leading to a rise in lubricant usage to ensure uptime and reliability. In addition, the increasing volume of used vehicle purchases adds further momentum, as older vehicles typically require more frequent oil changes and general upkeep. This creates a dual-layered demand scenario, new fleets requiring manufacturer-grade lubricants and older vehicles depending on routine aftermarket care. Together, these trends create a robust, continuous cycle of lubricant usage that aligns with Mexico’s automotive evolution, making the sector a key pillar of the country’s broader industrial and economic development.

Growth of E-Commerce and Digital Sales Channels

Digital transformation is reshaping how automotive lubricants are marketed and sold across Mexico, creating new avenues for growth and user engagement. With the rapid rise of e-commerce, individuals now have greater access to lubricants through online platforms, including auto parts retailers and brand-specific websites. These digital channels offer enhanced convenience, transparent pricing, detailed product comparisons, and user reviews, allowing buyers to make more informed purchasing decisions. Modern individuals, particularly younger and tech-savvy individuals, are also drawn to subscription-based oil delivery services, do-it-yourself (DIY) maintenance kits, and app-based loyalty programs that streamline vehicle care. In rural and remote areas, where physical service centers may be limited, e-commerce platforms serve as crucial points of access for high-quality lubricant products. This growing digital footprint is further supported by Mexico’s booming e-commerce sector, which reached a market size of USD 47.5 billion in 2024. According to IMARC Group, the market is projected to reach USD 176.6 billion by 2033, growing at a robust CAGR of 14.5% during 2025–2033. Such expansion signals a massive opportunity for lubricant brands to leverage digital strategies to tap into a broader user base. Ranging from streamlined logistics to personalized marketing, the online ecosystem is enabling companies to strengthen their distribution networks while fostering long-term brand loyalty.

Shift Toward Electric and Hybrid Vehicles

The rising interest in electric and hybrid vehicles (HEVs). Sales of electric, hybrid, and plug-in hybrid vehicles in Mexico rose by 26.3% in March 2025 compared to March 2024, with 12,225 cars sold versus 9,680 units, reported the Mexican Association of Automotive Distributors (AMDA). This growth reflects a dynamic change in user preferences and a broader shift toward sustainable mobility. Hybrid vehicles, which combine internal combustion engines with electric components, require specialized lubricants to support their unique engine and transmission configurations. Likewise, EVs, though they do not require traditional engine oils, still depend on high-performance lubricants for thermal management and transmission systems. This transition is encouraging lubricant manufacturers to develop innovative formulations and diversify their product lines to meet the needs of this evolving vehicle mix. The rise of EVs and HEVs is creating new product segments and emphasizing the significance of performance, efficiency, and flexibility.

Mexico Automotive Lubricants Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product and vehicle type.

Product Insights:

- Engine Oil

- Gear Oil

- Transmission Fluids

- Brake Fluids

- Coolants

- Greases

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes engine oil, gear oil, transmission fluids, brake fluids, coolants, greases, and others.

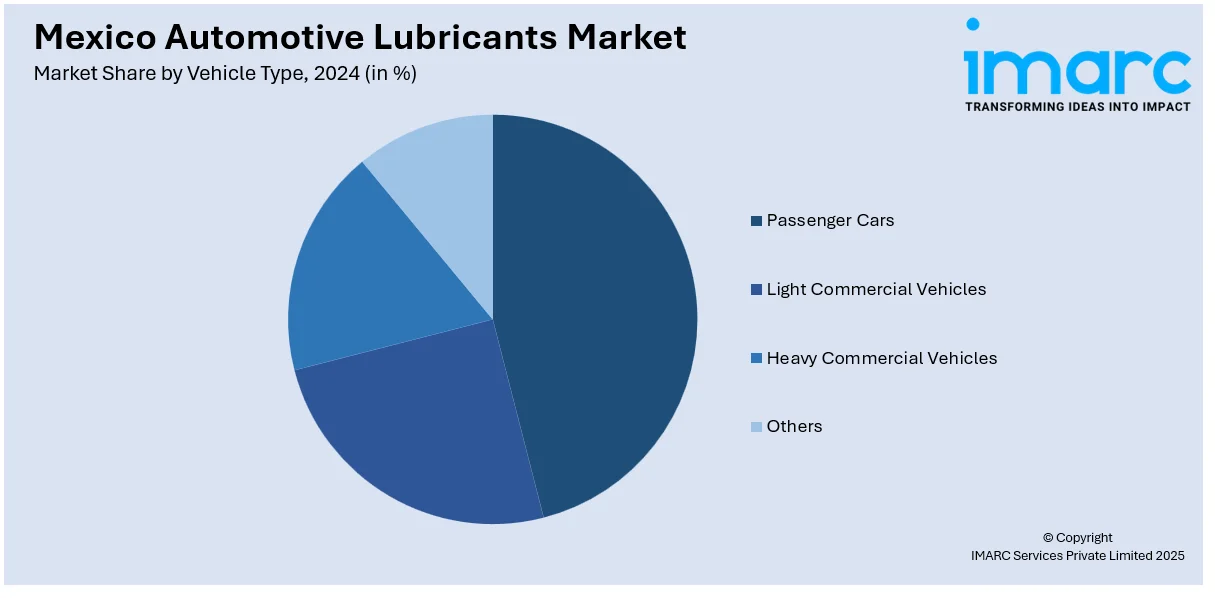

Vehicle Type Insights:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Others

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger cars, light commercial vehicles, heavy commercial vehicles, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Automotive Lubricants Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Engine Oil, Gear Oil, Transmission Fluids, Brake Fluids, Coolants, Greases, Others |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico automotive lubricants market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico automotive lubricants market on the basis of product?

- What is the breakup of the Mexico automotive lubricants market on the basis of vehicle type?

- What is the breakup of the Mexico automotive lubricants market on the basis of region?

- What are the various stages in the value chain of the Mexico automotive lubricants market?

- What are the key driving factors and challenges in the Mexico automotive lubricants market?

- What is the structure of the Mexico automotive lubricants market and who are the key players?

- What is the degree of competition in the Mexico automotive lubricants market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico automotive lubricants market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico automotive lubricants market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico automotive lubricants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)