Mexico Automotive Paints and Coatings Market Size, Share, Trends and Forecast by Resin Type, Technology, Layer, Application, and Region, 2025-2033

Mexico Automotive Paints and Coatings Market Overview:

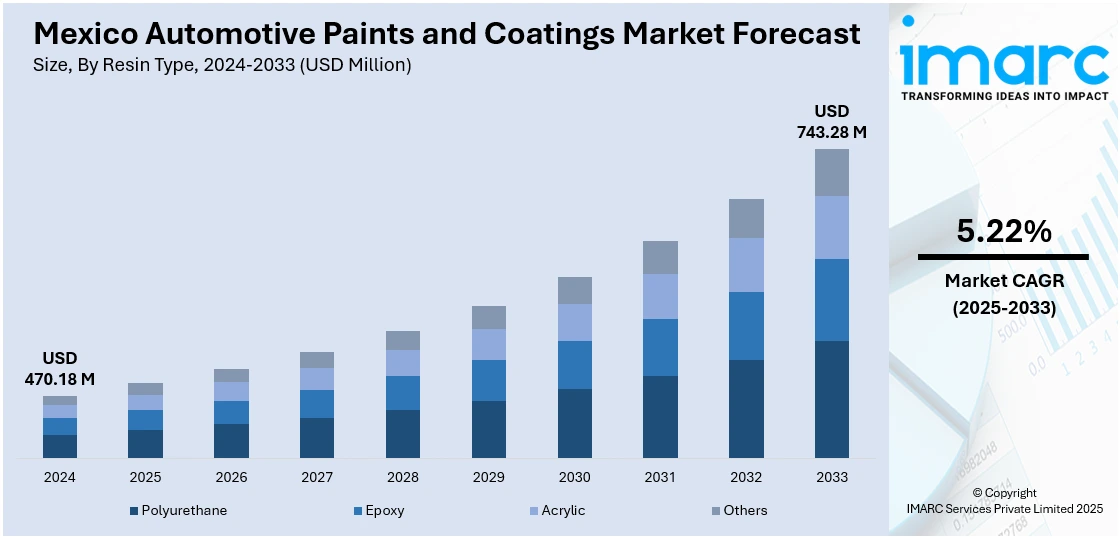

The Mexico automotive paints and coatings market size reached USD 470.18 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 743.28 Million by 2033, exhibiting a growth rate (CAGR) of 5.22% during 2025-2033. Expanding automotive export industry, growing OEM collaborations, shift toward customized coating solutions, rising investment in advanced protective technologies, production line modernization, increasing adoption of sustainable coating technologies, tightening regulatory compliance standards, growing demand for eco-friendly vehicles, multifunctional product innovation, and the development of full-service application solutions are some of the factors positively impacting the Mexico automotive paints and coatings market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 470.18 Million |

| Market Forecast in 2033 | USD 743.28 Million |

| Market Growth Rate 2025-2033 | 5.22% |

Mexico Automotive Paints and Coatings Market Trends:

Expanding Automotive Export Industry and OEM Collaborations

Mexico’s rapidly expanding automotive export industry and strengthened collaborations with original equipment manufacturers (OEMs) represent major drivers for the automotive paints and coatings market. With Mexico ranking among the world’s largest automobile exporters, international brands are increasingly setting up manufacturing operations within the country. This growth is generating rising demand for high-performance paints and coatings that meet international quality and aesthetic standards. Furthermore, OEMs are seeking local partnerships with coatings suppliers to ensure consistent production timelines, quality control, and adherence to regulatory requirements across diverse markets. The Mexico automotive paints and coatings market forecast anticipates rising investments in advanced coating technologies that deliver superior protection against abrasion, corrosion, and chemical exposure, particularly for vehicles destined for North American and European markets. Manufacturers are focusing on integrated solutions that enhance color matching, reduce waste, and streamline application processes. On March 12, 2024, WEG announced an investment of R$ 100 Million (approximately USD 20 Million) to construct a new industrial liquid paints factory in Atotonilco de Tula, Mexico, aiming to expand production capacity for the North and Central American markets. On the same date, WEG confirmed that the new 5,300 m² (57,000 ft²) facility will strengthen its industrial coatings presence and support rising demand for efficient and sustainable coating solutions in the region. In addition, proximity to the United States allows Mexican automotive production hubs to closely align with evolving trends in automotive design, materials innovation, and sustainable production techniques, further driving product demand. New investments in production line modernization, robotic application technologies, and quality assurance systems are contributing to enhanced coating efficiencies and lower defect rates.

Rising Focus on Sustainable Coating Technologies and Regulatory Compliance

The increasing focus on sustainable coating technologies and the growing complexity of regulatory compliance standards are critical factors driving change within the market. Global emphasis on environmental responsibility is pushing manufacturers to adopt lower-emission, energy-efficient coating solutions. The Mexico automotive paints and coatings market growth is increasingly shaped by consumer expectations for eco-friendly vehicles and corporate commitments to net-zero emissions targets. Suppliers are developing multifunctional coatings capable of improving vehicle aerodynamics, reducing heat absorption, and enhancing energy efficiency. Collaborative research programs between universities, chemical companies, and automotive manufacturers are fostering rapid development cycles for next-generation coatings. On May 21, 2024, PPG announced an investment of USD 300 Million to expand its advanced manufacturing capabilities across North America, including a major upgrade to its San Juan Del Rio, Mexico facility aimed at increasing production efficiency and supporting sustainable automotive coatings. On the same date, PPG confirmed that the San Juan Del Rio investments will focus on modernizing equipment and processes to meet the growing demand for waterborne technologies in the Mexican automotive sector. The Mexico automotive paints and coatings market outlook remains positive, driven by Mexico’s proactive approach to regulatory compliance, environmental sustainability, and technology adoption, positioning the country as a key player in the global automotive coatings industry. Regulatory frameworks such as stricter VOC (volatile organic compound) limits and sustainability reporting requirements are influencing procurement decisions, favoring suppliers that offer environmentally responsible products aligned with international norms. The growing emphasis on lean manufacturing principles is reinforcing the need for coatings that can be rapidly applied while maintaining exceptional finish standards.

Mexico Automotive Paints and Coatings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on resin type, technology, layer, and application.

Resin Type Insights:

- Polyurethane

- Epoxy

- Acrylic

- Others

The report has provided a detailed breakup and analysis of the market based on the resin type. This includes polyurethane, epoxy, acrylic, and others.

Technology Insights:

- Solvent-borne

- Water-borne

- Powder

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes solvent-borne, water-borne, powder, and others.

Layer Insights:

- E-coat

- Primer

- Base Coat

- Clear Coat

The report has provided a detailed breakup and analysis of the market based on the layer. This includes e-coat, primer, base coat, and clear coat.

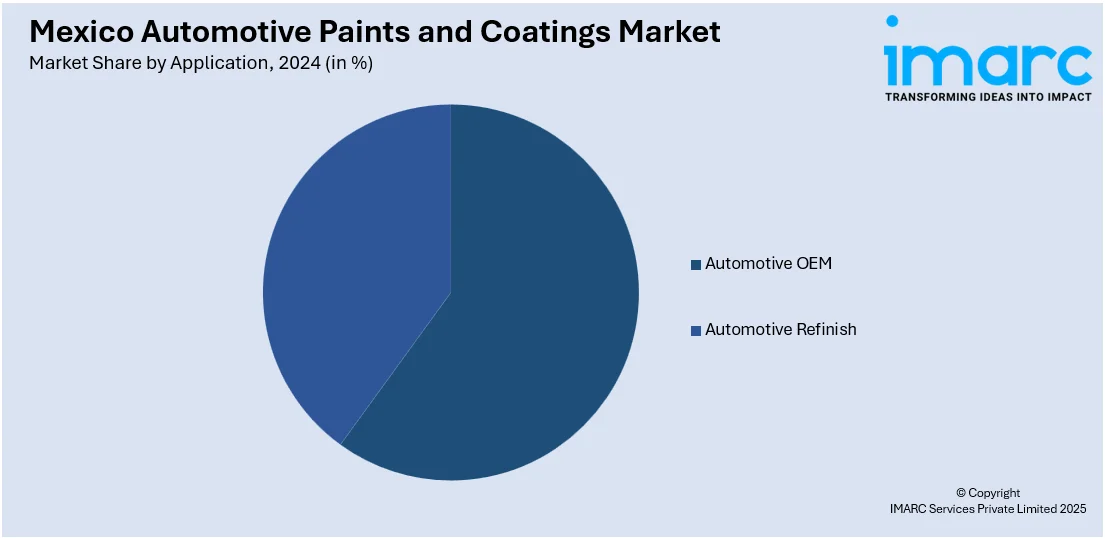

Application Insights:

- Automotive OEM

- Automotive Refinish

The report has provided a detailed breakup and analysis of the market based on the application. This includes automotive OEM and automotive refinish.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Automotive Paints and Coatings Market News:

- On January 29, 2025, Volkswagen de México inaugurated the world's first fully electric paint shop at its Puebla plant, eliminating the use of natural gas and relying entirely on renewable electricity. On the same date, Volkswagen confirmed that the facility, built with an investment of approximately USD 763.5 Million, can paint up to 90 vehicles per hour while minimizing energy consumption, material waste, and emissions through advanced automation and AI-driven quality control.

- On August 8, 2024, Axalta introduced its new FCLE (Fast Cure Low Energy) automotive paint technology in Mexico, designed to optimize ambient temperature and humidity to accelerate drying processes and reduce gas consumption in paint booths by up to 58%. On the same date, Axalta highlighted that the FCLE technology, part of the Spies Hecker Speed-TEC system, supports workshops in lowering operational costs and carbon emissions by enabling paint curing at room or low temperatures.

Mexico Automotive Paints and Coatings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Resin Types Covered | Polyurethane, Epoxy, Acrylic, Others |

| Technologies Covered | Solvent-borne, Water-borne, Powder, Others |

| Layers Covered | E-coat, Primer, Base Coat, Clear Coat |

| Applications Covered | Automotive OEM, Automotive Refinish |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico automotive paints and coatings market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico automotive paints and coatings market on the basis of resin type?

- What is the breakup of the Mexico automotive paints and coatings market on the basis of technology?

- What is the breakup of the Mexico automotive paints and coatings market on the basis of layer?

- • What is the breakup of the Mexico automotive paints and coatings market on the basis of application?

- What is the breakup of the Mexico automotive paints and coatings market on the basis of region?

- What are the various stages in the value chain of the Mexico automotive paints and coatings market?

- What are the key driving factors and challenges in the Mexico automotive paints and coatings market?

- What is the structure of the Mexico automotive paints and coatings market and who are the key players?

- What is the degree of competition in the Mexico automotive paints and coatings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico automotive paints and coatings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico automotive paints and coatings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico automotive paints and coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)