Mexico Automotive Refinish Coatings Market Size, Share, Trends and Forecast by Resin Type, Product Type, Technology, Vehicle Type, and Region, 2025-2033

Mexico Automotive Refinish Coatings Market Overview:

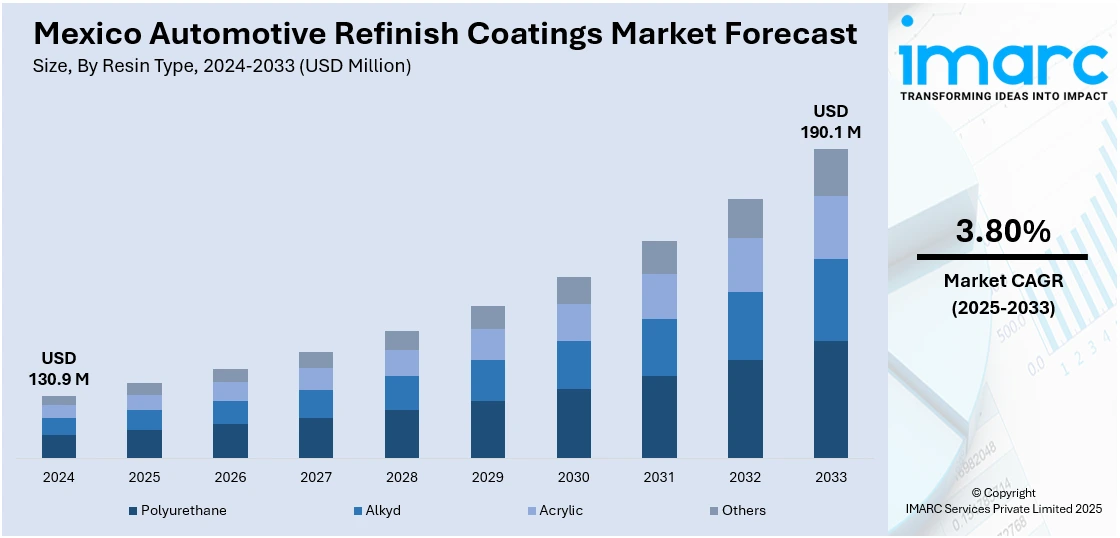

The Mexico automotive refinish coatings market size reached USD 130.9 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 190.1 Million by 2033, exhibiting a growth rate (CAGR) of 3.80% during 2025-2033. The market is advancing due to rising vehicle repairs, demand for sustainable solutions, and investments in production efficiency. Technological upgrades in application systems and a growing focus on eco-friendly coatings are driving steady growth across workshops and aftermarket service providers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 130.9 Million |

| Market Forecast in 2033 | USD 190.1 Million |

| Market Growth Rate 2025-2033 | 3.80% |

Mexico Automotive Refinish Coatings Market Trends:

Focus on Sustainable Production Efficiency

The Mexico automotive refinish coatings market is gradually aligning with global sustainability goals as manufacturers invest in cleaner, more efficient production methods. Demand for coatings with lower environmental impact is growing, especially in aftermarket segments where quality and compliance with green standards are becoming essential. Improved plant efficiency not only reduces operational costs but also supports environmental commitments, helping companies meet stricter emissions targets. This shift also enables quicker turnaround times and enhances supply reliability for distributors and workshops, giving manufacturers a stronger position in the regional market. In May 2024, PPG announced a USD 300 Million investment in advanced manufacturing across North America, which included significant upgrades at its San Juan Del Rio facility in Mexico. These enhancements boosted production efficiency and expanded capacity, aligning with the rising demand for eco-friendly automotive coatings. By integrating new equipment and energy-saving processes, the plant became more responsive to evolving aftermarket needs while lowering its environmental footprint. As sustainability becomes a standard expectation rather than a value-add, such investments are shaping the future of refinishing operations in Mexico. With stable supply chains and improved manufacturing performance, refinish coatings producers are better equipped to meet the growing expectations of repair centers and vehicle owners alike.

Advancements in Application Technologies

Technological upgrades in paint application systems are beginning to redefine operations within Mexico's automotive refinish coatings sector. These innovations allow for better coverage, precision, and material savings key factors for achieving high-quality results in vehicle repairs. Workshops are increasingly prioritizing equipment that delivers consistency and reduces waste as both regulatory expectations and customer demands become stricter. Application systems with improved control also help reduce rework, which translates to lower costs and faster service. In October 2024, ABB launched the RB 1000i-S paint atomizer, a system that increased transfer efficiency by 10% and reduced paint waste by a minimum of 30%. This technology also contributed to lower carbon and VOC emissions, making it a valuable tool for workshops seeking to align with environmental standards. The atomizer's ability to minimize overspray and optimize material usage offers measurable financial and operational benefits, especially in high-volume repair settings. These kinds of tools are now gaining traction in Mexico's refinish landscape, encouraging service providers to adopt smarter application methods. As the market continues to shift toward more sustainable, high-performance solutions, the integration of precision technologies will play a major role in shaping the efficiency, quality, and environmental responsibility of refinish operations.

Mexico Automotive Refinish Coatings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on resin type, product type, technology, and vehicle type.

Resin Type Insights:

- Polyurethane

- Alkyd

- Acrylic

- Others

The report has provided a detailed breakup and analysis of the market based on the resin type. This includes polyurethane, alkyd, acrylic, and others.

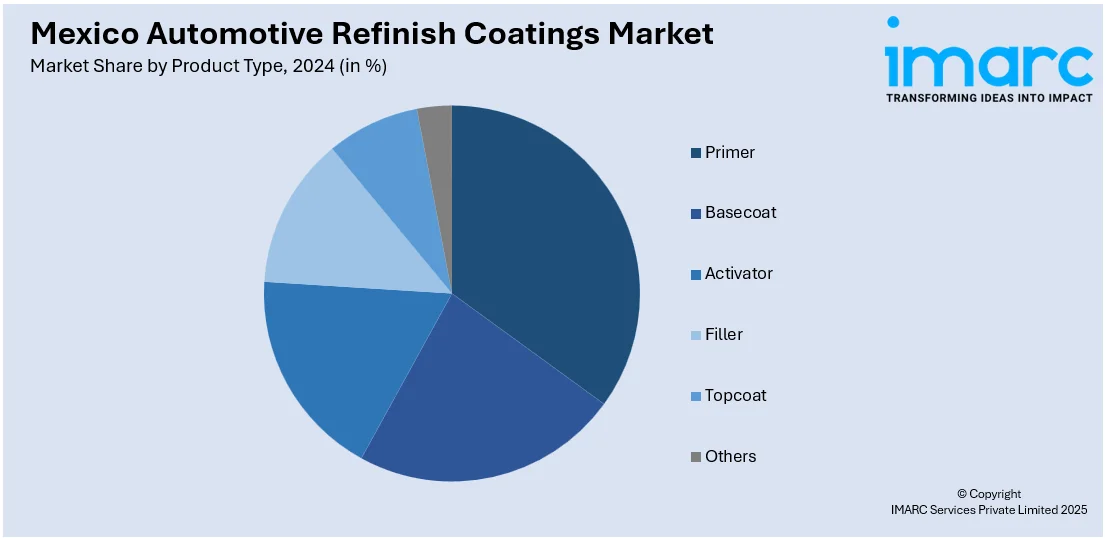

Product Type Insights:

- Primer

- Basecoat

- Activator

- Filler

- Topcoat

- Others

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes primer, basecoat, activator, filler, topcoat, and others.

Technology Insights:

- Solvent-borne

- Water-borne

- UV-cured

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes solvent-borne, water-borne, and UV-cured.

Vehicle Type Industry Insights:

- Passenger Cars

- Commercial Vehicles

- Others

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger cars, commercial vehicles, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Automotive Refinish Coatings Market News:

- February 2025: Volkswagen’s Puebla plant became the first all-electric paint shop in the global auto industry. With AI-driven quality control and zero natural gas use, this $764 million upgrade supported eco-friendly practices, indirectly encouraging demand for sustainable automotive refinish coatings in Mexico’s evolving industry.

- January 2025: Axalta partnered with Durr to introduce NextJet digital paint technology, enhancing efficiency in OEM coatings. Following its July 2024 acquisition of CoverFlexx Group, Axalta expanded its aftermarket offerings, indirectly strengthening Mexico’s automotive refinish coatings market through advanced solutions and broader product availability.

Mexico Automotive Refinish Coatings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Resin Types Covered | Polyurethane, Alkyd, Acrylic, Others |

| Product Types Covered | Primer, Basecoat, Activator, Filler, Topcoat, Others |

| Technologies Covered | Solvent-borne, Water-borne, UV-cured |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, and Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico automotive refinish coatings market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico automotive refinish coatings market on the basis of resin type?

- What is the breakup of the Mexico automotive refinish coatings market on the basis of product type?

- What is the breakup of the Mexico automotive refinish coatings market on the basis of technology?

- What is the breakup of the Mexico automotive refinish coatings market on the basis of vehicle type?

- What is the breakup of the Mexico automotive refinish coatings market on the basis of region?

- What are the various stages in the value chain of the Mexico automotive refinish coatings market?

- What are the key driving factors and challenges in the Mexico automotive refinish coatings?

- What is the structure of the Mexico automotive refinish coatings market and who are the key players?

- What is the degree of competition in the Mexico automotive refinish coatings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico automotive refinish coatings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico automotive refinish coatings market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico automotive refinish coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)