Mexico Automotive Safety Glass Market Size, Share, Trends and Forecast by Glass Type, Material Type, Vehicle Type, Application, Technology, End User, and Region, 2025-2033

Mexico Automotive Safety Glass Market Overview:

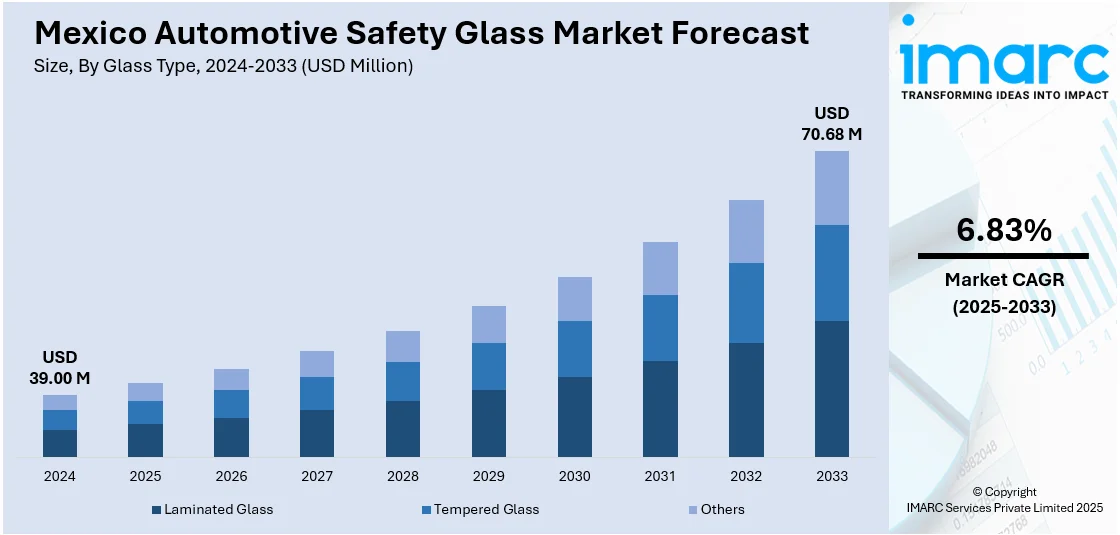

The Mexico automotive safety glass market size reached USD 39.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 70.68 Million by 2033, exhibiting a growth rate (CAGR) of 6.83% during 2025-2033. The market is driven by rising consumer demand for enhanced vehicle safety and comfort, leading to greater adoption of laminated glass for its ability to prevent injuries during accidents. Additionally, stricter safety regulations are pushing manufacturers to incorporate higher-quality glass in vehicles. The growing popularity of electric vehicles (EVs) and hybrid electric vehicles (HEVs) is also fueling the Mexico automotive safety glass market share for specialized glass that offers better thermal insulation and supports advanced technologies, such as augmented reality (AR) displays and energy-efficient solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 39.00 Million |

| Market Forecast in 2033 | USD 70.68 Million |

| Market Growth Rate 2025-2033 | 6.83% |

Mexico Automotive Safety Glass Market Analysis:

- Major Drivers: Expansion of Mexico's automotive sector, robust manufacturing sector, and increasing vehicle manufacturing propel demand for safety glass. Strict safety standards and increased consumer recognition of accident protection increase adoption thereby supporting the Mexico automotive safety glass market demand. Demand from OEM and aftermarket, bolstered by foreign investment and export opportunities, support long-term growth of automotive safety glass.

- Key Market Trends: Acoustic glazing, UV protection, and lightweight laminated glass are driving innovation. Car manufacturers incorporate more advanced safety features, which helps increase demand for impact-resistant glass. Recycling and energy-efficient production are encouraged by sustainability trends. Electric vehicle (EV) and smart car growth spur demand for advanced glazing with advanced thermal insulation and connectivity capabilities.

- Market Opportunities: Diversification of EV manufacturing, particularly in northern Mexico, generates excellent opportunities for high-end glazing solutions. Working with international OEMs provides access to export markets. Growing urbanization and automobile ownership drive aftermarket sales. Premium and luxury car demand further expands opportunities for laminated, tinted, and solar-control safety glass.

- Market Challenges: As per the Mexico automotive safety glass market analysis, fluctuating raw material prices and high energy consumption tighten profitability. Fierce competition between local and global suppliers compresses margins. Compliance with regulations creates complexity. Disruptions in logistics, currency fluctuations, and dependence on export leave the manufacturers vulnerable. Moreover, a shortage of domestic research and development (R&D) capabilities hinders innovation in advanced glazing technology in Mexico.

Mexico Automotive Safety Glass Market Trends:

Shift Toward Laminated Glass for Safety and Durability

Laminated glass has become more common in Mexico automotive safety glass market forecast due to its greater safety and comfort benefits. Compared to tempered glass, which shatters on collision, laminated glass holds its shape, minimizing the danger of injury from glass shards during an accident. Such greater protection equates to stronger safety standards and greater consumer pressure for safer automobiles. Apart from safety, laminated glass offers more strength, noise reduction, and insulation, leading to a better ride. Due to this, Mexican auto manufacturers are adding laminated glass to more car models as a way of meeting evolving safety requirements and enhancing customer satisfaction. It is all part of a broader shift in the industry towards a balance between car safety and comfort. With such advantages, laminated glass is becoming a dominant feature of modern cars across the Mexican automotive sector, a move towards higher standards of quality.

To get more information on this market, Request Sample

Government Initiatives Promoting Advanced Glass Solutions

Mexico’s push for a sustainable future is bolstering the Mexico automotive safety glass market growth in terms of technologies. In 2023, the country produced 109,695 electric vehicles (EVs), up from just 6,717 in 2020, with projections reaching 161,000 units by the end of 2024. This growth aligns with government goals to put millions of EVs and hybrids on the road. To support this transition, authorities are encouraging innovations like advanced glazing solutions that offer better thermal insulation and enhance in-car displays key features for EVs. As EV adoption rises, automakers are integrating specialized glass to meet these evolving needs, improve energy efficiency, and enhance passenger comfort. The synergy between policy and technology is shaping a more sustainable and high-tech automotive market in Mexico, with smart glass playing a crucial role in vehicle design for the future.

Integration of Smart Glass Technologies

Smart glass technologies are becoming increasingly popular in Mexico's automotive industry, particularly in luxury vehicles. They include electrochromic and thermochromic glass, which can automatically change their tint depending on sunlight or temperature. This flexibility improves passenger comfort by minimizing glare and heat, making the cabin environment more comfortable. Moreover, by restricting solar heat gain, smart glass reduces the load on air conditioning, enhancing overall vehicle energy efficiency. With comfort and sustainability being at the top of their agenda, carmakers are now integrating these high-end glass solutions more and more into their models. The increasing adoption of smart glass is an indicator of a transition towards luxury and innovation in Mexico's automotive market. As consumers' expectations grow and technology improves in the auto industry, smart glass will be a norm for new vehicles with both functional and luxury value for drivers and passengers.

Mexico Automotive Safety Glass Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on glass type, material type, vehicle type, application, technology and end user.

Glass Type Insights:

- Laminated Glass

- Tempered Glass

- Others

The report has provided a detailed breakup and analysis of the market based on the glass type. This includes laminated glass, tempered glass, and others.

Material Type Insights:

- IR PVB

- Metal Coated Glass

- Tinted Glass

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes IR PVB, metal coated glass, tinted glass, and others.

Vehicle Type Insights:

- Passenger Cars

- Light Commercial Vehicles

- Trucks

- Buses

- Others

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars, light commercial vehicles, trucks, buses, and others.

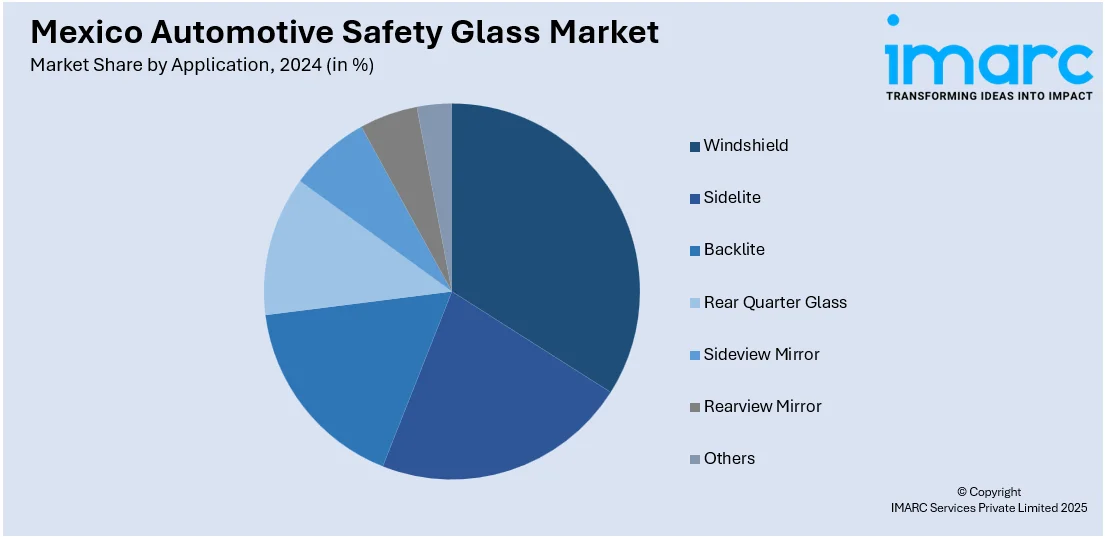

Application Insights:

- Windshield

- Sidelite

- Backlite

- Rear Quarter Glass

- Sideview Mirror

- Rearview Mirror

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes windshield, sidelite, backlite, rear quarter glass, sideview mirror, rearview mirror, and others.

Technology Insights:

- Active Smart Glass

-

- Suspended Particle Glass

- Electrochromic Glass

- Liquid Crystal Glass

-

- Passive Glass

-

- Thermochromic

- Photochromic

-

The report has provided a detailed breakup and analysis of the market based on the technology. This includes active smart glass (suspended particle glass, electrochromic glass, and liquid crystal glass), and passive glass (thermochromic and photochromic).

End-User Insights:

- OEMs

- Aftermarket Suppliers

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes OEMs, and aftermarket suppliers.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern, Central, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Automotive Safety Glass Market News:

- In May 2025, Myron Bowling Mexico announced a live webcast auction for the closure of a leading automotive glass manufacturer in Santa Catarina, Nuevo León, scheduled for May 7, 2025. The auction will feature high-quality machinery and equipment used in precision automotive glass production, including furnaces, assembly lines, and inspection cells. This event offers manufacturers, suppliers, and resellers a unique opportunity to acquire advanced production equipment at competitive prices.

- In February 2025, Mexico's glass sector is poised for growth, driven by nearshoring and increasing demand for high-quality glass. The country's automotive, solar, and electronics industries are major contributors to this demand. The election of President Claudia Sheinbaum is expected to accelerate the development of the glass industry, boosting domestic production. Additionally, the sector’s fragmentation and increased competition are helping lower costs, fostering further growth. With key players planning expansions, Mexico is set to become a regional leader in glass production.

Mexico Automotive Safety Glass Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Glass Types Covered | Laminated Glass, Tempered Glass, Others |

| Material Types Covered | IR PVB, Metal Coated Glass, Tinted Glass, Others |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Trucks, Buses, Others |

| Applications Covered | Windshield, Sidelite, Backlite, Rear Quarter Glass, Sideview Mirror, Rearview Mirror, Others |

| Technologies Covered |

|

| End Users Covered | OEMs, Aftermarket Suppliers |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico automotive safety glass market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico automotive safety glass market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico automotive safety glass industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive safety glass market in Mexico was valued at USD 39.00 Million in 2024.

The Mexico automotive safety glass market is projected to exhibit a CAGR of 6.83% during 2025-2033, reaching a value of USD 70.68 Million by 2033.

The Mexico automotive safety glass market is driven by growing vehicle production, stringent safety regulations, and rising consumer preference for enhanced protection. Strong foreign investment, a robust automotive manufacturing base, and increasing exports to North America fuel demand. Additionally, rising EV production and aftermarket growth further stimulate market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)