Mexico Automotive Safety Systems Market Size, Share, Trends and Forecast by System Type, Vehicle Type, End User, and Region, 2025-2033

Mexico Automotive Safety Systems Market Overview:

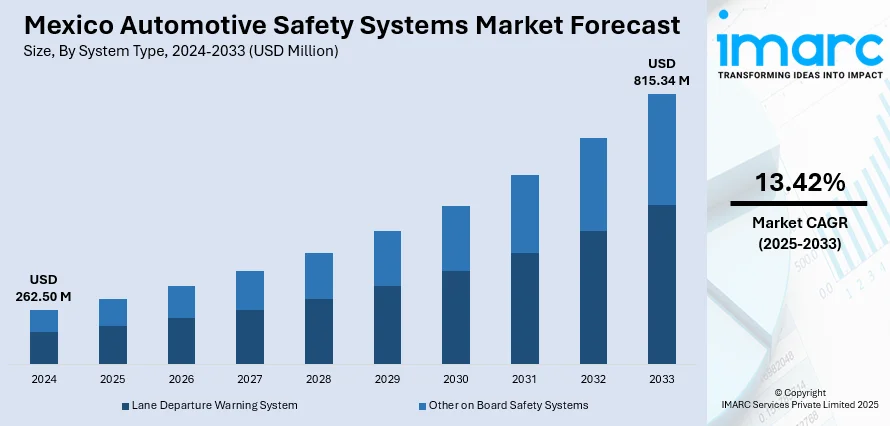

The Mexico automotive safety systems market size reached USD 262.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 815.34 Million by 2033, exhibiting a growth rate (CAGR) of 13.42% during 2025-2033. The market is experiencing steady growth with the boost from heightening consumer awareness, enhanced safety regulations, and accelerated adoption of advanced technologies in vehicles. Rising demand for active and passive safety features in passenger as well as commercial vehicle sectors further strengthens this growth trajectory. Technologies like ADAS and smart sensors are now default add-ons. Together, these all contribute to the overall growth in the Mexico automotive safety systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 262.50 Million |

| Market Forecast in 2033 | USD 815.34 Million |

| Market Growth Rate 2025-2033 | 13.42% |

Mexico Automotive Safety Systems Market Analysis:

- Major Market Drivers: Mexico automotive safety systems market share is growing as governments impose tougher safety requirements, automotive production rises, and consumers become more aware of the benefits of adopting safety technologies. Increased airbag, ADAS, and braking technology installations indicate increased dependence on sophisticated safety technologies, leading to growing demand for passenger vehicles and commercial fleets in Mexico.

- Key Market Trends: Technological advancements in driver-assistance systems, collision avoidance, and lane departure warning are reshaping the sector. Moving towards semi-autonomous cars, sensor-based solutions and interconnected technologies are swiftly being integrated, further propelling overall vehicle safety and in synchronization with global developments within the Mexican automotive sector.

- Competitive Landscape: As per Mexico automotive safety systems market analysis, competition is on the rise as both local and international suppliers consolidate partnerships with OEMs. R&D spending, adherence to changing safety norms, and localized manufacturing strategies continue to be key to enhancing cost effectiveness, technology uptake, and industry positioning in Mexico's automotive sector.

- Challenges and Opportunities: High cost of implementation and integration challenges within the system are also the major challenges. However, the opportunities are increasing exports, increasing demand for cost-effective advanced safety solutions, and encouraging regulations, making Mexico a hub for innovation and adoption of advanced automotive safety technologies in the making.

Mexico Automotive Safety Systems Market Trends:

Increasing Adoption of Advanced Driver Assistance Systems (ADAS)

Over the past several years, the deployment of Advanced Driver Assistance Systems (ADAS) has picked up speed in the automotive industry in Mexico. The growing need for a more secure driving experience is encouraging the adoption of functions like lane departure alerts, adaptive cruise control, and emergency braking systems. For instance, in November 2023, Geely Auto's debut in Mexico with Coolray 2024 and Geometry C 2024 showcases increasing demand for motor vehicle safety systems, with state-of-the-art ADAS technology in line with market trends. Moreover, such technologies are increasingly being seen in both passenger cars and commercial vehicles as manufacturers adopt changing safety standards and customer attitudes. With regulatory agencies putting more focus on vehicle safety, manufacturers are adding ADAS as a standard feature instead of an optional feature. Also, increasing awareness among people about road safety has encouraged consumers to pay more for technologically advanced vehicles. Mexico automotive safety systems market growth is significant due to this trend, indicative of an overall movement toward smart mobility solutions that emphasize driver and pedestrian protection through real-time threat detection and vehicle automation assistance.

To get more information on this market, Request Sample

Growing Demand for Passenger Vehicle Passive Safety Features

The need for passive safety elements, such as airbags, seat belts, and crumple zones, has gained strength in Mexico's automotive sector. Such systems, which help to reduce injury in the case of accidents, are growingly anticipated as standard fittings in cars. The rationale for this trend is driven both by regulatory reform and increasing consumer awareness of safety. Mass educational campaigns emphasizing road safety and the significance of protective equipment have led to a shift in consumer behavior, preferring cars with sound safety equipment. At the same time, growth in the middle class has grown the market for newer car models with passive safety technologies built in. Additionally, better material science and crash test regulations have allowed companies to make cars safer without having to negatively affect car design. The automotive safety systems market in Mexico is witnessing significant growth led by this increased demand for integrated occupant protection, making even base models of vehicles provide basic safety guarantees.

Smart Sensors Integration in Commercial Vehicles

Smart sensors are increasingly part of contemporary safety frameworks, especially for commercial vehicles plying Mexico. The sensors facilitate functions such as blind-spot assist, rear cross-traffic warning, and tire pressure monitoring, which are essential in minimizing road accidents with large transport trucks. For example, in March 2024 Yutong debuted its new generation light trucks in Mexico, equipped with advanced technologies such as T-Power electric chain, regenerative braking, and intelligent adaptive systems, promoting green logistics and energy efficiency. Furthermore, with the growth of logistics and transportation services to cater to rising economic needs, vehicle fleet operators are spending more money equipping their vehicles with sensors to guarantee operational safety and compliance with regulations. The drive towards fleet digitalization is also propelling sensor take-up, with real-time data about vehicle condition and driver behavior adding to preventative maintenance and accident-avoidance techniques. With proactive over reactive safety being enabled by smart sensor integration, it aligns with national road safety policy. The Mexico automotive safety systems market is witnessing significant growth as commercial operators give top priority to technologies that increase vehicle lifespan, minimize liability risks, and promote the health of drivers and cargo.

Mexico Automotive Safety Systems Market Opportunities:

Mexico automotive safety systems market offers significant opportunities as the nation consolidates its position as a global automaker manufacturing center. Increased foreign direct investment in automotive facilities and technology partnerships is building up rich opportunities for the incorporation of advanced safety features. With increased production, Mexico automotive safety systems market demand is growing rapidly, especially for airbags, anti-lock braking systems, and advanced driver-assistance systems. Additionally, Mexico's high export orientation, especially to North America and Europe, urges producers to adhere to global safety standards, driving innovation and quality enhancement. The increasing demand for semi-autonomous driving solutions, backed by digitalization and sensor integration, further increases growth prospects. Further, government-sponsored programs of vehicle safety and more stringent regulatory designs provide opportunities for expansion. Combined, these points emphasize Mexico's role as a regional leader in next-generation safety systems, which further solidifies the optimism expressed in the Mexico automotive safety systems market forecast.

Mexico Automotive Safety Systems Market Challenges:

Even with robust growth potential, the Mexico automotive safety systems market has significant challenges that may determine its long-term direction. The high cost of integrating advanced safety technologies is a major deterrent, especially for budget and mid-segment vehicles where price sensitivity is higher. In addition, uneven development of infrastructure and differences in consumer safety awareness restrain mass adoption of advanced systems like ADAS or collision prevention solutions. The dependence on imported components and technologies increases supply chain risks, exposing the market to international economic fluctuations and trade barriers. Compliance with global safety standards may prove costly for smaller local suppliers, reducing their ability to compete against entrenched global players. In addition, inadequate skilled workforce availability for advanced electronics and sensor integration is an operational hindrance. Conquering these obstacles will be critical for Mexico to maximize its automotive production power fully while promoting greater use of sophisticated safety systems.

Mexico Automotive Safety Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on system type, vehicle type, and end user.

System Type Insights:

- Lane Departure Warning System

- Other on Board Safety Systems

The report has provided a detailed breakup and analysis of the market based on the system type. This includes lane departure warning system and other on board safety systems.

Vehicle Type Insights:

- Passenger Car

- Commercial Vehicle

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger car and commercial vehicle.

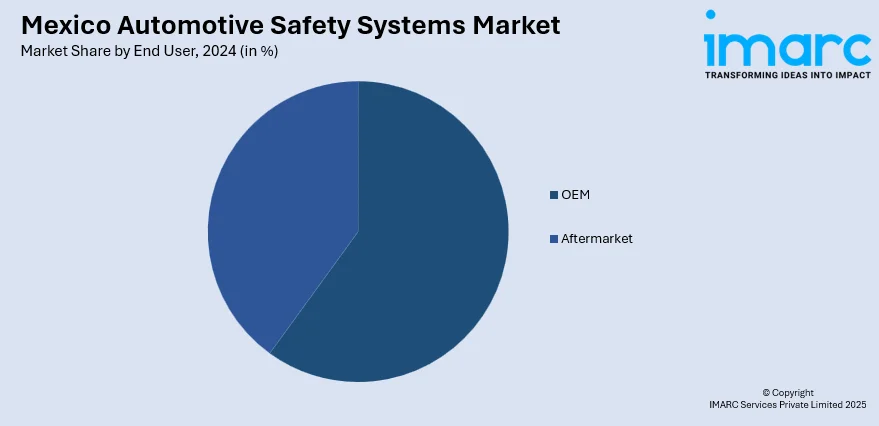

End User Insights:

- OEM

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the end user. This includes OEM and aftermarket.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Automotive Safety Systems Market News:

- In March 2025, General Motors Mexico and Geotab released the first OEM telematics integration in Mexico. The collaboration allows fleet operators to remotely access real-time data directly from GM vehicles with OnStar, simplifying fleet management and operation efficiency without requiring extra hardware or installations

- In February 2025, Motive introduced AI-based Drowsiness Detection and Forward Collision Warning systems in Mexico to counter distracted and drowsy driving. Coupled with dual-facing dashcams, the features send real-time notifications to drivers and managers, greatly enhancing fleet safety and minimizing accident threats in the country.

Mexico Automotive Safety Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| System Types Covered | Lane Departure Warning System, Other on Board Safety Systems |

| Vehicle Types Covered | Passenger Car, Commercial Vehicle |

| End Users Covered | OEM, Aftermarket |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico automotive safety systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico automotive safety systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico automotive safety systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive safety systems market in Mexico was valued at USD 262.50 Million in 2024.

The Mexico automotive safety systems market is projected to exhibit a CAGR of 13.42% during 2025-2033, reaching a value of USD 815.34 Million by 2033.

The market is driven by rising vehicle production, increasing regulatory emphasis on passenger safety, and growing consumer awareness of advanced technologies. Expanding exports to safety-conscious regions also boost adoption. Demand for ADAS, airbags, and braking systems is accelerating, supported by technological advancements and Mexico’s role as a key automotive manufacturing hub.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)