Mexico Automotive Software Market Size, Share, Trends and Forecast by Product, Vehicle Type, Application, and Region, 2025-2033

Mexico Automotive Software Market Overview:

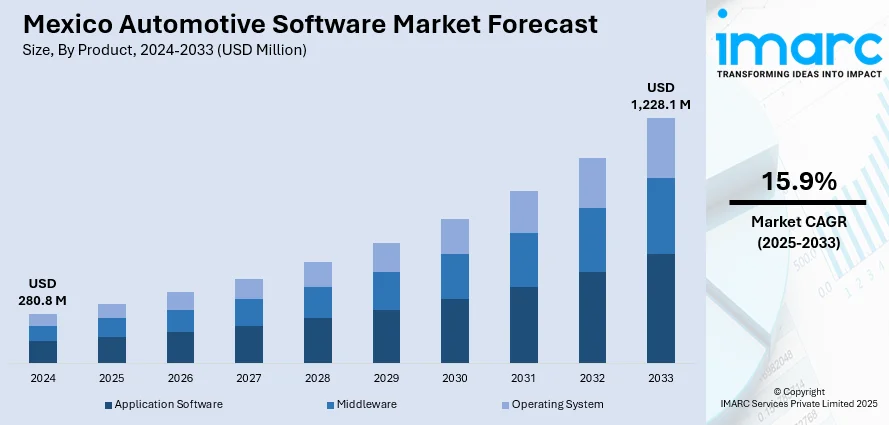

The Mexico automotive software market size reached USD 280.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,228.1 Million by 2033, exhibiting a growth rate (CAGR) of 15.9% during 2025-2033. The growing adoption of electric vehicles (EVs) that rely on advanced software systems for efficient operation, along with the rising demand for connected vehicles with infotainment systems, is strengthening the Mexico automotive software market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 280.8 Million |

| Market Forecast in 2033 | USD 1,228.1 Million |

| Market Growth Rate 2025-2033 | 15.9% |

Mexico Automotive Software Market Trends:

Increasing EV adoption

Rising EV adoption is positively influencing the market in Mexico. According to the data provided by Electro Movilidad Asociación (EMA), in 2024, sales of EVs and plug-in hybrid electric vehicles (PHEVs) in the country increased by 84%. EVs require integrated software for battery management, energy optimization, powertrain control, and charging infrastructure compatibility. As more people and businesses are shifting towards sustainable transportation, the demand for software that enhances EV performance is rising. The increasing popularity of EVs in urban areas is encouraging the development of smart navigation systems, predictive maintenance tools, and remote diagnostics. Automotive software aids in improving the driving experience, ensuring safety, and extending battery life, making it a core component of EV manufacturing. Mexico's strategic position in the worldwide automotive supply chain is attracting investments in EV manufacturing, leading to higher demand for localized software development. Automakers and tech firms in Mexico are collaborating to innovate and test next-generation automotive software tailored for EVs. Additionally, government incentives and policies that support EV usage is fueling the market growth. Connectivity features, real-time performance monitoring, and integration with mobile apps also add value to the EV user experience.

To get more information of this market, Request Sample

Rising urbanization activities

Increasing urbanization activities are impelling the Mexico automotive software market growth. As cities are expanding and the urbanization rate is rising, traffic congestion and transportation challenges are intensifying. According to the worldometer, 87.4% of Mexico's population was urban, which equated to 114,397,383 individuals in 2024. This shift is creating the need for advanced automotive software that can support features like real-time traffic navigation, intelligent route planning, and vehicle-to-infrastructure communication. The rising urban population is also increasing the number of vehicles on the roads, leading to a greater demand for software that enhances fuel efficiency, emissions control, and driver safety. Additionally, urban users prefer connected vehicles with infotainment systems, parking assistance, and smart diagnostics, which rely on sophisticated software platforms. Moreover, the rise in ride-sharing and fleet-based mobility services in urban areas is encouraging the development of management and tracking software. Urbanization not only increases vehicle ownership but also raises expectations for high-tech, efficient, and environment friendly transportation, making software a crucial element in meeting modern mobility needs in Mexico.

Mexico Automotive Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, vehicle type, and application.

Product Insights:

- Application Software

- Middleware

- Operating System

The report has provided a detailed breakup and analysis of the market based on the product. This includes application software, middleware, and operating system.

Vehicle Type Insights:

- ICE Passenger Vehicle

- ICE Light Commercial Vehicle

- ICE Heavy Commercial Vehicle

- Battery Electric Vehicle

- Hybrid Electric Vehicle

- Plug-in Hybrid Electric Vehicle

- Autonomous Vehicles

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes ICE passenger vehicle, ICE light commercial vehicle, ICE heavy commercial vehicle, battery electric vehicle, hybrid electric vehicle, plug-in hybrid electric vehicle, and autonomous vehicles.

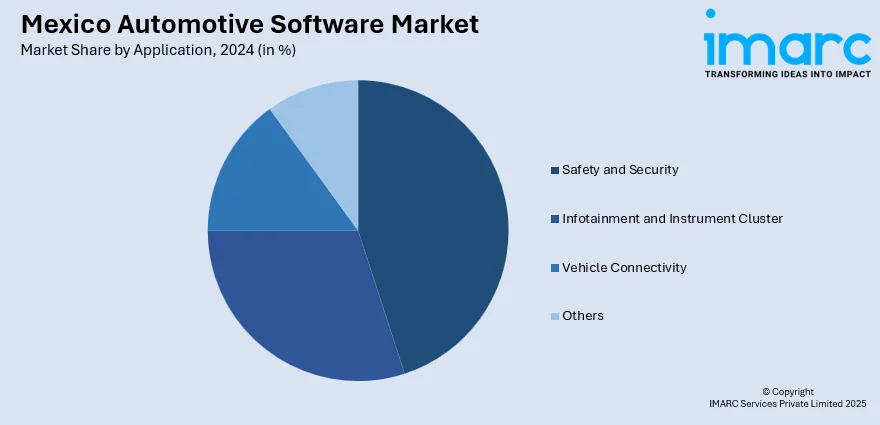

Application Insights:

- Safety and Security

- Infotainment and Instrument Cluster

- Vehicle Connectivity

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes safety and security, infotainment and instrument cluster, vehicle connectivity, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Automotive Software Market News:

- In January 2024, General Motors (GM) introduced new in-vehicle technology, OnStar Connected Services, in Saudi Arabia. It established a new standard with refined convenience and connectivity. It provided enhanced safety and security features, enabling a range of innovative solutions for GM clients. GM vehicle owners could access and benefit from free Standard Connectivity for a decade, which included features, such as over-the-air vehicle software updates and diagnostic alerts.

Mexico Automotive Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Application Software, Middleware, Operating System |

| Vehicle Types Covered | ICE Passenger Vehicle, ICE Light Commercial Vehicle, ICE Heavy Commercial Vehicle, Battery Electric Vehicle, Hybrid Electric Vehicle, Plug-in Hybrid Electric Vehicle, Autonomous Vehicles |

| Applications Covered | Safety and Security, Infotainment and Instrument Cluster, Vehicle Connectivity, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico automotive software market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico automotive software market on the basis of product?

- What is the breakup of the Mexico automotive software market on the basis of vehicle type?

- What is the breakup of the Mexico automotive software market on the basis of application?

- What is the breakup of the Mexico automotive software market on the basis of region?

- What are the various stages in the value chain of the Mexico automotive software market?

- What are the key driving factors and challenges in the Mexico automotive software?

- What is the structure of the Mexico automotive software market and who are the key players?

- What is the degree of competition in the Mexico automotive software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico automotive software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico automotive software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico automotive software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)