Mexico Automotive Steering System Market Size, Share, Trends and Forecast by Type, Component, Vehicle Type, and Region, 2025-2033

Mexico Automotive Steering System Market Overview:

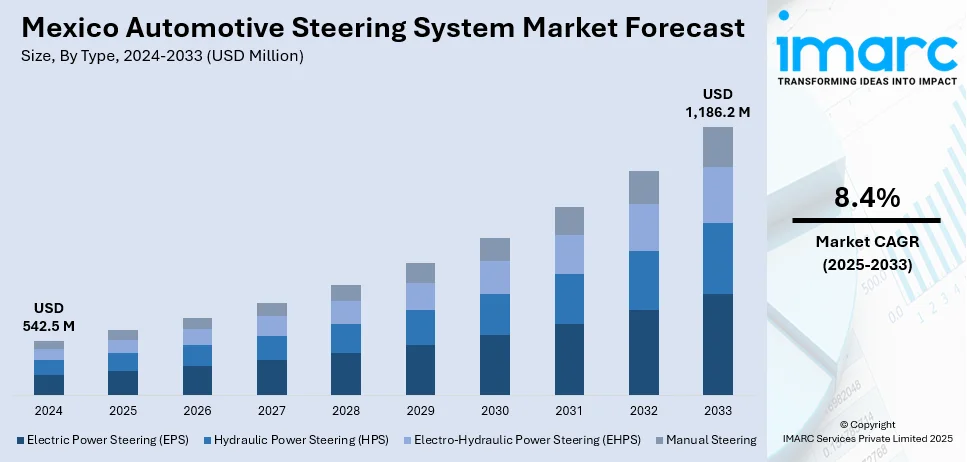

The Mexico automotive steering system market size reached USD 542.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,186.2 Million by 2033, exhibiting a growth rate (CAGR) of 8.4% during 2025-2033. The market is propelled by rising vehicle production, increasing adoption of electric power steering (EPS) systems, growing demand for advanced driver-assistance systems (ADAS), and focus on fuel efficiency and enhanced driving comfort. Moreover, the increasing focus of Mexican government on industrial development and attracting automotive investments, along with electromobility initiatives, contributes to the growth Mexico automotive steering system market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 542.5 Million |

| Market Forecast in 2033 | USD 1,186.2 Million |

| Market Growth Rate 2025-2033 | 8.4% |

Mexico Automotive Steering System Market Trends:

Technological Advancements in Steering Systems

Mexico is witnessing a significant transition from traditional hydraulic steering systems to electric power steering (EPS) and steer-by-wire technologies. These innovations bring about improved fuel efficiency, better vehicle handling, and improved compatibility with electric and hybrid vehicles. EPS systems minimize mechanical complexity and enable integration with sophisticated driver-assistance systems (ADAS), which make them a perfect fit for contemporary vehicles. This trend is further supported by the growing presence of multinational automotive suppliers in Mexico that invest heavily in R&D, which is creating a positive impact on the market outlook. The use of AI and automation in manufacturing also allows for the creation of more accurate and responsive steering solutions, making Mexico a competitive center for innovative automotive technologies. For instance, in February 2023, the German automotive firm ZF Group is set to expand its manufacturing facilities in Queretaro, Mexico by over 80,000 m2. Furthermore, the company plans to open a new distribution center in the area the following year to satisfy the increasing demand for its chassis technologies, such as integrated brake control systems and electric power assisted steering systems.

Rising Vehicle Production and Sales

Mexico is a global automotive manufacturing leader, ranking among the top exporters of light vehicles, further driving the Mexico automotive steering system market growth. The country’s expanding automotive production capacity directly boosts the demand for high-quality automotive components, including steering systems. With major OEMs like General Motors, Ford, and Volkswagen operating large-scale plants in Mexico, production volumes have surged in recent years. Domestic sales of passenger and light commercial vehicles are also growing steadily, driven by population growth and rising incomes. These trends translate into a higher need for reliable, efficient steering technologies that can meet international standards. As production grows, so does the demand for modern, efficient, and safe steering systems in new vehicles. For instance, in January 2024, Rane (Madras) broadened its global presence by establishing a greenfield plant in Mexico for producing steering and suspension parts for passenger vehicles to increase its portion of international revenue. This development is a direct response to the booming vehicle production in Mexico, which is further fueling the market share.

Mexico Automotive Steering System Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, component, and vehicle type.

Type Insights:

- Electric Power Steering (EPS)

- Hydraulic Power Steering (HPS)

- Electro-Hydraulic Power Steering (EHPS)

- Manual Steering

The report has provided a detailed breakup and analysis of the market based on the type. This includes electric power steering (EPS), hydraulic power steering (HPS), electro-hydraulic power steering (EHPS), and manual steering.

Component Insights:

- Steering Column

- Steering Wheel Speed Sensors

- Electric Motors

- Hydraulic Pumps

- Others

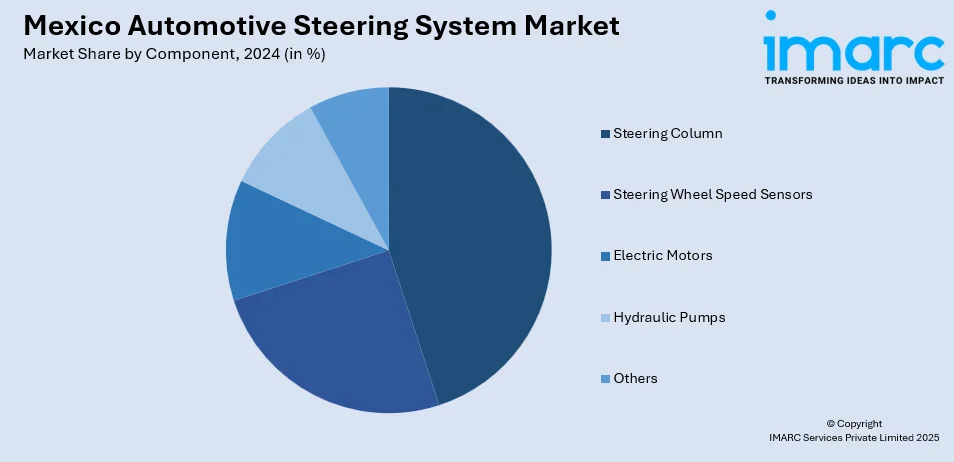

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes steering column, steering wheel speed sensors, electric motors, hydraulic pumps, and others.

Vehicle Type Insights:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger cars, light commercial vehicles, and heavy commercial vehicles.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Automotive Steering System Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Electric Power Steering (EPS), Hydraulic Power Steering (HPS), Electro-Hydraulic Power Steering (EHPS), Manual Steering |

| Components Covered | Steering Column, Steering Wheel Speed Sensors, Electric Motors, Hydraulic Pumps, Others |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico automotive steering system market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico automotive steering system market on the basis of type?

- What is the breakup of the Mexico automotive steering system market on the basis of component?

- What is the breakup of the Mexico automotive steering system market on the basis of vehicle type?

- What is the breakup of the Mexico automotive steering system market on the basis of region?

- What are the various stages in the value chain of the Mexico automotive steering system market?

- What are the key driving factors and challenges in the Mexico automotive steering system market?

- What is the structure of the Mexico automotive steering system market and who are the key players?

- What is the degree of competition in the Mexico automotive steering system market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico automotive steering system market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico automotive steering system market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico automotive steering system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)