Mexico Automotive Suspension Systems Market Size, Share, Trends and Forecast by Component Type, Type, Vehicle Type, and Region, 2025-2033

Mexico Automotive Suspension Systems Market Overview:

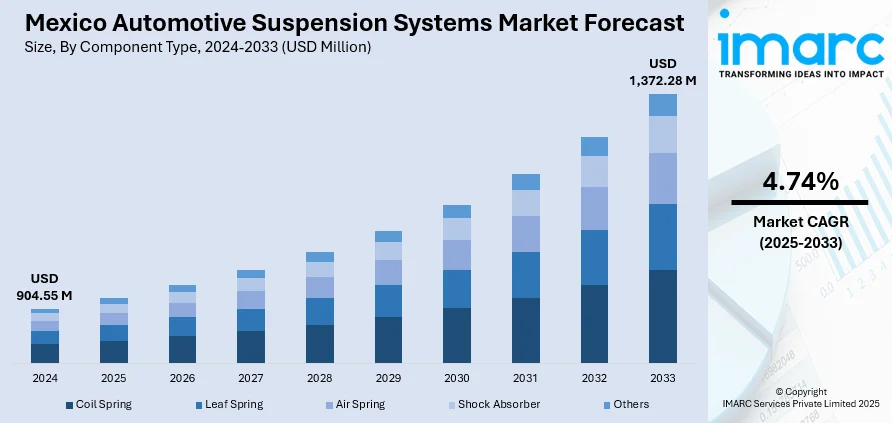

The Mexico Automotive Suspension Systems Market size reached USD 904.55 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,372.28 Million by 2033, exhibiting a growth rate (CAGR) of 4.74% during 2025-2033. The market is driven by the growing vehicle production, rising demand for improved ride comfort, and increasing adoption of electric and premium vehicles. Technological advancements in suspension design and materials are enhancing performance and fuel efficiency, aligning with environmental regulations. Additionally, a strong aftermarket sector and Mexico’s role as a manufacturing hub attract global investments. These factors collectively support rising Mexico automotive suspension systems market share by meeting evolving consumer preferences and enabling local production to serve both domestic and international markets efficiently.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 904.55 Million |

| Market Forecast in 2033 | USD 1,372.28 Million |

| Market Growth Rate 2025-2033 | 4.74% |

Mexico Automotive Suspension Systems Market Analysis:

- Key Market Drivers: The Mexico automotive suspension systems market size is sustained by increasing vehicle manufacturing, rising comfort and stability demand, and preference for lightweight materials. Rising exports and consumption of electric vehicles are also boosting long-term growth opportunities for local and foreign manufacturers.

- Key Market Trends: The Mexico automotive suspension systems market is experiencing trends like adoption of adaptive suspension, electronic control integration, and increasing air suspension demand. There is growing interest in energy-efficient designs and lightweight materials, particularly with electric vehicles driving future manufacturing and technology investment.

- Competitive Landscape: The Mexico automotive suspension systems market analysis notes intense competition among local and international players. Firms are increasing technological innovation, implementing increased production capacity, and establishing strategic partnerships to gain increased market positioning and address changing performance and sustainability needs in suspension technologies.

- Challenges and Opportunities: The Mexican automotive suspension systems market is challenged by raw material price volatility and regulatory compliance pressure. However, the opportunities include aftermarket growth, growth in EV production, and the future prospect of advanced suspension technologies that compromise on neither durability, safety, nor efficiency for both local and international markets.

Mexico Automotive Suspension Systems Market Trends:

Technological Advancements in Suspension Systems

Mexico's automotive suspension industry is adopting cutting-edge technology to satisfy increasing demands for comfort, performance, and safety. Automotive companies are using adaptive and active suspension systems that automatically change in real time to adapt to road conditions, providing smoother handling and improved ride quality. Electronically controlled dampers and air suspension are increasingly popular, particularly in electric vehicles (EVs) and luxury cars. Lightweight materials are also gaining popularity to lower vehicle weight overall and improve fuel efficiency. Smart mobility and tightening environmental regulations are fueling this trend. Electric vehicles, as they gain popularity, are introducing one-of-a-kind structural demands that are driving suspension design innovation. These systems are becoming a differentiator in vehicle performance reflecting growing Mexico automotive suspension systems market demand. Overall, the transition towards more intelligent, more responsive suspension is transforming the way cars are developed and driven in Mexico.

To get more information on this market, Request Sample

Mexico's Role as a Manufacturing Hub

Mexico has become a critical manufacturing base for the world's automotive industry, and its suspension systems market has been impacted by this. In 2023, Mexico experienced a 23% rise in the manufacture of suspension, steering, and associated components to a value of $1.37 billion. This is fueled by Mexico's strategic positioning, highly skilled workforce, and integration into international supply chains, which have made it a magnet for leading automakers and component suppliers. Firms are opening up local factories to accommodate increasing demand from domestic and export markets. Growing numbers of high-quality suspension component plants serve to lower costs and lead times for local vehicle assembly. Moreover, collaborations between international and local companies are facilitating technology transfer and human resource development. These dynamics reinforce Mexico's position as a trustworthy, affordable source of high-tech automotive components, emphasizing its increasing role as a driver of innovation and scale in international auto production, aligned with Mexico automotive suspension systems market forecast.

Expansion of the Aftermarket Segment

The Mexico suspension system aftermarket is growing steadily as owners of vehicles look for affordable maintenance and customization solutions. As many vehicles get older, replacements and upgrades of suspensions are on the rise. Car enthusiasts as well as regular drivers are placing orders for aftermarket items to improve ride quality, off-road performance, or appearance. These include items such as high-performance shocks, springs, and lift kits. Availability of a broad selection of choices through local service shops and distributors simplifies the process of finding what consumers require. The fact that aftermarket parts are cheaper than original equipment also motivates price-conscious consumers to use these solutions. Increased growth in this segment also creates more innovation on the part of parts manufacturers since they compete to provide better-performing and more long-lasting solutions. Generally, the aftermarket environment is an important factor in propping up Mexico automotive suspension systems market growth.

Mexico Automotive Suspension Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component type, type, and vehicle type.

Component Type Insights:

- Coil Spring

- Leaf Spring

- Air Spring

- Shock Absorber

- Others

The report has provided a detailed breakup and analysis of the market based on the component type. This includes coil spring, leaf spring, air spring, shock absorber, and others.

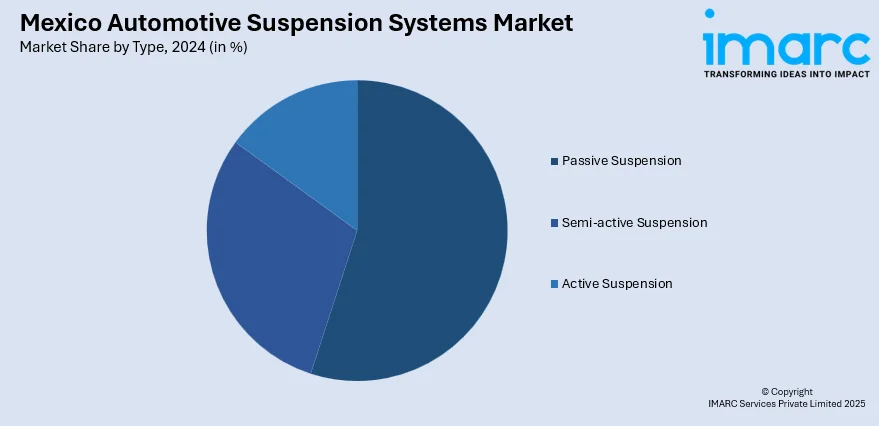

Type Insights:

- Passive Suspension

- Semi-active Suspension

- Active Suspension

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes passive suspension, semi-active suspension, and active suspension.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars and commercial vehicles.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Automotive Suspension Systems Market News:

- In April of 2025, BWI Group increased production capacity for its fourth-generation MagneRide® suspension system in China, Poland, and Mexico. The move added 600,000 units per year, increasing supply to almost two million vehicles and solidifying the use of sophisticated suspension technologies in the Mexico automotive suspension systems market.

- In November 2024, SKF Automotive launched a top-of-the-line steering and suspension range throughout the U.S. and Canada. With OE-quality specifications in mind, the lineup features control arms, ball joints, and stabilizer links. With patented synthetic grease technology, the products deliver improved safety, comfort, and durability along with guaranteed ease of installation for professionals.

Mexico Automotive Suspension Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered | Coil Spring, Leaf Spring, Air Spring, Shock Absorber, Others |

| Types Covered | Passive Suspension, Semi-active Suspension, Active Suspension |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico automotive suspension systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico automotive suspension systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico automotive suspension systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive suspension systems market in Mexico was valued at USD 904.55 Million in 2024.

The Mexico automotive suspension systems market is projected to exhibit a (CAGR) of 4.74% during 2025-2033, reaching a value of USD 1,372.28 Million by 2033.

The key factors driving the Mexico automotive suspension systems market include rising vehicle production, increasing consumer preference for comfort and ride quality, and the growing adoption of advanced suspension technologies. Additionally, strict safety regulations, urbanization-led infrastructure expansion, and rising demand for electric and hybrid vehicles further support strong market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)