Mexico Automotive Wiring Harness Market Size, Share, Trends and Forecast by Application, Material Type, Transmission Type, Vehicle Type, Category, Component, and Region, 2025-2033

Mexico Automotive Wiring Harness Market Overview:

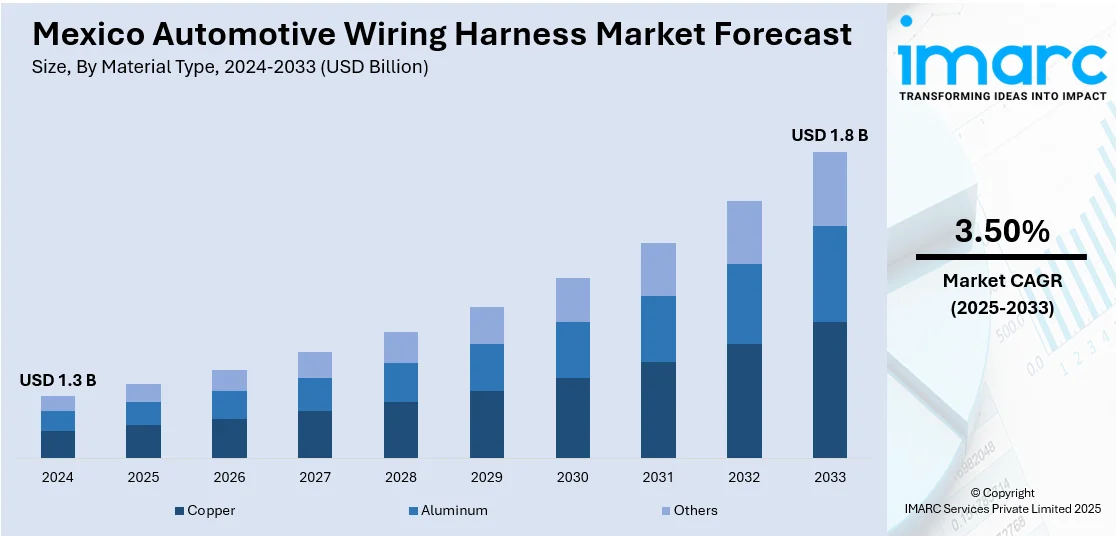

The Mexico automotive wiring harness market size reached USD 1.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.8 Billion by 2033, exhibiting a growth rate (CAGR) of 3.50% during 2025-2033. The market outlook is driven by the increasing demand for electric vehicles (EVs) and internet-connected vehicles, which require advanced wiring systems to perform optimally. Additionally, the cost reduction and light-weighting trend in vehicle production also increases the demand for innovative, high-strength, and low-cost wiring harness solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.3 Billion |

| Market Forecast in 2033 | USD 1.8 Billion |

| Market Growth Rate 2025-2033 | 3.50% |

Mexico Automotive Wiring Harness Market Trends:

Increased Production of Connected Vehicles

Growing acceptance of connected vehicles in Mexico is propelling an upsurge in demand for sophisticated automotive wiring harnesses. Such vehicles utilize sophisticated wiring networks to enable several features, including global positioning system (GPS), autonomous driving, and real-time cloud communication. The wiring harnesses have to be able to support high speeds of data transmission so that the sensors, antennas, and electronic modules communicate effortlessly with each other. With automobile manufacturers increasingly embedding more sophisticated technologies in their vehicles, the requirement for custom wiring harness solutions is even more vital. This phenomenon is further fueled by the increasing trend towards connected and smart cars, further complementing the Mexico automotive wiring harness market growth.

Electrification of Vehicles

The growing demand for EVs in Mexico is significantly boosting the automotive wiring harness market share. As EVs require advanced electrical systems, including high-voltage wiring for components like battery management and motors, the need for specialized wiring harnesses has surged. With automakers ramping up EV production to meet both domestic and global demand, suppliers are focusing on creating durable, lightweight, and efficient wiring solutions. This shift toward electrification is further driven by international investments, such as BYD’s plan to establish a plant in Mexico. Expected to create 10,000 jobs and produce 150,000 vehicles annually, BYD’s investment highlights the growing international interest in Mexico’s EV manufacturing capabilities. This transition toward electric mobility underscores the critical role of automotive wiring harnesses in Mexico's evolving automotive industry.

Cost Optimization and Lightweighting

To remain competitive in the global automotive industry, Mexican manufacturers are concentrating on minimizing production costs while enhancing the efficiency of vehicles. One major approach is the optimization of automotive wiring harnesses by using light materials, like aluminum, to minimize vehicle weight. This results in improved fuel efficiency and emissions reduction. Furthermore, producers are improving the cost-effectiveness of wiring harness manufacturing by simplifying designs, improving automation in manufacturing operations, and employing more cost-effective materials. These initiatives assist in fulfilling economic goals and contribute to environmental objectives since lower vehicle weight and improved efficiency complement efforts toward sustainability. This is the trend powering growth in Mexico's automotive wiring harness market, making the nation a leading contender in the international automobile industry.

Mexico Automotive Wiring Harness Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on application, material type, transmission type, vehicle type, category, and component.

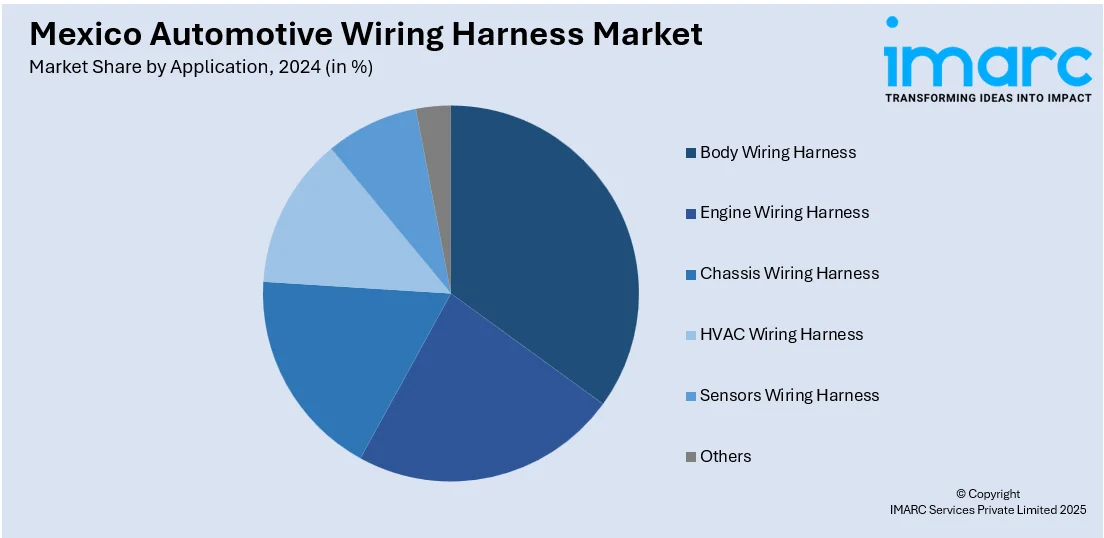

Application Insights:

- Body Wiring Harness

- Engine Wiring Harness

- Chassis Wiring Harness

- HVAC Wiring Harness

- Sensors Wiring Harness

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes body wiring harness, engine wiring harness, chassis wiring harness, HVAC wiring harness, sensors wiring harness, and others.

Material Type Insights:

- Copper

- Aluminum

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes copper, aluminum, and others.

Transmission Type Insights:

- Data Transmission

- Electrical Wiring

The report has provided a detailed breakup and analysis of the market based on the transmission type. This includes data transmission, and electrical wiring.

Vehicle Type Insights:

- Two Wheelers

- Passenger Cars

- Commercial Vehicles

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes two wheelers, passenger cars, and commercial vehicles.

Category Insights:

- General Wires

- Heat Resistant Wires

- Shielded Wires

- Tubed Wires

The report has provided a detailed breakup and analysis of the market based on the category. This includes general wires, heat resistant wires, shielded wires, and tubed wires.

Component Insights:

- Connectors

- Wires

- Terminals

- Others

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes connectors, wires, terminals, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern, Central, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Automotive Wiring Harness Market News:

- In July 2024, Chihuahua Electrical Wiring Systems (CEWS) opened a new plant in Campeche, creating over 2,200 jobs. The facility will produce automotive harnesses for companies like Kia and Hyundai. CEO Gustavo Saucedo highlighted the region's security, infrastructure growth, and skilled workforce as key factors in choosing Campeche. Governor Layda Sansores emphasized that CEWS' arrival will boost the state's economic diversification and job creation, positioning it as a growing industrial hub.

Mexico Automotive Wiring Harness Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Body Wiring Harness, Engine Wiring Harness, Chassis Wiring Harness, HVAC Wiring Harness, Sensors Wiring Harness, Others |

| Material Types Covered | Copper, Aluminum, Others |

| Transmission Types Covered | Data Transmission, Electrical Wiring |

| Vehicle Types Covered | Two Wheelers, Passenger Cars, Commercial Vehicles |

| Categories Covered | General Wires, Heat Resistant Wires, Shielded Wires, Tubed Wires |

| Components Covered | Connectors, Wires, Terminals, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico automotive wiring harness market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico automotive wiring harness market on the basis of application?

- What is the breakup of the Mexico automotive wiring harness market on the basis of material type?

- What is the breakup of the Mexico automotive wiring harness market on the basis of transmission type?

- What is the breakup of the Mexico automotive wiring harness market on the basis of vehicle type?

- What is the breakup of the Mexico automotive wiring harness market on the basis of category?

- What is the breakup of the Mexico automotive wiring harness market on the basis of component?

- What is the breakup of the Mexico automotive wiring harness market on the basis of region?

- What are the various stages in the value chain of the Mexico automotive wiring harness market?

- What are the key driving factors and challenges in the Mexico automotive wiring harness market?

- What is the structure of the Mexico automotive wiring harness market and who are the key players?

- What is the degree of competition in the Mexico automotive wiring harness market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico automotive wiring harness market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico automotive wiring harness market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico automotive wiring harness industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)