Mexico Aviation Market Size, Share, Trends and Forecast by Aircraft Type and Region, 2025-2033

Mexico Aviation Market Overview:

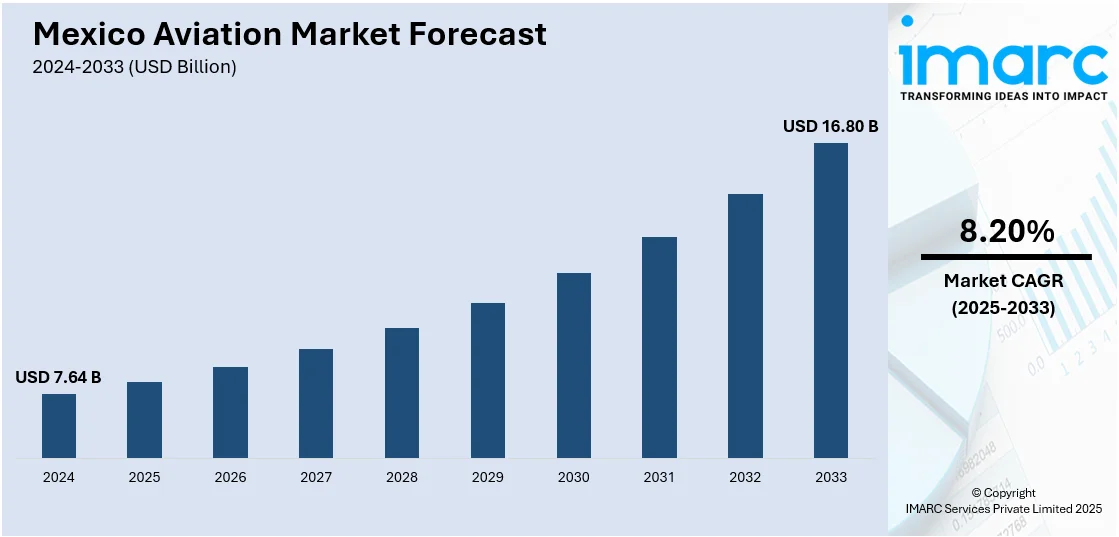

The Mexico aviation market size reached USD 7.64 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 16.80 Billion by 2033, exhibiting a growth rate (CAGR) of 8.20% during 2025-2033. The market is driven by rising domestic travel demand and broader middle-class participation. Also, strategic airport expansion and federal investment programs are fueling the product adoption. Additionally, international route growth and tourism sector recovery are accelerating airline operations. Fleet growth, low-cost carrier expansion, and infrastructure upgrades are some of the other factors positively impacting the Mexico aviation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.64 Billion |

| Market Forecast in 2033 | USD 16.80 Billion |

| Market Growth Rate 2025-2033 | 8.20% |

Mexico Aviation Market Trends:

Rapid Expansion of Domestic Air Travel and Rising Middle-Class Demand

Mexico has experienced a steady increase in domestic air travel demand, driven largely by population growth in urban centers and the expansion of its middle class. As more citizens achieve disposable income thresholds that allow for leisure and business travel by air, domestic carriers are responding with new routes and increased flight frequencies. The deregulation of airfares and entrance of low-cost carriers (LCCs) such as Volaris and Viva Aerobus have made air travel more accessible, especially for first-time flyers in secondary cities. These carriers have aggressively expanded into underserved regions, stimulating traffic in airports such as Tijuana, León, and Mérida. Mexico’s unique geography, with long distances between major population centers and limited high-speed ground transportation infrastructure, further supports a preference for air travel over land options. This environment is pushing airlines to increase fleet sizes, upgrade airport operations, and improve passenger services. The U.S. Federal Aviation Administration (FAA) has restored Mexico’s aviation safety rating to Category 1 after over two years of technical collaboration with Mexico’s civil aviation authority. This upgrade allows Mexican carriers to expand routes to the U.S. and re-engage in code-sharing agreements with U.S. airlines, unlocking significant commercial opportunities. The decision affirms that Mexico now meets the International Civil Aviation Organization’s safety standards, strengthening its international aviation credibility and potential for further market integration. This is a key factor driving Mexico aviation market growth, as air connectivity becomes an enabler for regional economic integration and tourism development. The result is a more competitive domestic aviation sector with increasing pressure on infrastructure, fleet modernization, and route optimization strategies.

International Connectivity and Tourism Sector Recovery

Mexico’s role as a leading global tourism destination, combined with its proximity to the United States and Canada, has made international air traffic a major growth lever. Major resort destinations such as Cancún, Los Cabos, and Puerto Vallarta attract millions of inbound tourists annually, driving strong demand for international seat capacity. In recent years, Mexico has benefited from its open skies agreements and bilateral arrangements that allow increased foreign carrier participation and route diversification. The country’s relatively relaxed travel restrictions during the COVID-19 pandemic gave it a first-mover advantage in recovering tourism volumes, with U.S.-Mexico routes rebounding ahead of many others globally. Airlines have responded with expanded services, including new long-haul routes from Europe and South America. The tourism sector's rebound is also being supported by government-backed promotional campaigns and investments in hospitality infrastructure. Additionally, international airlines are deepening partnerships with Mexican carriers through code-sharing and alliance integration, increasing connectivity across regional and global networks. On May 28, 2024, Diehl Aviation announced it is establishing a new production facility near Querétaro, Mexico, marking a strategic expansion to enhance support for key clients like Airbus, Boeing, and Embraer. The 8,000-square-meter site, set to begin operations by mid-2025, will produce components such as overhead bins for the Airbus A220 and is expected to scale up to 500 employees. These shifts are expanding Mexico’s aviation footprint, reinforcing its role as both a transit hub and a final destination for millions of international travelers.

Mexico Aviation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on aircraft type.

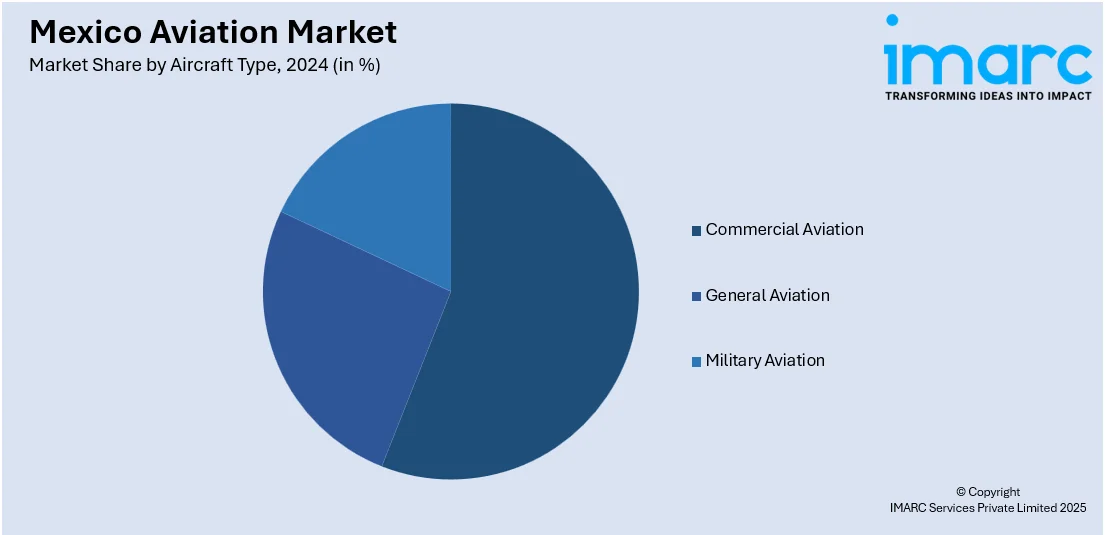

Aircraft Type Insights:

- Commercial Aviation

- General Aviation

- Military Aviation

The report has provided a detailed breakup and analysis of the market based on the aircraft type. This includes commercial aviation, general aviation, and military aviation.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has provided a comprehensive analysis of all major regional markets. This includes Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Aviation Market News:

- April 17, 2025: Embraer has added Fly Across MRO, based at Toluca International Airport, to its global Authorized Service Center Network, extending full maintenance support for Phenom, Praetor, Legacy 450, and Legacy 500 executive jets. The certification reinforces Mexico’s role as a regional hub for business aviation services, ensuring Embraer operators benefit from localized, high-standard support. This move strengthens Embraer's presence in Mexico and highlights the country's growing capabilities in the aviation maintenance and support sector.

- July 6, 2023: Textron Aviation has delivered the first Cessna Citation Longitude business jet registered in Mexico to a private customer, following its certification by Mexico’s aviation authority (AFAC) in 2022. This delivery underscores growing demand for high-performance business aircraft in the region, with operators seeking range and efficiency for domestic and North American travel.

Mexico Aviation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Aircraft Types Covered | Commercial Aviation, General Aviation, Military Aviation |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico aviation market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico aviation market on the basis of aircraft type?

- What is the breakup of the Mexico aviation market on the basis of region?

- What are the various stages in the value chain of the Mexico aviation market?

- What are the key driving factors and challenges in the Mexico aviation market?

- What is the structure of the Mexico aviation market and who are the key players?

- What is the degree of competition in the Mexico aviation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico aviation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico aviation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico aviation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)