Mexico Baby Apparel Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Age Group, End User, and Region, 2026-2034

Mexico Baby Apparel Market Summary:

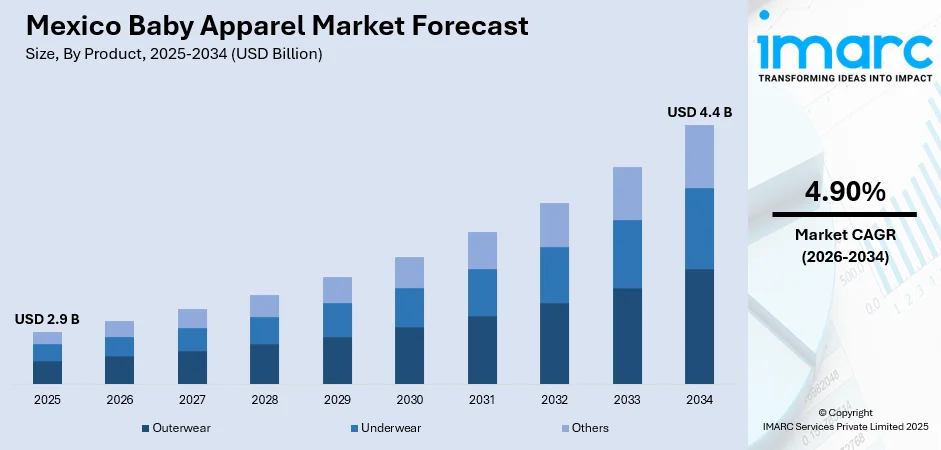

The Mexico baby apparel market size was valued at USD 2.9 Billion in 2025 and is projected to reach USD 4.4 Billion by 2034, growing at a compound annual growth rate of 4.90% from 2026-2034.

The Mexico baby apparel market is experiencing robust growth, driven by evolving consumer preferences and rising disposable incomes among Mexican families. Parents increasingly prioritize high-quality, comfortable clothing for infants and toddlers, particularly cotton-based outerwear that suits the country's warm climate. The market benefits from expanding retail infrastructure, growing e-commerce adoption, and strong cultural emphasis on family-centric purchasing decisions across urban and semi-urban regions.

Key Takeaways and Insights:

- By Product: Outerwear dominates the market with a share of 68.24% in 2025, driven by parental preference for versatile garments suitable for Mexico's diverse climate conditions and everyday wear requirements.

- By Material: Cotton leads the market with a share of 58.72% in 2025, owing to its softness, breathability, and hypoallergenic properties ideal for infant skin sensitivity in warm weather.

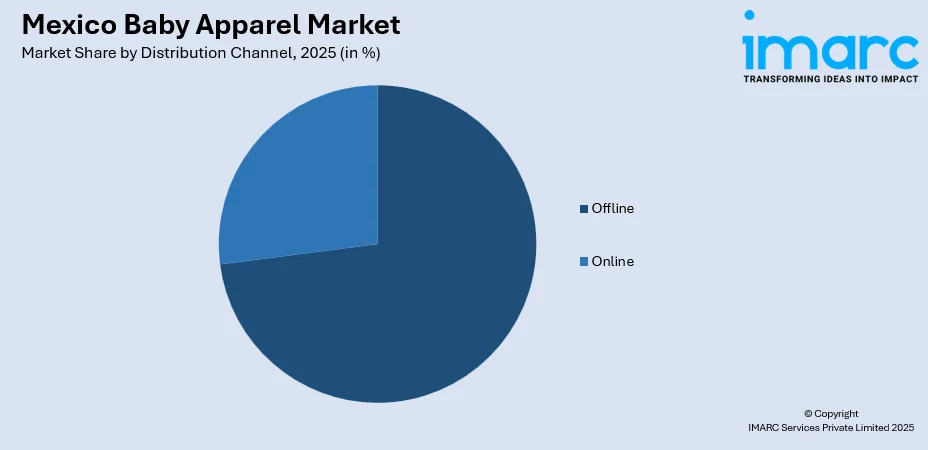

- By Distribution Channel: Offline represents the largest segment with a market share of 72.85% in 2025, attributed to Mexican consumers' preference for in-store shopping experiences and tactile product evaluation.

- By Age Group: 0-12 Months dominate with a share of 40% in 2025, reflecting higher clothing replacement frequency due to rapid infant growth and increased parental spending on newborns.

- By End User: Girls lead the market with a share of 51% in 2025, driven by greater product variety, fashion-forward designs, and cultural preferences for elaborate girls' clothing options.

- Key Players: The Mexico baby apparel market exhibits moderate competitive intensity, with established department store chains, international fast-fashion retailers, and local manufacturers competing across price segments through diverse product portfolios and omnichannel strategies.

To get more information on this market Request Sample

The Mexico baby apparel market is characterized by a dynamic interplay between traditional retail preferences and emerging digital commerce trends. Rising urbanization across major metropolitan areas has expanded access to modern retail formats, while the growing middle-class population demonstrates increased willingness to invest in quality infant clothing. In 2025, the Mexican government, in partnership with BBVA and Nacional Financiera under the broader Plan México, announced a MXN 120 billion initiative to modernize the country’s textile and footwear sectors, aimed at boosting productivity, digitalization, and competitiveness of domestic producers, including MSMEs that supply apparel segments. Influencer marketing and social media platforms have become instrumental in shaping purchasing decisions, particularly among millennial parents who seek fashionable yet functional garments for their children. The market also reflects strong cultural values emphasizing family celebrations, religious ceremonies, and special occasions that drive demand for premium baby apparel categories.

Mexico Baby Apparel Market Trends:

Growing Preference for Sustainable and Organic Baby Clothing

Mexican parents are increasingly seeking eco-friendly baby apparel made from organic cotton and sustainable materials. This shift reflects heightened awareness regarding environmental responsibility and concerns about chemical-free fabrics for sensitive infant skin. In 2025, Carter’s sustainability-focused Little Planet brand, built around GOTS-certified organic cotton and recycled materials, made its first standalone retail debut in Mexico with a flagship store opening in Guadalajara’s Andares shopping centre, underscoring rising local demand for sustainable children’s clothing. Retailers are responding by expanding organic product lines and emphasizing ethical manufacturing practices to capture this growing consumer segment.

Rising Influence of Social Media and Digital Marketing

Social media platforms have transformed how Mexican parents discover and purchase baby apparel, with influencer recommendations significantly impacting brand preferences. According to reports, 4 out of 10 consumers in Mexico now buy fashion items directly through TikTok and Instagram, with Gen Z especially driving this social-commerce shift, and many users discovering new brands on social platforms. Digital marketing strategies targeting young parents through Instagram, Facebook, and TikTok are driving brand awareness and engagement. This trend has accelerated the adoption of omnichannel retail strategies combining online presence with physical store experiences.

Integration of Traditional Mexican Designs with Contemporary Fashion

The market is witnessing a distinctive trend combining traditional Mexican cultural elements with modern baby fashion aesthetics. In 2025, Mexican President Claudia Sheinbaum’s frequent public wearing of hand‑embroidered garments by Indigenous artisans boosted visibility and demand for traditional textile techniques, helping elevate Indigenous patterns as a celebrated and commercial fashion influence. Vibrant colors, indigenous patterns, and artisanal craftsmanship are being incorporated into contemporary designs, appealing to parents seeking unique garments that celebrate cultural heritage while maintaining functionality and comfort for everyday use.

Market Outlook 2026-2034:

The Mexico baby apparel market is positioned for sustained expansion throughout the forecast period, supported by favorable demographic trends and evolving consumer behavior patterns. Growing urbanization, rising household incomes, and expanding retail infrastructure will continue driving market development across both established and emerging regions. The integration of e-commerce platforms with traditional retail channels is expected to enhance market accessibility while premium product segments gain traction among affluent urban consumers. The market generated a revenue of USD 2.9 Billion in 2025 and is projected to reach a revenue of USD 4.4 Billion by 2034, growing at a compound annual growth rate of 4.90% from 2026-2034.

Mexico Baby Apparel Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Outerwear | 68.24% |

| Material | Cotton | 58.72% |

| Distribution Channel | Offline | 72.85% |

| Age Group | 0-12 Months | 40% |

| End User | Girls | 51% |

Product Insights:

- Outerwear

- Underwear

- Others

The outerwear dominates with a market share of 68.24% of the total Mexico baby apparel market in 2025.

Outerwear constitutes the leading product category in the Mexico baby apparel market, commanding the highest market share. This segment's dominance stems from the practical necessity of versatile clothing items that accommodate Mexico's varied climate conditions, ranging from temperate highlands to tropical coastal regions. In 2025, Carter’s, a major global baby apparel brand, unveiled its new Spring‑Summer 2025 collection featuring style‑driven yet practical pieces designed for babies and young children, including elevated fabrics and seasonal layers that blend fashion with comfort.

Parents consistently prioritize durable, comfortable outerwear pieces including rompers, onesies, dresses, and casual tops that facilitate ease of dressing and movement for active infants and toddlers. The outerwear category continues expanding through product diversification and design innovation targeting specific occasions and seasonal requirements. Manufacturers are introducing functional features such as snap closures, stretchable fabrics, and moisture-wicking properties while maintaining aesthetic appeal through contemporary patterns and culturally inspired designs that resonate with Mexican family traditions and fashion sensibilities.

Material Insights:

- Cotton

- Wool

- Silk

The cotton leads with a share of 58.72% of the total Mexico baby apparel market in 2025.

Cotton maintains its position as the predominant material choice in Mexico's baby apparel market. This preference reflects cotton's natural softness, excellent breathability, and hypoallergenic characteristics that ensure comfort and safety for delicate infant skin. Mexican parents, particularly those in warmer regions, consistently favor cotton garments that provide temperature regulation and minimize skin irritation risks associated with synthetic alternatives. In June 2025, Carter’s, Inc. released its 2024 Raise the Future Impact Report, highlighting that 99 % of its apparel now meets OEKO‑TEX® STANDARD 100 safety standards and underscoring the company’s broader commitment to sustainable, eco‑friendly materials including organic cotton through its Little Planet brand.

The material segment is shifting as demand rises for organic cotton, reflecting modern parents’ growing environmental awareness. Premium blends combining cotton with bamboo and other natural fibers are increasingly popular, providing superior softness, moisture-wicking benefits, and durability. These innovations not only enhance comfort and functionality in baby apparel but also promote sustainability, aligning with eco-conscious consumer values and driving growth in environmentally responsible clothing options for infants and toddlers.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

The offline dominates with a market share of 72.85% of the total Mexico baby apparel market in 2025.

Offline retail channels continue to dominate Mexico’s baby apparel market, driven by consumers’ preference for hands-on shopping experiences. Parents largely favor department stores, specialty baby boutiques, supermarkets, and hypermarkets, where they can closely evaluate fabric quality, inspect garment construction, and verify sizing. This tactile approach allows buyers to make informed decisions, ensuring comfort, durability, and fit for infants, reinforcing the enduring importance of physical retail despite the growth of e-commerce in the region.

Traditional retail formats thrive in Mexico due to established consumer trust and the cultural value of in-person shopping. Leading chains provide extensive baby apparel selections supported by informed staff, while regional markets and specialty stores address varying price points. This combination ensures accessibility across socioeconomic segments, reinforces customer confidence, and preserves the appeal of tactile shopping experiences, making physical retail a central channel for baby clothing despite growing online alternatives.

Age Group Insights:

- 0-12 Months

- 12-24 Months

- 2-3 Years

The 0-12 months lead with a share of 40% of the total Mexico baby apparel market in 2025.

The infant age group spanning zero to twelve months represents the largest market segment, capturing the maximum market share. This dominance reflects the accelerated clothing replacement cycle necessitated by rapid infant growth rates, with babies typically requiring multiple wardrobe updates throughout their first year. Mexican families demonstrate heightened willingness to invest in quality apparel for newborns, often purchasing clothing as gifts for baby showers and celebrations. In Mexican Catholic culture, traditional infant baptism ceremonies (“bautizos”) are highly significant family events, and special outfits such as white baptism gowns or tailored infant suits remain central to these celebrations, making premium infant apparel a sought‑after purchase for such rites of passage.

Product development in this segment focuses on ease of use, featuring accessible closures, comfortable fits that accommodate diapers, and soft, gentle fabrics suitable for newborn skin. Additionally, cultural traditions such as baptisms and other religious ceremonies in Mexico boost demand for premium infant apparel, encouraging brands to create special occasion clothing that combines functionality, comfort, and aesthetic appeal for infants within this age group.

End User Insights:

- Girls

- Boys

The girls dominate with a market share of 51% of the total Mexico baby apparel market in 2025.

Girls’ baby apparel leads the market, driven by greater variety and design options compared to boys’ clothing. Mexican cultural preferences favor elaborate styles such as dresses, frills, and accessories, creating more occasions for purchase beyond essentials. The segment also benefits from extensive color and pattern choices, appealing to diverse aesthetic tastes and reinforcing strong consumer demand in infant girls’ clothing categories.

The girls’ baby apparel segment shows robust performance across all price tiers. High-end offerings featuring intricate embroidery, imported fabrics, and designer collaborations attract affluent urban shoppers, while value-oriented products provide fashionable yet affordable options for budget-conscious families. This dual approach ensures wide market coverage, catering to diverse consumer preferences, and sustaining strong demand across both premium and mass-market segments within Mexico’s infant girls’ clothing category.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico represents a significant baby apparel market characterized by higher disposable incomes and proximity to United States retail influences. Urban centers including Monterrey, Tijuana, and Hermosillo demonstrate strong demand for premium brands and quality-focused products. Cross-border shopping patterns and industrial economic development support elevated consumer spending on infant clothing categories.

Central Mexico dominates the national baby apparel landscape owing to concentrated population density and diverse retail infrastructure. Metropolitan areas including Mexico City and Guadalajara offer comprehensive shopping options spanning luxury department stores to traditional markets. This region benefits from well-developed distribution networks and serves as the primary hub for fashion retail innovation.

Southern Mexico presents growing opportunities driven by increasing urbanization and tourism-related economic development in destinations like Cancun and the Yucatan Peninsula. Traditional markets maintain significant presence alongside emerging modern retail formats. Cultural emphasis on artisanal craftsmanship influences regional preferences for distinctive baby apparel designs incorporating indigenous heritage elements.

Other regions encompassing Pacific coastal areas and emerging economic zones contribute to market diversification through expanding retail accessibility. These markets demonstrate growth potential as infrastructure development enhances distribution capabilities and rising household incomes enable increased discretionary spending on quality baby apparel products across previously underserved communities.

Market Dynamics:

Growth Drivers:

Why is the Mexico Baby Apparel Market Growing?

Rising Disposable Incomes and Expanding Middle-Class Population

Mexico's economic development has fostered substantial growth in household purchasing power, particularly among the expanding middle-class demographic. This upward mobility translates directly into increased willingness to invest in quality baby apparel products that offer superior comfort, durability, and aesthetic appeal. Parents are increasingly prioritizing premium clothing options for their children, viewing infant wardrobe investments as reflections of family values and social status. As part of its 2025 social investment agenda, the Mexican government committed nearly 835 billion to wellbeing programs benefiting more than 33 million families, including direct financial support that bolsters household incomes and spending capacity. The trend extends across urban and semi-urban areas where economic opportunities have elevated living standards and consumer expectations regarding product quality.

Accelerating Urbanization and Modern Retail Expansion

Rapid urbanization across Mexican metropolitan areas has significantly enhanced access to diverse retail formats offering comprehensive baby apparel selections. The proliferation of shopping centers, department stores, and specialty baby boutiques provides convenient purchasing environments where parents can explore extensive product ranges. According to real estate consultancy CBRE, Mexico is scheduled to open about 15 new shopping malls by the end of 2025, adding substantial modern retail space that will broaden consumer access to domestic and international brands. Modern retail expansion has introduced international brand availability while supporting domestic manufacturers through improved distribution channels. This retail infrastructure development continues attracting investment and innovation that elevates overall market sophistication and consumer choice accessibility.

Growing Digital Commerce Adoption and Omnichannel Strategies

E-commerce platforms have revolutionized baby apparel purchasing by offering unparalleled convenience and product variety to time-constrained parents. Mexico’s e‑commerce market size reached USD 54.4 billion in 2025, reflecting significant digital adoption and expanding online retail opportunities across categories including baby apparel. The integration of online channels with traditional retail through omnichannel strategies enables seamless shopping experiences accommodating diverse consumer preferences. Social media marketing and influencer collaborations effectively reach millennial parents who increasingly research products digitally before purchasing. Mobile commerce applications and improved payment infrastructure continue lowering barriers to online shopping adoption, expanding market reach beyond traditional retail geographic limitations.

Market Restraints:

What Challenges the Mexico Baby Apparel Market is Facing?

Declining Birth Rates Impacting Target Market Size

Mexico's persistently declining birth rate presents structural challenges for the baby apparel market by reducing the potential customer base. Demographic shifts reflecting delayed family formation and smaller household sizes constrain volume growth potential, requiring market participants to focus on value enhancement and premiumization strategies rather than volume expansion.

Intense Competition from Low-Cost International Imports

The influx of inexpensive baby apparel from Asian manufacturing centers creates significant pricing pressure on domestic producers and established retailers. Fast-fashion platforms offering ultra-competitive prices attract price-sensitive consumers, challenging traditional market participants to differentiate through quality, brand positioning, and customer service excellence.

Economic Uncertainty Affecting Consumer Spending Patterns

Macroeconomic shifts and inflation impact household spending, potentially reducing purchases of non-essential baby apparel. Fluctuations in consumer confidence affect buying frequency and average transaction value, encouraging retailers to use flexible pricing, discounts, and promotional strategies to sustain sales and appeal to budget-conscious parents in an uncertain economic climate.

Competitive Landscape:

The Mexico baby apparel market features a highly fragmented competitive landscape, including multinational retailers, domestic department store chains, specialty baby boutiques, and rapidly growing e-commerce platforms. Market players compete across multiple dimensions such as product quality, innovative designs, pricing strategies, and distribution network reach. Established retailers benefit from strong brand recognition and expansive physical store networks, while digital-native competitors leverage convenience, personalized marketing, and online engagement. This dynamic and competitive environment encourages continuous product development, service improvements, and differentiation strategies as companies strive to meet the evolving preferences of increasingly discerning Mexican consumers.

Recent Developments:

- In January 2025, Baby Creysi, the long-standing Mexican children’s fashion brand, unveiled its “Fashion & Gourmet” 360° concept store in Roma Norte, CDMX, blending baby and kids’ apparel with food and family entertainment, including ludoteca play areas, bakery and gourmet options to enhance the in-store experience for parents and children.

Mexico Baby Apparel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Outerwear, Underwear, Others |

| Materials Covered | Cotton, Wool, Silk |

| Distribution Channels Covered | Online, Offline |

| Age Groups Covered | 0-12 Months, 12-24 Months, 2-3 Years |

| End Users Covered | Girls, Boys |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico baby apparel market size was valued at USD 2.9 Billion in 2025.

The Mexico baby apparel market is expected to grow at a compound annual growth rate of 4.90% from 2026-2034 to reach USD 4.4 Billion by 2034.

Outerwear held the largest market share with 68.24%, driven by parental preferences for versatile, comfortable garments suitable for diverse climate conditions and everyday infant wear requirements.

Key factors driving the Mexico baby apparel market include rising disposable incomes, expanding middle-class population, accelerating urbanization, growing e-commerce adoption, and increasing parental focus on quality and comfort for infant clothing.

Major challenges include declining birth rates reducing target market size, intense competition from low-cost international imports, economic uncertainty affecting consumer spending patterns, and price sensitivity among budget-conscious consumers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)