Mexico Baby Care Products Market Size, Share, Trends and Forecast by Product Type, Category, Distribution Channel, and Region, 2025-2033

Mexico Baby Care Products Market Overview:

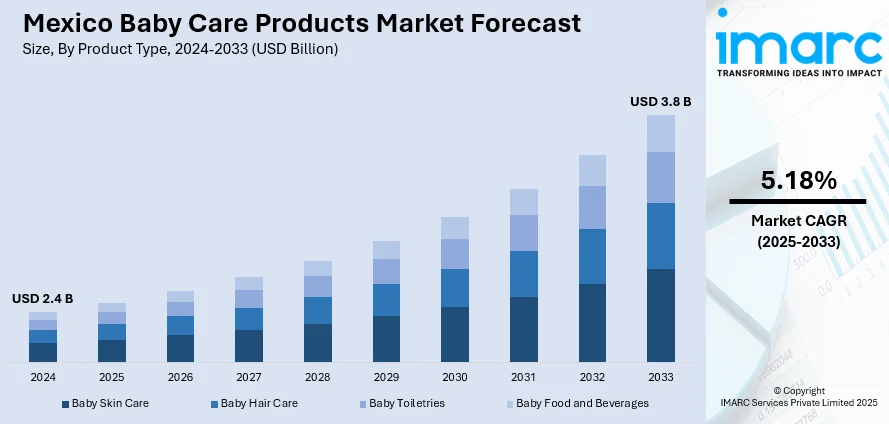

The Mexico baby care products market size reached USD 2.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.8 Billion by 2033, exhibiting a growth rate (CAGR) of 5.18% during 2025-2033. The market is fueled by growing consumer need for high-quality, safe, and easy-to-use products, as well as the growth of online channels of distribution, providing parents with greater access to a broad array of baby care solutions to address changing requirements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.4 Billion |

| Market Forecast in 2033 | USD 3.8 Billion |

| Market Growth Rate 2025-2033 | 5.18% |

Mexico Baby Care Products Market Trends:

Growing Need for High-end Baby Care Products

There is a growing need for high-end baby care products in Mexico due to increased concern among parents about the quality and safety of the products applied on their children. People are also becoming more critical about the contents of baby products, opting for organic, hypoallergenic, and dermatologically tested ones. This trend is especially evident within the baby hair care and baby skin care segments, where there is a trend toward using products that provide more protection and more nourishment to sensitive skin. As parents become intensely health-conscious, the market share of high-end products rises. This demand for premium baby care is anticipated to continue to propel industry growth, with manufacturers placing emphasis on creating new, high-end products that fulfill this requirement. For instance, in November 2023, Soft N Dry™ and ecoSuave Pañales de México joined forces to combine MicroFlex technology with eco-friendly baby diapers. The partnership represents a major milestone in diaper innovation, increasing performance and cost-effectiveness. Furthermore, the future Mexico baby care products market share is bright for premium products, as consumers highly spend on effective, safe, and high-quality products for infants.

Expansion of Baby Food and Drinks

Mexico's baby food and drink industry has experienced huge growth in the past few years as parents pay greater attention to their babies' nutritional requirements. This comes from amplified demand for organic and fortified infant food, together with plant-based items appealing to the health-oriented parent. With more parents wanting convenience, demand is rising for ready-to-feed baby formulas, organic infant foods, and infant-sized snacks that respond to infants' dietary needs. Having products like baby foods and beverages (F&B) that carry more robust nutritional profiles, like ones with added vitamins, minerals, and probiotics, adds fuel to the movement. The Mexico baby care products market growth is primarily driven by the expansion of the baby F&B category, with the industry set to continue performing well as parents seek healthier and more convenient ways of feeding their babies.

Growth of Online Sales Channels

The growth of online sales channels has emerged as a key trend in the Mexican baby care products market. For instance, in January 2024, WHP Global and El Puerto de Liverpool broadened their alliance on to bring Babies\"R\" Us into Mexico, opening a flagship e-commerce site with several stores planned. Moreover, with more parents embracing e-commerce, they have greater access to a variety of baby care items, ranging from food and drinks to toiletries and skin products. The advantage of shopping at home provides them with the comfort of comparing prices, reading customer reviews, and enjoying promotions that are not readily available in shops. This change towards online shopping is especially seen among time-starved and technologically advanced parents who value the convenience of doorstep delivery. Moreover, the rise in online shopping has encouraged numerous baby care brands to increase their digital presence and enhance their e-commerce websites. The Mexico baby care products market outlook suggests that online channels will continue to gain prominence, boosting convenience and accessibility for consumers and adding to the overall market growth.

Mexico Baby Care Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, category, and distribution channel.

Product Type Insights:

- Baby Skin Care

- Baby Hair Care

- Baby Toiletries

- Baby Bath Products and Fragrances

- Baby Diapers and Wipes

- Baby Food and Beverages

The report has provided a detailed breakup and analysis of the market based on the product type. This includes baby skin care, baby hair care, baby toiletries (baby bath products and fragrances, baby diapers and wipes), baby food and beverages

Category Insights:

- Premium

- Mass

A detailed breakup and analysis of the market based on the category have also been provided in the report. This includes premium, and mass.

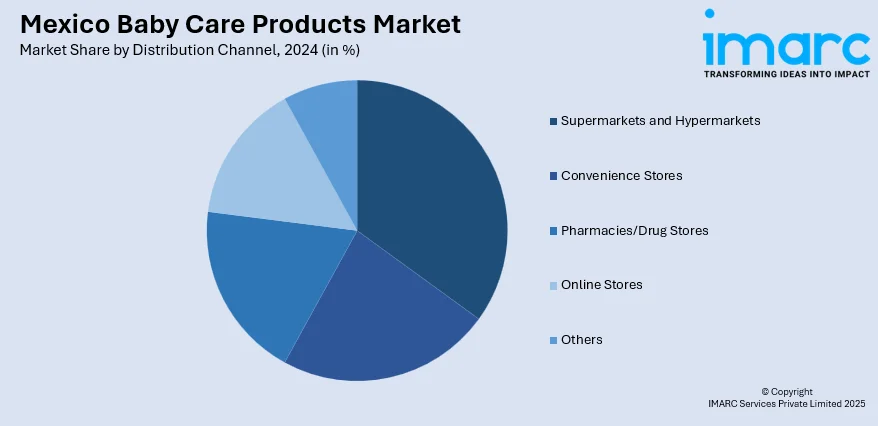

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmacies/Drug Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, pharmacies/drug stores, online stores, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Baby Care Products Market News:

- In In May 2024, TERRA, the luxury eco-friendly baby care brand, entered Taiwan, Canada, UAE, and Mexico. Riding high on its success in New Zealand and the USA, TERRA seeks to be at the forefront of the sustainable baby care market with its biodegradable wipes and plant-based diapers, providing environmentally friendly solutions to a worldwide market.

Mexico Baby Care Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Categories Covered | Premium, Mass |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Pharmacies/Drug Stores, Online Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico baby care products market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico baby care products market on the basis of product type?

- What is the breakup of the Mexico baby care products market on the basis of category?

- What is the breakup of the Mexico baby care products market on the basis of distribution channel?

- What is the breakup of the Mexico baby care products market on the basis of region?

- What are the various stages in the value chain of the Mexico baby care products market?

- What are the key driving factors and challenges in the Mexico baby care products?

- What is the structure of the Mexico baby care products market and who are the key players?

- What is the degree of competition in the Mexico baby care products market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico baby care products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico baby care products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico baby care products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)