Mexico Bags Market Size, Share, Trends and Forecast by Product Type, Material Type, Distribution Channel, End User, and Region, 2026-2034

Mexico Bags Market Summary:

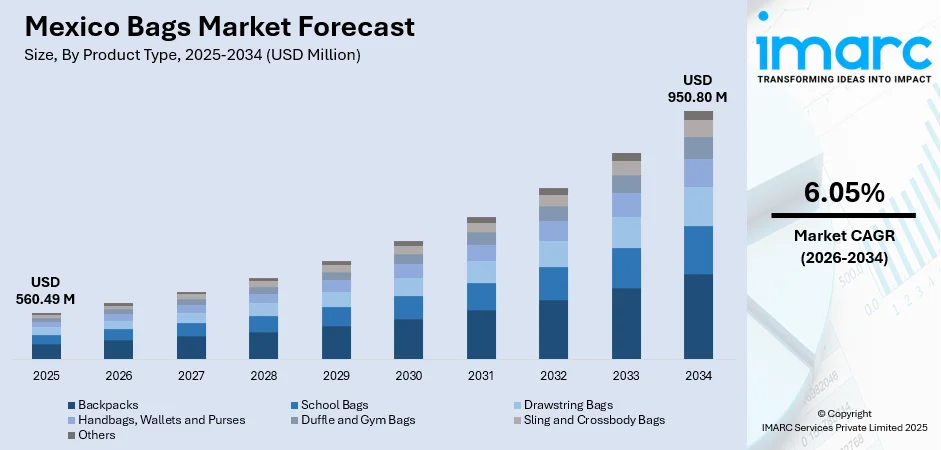

The Mexico bags market size was valued at USD 560.49 Million in 2025 and is projected to reach USD 950.80 Million by 2034, growing at a compound annual growth rate of 6.05% from 2026-2034.

The Mexico bags market is witnessing robust expansion, driven by evolving consumer preferences for fashionable yet functional accessories. Growing urbanization and rising disposable incomes among the expanding middle-class population are catalyzing the demand for diverse bag categories. Customers are placing greater importance on items that merge visual attractiveness with functional usefulness, seeking versatile designs suitable for professional, travel, and daily use contexts. The integration of digital retail channels is further democratizing access to premium and value-oriented bag products across urban and semi-urban regions.

Key Takeaways and Insights:

- By Product Type: Backpacks dominate the market with a share of 22% in 2025, owing to their versatility across educational, professional, and recreational applications. Rising demand among students, working professionals, and outdoor enthusiasts seeking ergonomic designs with multiple compartments is propelling market expansion.

- By Material Type: Polyesters lead the market with a share of 44% in 2025. This dominance is driven by the material's exceptional durability, lightweight characteristics, water resistance, and cost-effectiveness compared to natural alternatives, making it ideal for mass-market bag manufacturing.

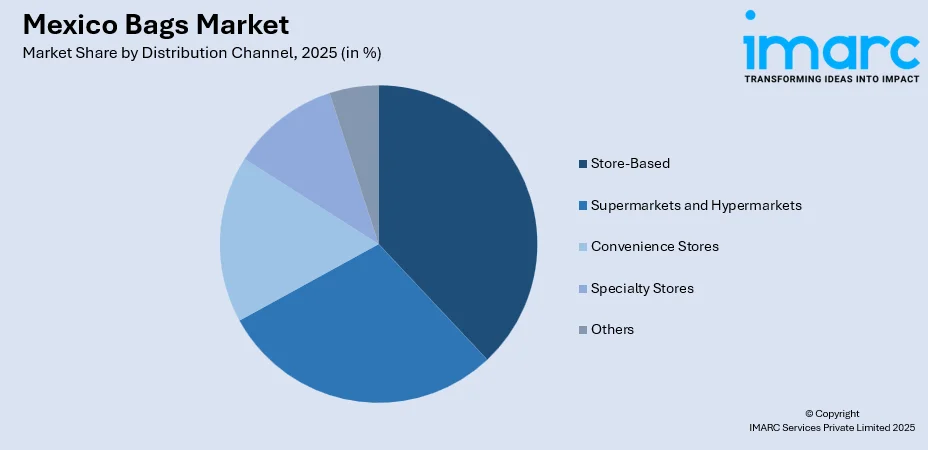

- By Distribution Channel: Store-based represents the largest segment with a market share of 38% in 2025, reflecting Mexican consumers' preference for tactile product evaluation before purchase. Physical retail environments enable personalized shopping experiences and immediate product availability.

- By End User: 20 years and above exhibit a clear dominance in the market with 60% share in 2025, indicating robust purchasing power among employed adults in search of professional bags, travel items, and lifestyle products that enhance their daily routines and fashion choices.

- By Region: Central Mexico comprises the largest region with 42% share in 2025, driven by the concentration of Mexico's largest consumer base in Mexico City and surrounding metropolitan areas, featuring extensive retail infrastructure and higher disposable incomes.

- Key Players: Key players drive the Mexico bags market by continuously expanding product portfolios, integrating sustainable materials, and strengthening omnichannel distribution networks. Their investments in innovative designs, localized marketing strategies, and strategic retail partnerships enhance brand visibility and consumer accessibility across diverse market segments.

To get more information on this market Request Sample

The Mexico bags market is experiencing dynamic growth, propelled by multifaceted demand drivers across consumer segments. The expanding middle-class population, characterized by rising disposable incomes and evolving lifestyle aspirations, is increasingly investing in quality bag products that balance functionality with fashion-forward designs. Urbanization trends are intensifying the demand for versatile bags suitable for professional environments, educational institutions, and recreational activities. Consumer preferences are shifting towards products that offer durability, organizational features, and aesthetic versatility. The Mexican Online Sales Association (AMVO) reported that online retail sales hit MXD 789.7 Billion in 2024, reflecting over 20% growth compared to 2023. Increasing influence of social media platforms is shaping purchasing decisions, with consumers seeking bags that reflect personal style and align with contemporary fashion trends. Additionally, the premiumization trend is gaining momentum, as affluent consumers demonstrate willingness to invest in high-quality, branded bag products.

Mexico Bags Market Trends:

Rising Adoption of Sustainable and Eco-Friendly Materials

The Mexico bags market is witnessing a significant shift towards sustainable and eco-friendly materials as environmentally conscious consumers increasingly prioritize products aligned with their values. Manufacturers are responding by incorporating recycled plastics, organic cotton, jute, and innovative plant-based leather alternatives into their product lines. This sustainability movement resonates particularly with younger demographics who view purchasing decisions as expressions of environmental responsibility. Mexican brands are pioneering creative approaches to sustainable production, exemplified by designer Camilo Morales, who launched his Rere brand in June 2024, upcycling vinyl election signs into stylish tote bags priced between 100 to 600 pesos, transforming political waste into fashionable commodities in Mexico.

Growing Demand for Multifunctional Fashion-Forward Designs

Contemporary Mexican consumers are increasingly seeking bags that seamlessly blend aesthetic appeal with practical functionality. This trend manifests in demand for versatile products, featuring adjustable straps, multiple compartments, lightweight construction, and designs suitable for diverse occasions ranging from professional settings to travel and leisure activities. Social media influence and the broadening middle-class consumer base are driving this premiumization trend, with consumers viewing bags as essential fashion accessories for self-expression. Brands are responding with collections that incorporate bright colors, personalization features, and designs that transition effortlessly between work, travel, and daily activities.

Integration of Digital Commerce and Omnichannel Retailing

The convergence of e-commerce and traditional retail channels is transforming how Mexican consumers discover and purchase bags. As per IMARC Group, the Mexico retail market size reached USD 475.2 Billion in 2025. Digital platforms offering extensive product variety, competitive pricing, and convenient doorstep delivery are attracting consumers across urban and rural regions. Major retailers are investing in omnichannel capabilities, integrating mobile applications with physical store experiences to provide seamless shopping journeys. The rapid expansion of social commerce through various platforms is creating new engagement channels, with younger demographics particularly receptive to influencer-driven product recommendations and live shopping experiences.

Market Outlook 2026-2034:

The Mexico bags market outlook remains positive, supported by favorable demographic trends, expanding retail infrastructure, and evolving consumer preferences. Continued urbanization, rising employment rates, and the growing household incomes are expected to sustain demand growth across product categories. The market generated a revenue of USD 560.49 Million in 2025 and is projected to reach a revenue of USD 950.80 Million by 2034, growing at a compound annual growth rate of 6.05% from 2026-2034. Innovations in sustainable materials, smart bag features, and customization options will differentiate market offerings. The expansion of organized retail and e-commerce penetration will enhance product accessibility, while strategic brand collaborations and localized marketing initiatives will strengthen consumer engagement across diverse segments.

Mexico Bags Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Backpacks | 22% |

| Material Type | Polyesters | 44% |

| Distribution Channel | Store-Based | 38% |

| End User | 20 Years and Above | 60% |

| Region | Central Mexico | 42% |

Product Type Insights:

- Backpacks

- School Bags

- Drawstring Bags

- Handbags, Wallets and Purses

- Duffle and Gym Bags

- Sling and Crossbody Bags

- Others

Backpacks dominate with a market share of 22% of the total Mexico bags market in 2025.

Backpacks represent the cornerstone of the Mexico bags market, driven by their unparalleled versatility across educational, professional, and recreational applications. The product category benefits from sustained demand among students at all academic levels, working professionals requiring organized storage for laptops and documents, and outdoor enthusiasts seeking durable companions for adventure activities.

The backpack segment continues to evolve through innovations in ergonomic design, material technology, and feature integration. Manufacturers are incorporating padded laptop compartments, anti-theft security features, universal serial bus (USB) charging ports, and water-resistant materials to address contemporary consumer requirements. The growing popularity of work-from-anywhere arrangements and increased domestic travel is expanding use cases beyond traditional educational contexts, with consumers seeking versatile backpacks that transition seamlessly between professional meetings, commuting, and leisure activities.

Material Type Insights:

- Polyesters

- Nylon

- Leather

- Cotton Canvas

- Others

Polyesters lead with a share of 44% of the total Mexico bags market in 2025.

Polyester fabric has established itself as the dominant material type in Mexico bags manufacturing. This synthetic material's popularity stems from its exceptional combination of durability, lightweight characteristics, water resistance, and cost-effectiveness. Polyester's resistance to abrasion, stretching, and shrinking makes it particularly suitable for bags subjected to daily wear and varied environmental conditions. The material's ability to retain vibrant colors through extensive use and washing further enhances its appeal for fashion-conscious consumers seeking long-lasting aesthetic appeal.

The polyester segment benefits from continuous material innovations, including the development of recycled polyester options that address growing environmental concerns without compromising performance characteristics. Manufacturers increasingly utilize recycled polyethylene terephthalate (PET) bottles and post-consumer materials to produce sustainable polyester fabrics, appealing to eco-conscious consumers. The material's versatility enables its application across all bag categories, ranging from budget-friendly school bags to premium travel accessories, supporting broad market penetration and consistent demand growth across consumer segments.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Store-Based

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Others

Store-based exhibits a clear dominance with a 38% share of the total Mexico bags market in 2025.

Store-based distribution channels maintain market leadership, reflecting Mexican consumers' preference for tactile product evaluation and personalized shopping experiences. Physical retail environments enable customers to assess bag quality, test functionality, and compare options before making purchasing decisions. Department stores, specialty retailers, and shopping center outlets provide extensive product assortments, knowledgeable sales assistance, and immediate product availability that appeal to consumers across demographic segments.

The store-based segment is evolving through integration of omnichannel capabilities, with retailers investing in click-and-collect services, in-store digital kiosks, and mobile application connectivity. According to ANTAD data, 2,300 new stores were launched in Mexico during 2024, with specialty retail locations experiencing significant expansion. This physical retail growth, combined with improved customer experience initiatives, ensures store-based channels maintain relevance despite rising e-commerce penetration, particularly for higher-value purchases where consumers seek assurance through direct product interaction.

End User Insights:

- 5 to 12 Years

- 13 to 19 Years

- 20 Years and Above

20 years and above represent the leading segment with a 60% share of the total Mexico bags market in 2025.

Individuals aged 20 years and above command the dominant market position, reflecting their substantial purchasing power and diverse bag requirements. This demographic encompasses working professionals requiring briefcases, laptop bags, and professional accessories, alongside lifestyle consumers seeking handbags, travel luggage, and recreational bags. Rising employment rates and growing household incomes enable increased discretionary spending on quality bag products that complement personal style and support daily activities.

Adult consumers demonstrate sophisticated purchasing behaviors, prioritizing durability, brand reputation, and design aesthetics when selecting bag products. The premiumization trend is particularly pronounced within this segment, with consumers demonstrating willingness to invest in higher-quality products that offer extended longevity and superior functionality. Professional requirements drive demand for organized laptop bags and business accessories, while growing travel activities are fueling the demand for luggage and travel bags across various price points.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Central Mexico dominates the market with a 42% share of the total Mexico bags market in 2025.

Central Mexico commands market leadership, driven by the concentration of Mexico's largest consumer base within the Mexico City metropolitan area and surrounding states, including Puebla, Querétaro, and Estado de México. This region features the nation's highest population density, most developed retail infrastructure, and strongest purchasing power concentration. Retail trade registered 2,533,033 economic units in Mexico, according to DENUE 2025. The states with the most economic units were Ciudad de México (210,168) and Estado de México (396,591). The region's extensive shopping center inventory and high internet penetration rates support both physical and digital retail growth.

Central Mexico benefits from diverse consumer demographics, spanning young professionals, families, and affluent consumers seeking premium products. The region's position as Mexico's business and cultural center drives demand for professional bags and fashion accessories. E-commerce fulfillment infrastructure development, including new distribution centers and last-mile delivery networks, further strengthens Central Mexico's market dominance.

Market Dynamics:

Growth Drivers:

Why is the Mexico Bags Market Growing?

Rising Consumer Preference for Sustainable and Eco-Friendly Materials

The Mexico bags market is experiencing significant momentum from growing consumer awareness regarding environmental sustainability and ethical consumption practices. Modern Mexican consumers, particularly younger demographics, increasingly prioritize products manufactured from eco-friendly materials, including recycled plastics, organic cotton, jute, and innovative plant-based leather alternatives. This sustainability consciousness extends beyond material composition to encompass manufacturing processes, with consumers favoring brands demonstrating commitment to reduced environmental impact. The trend resonates strongly with environmentally oriented customers who view purchasing decisions as expressions of personal values and environmental responsibility. Mexican brands are pioneering creative, sustainable solutions, exemplified by innovators transforming waste materials into fashionable accessories. The sustainability movement is driving product innovations, as manufacturers integrate green materials and eco-friendly production practices to satisfy evolving consumer expectations while differentiating their offerings in the competitive marketplace.

Expanding Middle-Class Consumer Base and Rising Disposable Incomes

Mexico's expanding middle-class population represents a fundamental driver of the market growth, characterized by increasing disposable incomes and evolving lifestyle aspirations. Economic development and employment growth are elevating household purchasing power, enabling greater discretionary spending on quality bag products. This demographic shift manifests in demand for bags that balance fashion importance with practical benefits, as consumers seek versatile products suitable for professional, travel, and daily use contexts. The middle-class expansion is particularly pronounced in urban centers where exposure to international fashion trends and brand awareness heightens product expectations. Social media influence amplifies this trend, with platforms showcasing aspirational lifestyles and fashion-forward accessories that resonate with upwardly mobile consumers. In January 2024, Mexico had 90.20 Million social media users, representing 70.0% of the entire population. The premiumization phenomenon is gaining momentum, as consumers demonstrate willingness to invest in higher-quality, branded products that reflect personal success and style preferences.

Digital Retailing and E-Commerce Channel Expansion

Digital commerce has emerged as a transformative growth driver for the Mexico bags industry, fundamentally reshaping consumer purchasing behaviors and market accessibility. Greater internet penetration, smartphone adoption, and enhanced online payment infrastructure have made digital commerce increasingly prevalent and convenient for Mexican consumers. As per IMARC Group, the Mexico smartphones market size is set to reach 29.95 Million Units by 2033, exhibiting a growth rate (CAGR) of 3.10% during 2025-2033. E-commerce platforms offer vast product variety, competitive pricing, customer reviews, and doorstep delivery that appeal to consumers across urban and rural regions. Online platforms provide valuable consumer data enabling manufacturers and retailers to implement targeted marketing and effective inventory management. Social commerce through online platforms is creating additional engagement channels, with influencer-driven product recommendations shaping purchasing decisions among younger consumers.

Market Restraints:

What Challenges the Mexico Bags Market is Facing?

Intense Competition from Imported and Low-Cost Products

The Mexico bags market faces significant competitive pressure from imported products, particularly from Asian manufacturing centers offering aggressive pricing that challenges domestic producers. Chinese e-commerce platforms have rapidly gained market share by providing extensive product variety at highly competitive prices, intensifying margin pressure across market segments. This influx creates challenges for established brands seeking to maintain premium positioning while competing on value.

Raw Material Price Fluctuations and Supply Chain Volatility

The bags manufacturing industry remains vulnerable to fluctuations in raw material costs, particularly for synthetic materials, including polyester and nylon that depend on petroleum-based inputs. Global supply chain disruptions and commodity price volatility create uncertainty in production costs, with manufacturers facing challenges in maintaining stable pricing while preserving profit margins. These cost pressures may constrain market accessibility for price-sensitive consumers.

Counterfeit Product Proliferation in Digital Marketplaces

The proliferation of counterfeit products, particularly through online marketplaces, poses significant challenges to legitimate brands and undermines consumer confidence. Counterfeit bags imitating premium brands have flooded digital platforms, negatively impacting brand integrity and creating quality concerns among consumers. The ease of e-commerce access makes detecting counterfeit products difficult, requiring enhanced authentication measures and consumer education efforts.

Competitive Landscape:

The Mexico bags market exhibits a fragmented competitive landscape, characterized by the existence of international multinational corporations, regional players, and local artisanal manufacturers. International brands leverage extensive distribution networks, brand recognition, and marketing resources to capture premium market segments. Domestic players compete through localized product development, cultural authenticity, and competitive pricing strategies. The competitive environment is intensifying, as e-commerce platforms lower market entry barriers while established players invest in omnichannel capabilities, sustainable product development, and digital marketing initiatives. Differentiation strategies focus on material innovations, design aesthetics, functional features, and brand storytelling. Strategic partnerships between international brands and local retailers are broadening the market reach, while mergers and acquisitions activity reshapes competitive dynamics across product categories.

Mexico Bags Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Backpacks, School Bags, Drawstring Bags, Handbags, Wallets & Purses, Duffle & Gym Bags, Sling & Crossbody Bags, Others |

| Material Types Covered | Polyesters, Nylon, Leather, Cotton Canvas, Others |

| Distribution Channels Covered | Store-Based, Supermarkets & Hypermarket, Convenience Stores, Specialty Stores, Others |

| End Users Covered | 5 To 12 Years, 13 To 19 Years, 20 Years & Above |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico bags market size was valued at USD 560.49 Million in 2025.

The Mexico bags market is expected to grow at a compound annual growth rate of 6.05% from 2026-2034 to reach USD 950.80 Million by 2034.

Backpacks dominated the market with a share of 22%, driven by their versatility across educational, professional, and recreational applications among diverse consumer segments.

Key factors driving the Mexico bags market include rising consumer preferences for sustainable materials, expanding middle-class population with increasing disposable incomes, growing e-commerce penetration, and demand for multifunctional fashion-forward designs.

Major challenges include intense competition from imported low-cost products, raw material price fluctuations affecting production costs, counterfeit product proliferation in digital marketplaces, and pressure to meet evolving sustainability expectations while maintaining competitive pricing.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)