Mexico Bakery Products Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Mexico Bakery Products Market Overview:

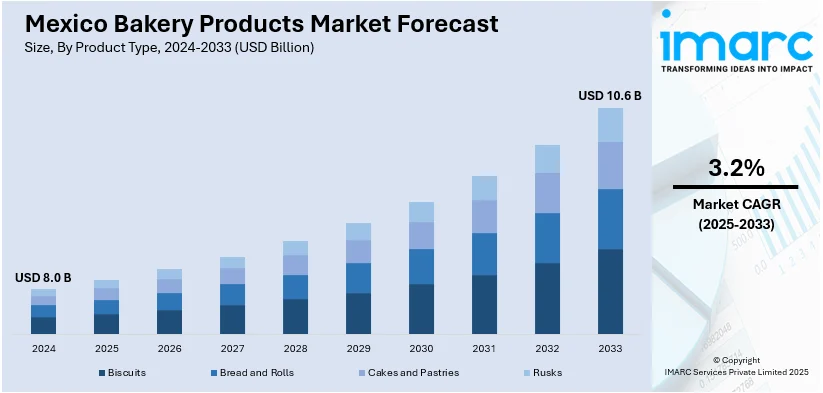

The Mexico bakery products market size reached USD 8.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 10.6 Billion by 2033, exhibiting a growth rate (CAGR) of 3.2% during 2025-2033. The market is witnessing significant growth, driven by health-conscious innovation, digital retail expansion, and strong demand for traditional and fresh-baked goods. Urbanization, evolving consumer preferences, and retail investments also continue to shape market dynamics and growth opportunities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.0 Billion |

| Market Forecast in 2033 | USD 10.6 Billion |

| Market Growth Rate 2025-2033 | 3.2% |

Mexico Bakery Products Market Trends:

Health-Conscious Product Innovation

Health-conscious product innovation is becoming a major force shaping consumer preferences in Mexico’s bakery sector. The Mexico bakery products market growth is increasingly driven by demand for nutritious, functional, and better-for-you options. Consumers are actively seeking high-fiber breads, gluten-free alternatives, low-sugar pastries, and products enriched with vitamins, minerals, or protein. This trend is especially prominent among younger demographics, urban dwellers, and individuals managing health conditions such as diabetes or gluten intolerance. Manufacturers and bakeries are responding with reformulated classics and new product lines that cater to lifestyle and dietary needs without compromising on taste or texture. Major players are expanding through acquisitions to strengthen their health-focused product portfolios. For instance, in February 2024, Mexican multinational food company Grupo Bimbo announced the acquisition of Spanish gluten-free bakery brand Amaritta Food SL to enhance its position in the gluten-free market. The deal, announced by CEO Daniel Servitje, aims to leverage Amaritta's expertise in gluten-free bread production. Labels highlighting “whole grain,” “sugar-free,” or “plant-based” are gaining visibility on supermarket shelves and online platforms. As wellness continues to influence food purchases, health-forward innovation is expected to remain central to the Mexico bakery products market outlook.

Expansion of In-Store Bakeries and Café Chains

The expansion of in-store bakeries and café chains is reshaping how bakery products are consumed and sold across Mexico. Supermarkets, hypermarkets, and convenience store chains are enhancing their fresh bakery sections to offer on-the-spot breads, pastries, and desserts that attract daily foot traffic. These freshly prepared products cater to consumers seeking both quality and convenience. Meanwhile, café chains are fueling demand for baked snacks like muffins, croissants, and sweet breads, often paired with beverages as part of quick meals or snacks. Retailers are leveraging bakery sections to improve margins and boost in-store customer retention. These investments in retail-based fresh baking experiences are playing a significant role in boosting availability and visibility, contributing to the growing Mexico bakery products market share.

Rising Popularity of Online and Retail Bakery Chains

In Mexico, the bakery products market is witnessing a surge in online and retail chain sales, driven by changing consumer habits and growing demand for convenience. E-commerce platforms are making it easier for consumers to order fresh and packaged baked goods from the comfort of their homes, with quick delivery options and seasonal offers. Simultaneously, organized bakery chains and modern retail outlets are expanding their footprint across urban and semi-urban areas, offering standardized quality, attractive packaging, and a wide variety of baked products. These channels also allow for better visibility and brand recognition, especially for artisanal and health-oriented brands. The combination of physical stores and digital presence enables bakeries to reach a broader audience, tap into impulse buying behavior, and maintain steady growth. This trend is reshaping the traditional bakery landscape and setting new expectations for product accessibility and presentation.

Mexico Bakery Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Biscuits

- Cookies

- Cream Biscuits

- Glucose Biscuits

- Marie Biscuits

- Non-Salt Cracker Biscuits

- Salt Cracker Biscuits

- Milk Biscuits

- Others

- Bread and Rolls

- Artisanal Bakeries

- In-Store Bakeries

- Packaged

- Cakes and Pastries

- Artisanal Bakeries

- In-Store Bakeries

- Packaged

- Rusks

- Artisanal Bakeries

- In-Store Bakeries

- Packaged

The report has provided a detailed breakup and analysis of the market based on the product type. This includes biscuits (cookies, cream biscuits, glucose biscuits, marie biscuits, non-salt cracker biscuits, salt cracker biscuits, milk biscuits, and others), bread and rolls (artisanal bakeries, in-store bakeries, and packaged), cakes and pastries (artisanal bakeries, in-store bakeries, and packaged) and rusks (artisanal bakeries, in-store bakeries, and packaged).

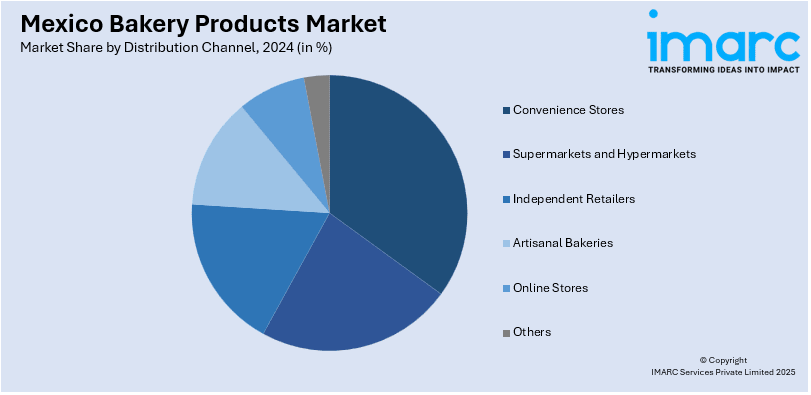

Distribution Channel Insights:

- Convenience Stores

- Supermarkets and Hypermarkets

- Independent Retailers

- Artisanal Bakeries

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes convenience stores, supermarkets and hypermarkets, independent retailers, artisanal bakeries, online stores, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Bakery Products Market News:

- In March 2025, Nestlé announced the launch of its Choco Trio line in Mexico, enhancing its Chocobakery portfolio after success in Brazil. The chocolate bars, featuring milk chocolate and crunchy biscuit pieces, will be available in peanut, cookies and cream, and chocolate flavors starting in April.

- In April 2024, Paris Baguette North America, a bakery café chain, announced that it is seeking a master franchisee to facilitate its expansion into Mexico, with plans to open over 100 stores in key cities such as Mexico City, Monterrey, and Guadalajara.

Mexico Bakery Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Convenience Stores, Supermarkets and Hypermarkets, Independent Retailers, Artisanal Bakeries, Online Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico bakery products market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico bakery products market on the basis of product type?

- What is the breakup of the Mexico bakery products market on the basis of distribution channel?

- What is the breakup of the Mexico bakery products market on the basis of region?

- What are the various stages in the value chain of the Mexico bakery products market?

- What are the key driving factors and challenges in the Mexico bakery products market?

- What is the structure of the Mexico bakery products market and who are the key players?

- What is the degree of competition in the Mexico bakery products market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico bakery products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico bakery products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico bakery products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)