Mexico Bancassurance Market Size, Share, Trends and Forecast by Product Type, Model Type, and Region, 2025-2033

Mexico Bancassurance Market Size and Share:

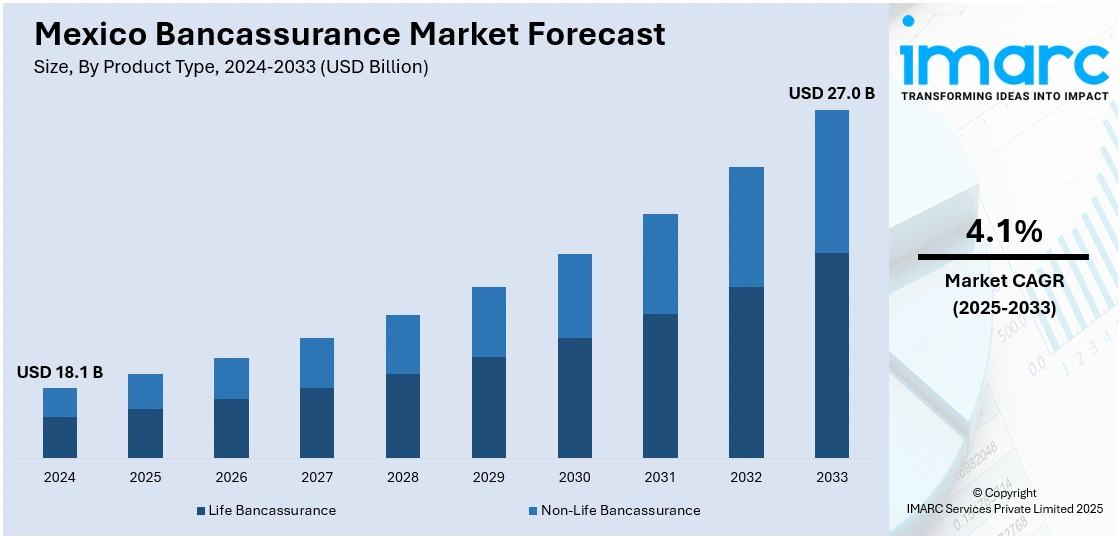

The Mexico bancassurance market size reached USD 18.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 27.0 Billion by 2033, exhibiting a growth rate (CAGR) of 4.1% during 2025-2033. The market in the region is driven by rising financial inclusion, increasing middle-class wealth, growing adoption of digital banking, favorable regulatory frameworks, expanding insurance awareness, and evolving customer preferences for convenient, and bundled financial products.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 18.1 Billion |

| Market Forecast in 2033 | USD 27.0 Billion |

| Market Growth Rate 2025-2033 | 4.1% |

Mexico Bancassurance Market Trends:

Digital Transformation and Embedded Insurance Offerings

The Mexico bancassurance market is experiencing a major digital transformation because banks and insurers are adopting modern technological solutions to improve customer interactions. Bancassurance strategies need advanced digital services, including banking platforms and mobile applications, and automated artificial intelligence (AI) advisory services for instant policy purchases and automated claims service, and 24/7 customer support. Moreover, the use of embedded insurance has expanded because insurance products now integrate directly with standard banking service platforms. For instance, in 2025, Oxxo, a leading convenience store chain, partnered with fintech startup Cuenca to offer digital wallets and financial services to its extensive customer base. This collaboration leverages Oxxo's physical presence and Cuenca's digital expertise to increase financial inclusion across Mexico. Besides this, insurers and banks are using rising smartphone ownership in Mexico to create investments for data analytics alongside AI and blockchain programs. These programs help achieve better underwriting decisions along with improved risk assessment techniques and fraud prevention systems. Furthermore, traditional bancassurance models are transforming as digital channels keep expanding, making this evolution of insurance distribution more efficient and accessible to consumers, thereby boosting the Mexico bancassurance market share.

Regulatory Developments and Financial Inclusion Initiatives

The Mexican regulatory framework has become essential for driving the Mexico bancassurance market growth, because authorities establish standards that promote transparency, consumer protection, and financial inclusion. In line with this, the Comisión Nacional Bancaria y de Valores (CNBV) and Comisión Nacional de Seguros y Fianzas (CNSF) have established guidelines to optimize bancassurance operations by maintaining solvency standards while advancing fair market conduct. Concurrently, the Mexican government works to expand financial inclusion to improve insurance coverage reach among underserved populations. For example, in November 2024, Santander introduced Openbank, its digital banking platform, to the Mexican market. This initiative aims to leverage Mexico's growing fintech landscape, offering digital services that enhance financial accessibility and inclusion. The banking sector is also integrating microinsurance products that align with the needs of poor population segments especially within rural markets. These initiatives receive financial literacy program support through collaborations between banks, insurers, and government agencies that teach consumers about risk management and insurance advantages. Apart from this, the development of regulatory frameworks is establishing market stability and growing consumer confidence while improving access to bancassurance for different demographic groups, which is significantly enhancing the Mexico bancassurance market outlook.

Mexico Bancassurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type and model type.

Product Type Insights:

- Life Bancassurance

- Non-Life Bancassurance

The report has provided a detailed breakup and analysis of the market based on the product type. This includes life bancassurance and non-life bancassurance.

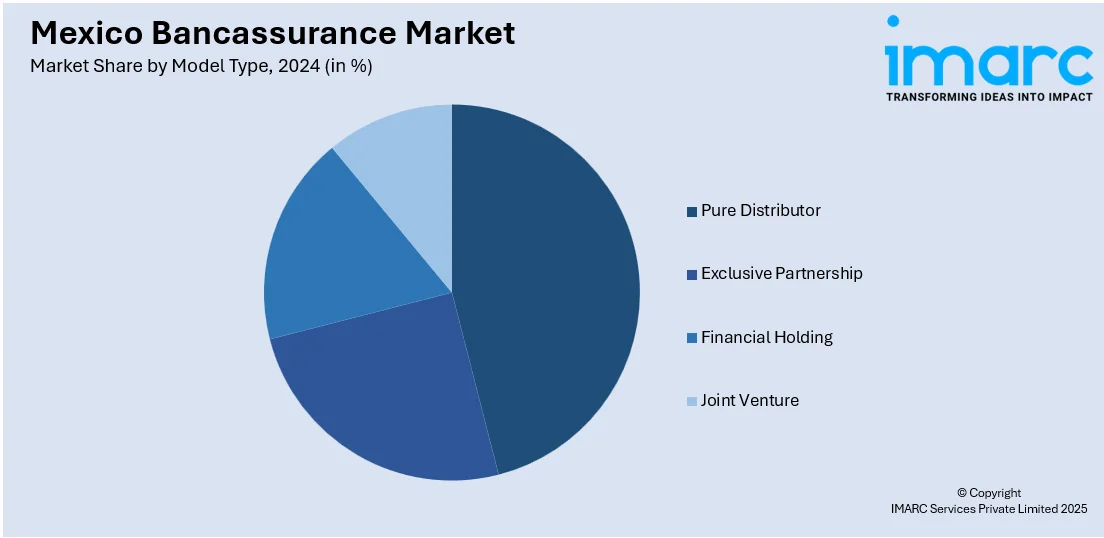

Model Type Insights:

- Pure Distributor

- Exclusive Partnership

- Financial Holding

- Joint Venture

A detailed breakup and analysis of the market based on the model type have also been provided in the report. This includes pure distributor, exclusive partnership, financial holding, and joint venture.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Bancassurance Market News:

- In October 2024, Hub International Limited (HUB) announced an exclusive referral and broker program partnership with MAS Seguros, Mexico's largest trucking insurance broker. This collaboration aims to provide seamless cross-border insurance solutions for clients operating throughout North America, addressing the growing need for comprehensive risk management in transportation.

- In August 2024, ACI Worldwide extended its partnership with Mexipay, a Mexican fintech company, to enhance the country's real-time payments ecosystem. Utilizing ACI's Digital Central Infrastructure solution, this initiative seeks to drive instant payments adoption, fostering economic growth and financial inclusion.

Mexico Bancassurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Life Bancassurance, Non-Life Bancassurance |

| Model Types Covered | Pure Distributor, Exclusive Partnership, Financial Holding, Joint Venture |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico bancassurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico bancassurance market on the basis of product type?

- What is the breakup of the Mexico bancassurance market on the basis of model type?

- What is the breakup of the Mexico bancassurance market on the basis of region?

- What are the various stages in the value chain of the Mexico bancassurance market?

- What are the key driving factors and challenges in the Mexico bancassurance?

- What is the structure of the Mexico bancassurance market and who are the key players?

- What is the degree of competition in the Mexico bancassurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico bancassurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico bancassurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico bancassurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)