Mexico Bath Soap Market Size, Share, Trends and Forecast by Product Type, Form, Distribution Channel, and Region, 2026-2034

Mexico Bath Soap Market Summary:

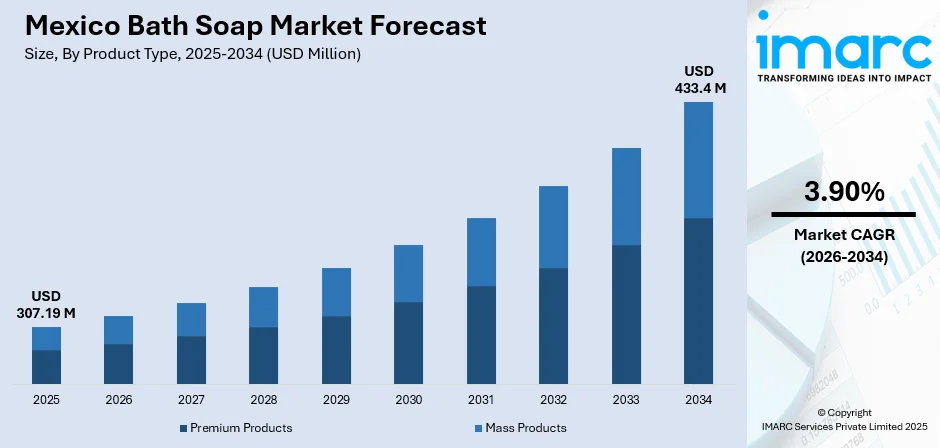

The Mexico bath soap market size was valued at USD 307.19 Million in 2025 and is projected to reach USD 433.4 Million by 2034, growing at a compound annual growth rate of 3.90% from 2026-2034.

The Mexico bath soap market is witnessing steady expansion driven by heightened consumer awareness regarding personal hygiene and wellness. Rising disposable incomes among urban households have enabled greater spending on daily-use personal care products, while the growing middle-class population continues to prioritize quality cleansing solutions. The market benefits from robust retail infrastructure, widespread supermarket penetration, and increasing adoption of modern trade channels that ensure consistent product availability across metropolitan and semi-urban regions, supporting sustained growth in Mexico bath soap market share.

Key Takeaways and Insights:

-

By Product Type: Mass products dominate the market with a share of 81% in 2025, owing to widespread retail accessibility, competitive pricing strategies, and established consumer familiarity with household brands that ensure consistent penetration across diverse income segments throughout Mexico.

-

By Form: Solid bath soaps lead the market with a share of 76.73% in 2025, This dominance reflects cultural bathing preferences, cost-effectiveness for household budgets, and growing environmental consciousness among consumers seeking sustainable packaging alternatives over plastic containers.

-

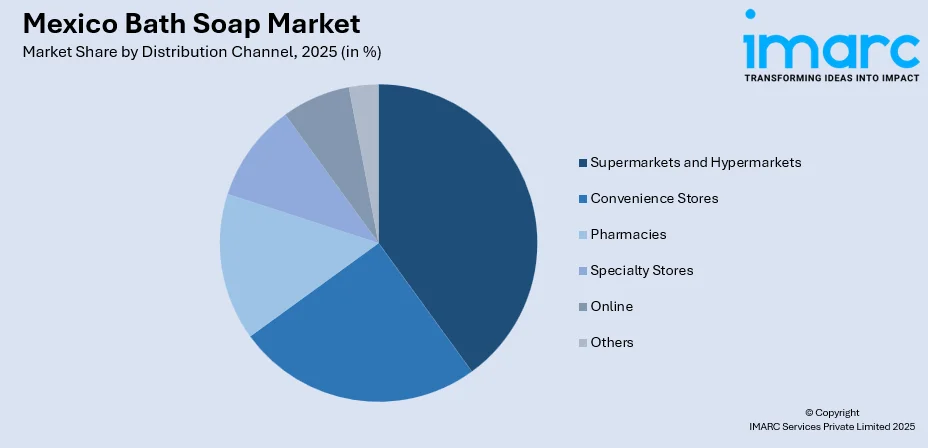

By Distribution Channel: Supermarkets and hypermarkets represent the biggest segment with an overall market share of 39% in 2025, reflecting the dominance of organized retail formats that offer convenient one-stop shopping experiences, promotional pricing, and extensive product assortments for personal care items.

-

By Region: Central Mexico is the largest region with 42% share in 2025, driven by the concentration of population in the Mexico City metropolitan area, higher purchasing power among urban consumers, and extensive retail network accessibility.

-

Key Players: Key players drive the Mexico bath soap market by expanding product portfolios, improving formulation technologies, and strengthening nationwide distribution. Their investments in marketing, affordability, and partnerships with retail chains boost awareness, accelerate adoption, and ensure consistent product availability.

To get more information on this market Request Sample

The Mexico bath soap market demonstrates robust fundamentals supported by favorable demographic trends and evolving consumer preferences. With most of the national population residing in urban areas, demand for accessible personal care products continues to strengthen across metropolitan centers. The market landscape features a competitive mix of multinational corporations and domestic manufacturers who collectively address diverse consumer needs ranging from economy-priced essentials to premium wellness-oriented formulations. Traditional bar soap formats maintain strong consumer loyalty due to their perceived value proposition and sustainability benefits, while modern retail channels facilitate product discovery and repurchase behavior. The expansion of supermarket chains and hypermarket formats has created consistent touchpoints for brand engagement, with in-store promotions influencing significant portions of purchase decisions. Digital commerce platforms are emerging as complementary distribution channels, enabling brands to reach younger demographics and expand geographic coverage beyond established retail footprints.

Mexico Bath Soap Market Trends:

Rising Consumer Preference for Natural and Organic Formulations

Mexican consumers are increasingly gravitating toward bath soaps formulated with natural and organic ingredients, reflecting broader wellness consciousness across personal care categories. This preference shift encompasses products featuring plant-based oils, botanical extracts, and essential oils while avoiding synthetic additives and harsh chemicals. The natural and organic bath soap segment is experiencing accelerated expansion at rates exceeding six percent annually, driven by heightened awareness of ingredient transparency and skin health considerations among urban consumers seeking cleaner beauty alternatives.

E-Commerce Expansion and Digital Shopping Adoption

Digital commerce is reshaping bath soap distribution patterns as Mexican consumers embrace online shopping for personal care products. The e-commerce channel represents the fastest-growing distribution format in the personal care sector, demonstrating significant expansion throughout the forecast period. Social media platforms, influencer marketing, and mobile-first shopping experiences are driving product discovery and purchase conversion among younger demographics, complementing traditional retail channels while enabling brands to engage directly with consumers seeking convenient purchasing options.

Sustainability and Eco-Friendly Packaging Initiatives

Environmental sustainability has emerged as a significant consumer consideration influencing bath soap purchasing decisions. Manufacturers are responding with recyclable packaging, biodegradable formulations, and reduced plastic usage across product lines. The shift toward FSC-certified paper packaging among soap brands increased substantially in recent years, reflecting corporate commitment to environmental responsibility and consumer demand for eco-conscious personal care solutions that minimize ecological impact.

Market Outlook 2026-2034:

The Mexico bath soap market is projected to experience sustained growth throughout the forecast period, which is supported by favorable macroeconomic conditions and evolving consumer behavior patterns. The market generated a revenue of USD 307.19 Million in 2025 and is projected to reach a revenue of USD 433.4 Million by 2034, growing at a compound annual growth rate of 3.90% from 2026-2034. Continued urbanization, rising hygiene consciousness, and expanding modern retail infrastructure will drive market expansion across product segments and geographic regions.

Mexico Bath Soap Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Mass Products |

81% |

|

Form |

Solid Bath Soaps |

76.73% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

39% |

|

Region |

Central Mexico |

42% |

Product Type Insights:

- Premium Products

- Mass Products

Mass products dominate with a market share of 81% of the total Mexico bath soap market in 2025.

The mass products segment maintains commanding leadership in the Mexico bath soap market through extensive retail penetration and competitive pricing strategies that resonate with value-conscious consumers. Major manufacturers including multinational personal care corporations have established robust distribution networks spanning supermarkets, hypermarkets, and convenience stores nationwide, ensuring consistent product availability across diverse geographic regions.

The accessibility of mass-market bath soaps across diverse retail formats ensures broad household penetration throughout urban and semi-urban regions. These products benefit from established brand recognition, economical multi-pack configurations, and promotional pricing that encourages repeat purchases among budget-minded consumers. The segment's dominance reflects fundamental consumer priorities for reliable cleansing solutions at accessible price points, supported by extensive advertising campaigns and shelf space allocation in organized retail environments. Manufacturing efficiencies and economies of scale enable producers to maintain attractive pricing while delivering consistent quality that meets daily hygiene requirements. Furthermore, the widespread familiarity with established mass-market brands fosters consumer loyalty and reduces perceived purchasing risk among households seeking dependable personal care solutions.

Form Insights:

- Solid Bath Soaps

- Liquid Bath Soaps

Solid bath soaps lead with a share of 76.73% of the total Mexico bath soap market in 2025.

Solid bath soaps maintain substantial market leadership driven by cultural bathing traditions, cost-effectiveness, and growing environmental consciousness among Mexican consumers. Bar soap formats offer superior value propositions for households seeking economical personal care solutions with extended usage duration. Traditional bar soap remains the preferred cleansing format, particularly among older demographics and households prioritizing budget optimization, reflecting deeply ingrained personal care habits passed through generations.

The sustainability movement has reinforced solid bath soap demand as consumers increasingly recognize the environmental advantages of minimal packaging compared to liquid alternatives. Bar soaps typically utilize biodegradable wrappers or recyclable cardboard packaging, reducing plastic waste contributions to landfills and waterways. This ecological benefit resonates strongly with environmentally conscious consumers seeking personal care products that align with sustainability values while delivering effective cleansing performance. Additionally, the compact nature of solid soap formats facilitates convenient storage and transportation, further enhancing their practical appeal among households managing limited bathroom space while maintaining commitment to daily hygiene routines.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmacies

- Specialty Stores

- Online

- Others

Supermarkets and hypermarkets exhibit a clear dominance with a 39% share of the total Mexico bath soap market in 2025.

Supermarkets and hypermarkets serve as the primary distribution channel for bath soap products, offering consumers convenient one-stop shopping experiences combined with competitive pricing and extensive product selection. Major retail chains have dedicated substantial shelf space to both mass-market and premium bath soap brands, ensuring high visibility and accessibility for personal care purchases. Walmart Mexico operates over three thousand stores across the country, thereby establishing comprehensive reach across metropolitan regions.

The organized retail format benefits from promotional pricing strategies, multi-buy discounts, and loyalty programs that encourage consistent consumer engagement with bath soap categories. Weekly grocery shopping trips create natural touchpoints for replenishment purchases, while end-cap displays and seasonal campaigns drive incremental sales volume. Industry research indicates that in-store promotional activities influence approximately sixty-four percent of bath soap purchasing decisions, underscoring the strategic importance of supermarket presence for brand success. These retail environments also facilitate product comparison and brand switching opportunities that benefit innovative manufacturers seeking to capture market share from established competitors.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Central Mexico represents the leading segment with a 42% share of the total Mexico bath soap market in 2025.

Central Mexico commands the largest regional share driven by the concentration of population and economic activity within the Mexico City metropolitan area, which encompasses over twenty-two million residents representing one of the largest urban agglomerations globally. Mexico City alone contributes approximately thirty-five percent of the national beauty and personal care market value, reflecting higher purchasing power among urban households and extensive retail infrastructure accessibility throughout the densely populated metropolitan corridor.

The region benefits from dense supermarket coverage, established distribution networks, and concentrated consumer demand that supports diverse product offerings across price segments. Premium retail formats and specialty stores complement mass-market channels, enabling consumers to access both economy and luxury bath soap options according to individual preferences and household budgets. Strong employment rates and relatively higher per capita income levels sustain robust consumption patterns for personal care products. Additionally, the presence of major manufacturing facilities and corporate headquarters within the region facilitates efficient supply chain operations and rapid product availability, reinforcing Central Mexico's dominant position within the national bath soap marketplace.

Market Dynamics:

Growth Drivers:

Why is the Mexico Bath Soap Market Growing?

Increasing Hygiene Awareness and Personal Care Consciousness

Heightened consumer awareness regarding personal hygiene and wellness has emerged as a fundamental growth catalyst for the Mexico bath soap market. Public health initiatives, educational campaigns, and evolving lifestyle preferences have reinforced daily bathing habits and handwashing practices across demographic segments. Research indicates that approximately seventy-eight percent of adults maintain daily full-body washing routines, creating sustained baseline demand for cleansing products. This hygiene consciousness extends beyond basic cleanliness to encompass skin health considerations, driving interest in formulations addressing specific dermatological needs including moisturization, sensitivity, and antibacterial protection.

Rising Urbanization and Disposable Income Growth

Mexico's progressive urbanization trajectory continues to support bath soap market expansion through concentrated consumer demand and improved retail accessibility. The majority of the national population currently resides in urban areas, representing substantial market density for personal care product distribution. Urban households typically demonstrate higher consumption rates for packaged consumer goods compared to rural counterparts, driven by modern lifestyle patterns, retail convenience, and exposure to brand marketing. Rising disposable incomes among the expanding middle class enable greater spending on quality personal care products beyond basic necessities, while increased access to modern retail formats further stimulates purchasing frequency and product variety exploration.

Expanding Modern Retail Infrastructure and Distribution Networks

The proliferation of organized retail formats has significantly enhanced bath soap market accessibility and product visibility across Mexico. Major supermarket chains and hypermarket operators have expanded store networks throughout metropolitan and secondary cities, creating consistent touchpoints for consumer engagement with personal care categories. Leading retailers maintain thousands of locations nationwide, while regional competitors sustain complementary coverage across diverse geographic markets. This extensive retail infrastructure supports both mass-market and premium bath soap distribution while enabling promotional activities that stimulate consumer trial and brand switching, ultimately strengthening the connection between manufacturers and end consumers throughout the country.

Market Restraints:

What Challenges the Mexico Bath Soap Market is Facing?

Price Sensitivity Among Consumer Segments

Economic fluctuations and income disparities create price sensitivity challenges that limit premium product adoption across certain consumer segments. Budget-conscious households prioritize value propositions over brand preferences, constraining manufacturer pricing power and margins in competitive retail environments. This cost-consciousness particularly affects premium and specialty soap categories that struggle to justify higher price points among families managing household budgets carefully.

Competition from Liquid Soap Alternatives

Body wash and liquid soap formats continue gaining traction among younger urban consumers who perceive these products as more hygienic and convenient. This format competition pressures traditional bar soap market share, particularly in premium segments targeting beauty-conscious demographics. Manufacturers must continuously innovate and communicate unique bar soap benefits to retain consumer loyalty amid shifting preferences toward liquid alternatives.

Raw Material Cost Fluctuations

Volatility in prices of key raw materials including palm oil, coconut oil, and specialty fats creates margin pressures for bath soap manufacturers. Supply chain disruptions and commodity market fluctuations complicate production cost management and pricing strategy implementation. These unpredictable cost variations challenge manufacturers to balance product affordability with profitability while maintaining consistent quality standards across their portfolios.

Competitive Landscape:

The Mexico bath soap market exhibits moderate concentration with established multinational corporations and domestic manufacturers competing across product segments. Leading players leverage extensive distribution networks, brand recognition, and manufacturing scale to maintain market positions. Companies differentiate through product innovation, formulation enhancements, and marketing investments targeting specific consumer segments. Strategic partnerships with retail chains ensure shelf presence while digital marketing initiatives address evolving consumer engagement patterns. The competitive environment encourages continuous improvement in product quality, packaging sustainability, and value propositions to capture market share.

Recent Developments:

-

In May 2025, Unilever announced that it will invest USD 1.5 Billion in Mexico between 2025 and 2028 to expand its beauty and personal care operations. The centerpiece includes a USD 407 Million manufacturing facility in Salinas Victoria, Nuevo León, expected to create approximately 1,200 jobs and strengthen regional production capacity.

Mexico Bath Soap Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Premium Products, Mass Products |

| Forms Covered | Solid Bath Soaps, Liquid Bath Soaps |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Pharmacies, Specialty Stores, Online, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico bath soap market size was valued at USD 307.19 Million in 2025.

The Mexico bath soap market is expected to grow at a compound annual growth rate of 3.90% from 2026-2034 to reach USD 433.4 Million by 2034.

Mass products dominate the market with a share of 81%, driven by widespread retail accessibility, competitive pricing, and established brand recognition among value-conscious consumers.

Key factors driving the Mexico bath soap market include increasing hygiene awareness, rising urbanization with approximately 87.9% urban population, growing disposable incomes, and expanding modern retail infrastructure.

Major challenges include price sensitivity among consumer segments, competition from liquid soap alternatives, raw material cost fluctuations, and economic uncertainties affecting discretionary spending patterns.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)