Mexico Battery Recycling Market Size, Share, Trends and Forecast by Type, Source, Material, End-Use, and Region, 2025-2033

Mexico Battery Recycling Market Overview:

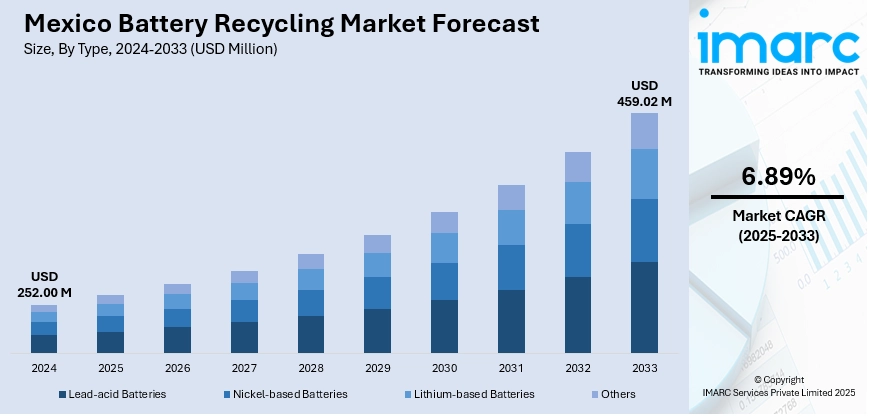

The Mexico battery recycling market size reached USD 252.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 459.02 Million by 2033, exhibiting a growth rate (CAGR) of 6.89% during 2025-2033. The rising environmental awareness, increasing government regulations on hazardous waste disposal, growing demand for secondary raw materials, the surge in electric vehicle (EV) adoption, and the implementation of sustainable waste management practices across the country are some of the key factors contributing to the market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 252.00 Million |

| Market Forecast in 2033 | USD 459.02 Million |

| Market Growth Rate 2025-2033 | 6.89% |

Mexico Battery Recycling Market Trends:

Surge in EV Adoption Fueling End-of-Life Battery Volumes

Mexico’s accelerating transition toward electrification is significantly increasing the volume of end-of-life batteries requiring proper recycling and resource recovery. By the end of 2024, electric vehicle (EV) sales, including hybrids and fully electric models, rose by 41.1% year-on-year, with 12,147 units sold in November alone. Fully electric vehicle registrations surged by 80%, totaling approximately 15,000 new units in 2024 compared to the previous year. Each lithium-ion battery pack, typically weighing between 400–600 kg, presents a valuable opportunity for the recovery of critical raw materials such as cobalt, nickel, and lithium. In response, both public and private stakeholders are investing in recycling infrastructure. The Secretariat of the Environment (SEDEMA) installed 50 additional public battery collection containers in 2023, increasing the total to 450 across Mexico City. Private recyclers are expanding advanced hydrometallurgical recycling operations, supporting the country’s circular economy objectives and reducing dependency on imported materials by recovering essential metals from discarded battery systems.

To get more information on this market, Request Sample

Strengthening Regulatory Frameworks and Mandated Collection Targets

Mexico is actively advancing its battery circular economy through strengthened regulations under the General Law for the Prevention and Integral Management of Waste (LGPGIR) and Resolution 851/2022. The latter mandates a 37% collection target for spent batteries and accumulators in 2022, with incremental annual increases of 1% through 2030. These regulatory requirements are spurring rapid capacity expansion, supported by targeted incentives such as tax credits for recycling equipment and enforcement mechanisms including fines of up to USD 50,000 per violation. Projections indicate this policy framework is fostering a favorable investment climate, encouraging both domestic and international players to scale recycling infrastructure. Further momentum is expected with the finalization of Mexico’s national waste-reduction strategy by December 2025, which will introduce clear Extended Producer Responsibility (EPR) guidelines, streamline collection logistics, and mandate recycled content in new battery packs. These initiatives are positioning Mexico as a regional leader in battery waste management and sustainable material recovery.

Mexico Battery Recycling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, source, material, and end-use.

Type Insights:

- Lead-acid Batteries

- Nickel-based Batteries

- Lithium-based Batteries

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes lead-acid batteries, nickel-based batteries, lithium-based batteries, and others.

Source Insights:

- Industrial

- Automotive

- Consumer Products

- Electronic Appliances

- Others

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes industrial, automotive, consumer products, electronic appliances, and others.

Material Insights:

- Manganese

- Iron

- Lithium

- Nickel

- Cobalt

- Lead

- Aluminum

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes manganese, iron, lithium, nickel, cobalt, lead, aluminum, and others.

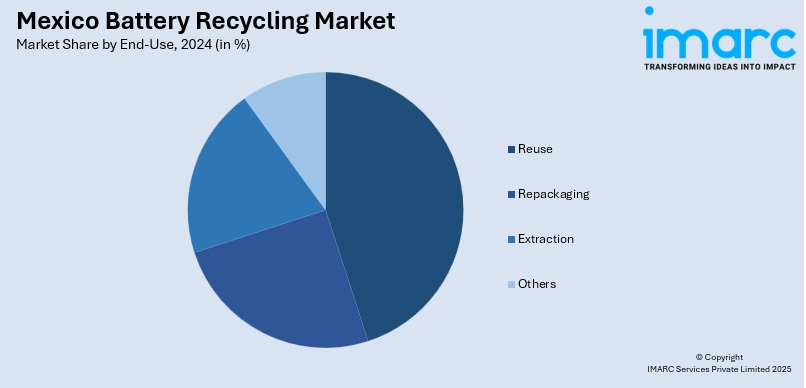

End-Use Insights:

- Reuse

- Repackaging

- Extraction

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use. This includes reuse, repackaging, extraction, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Battery Recycling Market News:

- January 2025: BMW Group and SK tes launched a closed-loop battery recycling partnership in Europe, mechanically shredding high-voltage cells to recover cobalt, nickel, and lithium via hydrometallurgy for reuse in BMW’s next-gen Neue Klasse and GEN 6 batteries. The system is expected to expand to the US–Mexico–Canada region by 2026, supporting a global circular battery economy.

- December 2024: UNAM researchers created low-cost, lightweight batteries using recycled plastics combined with seawater electrolyte, offering performance comparable to AA/AAA cells at a fraction of the cost. They are also pioneering recycling of lithium-ion batteries from phones and electric vehicles, repurposing electrodes for new devices and even water-treatment applications, strengthening Mexico’s circular‑battery approach.

Mexico Battery Recycling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Lead-acid Batteries, Nickel-based Batteries, Lithium-based Batteries, Others |

| Sources Covered | Industrial, Automotive, Consumer Products, Electronic Appliances, Others |

| Materials Covered | Manganese, Iron, Lithium, Nickel, Cobalt, Lead, Aluminum, Others |

| End-Uses Covered | Reuse, Repackaging, Extraction, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico battery recycling market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico battery recycling market on the basis of type?

- What is the breakup of the Mexico battery recycling market on the basis of source?

- What is the breakup of the Mexico battery recycling market on the basis of material?

- What is the breakup of the Mexico battery recycling market on the basis of end-use?

- What is the breakup of the Mexico battery recycling market on the basis of region?

- What are the various stages in the value chain of the Mexico battery recycling market?

- What are the key driving factors and challenges in the Mexico battery recycling market?

- What is the structure of the Mexico battery recycling market and who are the key players?

- What is the degree of competition in the Mexico battery recycling market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico battery recycling market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico battery recycling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico battery recycling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)