Mexico Bearings and Bushings Market Size, Share, Trends and Forecast by Product Type, Material Type, Application, Distribution Channel, and Region, 2026-2034

Mexico Bearings and Bushings Market Summary:

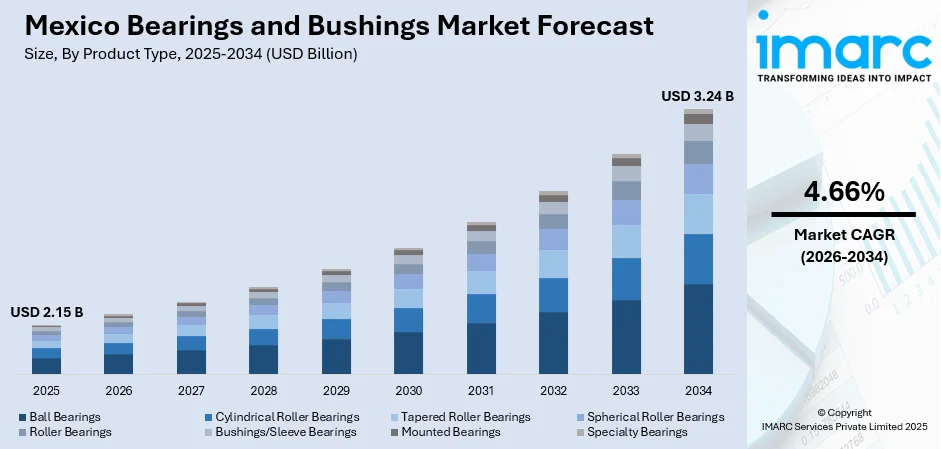

The Mexico bearings and bushings market size was valued at USD 2.15 Billion in 2025 and is projected to reach USD 3.24 Billion by 2034, growing at a compound annual growth rate of 4.66% from 2026-2034.

The market growth is driven by Mexico's robust automotive manufacturing sector, which is producing massive units of automotive parts representing an increase over the previous year. The country's strategic position as a major vehicle exporter globally and growing domestic manufacturing infrastructure continue to catalyze the demand for high-performance bearings across automotive, industrial machinery, and energy sectors, thereby expanding the Mexico bearings and bushings market share.

Key Takeaways and Insights:

-

By Product Type: Ball bearings dominate the market with a share of 40% in 2025, owing to their widespread application in automotive wheel hubs, transmissions, and electric motors where they efficiently handle both radial and axial loads.

-

By Material Type: Metal bearings and bushings lead the market with a share of 82% in 2025, driven by superior durability, high load-bearing capacity, and cost-effectiveness compared to alternative materials.

-

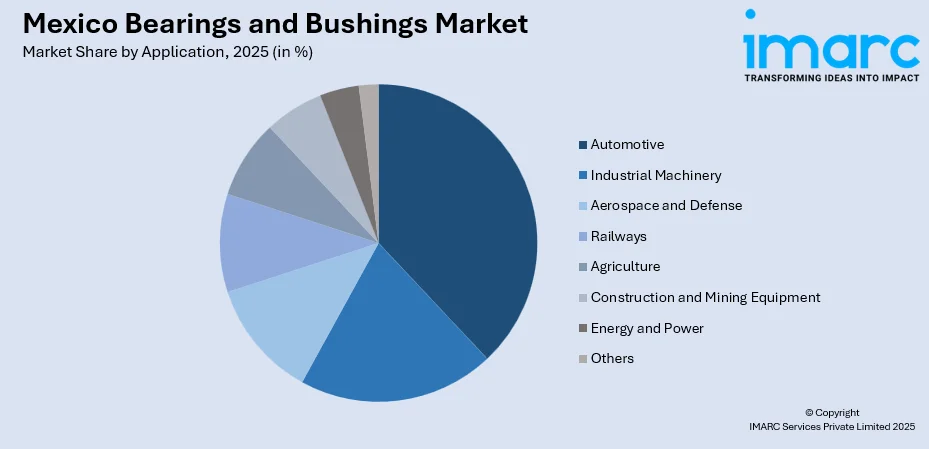

By Application: Automotive represents the largest segment with a market share of 38% in 2025, supported by Mexico's position as a major global automotive production hub.

-

By Distribution Channel: Original equipment manufacturers (OEMs) lead the market with a share of 57% in 2025, benefiting from long-term supply contracts with major automotive and industrial manufacturers.

-

By Region: Northern Mexico represents the largest segment with a market share of 43% in 2025, concentrated in states like Nuevo Leon, Chihuahua, and Coahuila where major automotive assembly plants and manufacturing clusters are located.

-

Key Players: Local manufacturers and suppliers are enhancing product quality and longevity, increasing production capacity, utilizing advanced materials, promoting predictive maintenance technology, bolstering service networks, and aligning their products with growth in automotive, industrial, and renewable sectors to satisfy growing demand.

To get more information on this market Request Sample

Mexico's bearings and bushings market benefits from significant automotive manufacturing expansion, with the country expected to become the fifth-largest global vehicle producer by end of 2025. The automotive industry represents 22% of national employment with over one million direct jobs, creating substantial demand for precision-engineered bearings. The National Agency of Automotive Sector Suppliers (ANAPSA) estimates Mexico's automotive industry will reach a production value of 127 billion dollars by 2024, establishing a robust foundation for bearing manufacturers. The electric vehicle (EV) segment has emerged as a particularly dynamic growth area, with 124,000 units manufactured in 2024 including models from various countries. Moreover, international players are building groundbreaking low-friction hub unit bearing that reduces friction compared to conventional products, helping extend the driving range of EV by approximately 1,000 kilometers annually through optimized seal technology and specialized grease formulations.

Mexico Bearings and Bushings Market Trends:

Rising EV Production Driving Specialized Bearing Demand

Mexico's electric vehicle manufacturing has experienced exponential growth, creating substantial demand for specialized low-friction, high-speed bearings designed for electric drivetrains. Between January and August 2025, Mexico manufactured 163,778 battery electric vehicles (BEVs), marking a 30.5% rise compared to the corresponding period in 2024. The nation is set to achieve 252,050 units by the end of the year, indicating a 21.8% yearly growth rate. Moreover, people in the country are becoming highly eco-conscious and are looking for sustainable transportation options. As a result, the need for EVs is rising among the masses and thereby supporting the growth of the market.

Industrial Automation and Smart Manufacturing Expansion

The integration of automation technologies across Mexico's manufacturing sectors is accelerating demand for precision bearings capable of supporting robotics, automated machinery, and advanced production systems, driven by nearshoring momentum that brought foreign direct investment in manufacturing to grow by 28% in 2024. Manufacturing production in Mexico surged by 5.2% annually in 2022, well above the previous decade's average growth of 2.3%, highlighting the sector's increasing capacity and competitiveness. Mexican suppliers play a critical role in United States supply chains with a major portion of US auto parts imports sourcing from Mexico, while many industrial parks in northern regions operate at full capacity indicating robust investment and development.

Advanced Bearing Technologies for Enhanced Performance

Manufacturers are introducing innovative bearing solutions featuring current insulation, advanced sealing systems, and specialized materials to meet evolving performance requirements across automotive and industrial applications. These technological advancements address critical challenges including electrical discharge damage in electric motors, contamination resistance in harsh operating environments, and extended service life requirements. Vesconite Hilube bearings are gaining prominence in the country’s pump sector for the past six years. Vesconite Hilube is a bearing material that withstands acidic conditions and the chemicals commonly encountered in copper and gold extraction. While water acidity can damage conventional materials, Vesconite Hilube remains strong, preserving its integrity and functionality even under the most demanding circumstances.

Market Outlook 2026-2034:

The Mexico bearings and bushings market is poised for sustained growth driven by expanding automotive production, increasing electric vehicle adoption, and strengthening industrial manufacturing infrastructure across the country. The market generated a revenue of USD 2.15 Billion in 2025 and is projected to reach a revenue of USD 3.24 Billion by 2034, growing at a compound annual growth rate of 4.66% from 2026-2034. Major automotive OEMs continue investing in Mexican production facilities, with the automotive industry expected to maintain its trajectory toward becoming the one of the major auto parts manufacturers.

Mexico Bearings and Bushings Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Ball Bearings | 40% |

| Material Type | Metal Bearings and Bushings | 82% |

| Application | Automotive | 38% |

| Distribution Channel | Original Equipment Manufacturers (OEMs) | 57% |

| Region | Northern Mexico | 43% |

Product Type Insights:

- Ball Bearings

- Cylindrical Roller Bearings

- Tapered Roller Bearings

- Spherical Roller Bearings

- Roller Bearings

- Bushings/Sleeve Bearings

- Mounted Bearings

- Specialty Bearings

Ball bearings dominate with a market share of 40% of the total Mexico bearings and bushings market in 2025.

Ball bearings maintain market leadership through their versatility in handling both radial and axial loads simultaneously, making them indispensable across automotive wheel hubs, electric motor applications, transmission systems, and precision machinery. Their compact design, relatively low friction characteristics, and ability to operate efficiently at high rotational speeds contribute to widespread adoption across passenger vehicles, commercial trucks, and industrial equipment. The automotive sector's preference for ball bearings stems from their reliability in critical applications including engine components, suspension systems, and drivetrain assemblies where performance and durability are paramount.

The segment continues experiencing robust growth driven by Mexico's expanding electric vehicle production, which requires specialized ball bearings designed to minimize energy consumption and maximize driving range. Ball bearings with advanced sealing technologies, optimized internal geometries, and low-viscosity lubricants are increasingly deployed in EV applications where even marginal efficiency improvements translate to measurable increases in battery range and vehicle performance. Mexico's position as a major automotive manufacturing hub, coupled with ongoing investments in production capacity and technology upgrades, ensures sustained demand for high-quality ball bearings throughout the forecast period.

Material Type Insights:

- Metal Bearings and Bushings

- Ceramic Bearings

- Polymer-Based Bearings and Bushings

Metal bearings and bushings lead with a share of 82% of the total Mexico bearings and bushings market in 2025.

Metal bearings and bushings, primarily manufactured from high-grade steel alloys, chrome steel, and stainless steel, dominate the market due to their superior load-bearing capacity, excellent durability under extreme operating conditions, and cost-effectiveness compared to alternative materials. Steel-based bearings provide optimal performance in heavy-duty applications including automotive transmissions, industrial machinery, construction equipment, and railway systems where they must withstand substantial mechanical stresses, thermal cycling, and potentially corrosive environments. The material's established supply chains, mature manufacturing processes, and proven reliability across diverse operating conditions reinforce its market leadership position.

The segment benefits from continuous material science innovations including advanced heat treatment processes, surface coating technologies, and metallurgical improvements that extend bearing service life while maintaining competitive pricing. Mexico's robust steel industry infrastructure and proximity to major automotive manufacturing clusters provide strategic advantages for metal bearing production, including reduced transportation costs, streamlined supply chains, and responsive technical support capabilities. As manufacturing operations increasingly prioritize cost optimization without compromising quality standards, metal bearings and bushings remain the preferred choice across most industrial and automotive applications throughout the country.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Industrial Machinery

- Aerospace and Defense

- Railways

- Agriculture

- Construction and Mining Equipment

- Energy and Power

- Others

Automotive exhibits a clear dominance with a 38% share of the total Mexico bearings and bushings market in 2025.

The automotive segment's dominance reflects Mexico's strategic importance as a global automotive manufacturing powerhouse, producing nearly four million vehicles annually with over 95% exported to international markets including the United States, Canada, and Germany. Major OEMs including General Motors, Ford, Volkswagen, Nissan, Toyota, Honda, BMW, and Mercedes-Benz operate extensive production facilities across Mexico, creating substantial sustained demand for bearings across engine systems, transmissions, wheel assemblies, steering mechanisms, and suspension components. The country's automotive industry directly employs over one million workers while supporting extensive supplier networks that manufacture components, parts, and subsystems requiring precision-engineered bearings.

Electric vehicle production has emerged as a transformative growth driver, with a large number of EVs manufactured in Mexico during 2024 demand specialized bearing technologies optimized for high-speed electric motors, regenerative braking systems, and energy-efficient powertrains. The automotive sector's emphasis on reducing friction losses, improving fuel economy, and extending component service life drives continuous adoption of advanced bearing solutions featuring low-friction seals, specialized lubricants, and optimized internal geometries. Mexico's strategic location, skilled manufacturing workforce, established supply chains, and comprehensive trade agreements position the automotive application segment for sustained expansion throughout the forecast period.

Distribution Channel Insights:

- Original Equipment Manufacturers (OEMs)

- Aftermarket

Original equipment manufacturers (OEMs) lead with a share of 57% of the total Mexico bearings and bushings market in 2025.

The OEM distribution channel maintains market leadership through long-term supply agreements with automotive manufacturers, industrial equipment producers, and machinery builders who require consistent quality, reliable delivery schedules, and technical collaboration throughout product development cycles. OEMs prioritize bearing suppliers capable of meeting stringent quality specifications, supporting high-volume production requirements, and providing engineering expertise during vehicle and equipment design phases where bearing selection significantly impacts overall system performance, efficiency, and reliability. The channel benefits from stable demand patterns driven by automotive production schedules, industrial machinery manufacturing, and equipment assembly operations across Mexico's major manufacturing regions.

The segment's strength reflects Mexico's position as a major global manufacturing destination with extensive OEM operations across automotive, aerospace, industrial machinery, and agricultural equipment sectors. Major bearing manufacturers including SKF, Schaeffler, NSK, NTN, and Timken maintain dedicated OEM sales organizations and technical support teams that collaborate closely with automotive engineers, machinery designers, and manufacturing operations to optimize bearing specifications, validate performance characteristics, and ensure seamless integration into final products. As Mexico continues attracting manufacturing investments through nearshoring initiatives and expanding production capacity across multiple industrial sectors, the OEM distribution channel remains positioned for sustained growth throughout the forecast period.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico exhibits a clear dominance with a 43% share of the total Mexico bearings and bushings market in 2025.

Northern Mexico's market dominance stems from its concentration of major automotive manufacturing facilities, robust industrial infrastructure, and strategic proximity to the United States border facilitating efficient logistics and supply chain operations. States including Nuevo Leon, Chihuahua, Coahuila, Tamaulipas, and Sonora host extensive automotive assembly plants operated by General Motors, Ford, Chrysler, Nissan, Toyota, and other global OEMs that collectively produce millions of vehicles annually. The region's manufacturing ecosystem includes hundreds of tier-one and tier-two suppliers producing components, subsystems, and assemblies requiring precision bearings for automotive applications, industrial machinery, and specialized equipment.

The region benefits from well-developed transportation networks, established industrial parks, skilled manufacturing workforce, and comprehensive supplier ecosystems that support advanced manufacturing operations across automotive, aerospace, electronics, and machinery sectors. Northern Mexico's proximity to major United States markets provides strategic advantages including reduced shipping times, lower logistics costs, and enhanced supply chain responsiveness compared to other Mexican regions or international manufacturing locations. As automotive manufacturers continue expanding production capacity and diversifying into electric vehicle assembly, Northern Mexico's established infrastructure, technical capabilities, and strategic location ensure sustained market leadership throughout the forecast period.

Market Dynamics:

Growth Drivers:

Why is the Mexico Bearings and Bushings Market Growing?

Expanding Automotive Manufacturing

Mexico's automotive industry continues experiencing robust expansion, with total vehicle production reaching 3,989,403 units in 2024 representing a 5.56% increase over 2023, while industry experts forecast additional 2.7% growth in 2025 as the country advances toward becoming the fifth-largest global vehicle producer. The Mexican Automotive Industry Association (AMIA) projects sustained production growth driven by established OEM operations, expanding supplier networks, and increasing nearshoring investments from global manufacturers seeking competitive production costs and strategic access to North American markets. The Inflation Reduction Act's provisions for North American EV supply chains are attracting substantial investments in battery manufacturing capacity, which is expected to increase twentyfold by 2030, creating extensive opportunities for bearing suppliers supporting electric vehicle assembly operations, battery production facilities, and charging infrastructure development across Mexico's major manufacturing regions.

Growing Industrial Manufacturing and Infrastructure Development

Mexico's industrial machinery sector is experiencing significant expansion driven by nearshoring initiatives, infrastructure investments, and manufacturing capacity additions across construction equipment, agricultural machinery, mining operations, and industrial automation systems that require precision-engineered bearings for reliable operation under demanding conditions. In Mexico, allocated spending to the Ministry of Infrastructure, Communications, and Transport (SICT) grew by 62.5%, increasing from MX$31.6 billion to MX$53.3 billion in 2025. Mexico's strategic advantages including USMCA trade agreement benefits, skilled manufacturing workforce, established industrial infrastructure, and competitive production costs continue attracting global manufacturers across automotive, aerospace, electronics, and machinery sectors. The country serves as a major logistics and distribution hub with direct jobs in the automotive industry representing 22% of national employment, while automotive manufacturing clusters in states including Guanajuato, Nuevo Leon, Puebla, Mexico State, and Jalisco create concentrated demand for bearings supporting vehicle assembly, component production, and industrial equipment operations throughout Mexico's major manufacturing regions.

Technological Advancements and Smart Manufacturing Integration

The adoption of advanced manufacturing technologies including industrial automation, robotics, IoT-enabled condition monitoring, and predictive maintenance systems is accelerating demand for precision bearings capable of supporting high-speed automated operations while providing real-time performance data through integrated sensor technologies. Global industrial automation sector growth creates substantial opportunities for bearing manufacturers developing smart bearing solutions that enhance operational efficiency, reduce unexpected downtime, and optimize maintenance schedules across automotive assembly lines, industrial machinery installations, and automated production systems. Bearing manufacturers are introducing innovative technologies including current-insulated bearings with advanced protective coatings, low-friction sealing systems optimized for electric vehicle applications, and manufacturable bearing designs supporting circular economy initiatives that extend product lifecycles while reducing environmental impact. These technological advancements address evolving customer requirements for improved energy efficiency, extended service life, reduced maintenance costs, and enhanced operational reliability across automotive, industrial machinery, and energy sector applications. IMARC Group predicts that the Mexico smart manufacturing market is projected to attain USD 10.9 Billion by 2034.

Market Restraints:

What Challenges the Mexico Bearings and Bushings Market is Facing?

Fluctuating Raw Material Costs and Supply Chain Vulnerabilities

The bearings market faces significant challenges from volatile raw material pricing, particularly bearing-grade steel and specialty alloys that experienced a year-on-year price increase during the first half of 2025, creating margin pressure for manufacturers and uncertainty for long-term supply contracts. Price fluctuations stem from complex global factors including geopolitical tensions affecting international trade, transportation bottlenecks disrupting material flows, mining output variations, and energy cost volatility impacting steel production economics. Small and medium-sized bearing manufacturers face particular difficulty managing raw material cost variations compared to larger multinational corporations that can leverage long-term supply agreements, futures hedging strategies, and diversified sourcing networks to mitigate price risks.

Counterfeit Products Undermining Market Integrity

The proliferation of counterfeit bearings represents a serious challenge affecting product safety, brand reputation, and market credibility across Mexico's manufacturing sector. Counterfeit bearings typically originate from regions with weak intellectual property protections and utilize inferior materials, outdated manufacturing equipment, and inadequate quality control processes resulting in products that compromise vehicle performance, increase failure risks, and reduce operational reliability. These substandard products often feature packaging designed to resemble genuine branded bearings, misleading purchasers and users while creating safety hazards in critical automotive and industrial applications where bearing failures can result in equipment damage, production disruptions, or safety incidents.

Supply Chain Disruptions and Global Trade Uncertainties

The global nature of bearing manufacturing and distribution creates vulnerabilities to supply chain disruptions arising from geopolitical conflicts, transportation bottlenecks, port congestion, pandemic-related restrictions, and trade policy changes affecting material sourcing, component procurement, and finished product distribution. Recent supply chain challenges have demonstrated the automotive and industrial sectors' susceptibility to extended lead times, component shortages, and production disruptions when critical bearing supplies are delayed or unavailable. Trade restrictions, tariff changes, and evolving regulatory requirements add complexity to cross-border operations, particularly for manufacturers serving North American markets through Mexican production facilities that rely on coordinated supply chains spanning multiple countries for raw materials, manufacturing inputs, and component distribution networks.

Competitive Landscape:

The Mexico bearings and bushings market features a competitive landscape dominated by established global manufacturers who collectively maintain significant market presence through comprehensive product portfolios, advanced engineering capabilities, and strategic partnerships with major automotive OEMs and industrial manufacturers. These industry leaders continuously invest in research and development activities focused on developing advanced bearing technologies including low-friction solutions for electric vehicles, current-insulated bearings for electric motor applications, smart bearings with integrated sensor capabilities, and sustainable manufacturable designs supporting circular economy initiatives. Regional and local manufacturers maintain competitive positions through specialized product offerings, responsive customer service, competitive pricing strategies, and established relationships with domestic automotive suppliers and industrial equipment manufacturers across Mexico's major manufacturing clusters.

Recent Developments:

-

In October 2025, CW Bearing has finished Phase 2 of its expansion at the Guanajuato manufacturing site, after three years of installing equipment, optimizing processes, and introducing new production lines. The firm is now preparing a third phase to facilitate additional growth and enhance its status as a supplier to automotive OEMs. Recent investments encompass complete in-house production of ball nuts (IBNA), from steel bar to completed item, growth of four-point and double-row angular contact bearing manufacturing, improved deep groove bearing assembly with new machinery, and the launch of a metrology lab to boost quality control and product validation.

Mexico Bearings and Bushings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Material Types Covered | Metal Bearings and Bushing, Ceramic Bearings, Polymer-Based Bearings and Bushings |

| Application Covered | Automotive, Industrial Machinery, Aerospace and Defense, Railways, Agriculture, Construction and Mining Equipment, Energy and Power, Others |

| Distribution Channel Covered | Original Equipment Manufacturers (OEMs), Aftermarket |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico bearings and bushings market size was valued at USD 2.15 Billion in 2025.

The Mexico bearings and bushings market is expected to grow at a compound annual growth rate of 4.66% from 2026-2034 to reach USD 3.24 Billion by 2034.

Ball bearings hold the largest market share at 40%, driven by widespread automotive applications in wheel hubs, transmissions, and electric motors where they efficiently handle both radial and axial loads while providing compact design and reliable high-speed operation across diverse operating conditions.

Key factors driving the Mexico bearings and bushings market include expanding automotive production reaching nearly four million vehicles annually, surging electric vehicle (EV) manufacturing, nearshoring momentum bringing FDI growth, robust US-Mexico trade totaling, and USMCA trade agreement benefits strengthening regional manufacturing competitiveness.

Major challenges include volatile raw material costs with bearing-grade steel prices rising year-over-year, proliferation of counterfeit products hampering sales of industries, supply chain disruptions from geopolitical tensions, trade policy uncertainties, and transportation bottlenecks affecting material sourcing and distribution networks.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)