Mexico Bearings Market Size, Share, Trends and Forecast by Product, Type, End User, and Region, 2026-2034

Mexico Bearings Market Summary:

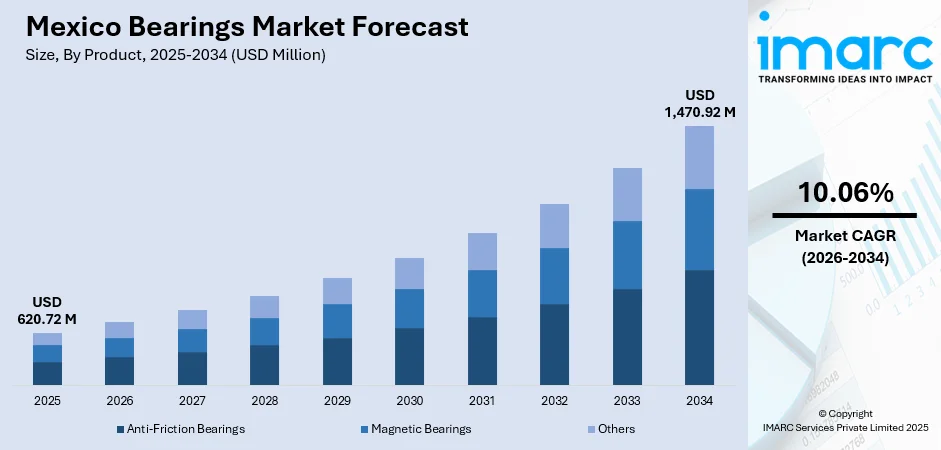

The Mexico bearings market size was valued at USD 620.72 Million in 2025 and is projected to reach USD 1,470.92 Million by 2034, growing at a compound annual growth rate of 10.06% from 2026-2034.

The Mexico bearings market is experiencing robust expansion, driven by the country's thriving automotive manufacturing sector, accelerating nearshoring investments, and growing industrial automation adoption. The market benefits from Mexico's strategic position as a global automotive production hub. Rising demand for high-precision anti-friction bearings across automotive, heavy industry, and aerospace applications continues to significantly strengthen the Mexico bearings market share.

Key Takeaways and Insights:

- By Product: Anti-friction bearings dominate the market with a share of 86% in 2025, owing to their superior friction reduction capabilities, enhanced durability, and widespread adoption across automotive powertrains and industrial machinery. Growing demand for energy-efficient motion components is fueling the market expansion.

- By Type: Ball bearings lead the market with a share of 53% in 2025. This dominance is driven by their versatile applications across electric motors, wheel hubs, and transmission systems, combined with cost-effectiveness and reliable performance under varying load conditions.

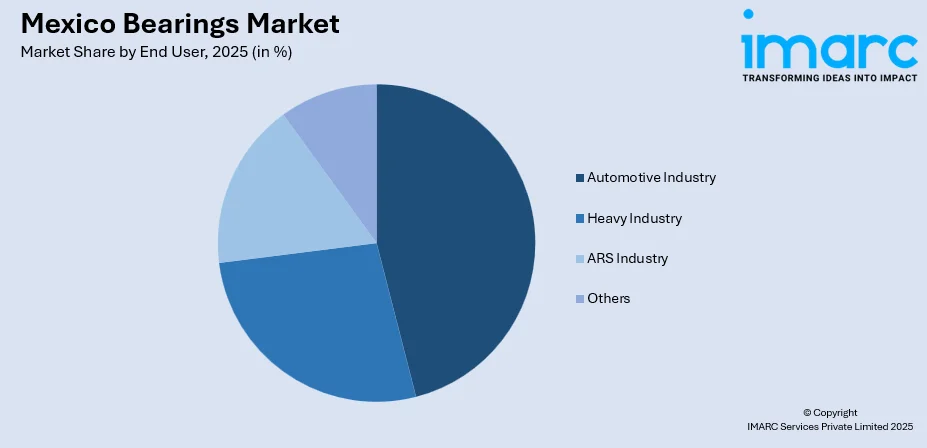

- By End User: Automotive industry represents the largest segment with a market share of 46% in 2025, due to high vehicle production volumes and extensive use of bearings across engines, transmissions, wheels, and steering systems. Continuous vehicle manufacturing and strong aftermarket activities ensure consistent, large-scale consumption of bearings.

- By Region: Northern Mexico comprises the largest region with 38% share in 2025, driven by the concentration of automotive manufacturing clusters in Monterrey, Saltillo, and industrial hubs along the United States-Mexico border corridor.

- Key Players: Key players drive the Mexico bearings market by expanding manufacturing capabilities, investing in electric vehicle (EV)-compatible bearing technologies, and strengthening regional distribution networks. Their strategic focus on precision engineering, aftermarket services, and partnerships with automotive original equipment manufacturers (OEMs) accelerates market penetration and ensures consistent product availability across diverse industrial applications.

To get more information on this market Request Sample

The Mexico bearings market is propelled by the country's expanding industrial manufacturing ecosystem and strategic positioning within North American supply chains. The accelerating nearshoring trend has attracted substantial foreign direct investment (FDI), with Mexico registering a record USD 31 Billion in FDI during the first half of 2024, representing a 7% year-over-year increase. The automotive sector remains the primary growth catalyst, as major original equipment manufacturers continue to expand production facilities across northern and central Mexican states. Rising adoption of industrial automation and robotics across manufacturing facilities is intensifying demand for high-precision bearing solutions that optimize machinery performance and operational efficiency. Furthermore, the expanding EV production capabilities are creating new requirements for specialized bearings designed to handle higher rotational speeds and thermal loads characteristic of electric powertrains and motor systems.

Mexico Bearings Market Trends:

EV Transition Reshaping Bearing Requirements

The transition towards electric mobility is fundamentally transforming bearing specifications across Mexico’s EV manufacturing sector. In 2024, Mexico's adoption of EVs reached 124,000 units, marking a 67% increase from 2023. EV powertrains operate at significantly higher rotational speeds compared to internal combustion engines, necessitating specialized bearings engineered for enhanced thermal management and reduced friction coefficients. Manufacturers are increasingly developing hybrid ceramic bearings and advanced sealing solutions optimized for e-axle applications. This shift is driving innovations in lightweight materials and precision engineering to maximize energy efficiency and extend vehicle driving range.

Industrial Automation Accelerating Precision Bearing Adoption

Mexican manufacturing facilities are rapidly embracing Industry 4.0 technologies, driving demand for high-precision bearings integrated with smart monitoring capabilities. As per IMARC Group, the Mexico Industry 4.0 market size reached USD 2,470.50 Million in 2024. The adoption of robotics, automated assembly systems, and advanced data analytics across automotive and electronics production lines requires bearings that deliver exceptional accuracy and reliability. Manufacturers are incorporating sensor-enabled bearings that facilitate predictive maintenance strategies, reducing equipment downtime and optimizing operational efficiency. This technological evolution is establishing new performance benchmarks for bearing solutions serving automated industrial applications.

Nearshoring Investments Expanding Manufacturing Capacities

The nearshoring phenomenon continues to reshape Mexico's industrial landscape, attracting significant investments from bearing manufacturers seeking to strengthen North American supply chain presence. Companies are establishing local production facilities and expanding existing operations to capitalize on trade agreement advantages and proximity to major automotive markets. This strategic relocation trend is enhancing domestic bearing manufacturing capabilities while shortening lead times for customers across diverse industrial sectors. Regional production expansion is positioning Mexico as an increasingly important bearing manufacturing hub within the Americas.

Market Outlook 2026-2034:

The Mexico bearings market outlook remains highly favorable, underpinned by sustained automotive production growth, industrial modernization initiatives, and expanding EV manufacturing capabilities. The market generated a revenue of USD 620.72 Million in 2025 and is projected to reach a revenue of USD 1,470.92 Million by 2034, growing at a compound annual growth rate of 10.06% from 2026-2034. Strategic investments by global bearing manufacturers, government-supported industrial development programs, and Mexico's strengthening position as a nearshoring destination are expected to sustain market momentum throughout the forecast period.

Mexico Bearings Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Anti-Friction Bearings | 86% |

| Type | Ball Bearings | 53% |

| End User | Automotive Industry | 46% |

| Region | Northern Mexico | 38% |

Product Insights:

- Anti-Friction Bearings

- Magnetic Bearings

- Others

Anti-friction bearings dominate with a market share of 86% of the total Mexico bearings market in 2025.

Anti-friction bearings have established market dominance owing to their exceptional capability to minimize friction between rotating components while supporting substantial load capacities across diverse industrial applications. These bearings are extensively deployed in automotive powertrains, wheel assemblies, and transmission systems where reliable performance under varying operational conditions is essential. The growing emphasis on energy efficiency and reduced maintenance requirements across Mexican manufacturing facilities continues to drive preference for advanced anti-friction bearing solutions.

The segment's expansion is further supported by technological innovations in bearing materials and design optimization that enhance durability and thermal performance. Mexican manufacturers increasingly prioritize anti-friction bearings for their ability to improve machinery efficiency, extend equipment service life, and reduce overall operational costs across automotive and industrial applications.

Type Insights:

- Ball Bearings

- Roller Bearings

- Plain Bearings

- Others

Ball bearings lead with a share of 53% of the total Mexico bearings market in 2025.

Ball bearings maintain market leadership, owing to their versatile design that efficiently handles both radial and axial loads while delivering smooth rotational motion across numerous applications. Their widespread adoption stems from cost-effectiveness, simplified manufacturing processes, and proven reliability in automotive motors, wheel hubs, and consumer appliances. The expanding production of electric scooters and electric cars in Mexico is intensifying demand for specialized ball bearings engineered for high-speed electric motor applications requiring exceptional precision and minimal friction losses. As per IMARC Group, the Mexico electric scooters market size reached USD 444.84 Million in 2024.

The ball bearings segment continues to benefit from material science advancements and improved manufacturing techniques that enhance performance characteristics. Deep groove ball bearings remain particularly popular for their ability to accommodate high rotational speeds while maintaining operational stability under varying temperature conditions. Additionally, hybrid ceramic ball bearings are gaining traction in EV powertrains where reduced electrical conductivity and superior thermal management capabilities are critical performance requirements for optimizing drivetrain efficiency and longevity.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Automotive Industry

- Heavy Industry

- ARS Industry

- Others

Automotive industry exhibits a clear dominance with a 46% share of the total Mexico bearings market in 2025.

The automotive industry commands the largest market share, reflecting Mexico's prominent position as the world's fifth-largest vehicle exporter and a critical manufacturing hub within North American automotive supply chains. This substantial production volume generates consistent demand for diverse bearing types utilized across engine components, transmission systems, wheel assemblies, and steering mechanisms.

Major global automakers operate extensive manufacturing facilities across Mexico, creating sustained requirements for high-quality bearing solutions. The ongoing transition towards EVs is reshaping bearing specifications within the automotive sector, with manufacturers developing specialized products optimized for electric motor applications and advanced drivetrain systems. Furthermore, the robust automotive aftermarket segment contributes significantly to bearing demand through replacement and maintenance requirements across Mexico's large vehicle fleet.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico represents the leading region with a 38% share of the total Mexico bearings market in 2025.

Northern Mexico maintains market leadership, driven by the concentration of automotive manufacturing clusters across states, including Nuevo León, Coahuila, and Chihuahua. The region benefits from strategic proximity to United States border crossings, facilitating efficient cross-border trade and supply chain integration. Monterrey has emerged as a particularly dynamic manufacturing center, with the automotive sector securing USD 4.16 Billion in investment during 2024 alone, generating more than 110,000 direct jobs across powertrain manufacturing, electronics, and e-mobility technologies.

The region's robust industrial infrastructure, skilled workforce availability, and extensive transportation networks continue to attract FDI from bearing manufacturers and automotive suppliers. Major cities, including Saltillo and Ciudad Juárez, complement the regional manufacturing ecosystem, providing diversified production capabilities across automotive components, heavy machinery, and electronics sectors requiring high-quality bearing solutions.

Market Dynamics:

Growth Drivers:

Why is the Mexico Bearings Market Growing?

Expansion of the Automotive Manufacturing Ecosystem

The expansion of Mexico’s automotive manufacturing ecosystem is a major driver of the bearings market. Bearings are essential components in engines, transmissions, wheel hubs, steering systems, and auxiliary assemblies, ensuring smooth motion and durability. Rising vehicle production volumes increase original equipment demand, while long vehicle lifecycles generate continuous aftermarket replacement needs. In October 2025, new light vehicle sales in Mexico increased by 6.3% compared to 2024, totaling 129,736 units. Growth in both passenger and commercial vehicle segments supports diverse bearing requirements. Automotive suppliers and component manufacturers also increase localized sourcing, strengthening domestic bearing consumption. As vehicle models evolve with higher performance standards, demand for precision and long-lasting bearings rises. Export-oriented vehicle production further amplifies volume requirements. This strong linkage between automotive output and component usage ensures stable, large-scale demand. As Mexico remains a key automotive manufacturing hub, the bearings market benefits from sustained and predictable growth driven by vehicle assembly and replacement cycles.

Rising Industrialization and Manufacturing Output

Industrialization across Mexico significantly drives bearing demand across multiple sectors. Bearings are widely used in industrial machinery, conveyors, motors, compressors, and processing equipment. The expansion of manufacturing activities is increasing operational machinery counts, directly raising bearing consumption. Industries, such as food processing, packaging, textiles, and metalworking, rely on bearings for continuous and efficient operations. Increased automation also boosts demand for high-precision bearings capable of supporting high-speed and heavy-load applications. Industrial maintenance schedules create steady replacement demand. As factories are scaling up production and modernizing equipment, bearing usage is intensifying. The growth of export-driven manufacturing further strengthens demand for reliable mechanical components. This broad-based industrial expansion supports consistent bearing consumption, making manufacturing growth a core driver of the Mexico bearings market.

Infrastructure Development and Construction Equipment Demand

Ongoing infrastructure development across Mexico drives strong demand for bearings used in construction equipment and heavy machinery. As per IMARC Group, the Mexico construction equipment market size reached USD 1.5 Billion in 2024. Bearings are critical components in excavators, cranes, loaders, mixers, and material handling systems. Large infrastructure projects require reliable equipment capable of operating under heavy loads and harsh conditions. Continuous equipment operation increases wear, leading to frequent bearing replacement. Growth in transportation networks, urban development, and public infrastructure supports sustained equipment utilization. Construction machinery manufacturers and service providers require high-durability bearings to minimize downtime. As infrastructure projects progress across regions, demand for both original equipment and replacement bearings remains strong. This steady equipment usage makes infrastructure development an important growth factor for the Mexico bearings market.

Market Restraints:

What Challenges is the Mexico Bearings Market Facing?

Import Dependency and Raw Material Cost Fluctuations

The Mexico bearings market faces challenges from significant import dependency for specialized bearing components and raw materials essential for domestic manufacturing operations. Fluctuations in international steel prices and supply chain disruptions can impact production costs and profit margins for bearing manufacturers. High import duties on certain bearing categories further contribute to elevated product pricing, potentially limiting adoption across price-sensitive market segments.

Counterfeit Products and Quality Concerns

The proliferation of counterfeit bearings in the Mexican market poses significant challenges to legitimate manufacturers and end-users seeking reliable components. Substandard products entering distribution channels undermine quality standards and create safety risks across industrial applications. Counterfeiting activities impact market pricing dynamics while eroding consumer confidence in bearing products, particularly within aftermarket segments where product authentication presents ongoing challenges.

Infrastructure and Energy Supply Constraints

Mexico's rapid industrial expansion has outpaced infrastructure development in certain regions, creating challenges for bearing manufacturers requiring reliable energy supplies and transportation connectivity. Power grid limitations in some industrial zones can impact manufacturing operations and facility expansion plans. Addressing these infrastructure gaps requires substantial investment coordination between government agencies and private sector stakeholders to maintain manufacturing competitiveness in the market.

Competitive Landscape:

The Mexico bearings market exhibits a moderately consolidated structure with prominent global manufacturers maintaining substantial market presence alongside regional distributors and specialized suppliers. Leading international companies leverage extensive product portfolios, advanced manufacturing technologies, and established relationships with automotive OEMs to capture significant market share. Competition intensifies around product quality, technical support capabilities, pricing strategies, and supply chain reliability. Market participants increasingly focus on developing application-specific bearing solutions, particularly for EV and automation applications, while strengthening aftermarket service networks to capture replacement demand across Mexico's growing industrial base.

Mexico Bearings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Anti-Friction Bearings, Magnetic Bearings, Others |

| Types Covered | Ball Bearings, Roller Bearings, Plain Bearings, Others |

| End Users Covered | Automotive Industry, Heavy Industry, ARS Industry, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico bearings market size was valued at USD 620.72 Million in 2025.

The Mexico bearings market is expected to grow at a compound annual growth rate of 10.06% from 2026-2034 to reach USD 1,470.92 Million by 2034.

Anti-friction bearings dominated the market with a share of 86%, owing to their superior friction reduction capabilities, widespread adoption across automotive powertrains, and growing emphasis on energy-efficient motion components.

Key factors driving the Mexico bearings market include expanding automotive manufacturing capacity, accelerating nearshoring investments, growing EV production, industrial automation adoption, and Mexico's strategic position within North American supply chains.

Major challenges include import dependency and raw material cost fluctuations, counterfeit product proliferation, infrastructure and energy supply constraints in rapidly expanding industrial zones, and intensifying competition for skilled manufacturing workforce across the country's industrial corridors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)