Mexico Bed Linen Market Size, Share, Trends and Forecast by Type, Application, Distribution Channel, and Region, 2026-2034

Mexico Bed Linen Market Summary:

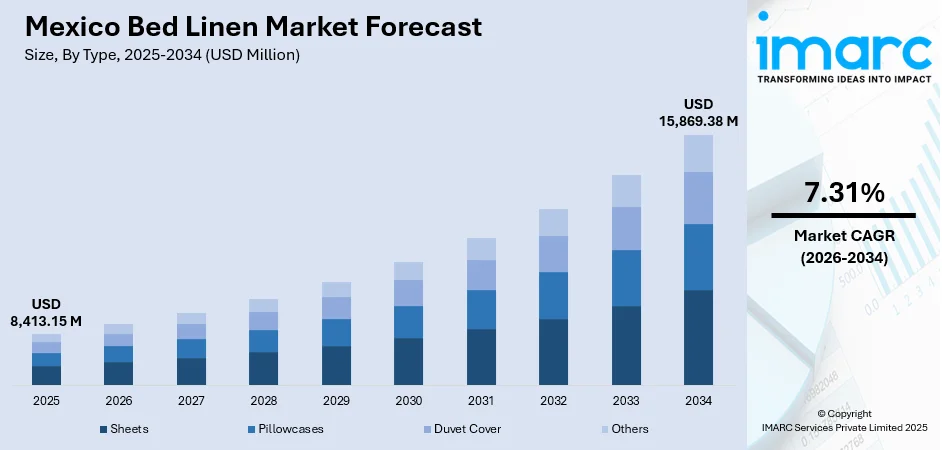

The Mexico bed linen market size was valued at USD 8,413.15 Million in 2025 and is projected to reach USD 15,869.38 Million by 2034, growing at a compound annual growth rate of 7.31% from 2026-2034.

The Mexico bed linen market is experiencing robust expansion fueled by rapid urban growth, higher household earnings, and a rising inclination among consumers toward upscale home textile products. The evolving lifestyle patterns and heightened awareness regarding sleep quality are significantly influencing purchasing decisions. Additionally, the expanding hospitality and tourism sectors, coupled with the rapid growth of e-commerce platforms, are creating diverse opportunities for market participants seeking to capitalize on changing consumer preferences and retail dynamics.

Key Takeaways and Insights:

- By Type: Sheets dominate the market with a share of 42% in 2025, driven by their essential role in daily household use and frequent replacement cycles, combined with growing consumer interest in premium fabric quality and aesthetically appealing designs.

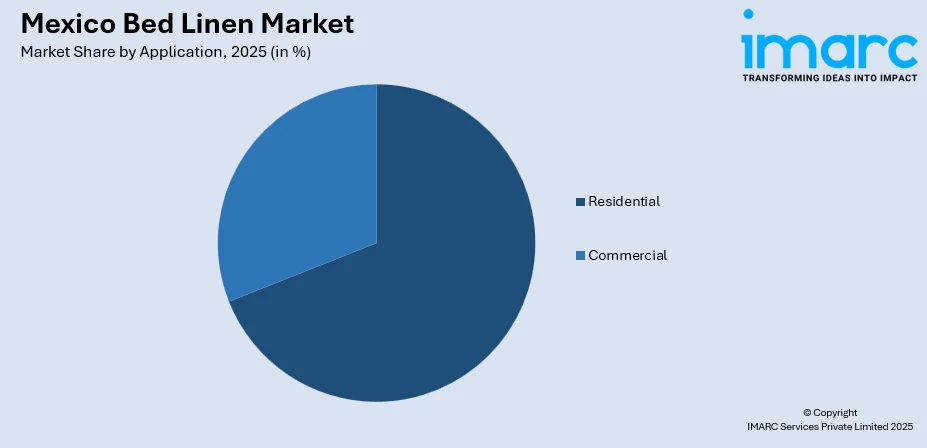

- By Application: Residential leads the market with a share of 69% in 2025, attributed to the expanding middle-class population, increasing homeownership rates, and rising consumer spending on home décor and comfort-enhancing products.

- By Distribution Channel: Offline represents the largest segment with a market share of 71% in 2025, owing to consumers' preference for physical examination of fabric quality and texture before purchase, supported by extensive retail networks across urban and suburban areas.

- By Region: Central Mexico exhibits clear dominance with a 35% share in 2025, reflecting the concentration of population centers, higher purchasing power in metropolitan areas like Mexico City, and the presence of major retail infrastructure.

- Key Players: The Mexico bed linen market exhibits moderate competitive intensity, with a mix of international brands and domestic manufacturers competing across various price segments. Market participants are focusing on product innovation, sustainable materials, and omnichannel distribution strategies to strengthen their market positions and capture emerging consumer preferences.

To get more information on this market Request Sample

The Mexico bed linen market is witnessing transformative growth driven by fundamental shifts in consumer lifestyles and purchasing behaviors. The country's expanding middle class, representing over forty million households, is increasingly prioritizing home comfort and aesthetics, creating substantial demand for quality bedding products. Urbanization trends have accelerated, fostering greater exposure to modern home furnishing concepts and international design influences. As of 2024, Mexico’s urban population stands at 81.86%, reflecting a slight rise from 81.58% recorded in 2023. The hospitality sector's expansion, evidenced by the addition of thousands of new hotel rooms annually across major tourist destinations, has created robust institutional demand for premium bed linens. Furthermore, the growing awareness regarding the relationship between sleep quality and overall well-being has prompted consumers to invest in superior bedding products, thereby supporting market expansion across both value and premium segments.

Mexico Bed Linen Market Trends:

Rising Demand for Sustainable and Organic Bedding Materials

The surge in environmental consciousness among Mexican consumers is driving significant demand for eco-friendly bed linen products. Organic cotton, bamboo-derived fabrics, and recycled materials are gaining substantial traction as consumers increasingly prioritize sustainability in their purchasing decisions. Major retailers are responding by expanding their certified organic product lines and emphasizing environmental credentials in marketing communications. This shift toward sustainable bedding aligns with broader global trends favoring ethical consumption and is particularly prominent among younger demographic segments seeking products that reflect their environmental values.

Digital Transformation and E-Commerce Penetration

The digital transformation of retail is fundamentally reshaping how Mexican consumers discover and purchase bed linen products. E-commerce platforms have emerged as increasingly important distribution channels, offering consumers convenience, extensive product variety, and competitive pricing. The Mexico e-commerce market size reached USD 54.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 175.8 Billion by 2034, exhibiting a growth rate (CAGR) of 13.92% during 2026-2034. Social media and influencer marketing have become powerful tools for brand engagement, particularly among urban millennials and Generation Z consumers who value peer recommendations and authentic content. Retailers are implementing omnichannel strategies, integrating physical and digital touchpoints to deliver seamless shopping experiences that meet evolving consumer expectations.

Integration of Smart and Functional Textiles

The integration of advanced technologies into bedding products represents an emerging trend in the Mexico bed linen market. Smart textiles featuring temperature-regulating properties, antimicrobial treatments, and moisture-wicking capabilities are gaining consumer interest. These innovations address growing health and wellness consciousness, with consumers seeking products that enhance sleep quality and hygiene. Premium segments are witnessing particular interest in performance-oriented bedding that combines comfort with functional benefits, reflecting broader lifestyle trends emphasizing holistic well-being and technological convenience.

Market Outlook 2026-2034:

The Mexico bed linen market is set to experience steady growth over the forecast period, driven by positive demographic shifts and changing consumer tastes. The continued expansion of the middle class, combined with increasing urbanization and rising disposable incomes, will drive demand across both residential and commercial segments. The hospitality sector's recovery and expansion, particularly in tourist-centric regions, will contribute significantly to institutional demand. Innovation in sustainable materials and smart textiles will create differentiation opportunities for market participants. The market generated a revenue of USD 8,413.15 Million in 2025 and is projected to reach a revenue of USD 15,869.38 Million by 2034, growing at a compound annual growth rate of 7.31% from 2026-2034.

Mexico Bed Linen Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Sheets | 42% |

| Application | Residential | 69% |

| Distribution Channel | Offline | 71% |

| Region | Central Mexico | 35% |

Type Insights:

- Sheets

- Pillowcases

- Duvet Covers

- Others

The sheets segment dominates with a market share of 42% of the total Mexico bed linen market in 2025.

Sheets represent the foundational element of bedding ensembles and experience the highest replacement frequency among all bed linen categories. The segment's dominance reflects the essential nature of sheets in daily use, with consumers increasingly seeking products that combine comfort, durability, and aesthetic appeal. Premium cotton sheets, particularly those featuring high thread counts and sateen or percale weaves, have gained significant traction among quality-conscious consumers willing to invest in superior sleep experiences.

The increasing consumer awareness about fabric quality and its influence on sleep has encouraged manufacturers to develop a wide range of product lines targeting different price segments and preferences. Advances in fabric technologies, such as wrinkle-resistant finishes and temperature-regulating properties, have further boosted product attractiveness. Seasonal buying trends also play a role, as customers frequently update their bedding to align with changing climate conditions, ensuring comfort throughout the year. These factors collectively drive innovation, variety, and sustained demand in the bedding and textile market.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

The residential segment leads with a share of 69% of the total Mexico bed linen market in 2025.

The residential segment's dominance reflects the fundamental importance of bed linens in every household, coupled with the expanding homeownership rates and growing middle-class population across Mexico. Rising disposable incomes have enabled consumers to prioritize home comfort and aesthetics, driving demand for quality bedding products across various price segments. The increasing trend of home decoration and the influence of interior design media have elevated bed linens from necessities to style statements.

Consumer preferences within the residential segment are evolving toward products that combine functionality with design versatility. The influence of international home décor trends, accessible through digital platforms and social media, has expanded consumer expectations regarding product variety and quality. Additionally, the growing focus on wellness and sleep quality has prompted residential consumers to invest in premium bedding products that promise enhanced comfort and health benefits.

Distribution Channel Insights:

- Online

- Offline

The offline segment exhibits a clear dominance with a 71% share of the total Mexico bed linen market in 2025.

The dominance of offline distribution channels highlights consumers’ preference for physically examining bedding products before making a purchase. Retail formats such as supermarkets, hypermarkets, specialty stores, and department stores allow shoppers to evaluate fabric quality, texture, and color accuracy firsthand. A widespread retail presence across urban and suburban areas ensures convenient access, while knowledgeable sales staff provide assistance with product selection, care guidance, and usage tips. This combination of accessibility, tactile evaluation, and personalized support reinforces the continued importance of offline channels in the bedding market.

Department stores and specialty home furnishing retailers have strengthened their market presence by offering immersive shopping experiences that display bed linen within styled room setups. This experiential approach enables consumers to envision products in their own living spaces, supporting informed purchase decisions. Complementary initiatives, including promotional campaigns, loyalty programs, and product bundling, further attract shoppers to physical stores. By combining visual inspiration with practical incentives, these retailers enhance customer engagement, increase foot traffic, and foster brand loyalty in the competitive bedding and home textiles sector.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Central Mexico dominates the regional landscape with a 35% share of the total Mexico bed linen market in 2025.

Central Mexico’s market leadership is largely driven by the presence of major metropolitan areas, including Mexico City and nearby urban centers, which account for a significant share of the country’s population with relatively higher disposable incomes. The region boasts a well-established retail ecosystem, encompassing large shopping malls, department stores, and specialty home furnishing outlets, providing extensive product availability and a wide range of shopping choices. This combination of population density, purchasing power, and retail accessibility reinforces Central Mexico’s prominence as a key market for bed linen and home textile products.

The demand for premium and mid-range bed linen in Central Mexico is fueled by a sizeable middle and upper-middle-class population. The region benefits from active hospitality sector operations, including hotels, boutique lodgings, and vacation rentals, which regularly procure bedding products. Additionally, the presence of interior design services and home furnishing showrooms shapes consumer preferences and drives adoption of contemporary trends. These factors collectively contribute to strong market demand, encouraging retailers and manufacturers to focus on Central Mexico as a strategic hub for bed linen sales.

Market Dynamics:

Growth Drivers:

Why is the Mexico Bed Linen Market Growing?

Expanding Middle Class and Rising Disposable Incomes

Mexico's expanding middle class represents a fundamental driver of bed linen market growth. Economic development has enabled millions of households to transition into middle-income status, substantially increasing discretionary spending capacity. This demographic shift has transformed consumer attitudes toward home furnishings, with households increasingly viewing quality bed linens as essential investments in comfort and well-being rather than mere functional necessities. Rising disposable incomes have facilitated the purchase of premium products featuring superior fabrics, innovative designs, and brand credentials. The aspirational nature of middle-class consumption further amplifies demand, as households seek products that reflect improved living standards and personal achievement.

Rapid Urbanization and Changing Lifestyle Patterns

Mexico's ongoing urbanization continues to reshape consumption patterns and drive bed linen market expansion. Urban environments expose consumers to contemporary home décor concepts through retail displays, media influence, and social interactions. City dwellers typically maintain smaller living spaces where bedroom aesthetics and comfort assume heightened importance. The fast-paced urban lifestyle has intensified focus on quality sleep and home sanctuary concepts, prompting investment in superior bedding products. Furthermore, urban consumers demonstrate greater receptivity to new trends, sustainable products, and premium offerings, collectively elevating average transaction values and market revenue.

Hospitality Sector Expansion and Tourism Growth

The expansion of Mexico's hospitality sector creates substantial institutional demand for bed linen products. The country's position as a premier tourist destination drives continuous investment in accommodation facilities, from luxury resorts to boutique hotels and vacation rentals. In 2024, Mexico’s tourism industry maintained a strong post-pandemic rebound, accounting for 8.6% of the country’s GDP and providing employment for more than 4.9 million individuals. The nation welcomed 27 million visitors, including 22.3 million arrivals by air, with 63% originating from the United States, highlighting Mexico’s sustained attractiveness as a global travel destination. Hotels maintain rigorous replacement schedules for bed linens to ensure guest satisfaction and maintain brand standards. The expanding short-term rental sector has generated increased demand, as property owners prioritize high-quality bedding to enhance guest satisfaction, secure positive feedback, and encourage repeat stays. Moreover, sustainability initiatives within the hospitality sector are driving the adoption of eco-friendly bed linen options, creating opportunities for differentiated product offerings.

Market Restraints:

What Challenges is the Mexico Bed Linen Market Facing?

Competition from Low-Cost Imports

The influx of low-priced bed linen imports, particularly from Asian manufacturing centers, creates significant competitive pressure on domestic producers and established brands. These imports often undercut local pricing structures, squeezing profit margins and challenging market sustainability for quality-focused manufacturers. While government tariff measures aim to address this issue, the price sensitivity of certain consumer segments continues to favor imported alternatives over domestically produced or branded products.

Raw Material Price Volatility

Fluctuations in cotton and synthetic fiber prices create uncertainty for bed linen manufacturers and distributors. Raw material costs directly impact production economics and ultimately consumer pricing. When material costs rise unexpectedly, manufacturers face difficult choices between absorbing margin compression or passing increases to consumers, potentially affecting demand. Supply chain disruptions and global commodity market dynamics add layers of complexity to procurement planning and pricing strategies.

Consumer Price Sensitivity and Limited Premium Awareness

Despite rising incomes, significant consumer segments remain highly price-sensitive when purchasing bed linens. Limited awareness regarding the tangible benefits of premium products, including superior fabric quality, durability, and comfort advantages, constrains market premiumization efforts. Many consumers struggle to distinguish quality differentials among products, defaulting to price-based purchasing decisions that limit revenue growth opportunities for quality-focused market participants.

Competitive Landscape:

The Mexico bed linen market exhibits moderate competitive intensity characterized by the presence of both international brands and domestic manufacturers competing across diverse market segments. The competitive landscape is stratified, with premium segments dominated by established international brands leveraging their heritage, quality credentials, and sophisticated marketing capabilities. Mid-range segments witness intense competition among both international and local players, with differentiation achieved through product innovation, design diversity, and value propositions. Mass-market segments remain highly competitive, with price positioning and distribution reach serving as primary competitive factors. Market participants are increasingly investing in sustainable product development, digital marketing capabilities, and omnichannel distribution strategies to strengthen market positions. The evolving retail landscape, including e-commerce growth, is prompting traditional players to enhance their digital presence while enabling new entrants to access consumers directly.

Recent Developments:

- In January 2025, the Mexican government implemented significant tariff measures on textile imports, including bed linens, with finished products now facing a thirty-five percent import tariff. This policy aims to protect domestic manufacturing capabilities and strengthen the local textile industry's competitive position.

Mexico Bed Linen Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Sheets, Pillowcases, Duvet Covers, Others |

| Applications Covered | Residential, Commercial |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico bed linen market size was valued at USD 8,413.15 Million in 2025.

The Mexico bed linen market is expected to grow at a compound annual growth rate of 7.31% from 2026-2034 to reach USD 15,869.38 Million by 2034.

Sheets dominated the market with a 42% share in 2025, driven by their essential role in daily household use, frequent replacement requirements, and growing consumer preference for premium fabric quality and aesthetically appealing designs.

Key factors driving the Mexico bed linen market include rising disposable incomes, rapid urbanization, expanding middle-class population, growing hospitality sector demand, increasing consumer awareness regarding sleep quality, and the proliferation of e-commerce channels enabling broader product accessibility.

Major challenges include competition from low-cost Asian imports, fluctuating raw material prices affecting production costs, consumer price sensitivity limiting premiumization, counterfeit products in informal markets, and the need for greater consumer education regarding quality differentials and sustainable product benefits.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)