Mexico Bedsheet Market Size, Share, Trends and Forecast by Type, Application, Sales Channel, and Region, 2026-2034

Mexico Bedsheet Market Summary:

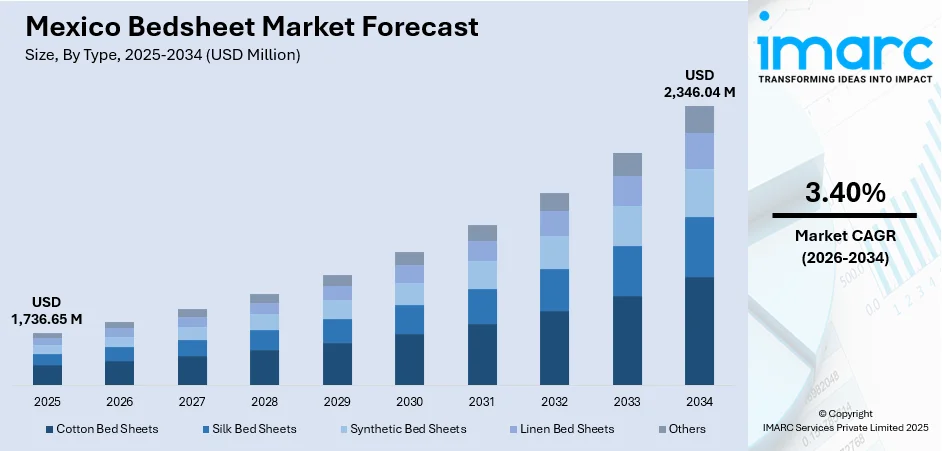

The Mexico bedsheet market size was valued at USD 1,736.65 Million in 2025 and is projected to reach USD 2,346.04 Million by 2034, growing at a compound annual growth rate of 3.40% from 2026-2034.

Market growth is propelled by rapid urban developments along with nearly 80% of population living in urban areas, rising disposable incomes, and accelerating e-commerce adoption with online retail sales surging annually. Apart from this, the flourishing residential construction sector, particularly affordable housing initiatives targeting new homes, coupled with heightened awareness about sleep quality and home aesthetics, expanding the Mexico bedsheet market share.

Key Takeaways and Insights:

- By Type: Cotton bed sheets dominate the market with a share of 48.02% in 2025, driven by the material's superior breathability, durability, and comfort properties preferred by Mexican consumers.

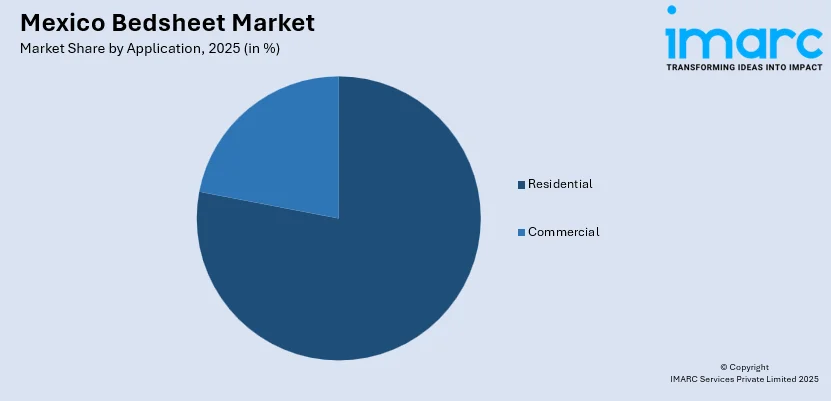

- By Application: Residential leads the market with a share of 78.05% in 2025, reflecting widespread household adoption and the primacy of home comfort expenditures among urban and suburban populations.

- By Sales Channel: Supermarket and hypermarket represent the largest segment with a market share of 41.12% in 2025, benefiting from extensive retail networks and consumers' preference for tactile product evaluation before purchase.

- By Region: Central Mexico leads the market with a share of 33% in 2025, anchored by high population density in Mexico City, Guadalajara, and surrounding metropolitan areas with elevated purchasing power.

- Key Players: The Mexico bedsheet market exhibits moderate competitive intensity, with established department store chains, international home textile brands, and regional manufacturers competing across price segments to capture market share.

To get more information on this market Request Sample

The market landscape is shaped by several converging factors that reinforce growth momentum. Urban developments are increasing in the country with a major section of population residing in urban areas. This demographic shift has amplified demand for home furnishing products as newly urbanized households establish residences and prioritize interior comfort. E-commerce penetration surged dramatically, with Mexico achieving 84% online shopping penetration among adults and 67.2 million consumers making at least one online purchase annually. In January 2025, Walmart Mexico announced a six billion dollar investment program to expand stores and supply chain hubs while adding a massive number of jobs, exemplifying major retailers' commitment to capturing the expanding home goods market. Housing construction activity accelerated with government initiatives targeting affordable housing units, creating sustained demand for furnishing newly constructed residences.

Mexico Bedsheet Market Trends:

Digital Commerce Transformation Reshaping Distribution Channels

Mexico's bedsheet market is experiencing profound transformation through e-commerce expansion, fundamentally altering how consumers discover and purchase bedding products. Digital retail captured 15.8 percent of total retail in 2024. Mobile commerce representing 78% of total e-commerce volume in 2024, with customers increasingly favoring the convenience of browsing extensive product catalogs from smartphones. The proliferation of digital payment solutions, including Mercado Pago and buy-now-pay-later services, has democratized access to premium bedding products for consumers across income brackets. Social media commerce is projected to account for 40 percent of all online sales by 2025, exceeding six billion dollars in transaction value.

Sustainability and Organic Material Preferences Gaining Prominence

Consumer demand for environmentally conscious bedding options is intensifying across Mexico, reflecting global trends toward sustainable textile consumption. Organic cotton and bamboo fiber bedsheets are gaining market traction among health-conscious consumers seeking chemical-free sleeping environments, with manufacturers increasingly highlighting Global Organic Textile Standard certifications. The emphasis on eco-friendly textiles aligns with broader environmental consciousness, exemplified by the State of Mexico government unveiling four significant environmental initiatives in January 2025 to establish the area as a sustainability leader. Mexicans are progressively prioritizing products manufactured through ethical production processes and Fair Trade practices, valuing transparency in supply chains. Recycled cotton and closed-loop manufacturing systems are emerging as competitive differentiators for premium bedsheet brands targeting environmentally aware middle-class households. The integration of moisture-wicking organic fibers appeals particularly to people with sensitive skin and allergies, expanding market reach beyond traditional eco-conscious demographics to include health-focused consumers seeking hypoallergenic bedding solutions.

Premium Home Aesthetics Elevating Product Expectations

The Mexico bedsheet market is witnessing elevated consumer expectations for design sophistication and premium materials, driven by social media influence and interior design trends. People increasingly view bedding as integral to overall home aesthetics rather than purely functional purchases, with demand surging for visually appealing patterns, textures, and color palettes that complement contemporary bedroom designs. The influence of interior design content on platforms including Instagram and Pinterest has cultivated heightened awareness of home decor possibilities, prompting consumers to invest in coordinated bedding ensembles. Department stores have expanded their premium bedding offerings to capture this trend, partnering with international brands to provide Mexican consumers access to high-end home textile products. In 2024, renowned American department store chain TJ Maxx stepped into Mexico via a strategic alliance with retail brand distributor Grupo Axo. TJ Max stores were planned to open from 2025.

Market Outlook 2026-2034:

The Mexico bedsheet market is positioned for sustained expansion through 2033, propelled by demographic tailwinds, technological adoption, and evolving user preferences. The market generated a revenue of USD 1,736.65 Million in 2025 and is projected to reach a revenue of USD 2,346.04 Million by 2034, growing at a compound annual growth rate of 3.40% from 2026-2034. E-commerce channels will capture progressively larger market shares as internet penetration advances. The sustainability movement will intensify, with eco-conscious consumers driving manufacturers to expand organic cotton, bamboo, and recycled textile offerings while maintaining competitive pricing through supply chain efficiency.

Mexico Bedsheet Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Cotton Bed Sheets | 48.02% |

| Application | Residential | 78.05% |

| Sales Channel | Supermarket and Hypermarket | 41.12% |

| Region | Central Mexico | 33% |

Type Insights:

- Cotton Bed Sheets

- Silk Bed Sheets

- Synthetic Bed Sheets

- Linen Bed Sheets

- Others

Cotton bed sheets dominate with a market share of 48.02% of the total Mexico bedsheet market in 2025.

Cotton bedsheets command market leadership across Mexico owing to intrinsic material advantages that resonate with user priorities for comfort, breathability, and durability. The natural fiber properties of cotton enable superior moisture absorption and air circulation, creating optimal sleeping conditions in Mexico's diverse climate zones ranging from humid coastal regions to temperate highland areas. People across income brackets recognize cotton's longevity compared to synthetic alternatives, justifying higher initial investment through extended product lifecycles that reduce replacement frequency.

The material's hypoallergenic characteristics appeal particularly to households with children and individuals with sensitive skin, positioning cotton as the default choice for health-conscious consumers. Traditional cultural preferences for natural fibers reinforce cotton's market dominance, with established consumer trust built through generations of usage experience. In December 2024, the Mexican government imposed a 35 percent tariff on textile imports from countries without free trade agreements, primarily targeting synthetic products, which indirectly strengthened demand for domestically available cotton bedsheet options. Premium Egyptian cotton and Pima cotton variants capture high-end market segments, while affordable cotton blends serve budget-conscious consumers, enabling comprehensive market coverage across price points.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

Residential leads with a share of 78.05% of the total Mexico bedsheet market in 2025.

Residential drive overwhelming market demand as bedsheets constitute essential household items requiring periodic replacement to maintain hygiene standards and aesthetic preferences. Mexican households prioritize bedroom comfort as foundational to quality of life, allocating significant portions of home furnishing budgets to bedding purchases that directly impact daily sleep experiences. Increase in urban developments in 2024 has expanded the residential customer base as rural populations migrate to cities and establish urban households requiring complete bedding ensembles for new residences. The growing middle class with rising disposable incomes increasingly purchases multiple bedsheet sets to enable regular rotation, extending product usage frequency while maintaining freshness and variety in bedroom aesthetics.

In 2025, the National Workers' Housing Fund Institute announced plans to construct 1.2 million homes during the current presidential term, substantially exceeding the initial target of 500,000 homes, which will generate massive demand for bedding products to furnish newly constructed residential units. Young demographics, including millennials and Generation Z establishing first independent households, represent a crucial consumer segment with preferences for contemporary designs and willingness to explore premium organic and sustainable bedsheet options. Cultural practices emphasizing home hospitality encourage Mexican families to maintain guest bedrooms with quality bedding, multiplying per-household bedsheet requirements beyond primary bedroom needs.

Sales Channel Insights:

- Supermarket and Hypermarket

- Specialty Store

- Online

Supermarket and hypermarket exhibit a clear dominance with a 41.12% share of the total Mexico bedsheet market in 2025.

Supermarkets and hypermarkets dominate bedsheet distribution owing to extensive physical footprints that provide convenient shopping access across urban and suburban areas throughout Mexico. Major chains including Walmart Mexico, with over 2,700 stores nationwide, and Liverpool, operating 82 locations, offer comprehensive bedding selections that enable people to physically examine fabric quality, thread count, and color accuracy before purchase. The tactile evaluation capability remains crucial for bedsheet purchases where texture and feel constitute primary purchase criteria that digital channels cannot adequately convey through product descriptions and images.

Integrated shopping experiences allow individuals to purchase bedsheets alongside complementary home goods during single shopping trips, leveraging operational efficiencies that reduce travel time and costs. Promotional events including Hot Sale, which generated 23.8 percent growth in online retail sales during El Buen Fin 2024, extend to physical stores where consumers combine in-store evaluation with sale pricing to maximize value. In 2025, Walmart Mexico committed six billion dollars to expand stores and supply chain infrastructure, signaling continued investment in physical retail despite e-commerce growth.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Central Mexico leads with a share of 33% of the total Mexico bedsheet market in 2025.

Central Mexico's market dominance stems from concentrated population density, elevated income levels, and robust retail infrastructure anchored by Mexico City, Guadalajara, and Toluca metropolitan areas. Mexico City alone comprises a major portion of the nation's total urban population, creating massive customer concentrations that attract both domestic and international bedsheet brands establishing market presence. The region's economic vitality, driven by diversified industries including finance, technology, and manufacturing, generates high disposable incomes that enable premium bedsheet purchases beyond basic commodity products.

Apart from this, the average monthly rent in Mexico City increased, indicating substantial purchasing power among resident populations. Retail infrastructure density in Central Mexico surpasses other regions. E-commerce adoption rates exceed national averages in Central Mexico, supported by superior internet connectivity and logistics infrastructure enabling reliable product delivery. The region's housing construction activity remains robust, with Mexico City requiring new dwellings in central boroughs by 2030 to meet demand, creating sustained bedsheet requirements for furnishing newly constructed residences.

Market Dynamics:

Growth Drivers:

Why is the Mexico Bedsheet Market Growing?

Accelerating Housing Construction Activity

Mexico's rapid urbanization trajectory constitutes a fundamental growth driver for the bedsheet market as population migration from rural to urban areas creates continuous demand for home furnishing products. Urban population reached 81.86 percent in 2024, increasing from the previous year, with absolute urban resident numbers expanding as both migration and natural population growth concentrate in metropolitan areas. Cities including Mexico City, Guadalajara, and Monterrey are extending urban footprints to accommodate population influx, generating new residential developments requiring complete household furnishings including bedding ensembles. The National Workers' Housing Fund Institute announced in 2025 demonstrated an increase in its housing construction target to 1.2 million homes during the current presidential term, substantially exceeding the initial goal of 500,000 homes, demonstrating government commitment to addressing housing shortages. In April 2025, Vinte revealed plans to invest 2.7 billion Mexican pesos in Hidalgo for the Real Bilbao project, expected to provide affordable housing options and generate over 18,000 jobs, exemplifying private sector participation in residential development that cascades into home goods demand. Urban households typically maintain multiple bedsheet sets to enable regular rotation for hygiene purposes, multiplying per-household purchase frequency compared to rural populations with more limited purchasing patterns.

E-Commerce Penetration Transforming Shopping Accessibility

E-commerce expansion has revolutionized Mexican consumers' ability to access diverse bedsheet options while enjoying competitive pricing and convenient home delivery services that eliminate traditional shopping barriers. The Mexican Online Sales Association (AMVO) reports that online retail sales in 2024 hit MX$789.7 billion, showing over 20% growth compared to the previous year. In a separate report, the National Institute of Statistics and Geography (INEGI) indicated that in 2023, digital commerce accounted for 6.4% of the national GDP, with an 8.5% increase in real value-added. This mobile-first approach particularly resonates with younger demographics establishing initial households and demonstrating higher comfort levels with digital purchasing channels. Major e-commerce platforms provide extensive bedsheet selections that surpass physical store inventory constraints, enabling people to compare products across brands, materials, thread counts, and price points without geographic limitations.

Rising Disposable Income and Middle-Class Expansion

Mexico's economic development is generating broader prosperity that enables people across income brackets to allocate larger household budgets toward home comfort and aesthetic improvements including premium bedding purchases. Manufacturing nearshoring trends have expanded salaried employment opportunities as international companies relocate operations from Asia to Mexico to reduce supply chain distances and capitalize on favorable trade agreements including USMCA. This employment growth strengthens the middle class, with people increasingly prioritizing sleep quality and bedroom aesthetics as markers of improved living standards. Moreover, awareness about sleep health benefits has intensified, encouraging households to view bedding as health investments rather than discretionary home goods, thereby justifying premium pricing for products that enhance sleep quality and overall wellbeing. In January 2025, Coppel announced a MX$14.2 billion plan to open 100 outlets and modernize e-commerce fulfillment, indicating retailer confidence in sustained consumer spending across home goods categories including bedsheets.

Market Restraints:

What Challenges the Mexico Bedsheet Market is Facing?

Raw Material Price Volatility Pressuring Profit Margins

Bedsheet manufacturers confront significant challenges managing input cost fluctuations for cotton, polyester, and specialty fibers influenced by global commodity markets, weather patterns affecting agricultural yields, and geopolitical disruptions. Cotton prices exhibit cyclical volatility driven by growing season weather conditions, pest infestations, and shifting global production patterns that create unpredictable cost structures for textile manufacturers. Price increases in raw materials compress profit margins for manufacturers unable to immediately pass costs to price-sensitive consumers, particularly in competitive market segments where retailers resist price escalations.

Intense Market Competition and Price Sensitivity

The Mexico bedsheet market experiences fierce competition among department stores, specialty retailers, e-commerce platforms, and international brands competing for market share through aggressive pricing strategies. Major retailers and online platforms maintain extensive product selections across price points, creating intense competitive pressure. Consumer price sensitivity remains elevated, with purchasing decisions frequently prioritizing value propositions over brand loyalty, compelling manufacturers and retailers to compress margins to maintain sales volumes. The proliferation of low-cost imports from Asian manufacturers offering basic bedsheet products at deeply discounted prices challenges domestic producers' ability to compete on price while maintaining quality standards.

Regulatory Complexity and Trade Policy Uncertainty

Mexico's evolving trade policies and regulatory frameworks create operational challenges for bedsheet importers and manufacturers navigating compliance requirements and tariff structures. The 2024 implementation of 35 percent tariffs on textile imports from countries without free trade agreements introduced sudden cost increases for businesses relying on non-treaty suppliers, requiring rapid supply chain reconfigurations. Restrictions on temporary imports under the IMMEX duty-deferral program, effective December 20, 2024, created additional compliance burdens for apparel and textile importers. Bureaucratic processes for obtaining business licenses, import permits, and regulatory approvals can extend timelines and inflate costs for companies entering or expanding in the Mexican market.

Competitive Landscape:

The Mexico bedsheet market exhibits fragmented competitive dynamics with multiple player categories including international home goods brands, domestic department store chains, regional textile manufacturers, and emerging direct-to-consumer digital brands competing across price segments and distribution channels. Established department store operators leverage extensive physical retail networks spanning urban and suburban markets to offer comprehensive bedding selections, combining private label products with third-party brands to capture consumers across price points. International retailers dominate through operational scale, sophisticated supply chain management, and pricing power that enables aggressive promotional strategies during shopping events. E-commerce platforms have emerged as critical distribution channels, providing manufacturers and brands with digital marketplaces reaching millions of connected consumers while offering competitive pricing through reduced overhead costs compared to traditional retail. The competitive landscape continues evolving as market consolidation among retailers contrasts with manufacturer fragmentation across numerous small and medium-sized textile producers serving regional markets.

Mexico Bedsheet Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Cotton Bed Sheets, Silk Bed Sheets, Synthetic Bed Sheets, Linen Bed Sheets, Others |

| Applications Covered | Residential, Commercial |

| Sales Channels Covered | Supermarket and Hypermarket, Specialty Store, Online |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico bedsheet market size was valued at USD 1,736.65 Million in 2025.

The Mexico bedsheet market is expected to grow at a compound annual growth rate of 3.40% from 2026-2034 to reach USD 2,346.04 Million by 2034.

Cotton bed sheets dominated the Mexico bedsheet market with 48.02% share in 2025, driven by superior breathability, durability, and comfort properties preferred by Mexican consumers seeking natural fiber bedding solutions that perform effectively across diverse climate zones.

Key factors driving the Mexico bedsheet market include accelerating urban developments, government housing construction initiatives targeting new homes, explosive e-commerce growth with annual increases in online retail sales, rising disposable incomes expanding the middle class, and growing user awareness about sleep health benefits that encourage premium bedding investments.

Major challenges include raw material price volatility affecting cotton and synthetic fiber costs, intense market competition among department stores and e-commerce platforms compressing profit margins, consumer price sensitivity limiting premium product adoption, regulatory complexity including new textile import tariffs reaching 35 percent, bureaucratic hurdles in business operations, and competitive pressure from low-cost Asian imports flooding the market with deeply discounted products.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)