Mexico Beverage Packaging Market Size, Share, Trends and Forecast by Material, Product, Application, and Region, 2025-2033

Mexico Beverage Packaging Market Overview:

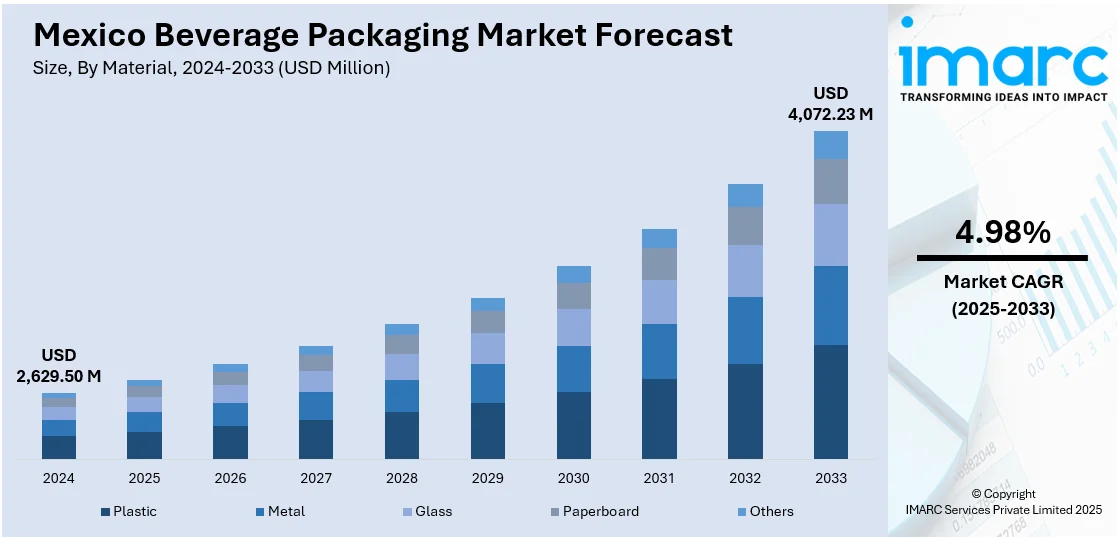

The Mexico beverage packaging market size reached USD 2,629.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,072.23 Million by 2033, exhibiting a growth rate (CAGR) of 4.98% during 2025-2033. The market includes rising consumer demand for sustainable materials, growing environmental awareness, advancements in packaging technology, and strong cultural ties to traditional formats like glass. Additionally, government regulations and shifting lifestyle preferences toward convenience and premium experiences are pushing brands to innovate and adapt.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,629.50 Million |

| Market Forecast in 2033 | USD 4,072.23 Million |

| Market Growth Rate 2025-2033 | 4.98% |

Mexico Beverage Packaging Market Trends:

Technological Innovation and Smart Packaging

Technology is transforming how drinks are packaged and consumed in Mexico. Companies are embracing intelligent packaging technologies that serve to simply hold a product but instead inform, interact, and communicate. Interactive elements such as quick response (QR) codes or Near Field Communication (NFC) tags enable people to scan labels for information regarding product origin, sustainability information, or promotion materials. At the same time, manufacturing processes are evolving to develop lighter, more durable, and more efficient packs. These innovations cut costs and environmental footprint while maintaining product integrity further aiding the Mexico beverage packaging market growth. With increasing consumer expectations, packaging is becoming an instrument for storytelling, trust, and personalization. Businesses are putting money into tech-enabled packaging not just to differentiate on shelves but to engage with a new generation of digitally native consumers.

Sustainable and Eco-Friendly Packaging

The growing emphasis on sustainability in packaging, fueled by rising environmental awareness and increasing consumer demand for eco-friendly products, is significantly contributing to the expansion of the Mexico beverage packaging market share. Companies are abandoning the use of conventional plastics, turning towards biodegradable packaging, plant-based films, and recycled containers in efforts to minimize their ecological footprint. Developments now aim at reducing waste, simplifying recyclability, and requiring fewer raw materials. The change corresponds to tighter environmental laws and increasing consumer demands for transparency and accountability. Brands, such as PepsiCo, will incorporate 50% recycled content into plastic packaging and decrease the use of virgin plastic by 20%, illustrating a larger movement towards sustainability. This trend is not just a fad but a long-term plan, as the producers of beverages increasingly incorporate environmental values into their brand image, understanding that environmentally responsible packaging is crucial for business and environmental health.

Cultural Preference for Glass Packaging

Glass remains an important part of Mexico beverage packaging market outlook as its deep cultural heritage and perceived premium status. Most traditional Mexican drinks, ranging from craft sodas to premium spirits, are linked with glass bottles, which represent authenticity and craftsmanship. Consumers tend to choose glass for its preservation of flavor and freshness without changing taste. Its reusability and recyclability also contribute to its popularity. Although heavier and breakable than plastic, glass remains a popular material due to its visual and traditional appeal. Many brands see the use of glass packaging as representative of heritage values, which it can be perceived to represent on a cultural pride and consumer emotions level.

Mexico Beverage Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on material, product, and application.

Material Insights:

- Plastic

- Metal

- Glass

- Paperboard

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes plastic, metal, glass, paperboard, and others.

Product Insights:

- Bottles

- Cans

- Pouches

- Cartons

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes bottles, cans, pouches, cartons, and others.

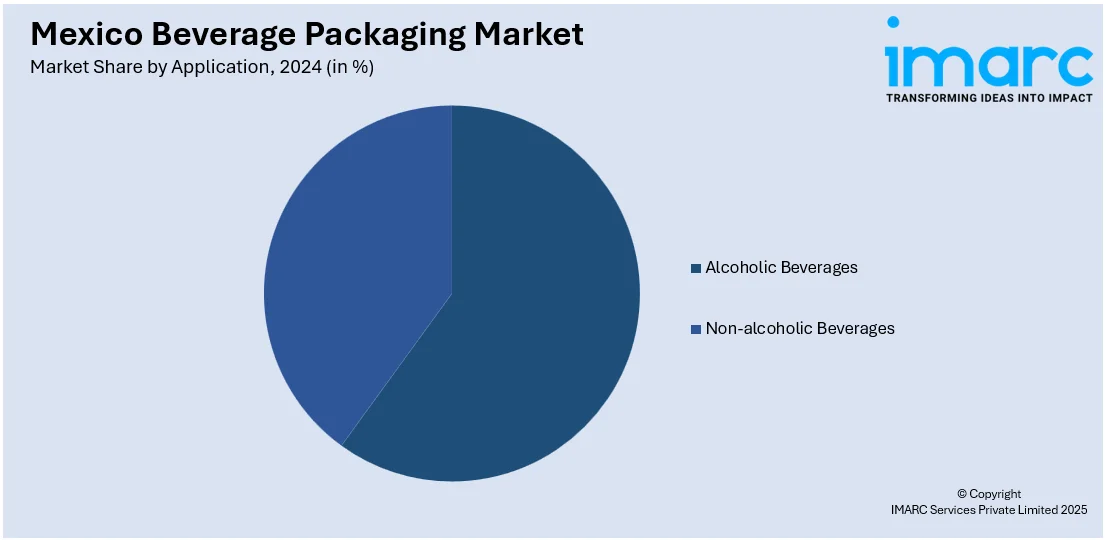

Application Insights:

- Alcoholic Beverages

- Non-alcoholic Beverages

- Carbonated drinks

- Bottled water

- Milk

- Fruit and vegetable juices

- Energy drinks

- Plant-based drinks

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes alcoholic beverages and non-alcoholic beverages (carbonated drinks, bottled water, milk, fruit and vegetable juices, energy drinks, plant-based drinks, and others).

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Beverage Packaging Market News:

- In November 2024, Fastmarkets plans to launch two new price assessments starting January 2025 for Mexico’s packaging market. The first covers domestic coated recycled boxboard (CRB) with kraft/grey back, while the second tracks U.S. exports of solid bleached sulfate (SBS) board to Mexico. These prices will be reported monthly in PPI Pulp & Paper Week and PPI Latin America, enhancing transparency and market insight for North American and Latin American boxboard markets.

Mexico Beverage Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Plastic, Metal, Glass, Paperboard, Others |

| Products Covered | Bottles, Cans, Pouches, Cartons, Others |

| Applications Covered |

|

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico beverage packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico beverage packaging market on the basis of material?

- What is the breakup of the Mexico beverage packaging market on the basis of product?

- What is the breakup of the Mexico beverage packaging market on the basis of application?

- What is the breakup of the Mexico beverage packaging market on the basis of region?

- What are the various stages in the value chain of the Mexico beverage packaging market?

- What are the key driving factors and challenges in the Mexico beverage packaging?

- What is the structure of the Mexico beverage packaging market and who are the key players?

- What is the degree of competition in the Mexico beverage packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico beverage packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico beverage packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico beverage packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)