Mexico Biocatalyst Market Size, Share, Trends and Forecast by Type, Application, Source, and Region, 2025-2033

Mexico Biocatalyst Market Overview:

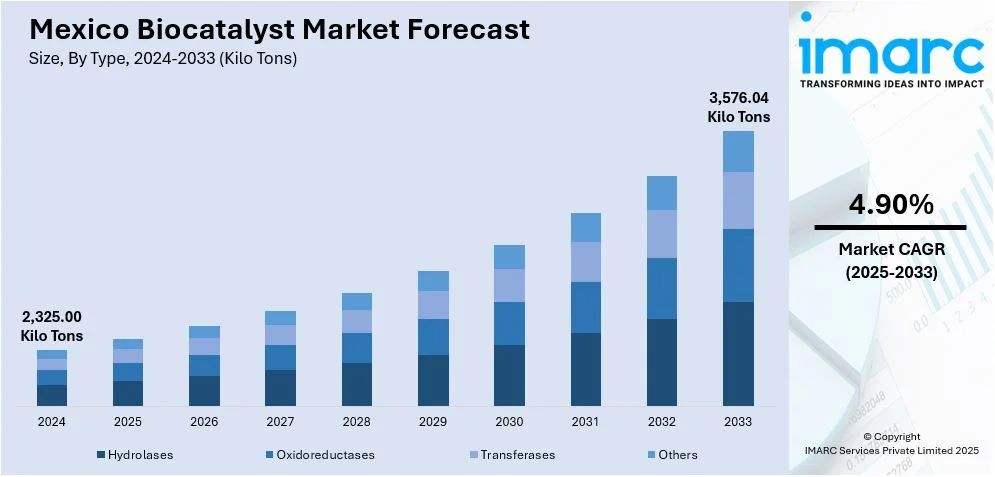

The Mexico biocatalyst market size reached 2,325.00 Kilo Tons in 2024. Looking forward, IMARC Group expects the market to reach 3,576.04 Kilo Tons by 2033, exhibiting a growth rate (CAGR) of 4.90% during 2025-2033. The market is driven by increased demand for sustainable chemical processes, rising biofuel production, supportive environmental regulations, and expanding pharmaceutical and food processing sectors. Local investment in green technologies and the growing availability of raw materials further contribute to the market’s development across industrial and academic applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 2,325.00 Kilo Tons |

| Market Forecast in 2033 | 3,576.04 Kilo Tons |

| Market Growth Rate 2025-2033 | 4.90% |

Mexico Biocatalyst Market Trends:

Adoption of Immobilized Enzymes in Industrial Bioprocesses

The adoption of immobilized enzyme systems in Mexican biocatalyst applications is gaining traction, especially in large-scale industrial processes. Immobilization enhances enzyme stability, reusability, and operational control, making it economically attractive for continuous and batch production environments. This technology is finding increased usage in sectors such as biofuel production, food processing, and wastewater treatment, where process efficiency and cost optimization are critical. For instance, in November 2023, Novozymes launched Quara LowP, an enzymatic solution for pre-treating renewable diesel and sustainable aviation fuel (SAF) feedstocks. The product enhances the processing of HVO and HEFA feedstocks, enabling higher yields, lower operational costs, and reduced environmental impact. By replacing traditional methods like excessive use of bleaching clay, Quara LowP improves efficiency and supports sustainability goals. This innovation aligns with growing global demand for renewable fuels and highlights Novozymes' role in advancing industrial biosolutions. In addition, immobilized biocatalysts offer improved resistance to changes in temperature and pH, which is advantageous in diverse climatic and industrial settings across Mexico. Companies are investing in bioreactor systems and tailored enzyme carriers to optimize performance further. The focus on operational efficiency and environmental compliance is expected to reinforce the use of immobilized enzymes in various end-use industries.

Academic-Industrial Collaborations for Biocatalyst Innovation

Collaborations between Mexican academic institutions and industrial stakeholders are playing a vital role in driving innovation in the biocatalyst market. Universities and research centers are actively developing novel enzymes, optimizing expression systems, and exploring new substrates for catalysis. For instance, in July 2024, Amano Enzyme, with significant presence in Mexico, signed a five-year Memorandum of Understanding (MOU) with Vietnam National University – Hanoi University of Science (VNU-HUS). The agreement focuses on collaborative research, technology transfer, and student exchange in enzyme and protein technology. These efforts are frequently supported by government-backed science and technology funding initiatives. Industrial partners contribute by scaling up successful prototypes and integrating them into commercial operations, thereby bridging the gap between laboratory research and market-ready solutions. Such partnerships also foster knowledge exchange, accelerate technology transfer, and create opportunities for local workforce development in biotechnology. As a result, Mexico is nurturing a domestic ecosystem of biocatalysis innovation, which strengthens national capacity for sustainable industrial practices and reduces reliance on imported enzymatic solutions.

Mexico Biocatalyst Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on type, application, and source.

Type Insights:

- Hydrolases

- Oxidoreductases

- Transferases

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes hydrolases, oxidoreductases, transferases, and others.

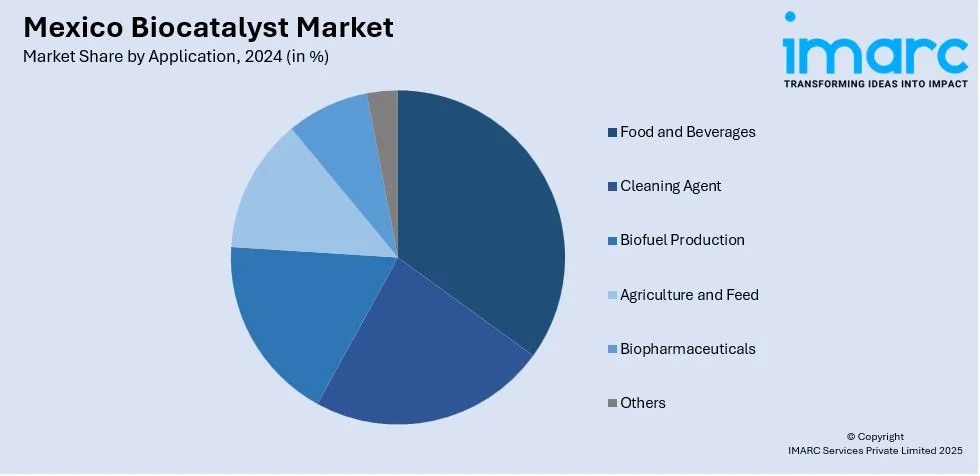

Application Insights:

- Food and Beverages

- Cleaning Agent

- Biofuel Production

- Agriculture and Feed

- Biopharmaceuticals

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes food and beverages, cleaning agent, biofuel production, agriculture and feed, biopharmaceuticals, and others.

Source Insights:

- Microorganisms

- Plants

- Animal

The report has provided a detailed breakup and analysis of the market based on the source. This includes microorganisms, plants, and animal.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, and Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Biocatalyst Market News:

- In July 2024, BASF, in partnership with the University of Graz and acib, developed a new computer-assisted model to optimize biocatalytic production processes. The model predicts the ideal combination of temperature and solvent concentration for enzyme efficiency, significantly reducing lab work and enabling faster scale-up from lab to industrial production. This innovation enhances sustainability by lowering costs and resource use.

Mexico Biocatalyst Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Kilo Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hydrolases, Oxidoreductases, Transferases, Others |

| Applications Covered | Food and Beverages, Cleaning Agent, Biofuel Production, Agriculture and Feed, Biopharmaceuticals, Others |

| Sources Covered | Microorganisms, Plants, Animal |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico biocatalyst market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico biocatalyst market on the basis of type?

- What is the breakup of the Mexico biocatalyst market on the basis of application?

- What is the breakup of the Mexico biocatalyst market on the basis of source?

- What is the breakup of the Mexico biocatalyst market on the basis of region?

- What are the various stages in the value chain of the Mexico biocatalyst market?

- What are the key driving factors and challenges in the Mexico biocatalyst market?

- What is the structure of the Mexico biocatalyst market and who are the key players?

- What is the degree of competition in the Mexico biocatalyst market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico biocatalyst market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico biocatalyst market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico biocatalyst industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)