Mexico Biochar Market Size, Share, Trends and Forecast by Feedstock Type, Technology Type, Product Form, Application, and Region, 2025-2033

Mexico Biochar Market Overview:

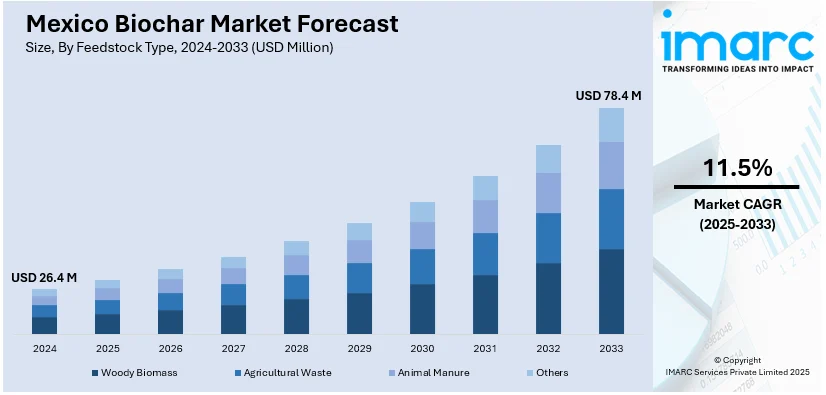

The Mexico biochar market size reached USD 26.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 78.4 Million by 2033, exhibiting a growth rate (CAGR) of 11.5% during 2025-2033. The rising demand for sustainable agriculture, increasing awareness of soil degradation, government support for carbon sequestration initiatives, growing interest in organic farming, and the need for efficient waste management are some of the major factors augmenting the Mexico biochar market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 26.4 Million |

| Market Forecast in 2033 | USD 78.4 Million |

| Market Growth Rate 2025-2033 | 11.5% |

Mexico Biochar Market Trends:

Expansion of Biochar Use in Agriculture

The agricultural sector in Mexico is increasingly adopting biochar due to its multifaceted benefits for soil management and crop productivity, which is enhancing Mexico biochar market outlook. As Mexico has established its standing as the world’s seventh-largest agricultural exporter, supplying produce to 192 countries, there is a growing focus on innovations that can maintain and improve long-term agricultural output. Biochar has gained traction in this context due to its porous structure that improves soil aeration, enhances water retention, and supports beneficial microbial activity. These features are particularly advantageous for crop health and yield. Farmers cultivating staple crops such as maize and beans, as well as high-value crops like coffee and avocados, are gradually incorporating biochar to improve soil fertility, particularly in regions with nutrient-depleted or erosion-prone lands. Furthermore, biochar’s ability to reduce the leaching of nutrients makes it an attractive solution in areas facing water scarcity or irregular rainfall. In addition to its role in soil amendment, biochar is also being explored as a livestock feed additive and bedding material, offering supplementary benefits such as odor reduction and improved waste composting. The versatility of biochar within various agricultural processes aligns with the country’s broader push for sustainable farming practices, making it a growing area of interest among producers and agronomists.

Integration into Carbon Sequestration Strategies

Mexico is increasingly exploring innovative solutions for long-term carbon sequestration, which is providing a boost to Mexico biochar market growth. One promising approach gaining momentum in the country's environmental strategy is the use of biochar. Biochar has a unique ability to lock carbon into the soil for hundreds to thousands of years. This makes it an asset in the fight against rising atmospheric carbon dioxide levels. Moreover, Mexico has set ambitious climate targets, aiming to cut emissions by 30% by 2020 and 50% by 2050, relative to 2000 levels. In this context, biochar presents a strategic opportunity to support these goals through its role in carbon storage. The integration of biochar into land use planning and agricultural policy reflects a strategic approach to leverage its environmental potential. Furthermore, the possibility of measuring, reporting, and verifying the carbon sequestration benefits of biochar aligns with mechanisms used in carbon offset programs. These initiatives create economic incentives for farmers and producers who implement biochar systems responsibly. The alignment of environmental objectives with economic motivations positions biochar as a viable component of Mexico’s broader sustainability framework. As scientific understanding and methodological standards for carbon accounting evolve, biochar’s role in climate policy and agricultural resilience is expected to deepen.

Mexico Biochar Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on feedstock type, technology type, product form, and application.

Feedstock Type Insights:

- Woody Biomass

- Agricultural Waste

- Animal Manure

- Others

The report has provided a detailed breakup and analysis of the market based on the feedstock type. This includes woody biomass, agricultural waste, animal manure, and others.

Technology Type Insights:

- Slow Pyrolysis

- Fast Pyrolysis

- Gasification

- Hydrothermal Carbonization

- Others

A detailed breakup and analysis of the market based on the technology type have also been provided in the report. This includes slow pyrolysis, fast pyrolysis, gasification, hydrothermal carbonization, and others.

Product Form Insights:

- Coarse and Fine Chips

- Fine Powder

- Pellets, Granules and Prills

- Liquid Suspension

The report has provided a detailed breakup and analysis of the market based on the product form. This includes coarse and fine chips, fine powder, pellets, granules and prilles, and liquid suspension.

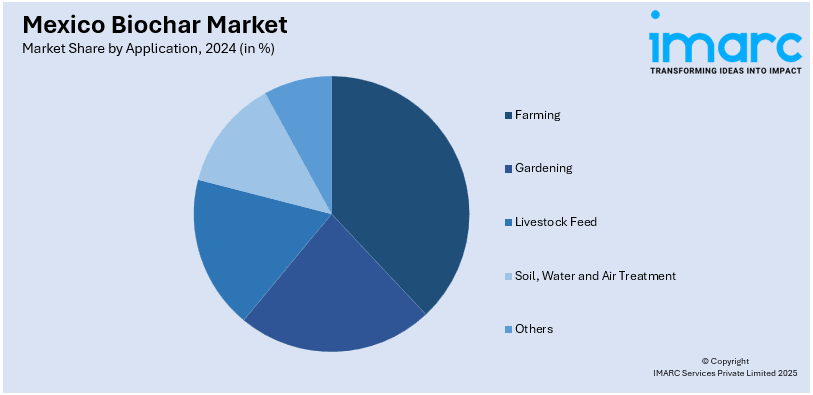

Application Insights:

- Farming

- Gardening

- Livestock Feeds

- Soil, Water and Air Treatment

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes farming, gardening, livestock feeds, soil, water and air treatment, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Other

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Biochar Market News:

- On March 18, 2025, Yazaki North America (YNA) and TOWING Co., Ltd. signed an MOU to establish a biochar production company in Mexico and Central America. In the past, the partnership has worked together to alleviate agricultural issues and lower carbon emissions in Mexico by utilizing TOWING's high-performance biochar, Soratan. The purpose of this agreement is to create a framework for commercial biochar that will boost crop yields, improve soil health, and reduce greenhouse gas emissions.

Mexico Biochar Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Feedstock Types Covered | Woody Biomass, Agricultural Waste, Animal Manure, Others |

| Technology Types Covered | Slow Pyrolysis, Fast Pyrolysis, Gasification, Hydrothermal Carbonization, Others |

| Product Forms Covered | Coarse And Fine Chips, Fine Powder, Pellets, Granules and Prilles, Liquid Suspension |

| Applications Covered | Farming, Gardening, Livestock Feeds, Soil, Water and Air Treatment, Others |

| Regions Covered | Northen Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico biochar market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico biochar market on the basis of feedstock type?

- What is the breakup of the Mexico biochar market on the basis of technology type?

- What is the breakup of the Mexico biochar market on the basis of product form?

- What is the breakup of the Mexico biochar market on the basis of application?

- What is the breakup of the Mexico biochar market on the basis of region?

- What are the various stages in the value chain of the Mexico biochar market?

- What are the key driving factors and challenges in the Mexico biochar market?

- What is the structure of the Mexico biochar market and who are the key players?

- What is the degree of competition in the Mexico biochar market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico biochar market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico biochar market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico biochar industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)