Mexico Biodegradable Food Service Disposables Market Size, Share, Trends and Forecast by Raw Material Type, Product Type, Distribution Channel, and Region, 2025-2033

Mexico Biodegradable Food Service Disposables Market Overview:

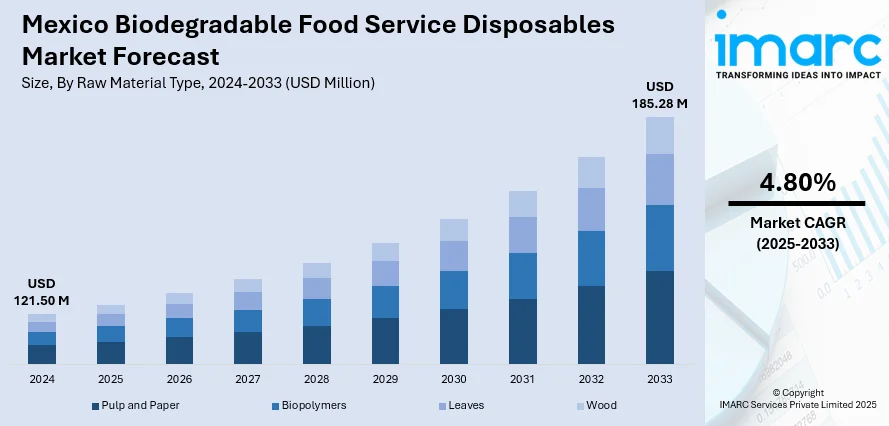

The Mexico biodegradable food service disposables market size reached USD 121.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 185.28 Million by 2033, exhibiting a growth rate (CAGR) of 4.80% during 2025-2033. The market share is growing driven by rising environmental awareness, stringent plastic regulations, sustainability-focused tourism demands, and the expanding food delivery sector, all of which are encouraging businesses to adopt eco-friendly packaging as both a compliance measure and a competitive strategy.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 121.50 Million |

| Market Forecast in 2033 | USD 185.28 Million |

| Market Growth Rate 2025-2033 | 4.80% |

Mexico Biodegradable Food Service Disposables Market Trends:

Growing Environmental Awareness and Government Regulation

The rising awareness about environmental issues among consumers in Mexico is a key factor propelling the market growth. As knowledge regarding the harmful impacts of plastic pollution grows, individuals and businesses alike are pursuing more eco-friendly options. This transition is also driven by stringent government policies designed to lessen plastic waste, encompassing national and regional laws that have implemented bans or restrictions on single-use plastics. For example, the Mexico Plastics Pact (PPMX), initiated in 2024, functions as a joint platform designed to encourage a circular economy for plastics. Spearheaded by WWF Mexico, the agreement brings together 18 members from different sectors to enhance strategies and refine national policies. A primary emphasis is placed on improving the circularity of materials like PS and flexible plastics, accompanied by an innovation challenge to inspire novel sustainable solutions. Backed by these environmental commitments and policy shifts, the Mexico biodegradable food service disposables market forecast points to steady expansion as businesses seek sustainable alternatives. These legal, social, and economic elements are establishing an environment in which biodegradable products are not only necessary for compliance but also serve as a strategic asset for companies seeking to remain competitive with market trends and fulfill consumer expectations for sustainability.

Influence of Tourism and International Standards

Mexico’s dynamic tourism sector is influencing the market, as hotels, resorts, and restaurants in popular tourist destinations encounter rising pressure to comply with global environmental standards. In 2024, Mexico's National Statistics Institute (Inegi) reports 45.04 million international visitors, many of whom hail from nations where sustainability is a core component of consumer culture. These travelers carry their environmentally aware expectations, prompting local businesses to implement more sustainable practices to stay competitive in international hospitality rankings. To meet the needs of this demographic, numerous businesses are adopting sustainable methods like utilizing biodegradable packaging, utensils, and various disposable products. Additionally, international hotel and restaurant chains operating in Mexico frequently implement consistent sustainability policies at all sites, advocating for the broad implementation of biodegradable alternatives. This global impact not only speeds up the move towards sustainable methods but also establishes elevated environmental standards for local rivals, who are working to achieve these international criteria. As Mexico advances its image as a sustainable tourism destination, biodegradable food service items are becoming a key component of the country's initiatives to harmonize local hospitality practices with worldwide environmental principles. These developments are contributing to notable Mexico biodegradable food service disposables market growth, fueled by eco-conscious tourism and rising sustainability benchmarks in the hospitality industry.

Growth of Food Delivery and Takeout Culture

The swift expansion of food delivery services and informal food sellers is transforming packaging usage trends in Mexico, considerably boosting the need for single-use disposables. As quick-service eateries and delivery applications expand in urban areas, there is a corresponding rise in the use of disposable tableware. This change is especially evident in highly populated regions where takeaway habits influence meal choices. As a result, the growing public concerns regarding plastic pollution is encouraging these companies to investigate more environment-friendly packaging alternatives. Biodegradable disposables, crafted from bagasse, cornstarch, or paperboard, are becoming more appealing due to their capacity to satisfy cost, compliance, and performance criteria. These materials are ideal for the high-volume, rapid environment of food delivery, aiding brands in establishing a sustainable image. Businesses are also implementing certification programs or collaborating with eco-friendly delivery services to enhance their environmental stance. The shift is not only moral but also tactical, considering the enormous market potential. In 2024, Mexico's online food delivery market reached USD 8.9 billion and is expected to expand at a CAGR of 14.3%, reaching USD 32.6 billion by 2033. As this expansion occurs, the volume of packaging will increase alongside it, heightening the need for compostable options. The Mexico biodegradable food service disposables market outlook remains promising, supported by regulatory momentum and rising sustainability priorities among businesses.

Mexico Biodegradable Food Service Disposables Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on raw material type, product type, and distribution channel.

Raw Material Type Insights:

- Pulp and Paper

- Biopolymers

- Leaves

- Wood

The report has provided a detailed breakup and analysis of the market based on the raw material type. This includes pulp and paper, biopolymers, leaves, and wood.

Product Type Insights:

- Cups

- Clamshells and Containers

- Plates

- Cutleries

- Others

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes cups, clamshells and containers, plates, cutleries, and others.

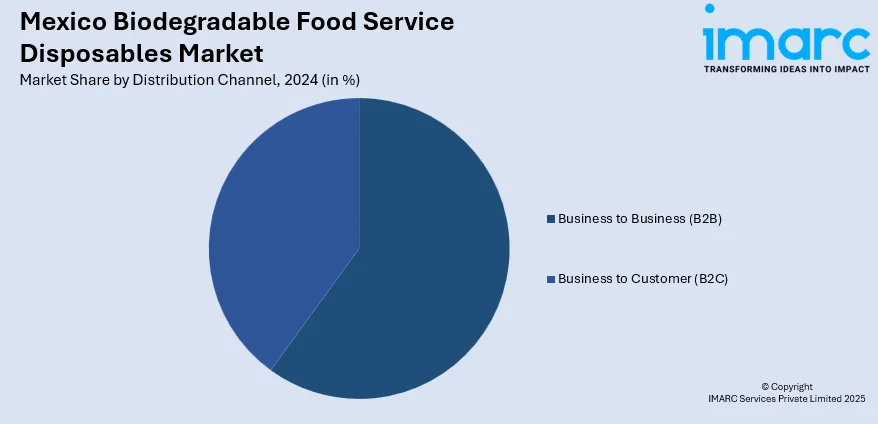

Distribution Channel Insights:

- Business to Business (B2B)

- Business to Customer (B2C)

- Supermarkets and Hypermarkets

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes business to business (B2B) and business to customer (B2C) (supermarkets and hypermarkets, online stores, and Others).

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Biodegradable Food Service Disposables Market News:

- In June 2024, EXPO PACK México 2024, held from June 4–7, showcased 700 exhibitors and attracted nearly 20,000 attendees, setting a new record for Latin America's largest packaging and processing trade show. The event highlighted innovations in sustainability, efficiency, and consumer convenience. It also featured presentations on key industry topics like latest packaging technologies.

- In January 2024, Biofase, a Mexico-based startup, introduced eco-friendly cutlery made from avocado pits, addressing plastic pollution. The company used a patented process to turn avocado seeds into biodegradable utensils, which naturally degraded in 240 days. Biofase's products were sold in Mexico, Europe, and Australia, with growing demand from restaurants.

Mexico Biodegradable Food Service Disposables Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Material Types Covered | Pulp and Paper, Biopolymers, Leaves, Wood |

| Product Types Covered | Cups, Clamshells and Containers, Plates, Cutleries, Others |

| Distribution Channels Covered |

|

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico biodegradable food service disposables market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico biodegradable food service disposables market on the basis of raw material type?

- What is the breakup of the Mexico biodegradable food service disposables market on the basis of product type?

- What is the breakup of the Mexico biodegradable food service disposables market on the basis of distribution channel?

- What is the breakup of the Mexico biodegradable food service disposables market on the basis of region?

- What are the various stages in the value chain of the Mexico biodegradable food service disposables market?

- What are the key driving factors and challenges in the Mexico biodegradable food service disposables?

- What is the structure of the Mexico biodegradable food service disposables market and who are the key players?

- What is the degree of competition in the Mexico biodegradable food service disposables market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico biodegradable food service disposables market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico biodegradable food service disposables market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico biodegradable food service disposables industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)