Mexico Biodegradable Packaging Market Size, Share, Trends and Forecast by Material Type, Application, and Region, 2026-2034

Mexico Biodegradable Packaging Market Summary:

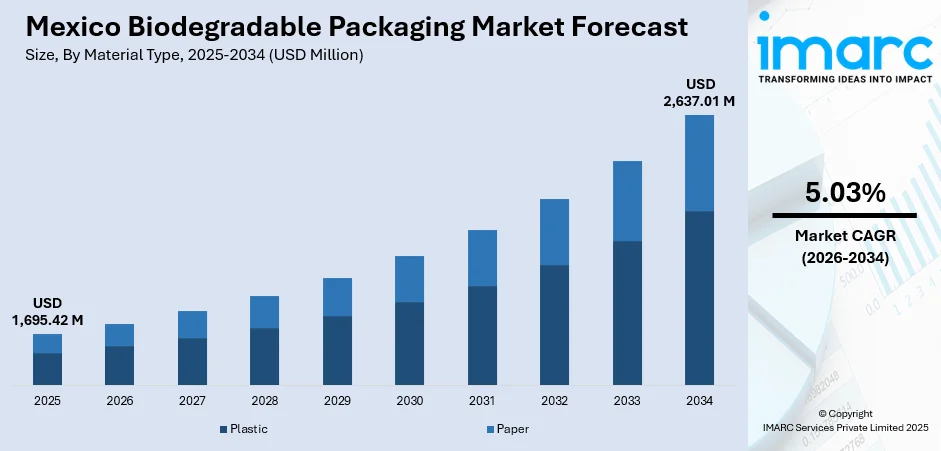

The Mexico biodegradable packaging market size was valued at USD 1,695.42 Million in 2025 and is projected to reach USD 2,637.01 Million by 2034, growing at a compound annual growth rate of 5.03% from 2026-2034.

The market is driven by stringent government regulations mandating sustainable alternatives to single-use plastics, compelling industries to adopt biodegradable solutions. Rising consumer consciousness around environmental sustainability and a stronger preference for eco-friendly products are further fueling market growth. The rapid growth of e-commerce and food delivery services has amplified demand for sustainable packaging solutions, as businesses seek to reduce their environmental footprint while meeting customer expectations for responsible practices, thereby augmenting the Mexico biodegradable packaging market share.

Key Takeaways and Insights:

-

By Material Type: Paper dominates the market with a share of 58% in 2025, driven by consumer preference for recyclable and low-carbon footprint packaging materials that support Mexico's circular economy initiatives.

-

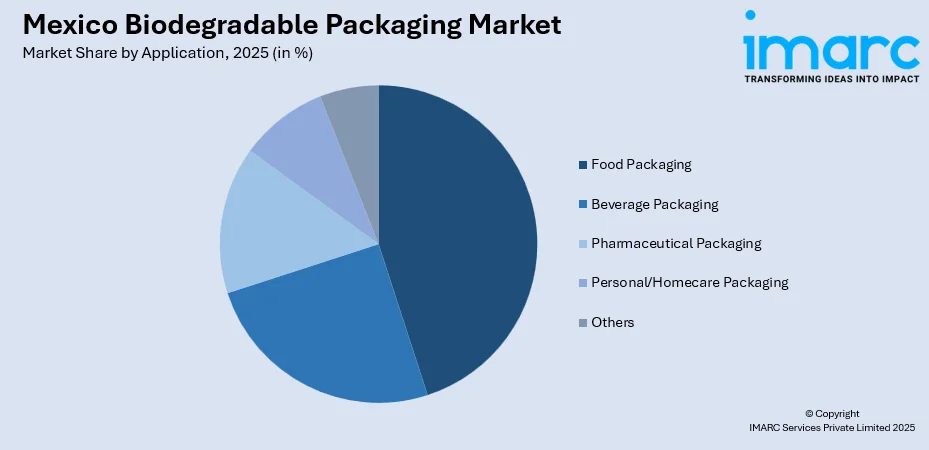

By Application: Food packaging leads the market with a share of 43% in 2025, owing to the extensive adoption of biodegradable containers, wraps, and utensils across quick-service restaurants, retail outlets, and food delivery platforms.

-

By Region: Central Mexico represents the largest segment with a market share of 40% in 2025, supported by concentrated consumer markets in Mexico City and Guadalajara, robust manufacturing infrastructure, and stringent environmental regulations.

-

Key Players: The Mexico biodegradable packaging market exhibits a fragmented competitive landscape with both multinational corporations and regional manufacturers operating across diverse price segments. Companies are actively investing in sustainable material innovations and expanding production capacities to meet rising demand.

To get more information on this market Request Sample

The Mexico biodegradable packaging market is experiencing a notable shift as environmental awareness increasingly shapes both consumer choices and corporate decision-making. Growing concern over plastic waste has encouraged businesses to adopt more sustainable packaging alternatives, supported by a regulatory environment that promotes responsible material use. Companies across the food, beverage, and retail sectors are prioritizing eco-friendly packaging as part of broader sustainability commitments, accelerating the transition away from conventional plastics. At the same time, local innovation is gaining momentum, with manufacturers exploring biodegradable materials derived from agricultural byproducts to create environmentally safe packaging solutions. The continued expansion of e-commerce has further reinforced demand for sustainable packaging used in shipping and logistics, while the hospitality and tourism sectors are steadily embracing biodegradable options to align with environmentally responsible practices. Collectively, these factors are reshaping the packaging landscape in Mexico and creating long-term growth opportunities for biodegradable alternatives.

Mexico Biodegradable Packaging Market Trends:

Accelerated Adoption of Plant-Based Bioplastics

The market is experiencing a clear transition toward plant-based, biodegradable materials as manufacturers look for sustainable substitutes to petroleum-based plastics. Polylactic acid and starch-derived polymers are increasingly being adopted across food service and retail segments. At the same time, Mexican companies are exploring native resources such as nopal cactus and avocado waste to develop innovative biopolymer formulations. Overall, the shift highlights the industry’s growing focus on materials that deliver performance like conventional plastics while aligning with environmental and compostability standards.

Integration of Circular Economy Principles

Businesses across Mexico are increasingly embedding circular economy concepts into their packaging strategies, establishing closed-loop systems that minimize waste and maximize material recovery. The Mexico Plastics Pact, launched in 2024 with participation from diverse industry stakeholders, exemplifies this collaborative approach toward achieving sustainable packaging objectives. Companies are developing returnable container networks and implementing in-store take-back programs to facilitate material recirculation. This systemic approach extends beyond individual product decisions to encompass entire supply chains, with manufacturers investing in on-site recycling capabilities that reprocess used materials into new packaging components.

Expansion of Sustainable Packaging in Food Delivery Services

The burgeoning food delivery sector is driving substantial demand for biodegradable packaging solutions as platforms and restaurants prioritize environmental responsibility. The Mexico online food delivery market size reached USD 8.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 32.6 Billion by 2033, exhibiting a growth rate (CAGR) of 14.3% during 2025-2033, generates significant packaging volumes that increasingly incorporate compostable materials. Quick-service restaurants and cloud kitchens are transitioning to biodegradable containers, bags, and utensils to align with consumer expectations and regulatory requirements. This trend is further reinforced by certification programs and partnerships with eco-friendly delivery services that help businesses communicate their sustainability commitments.

Market Outlook 2026-2034:

The Mexico biodegradable packaging market is positioned for sustained expansion as regulatory pressures intensify and consumer preferences increasingly favor sustainable alternatives. Investment in local production facilities is expected to reduce import dependency and lower material costs, making biodegradable options more competitive with conventional plastics. Technological advancements in barrier properties and material durability will address current performance limitations, enabling broader application across demanding end-use categories. Strategic infrastructure development, including expanded composting facilities and waste management systems, will support proper disposal and decomposition of biodegradable materials. The market generated a revenue of USD 1,695.42 Million in 2025 and is projected to reach a revenue of USD 2,637.01 Million by 2034, growing at a compound annual growth rate of 5.03% from 2026-2034.

Mexico Biodegradable Packaging Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Material Type | Paper | 58% |

| Application | Food Packaging | 43% |

| Region | Central Mexico | 40% |

Material Type Insights:

- Plastic

- Starch-based Plastics

- Cellulose-based Plastics

- Polylactic Acid (PLA)

- Poly-3-Hydroxybutyrate (PHB)

- Polyhydroxyalkanoates (PHA)

- Others

- Paper

- Kraft Paper

- Flexible Paper

- Corrugated Fiberboard

- Boxboard

The paper segment dominates the market with a share of 58% of the total Mexico biodegradable packaging market in 2025.

Paper-based biodegradable packaging materials have established market leadership owing to their inherent recyclability, low carbon footprint, and versatility across diverse applications. The Mexico paper packaging market size reached USD 6.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.1 Billion by 2033, exhibiting a growth rate (CAGR) of 2.40% during 2025-2033. Mexican consumers increasingly favor paper packaging as environmental awareness grows, driving adoption across food service, retail, and industrial sectors. Paper-based materials align with the country's circular economy objectives, as they integrate seamlessly into existing recycling infrastructure and support waste reduction goals. The adaptability of paper substrates enables their use in corrugated boxes, kraft bags, food wraps, and cosmetic packaging, addressing requirements across multiple industry verticals.

Within the paper segment, corrugated fiberboard maintains a prominent position due to its extensive use in e-commerce shipping and industrial packaging applications. Mexico's major paper packaging manufacturers operate integrated facilities that combine recycled fiber collection with production capabilities, ensuring supply chain reliability and material traceability. Kraft paper is gaining traction in food packaging applications, particularly for takeaway bags and wraps, as quick-service restaurants transition away from plastic alternatives. Technological advancements in moisture-resistant coatings and barrier treatments are expanding the functional capabilities of paper-based packaging, enabling its use in applications previously dominated by plastic materials.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Food Packaging

- Beverage Packaging

- Pharmaceutical Packaging

- Personal/Homecare Packaging

- Others

The food packaging segment leads with a share of 43% of the total Mexico biodegradable packaging market in 2025.

Food packaging represents the largest application segment due to the extensive network of restaurants, street food vendors, retail outlets, and food delivery services across Mexico. The Mexico food packaging market size reached USD 6,081.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 9,182.7 Million by 2033, exhibiting a growth rate (CAGR) of 4.68% during 2025-2033. The implementation of single-use plastic bans in major municipalities has accelerated the transition to biodegradable containers, utensils, and wraps in food service establishments. Mexico's vibrant street food culture, which relies heavily on disposable packaging, presents significant opportunities for biodegradable alternatives that maintain food safety while reducing environmental impact. Quick-service restaurants and institutional caterers are increasingly adopting compostable food containers that meet both regulatory requirements and consumer expectations for sustainable practices.

The food packaging segment benefits from innovations in barrier materials that preserve freshness and extend shelf life without compromising biodegradability. Major food manufacturers are pursuing comprehensive sustainability commitments that encompass packaging across their entire product portfolios, creating substantial demand for biodegradable solutions. The tourism sector, which welcomes tens of millions of international visitors annually, exerts additional pressure on hotels and restaurants to adopt packaging materials that align with global environmental standards. Indigenous innovations such as bioplastics derived from avocado agricultural waste demonstrate the potential for locally-sourced materials to address food packaging requirements while supporting regional economic development.

Regional Insights:

-

Northern Mexico

Central Mexico

Southern Mexico

Others

Central Mexico holds the largest share with 40% of the total Mexico biodegradable packaging market in 2025.

Central Mexico's market leadership stems from the concentration of consumer markets, manufacturing infrastructure, and regulatory enforcement in the Mexico City metropolitan area and surrounding states. The region accounts for the highest retail sales volumes in the country, generating substantial demand for packaging materials across food, beverage, and consumer goods categories. Mexico City's pioneering single-use plastic ban, which has been actively enforced with thousands of compliance actions, establishes a stringent regulatory environment that compels businesses to adopt biodegradable alternatives. The metropolitan area's consumer products industry represents a significant share of national food and beverage packaging material consumption.

The region benefits from robust highway and rail connectivity that facilitates efficient distribution of packaging materials to manufacturing facilities and end-users. Guadalajara, as a major commercial and industrial hub, is experiencing rapid growth in sustainable packaging demand driven by electronics, technology, and consumer goods sectors. Central manufacturing corridors attract flexible packaging converters serving food and personal care brands, while the dense supplier base supports rapid material pivots in response to evolving regulations. The concentration of multinational corporations with sustainability mandates further accelerates adoption of biodegradable packaging solutions throughout the region.

Market Dynamics:

Growth Drivers:

Why is the Mexico Biodegradable Packaging Market Growing?

Stringent Government Regulations on Single-Use Plastics

Mexico’s evolving regulatory landscape is driving the adoption of biodegradable packaging by restricting single-use plastics. Laws in major cities, such as Mexico City, prohibit the sale of items like plastic bags, cutlery, containers, cups, straws, and balloons, encouraging businesses to adopt sustainable alternatives. Similar measures across various states and municipalities create a regulatory environment that collectively accelerates the shift toward eco-friendly materials. Additionally, initiatives like the Mexico Plastics Pact bring together industry players and environmental organizations to promote circular economy practices, reinforcing the transition from conventional plastics to biodegradable solutions while supporting broader sustainability goals.

Rising Consumer Demand for Sustainable Packaging Solutions

Growing environmental awareness among Mexican consumers is driving substantial demand for products packaged in eco-friendly materials. Consumers are actively seeking brands that demonstrate environmental responsibility, prompting manufacturers and retailers to integrate biodegradable packaging into their operations. This behavioral shift extends across demographic segments, with younger consumers particularly receptive to sustainability messaging and willing to support businesses aligned with their environmental values. The tourism industry amplifies this trend, as millions of international visitors from environmentally conscious markets expect sustainable practices from hospitality establishments. Retailers are responding by expanding their assortment of products featuring biodegradable packaging, while brand owners leverage sustainability credentials as competitive differentiators in crowded market categories.

Expansion of E-Commerce and Food Delivery Services

The rapid growth of e-commerce and food delivery platforms generates substantial demand for protective and sustainable packaging solutions. The Mexico e-commerce market size reached USD 54.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 175.8 Billion by 2034, exhibiting a growth rate (CAGR) of 13.92% during 2026-2034. Mexico's online retail penetration continues to accelerate, with digital commerce representing an increasingly significant share of total retail sales. Each shipment requires packaging materials that protect products during transit while meeting consumer expectations for environmental responsibility. Food delivery platforms, which have experienced exponential growth, utilize enormous volumes of containers, bags, and protective materials that increasingly incorporate biodegradable components. Logistics companies face increasing pressure to lower their carbon emissions, prompting greater use of biodegradable mailers, compostable padding, and plant-based adhesive tapes. This structural shift in retail and food service channels creates enduring demand for sustainable packaging innovations.

Market Restraints:

What Challenges the Mexico Biodegradable Packaging Market is Facing?

Higher Production Costs Compared to Conventional Plastics

Biodegradable packaging materials typically command premium prices relative to petroleum-based plastics, creating adoption barriers for cost-sensitive businesses. Manufacturing processes for bioplastics and specialized paper products require significant capital investment in equipment and technology. Raw material costs for bio-based feedstocks fluctuate based on agricultural conditions and competing demand from food and fuel applications. Small and medium enterprises face particular challenges in absorbing these cost differentials while remaining competitive in their respective markets.

Limited Composting and Waste Management Infrastructure

Mexico's waste management infrastructure lacks sufficient industrial composting facilities required for proper decomposition of many biodegradable materials. Municipal material recovery facilities often cannot process compostable packaging streams, resulting in biodegradable materials being sent to landfills where decomposition conditions may be suboptimal. This infrastructure gap undermines the environmental benefits of biodegradable packaging and creates confusion among consumers regarding proper disposal methods. Regional disparities in waste management capabilities further complicate the market landscape.

Performance Limitations in Demanding Applications

Certain biodegradable materials exhibit functional limitations compared to conventional plastics in applications requiring high barrier properties, moisture resistance, or extended shelf life. Performance inconsistencies under varying temperature and humidity conditions restrict adoption in climate-sensitive applications. The degradation properties that make these materials environmentally beneficial can compromise durability during storage and transportation. Continuous research and development initiatives are focused on overcoming these challenges by leveraging innovative material formulations and cutting-edge coating technologies.

Competitive Landscape:

The Mexico biodegradable packaging market features a diverse competitive landscape comprising multinational packaging corporations, regional manufacturers, and innovative startups developing proprietary sustainable materials. Established players leverage extensive distribution networks and production scale to serve large-volume customers across food service, retail, and industrial sectors. Competition intensifies as companies invest in research and development to enhance material performance while reducing production costs. Strategic partnerships between material suppliers and brand owners facilitate customized solution development and accelerate market penetration. Local innovators differentiate through unique feedstock utilization, such as agricultural waste conversion, while international companies bring advanced technologies and global best practices. The market structure encourages collaboration alongside competition, with industry associations and sustainability pacts providing platforms for collective action toward shared environmental objectives.

Recent Developments:

-

March 2025: Nefab has launched a second packaging facility in Guadalajara, Mexico, spanning 5,400 m², effectively doubling its production capacity for eco-friendly packaging solutions. The facility integrates design, production, and closed-loop recycling capabilities, producing recyclable trays and cushioning via thin-gauge thermoforming for automotive, electronics, datacom, and e-mobility industries.

-

December 2024: Biocup, a Mexican eco-packaging company specializing in biodegradable and compostable containers, entered the US market through the MileOne Incubator Program with the launch of Biocup USA in Laredo. The company's expansion reflects growing international demand for sustainable food service disposables.

Mexico Biodegradable Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Types Covered |

|

| Applications Covered | Food Packaging ,Beverage Packaging,Pharmaceutical Packaging , Personal/Homecare,Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico,Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico biodegradable packaging market size was valued at USD 1,695.42 Million in 2025.

The Mexico biodegradable packaging market is expected to grow at a compound annual growth rate of 5.03% from 2026-2034 to reach USD 2,637.01 Million by 2034.

Paper dominated the market with a 58% share in 2025, driven by consumer preference for recyclable materials, low carbon footprint characteristics, and versatility across food service, retail, and industrial applications.

Key factors driving the Mexico biodegradable packaging market include stringent government regulations banning single-use plastics, rising consumer demand for sustainable packaging solutions, and the expansion of e-commerce and food delivery services requiring environmentally responsible packaging materials.

Major challenges include higher production costs compared to conventional plastics, limited composting and waste management infrastructure, performance limitations in demanding applications, consumer confusion regarding proper disposal methods, and raw material price volatility.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)