Mexico Biofertilizer Market Size, Share, Trends and Forecast by on Type, Crop, Microorganism, Mode of Application, and Region, 2025-2033

Mexico Biofertilizer Market Overview:

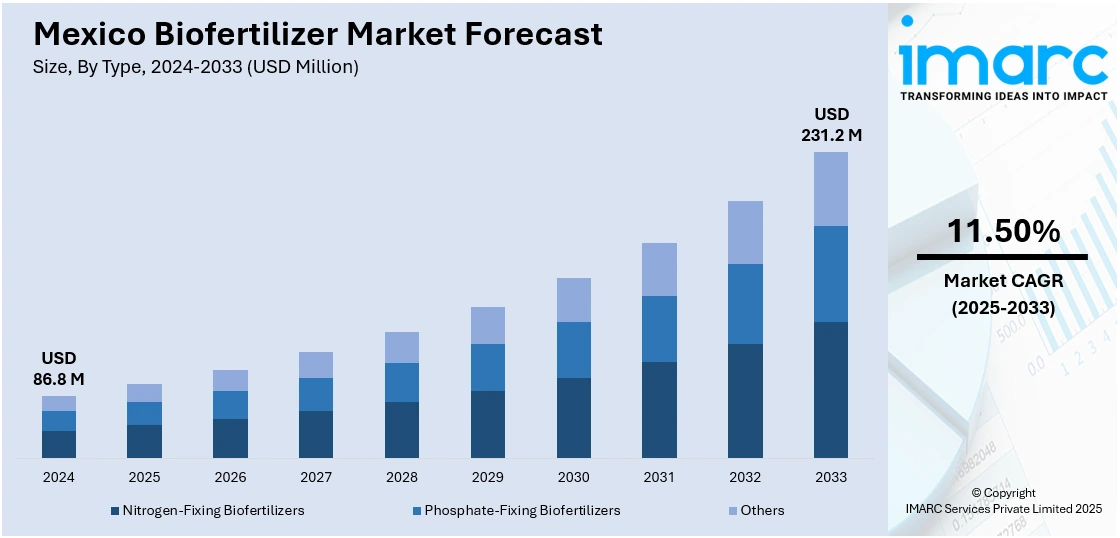

The Mexico biofertilizer market size reached USD 86.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 231.2 Million by 2033, exhibiting a growth rate (CAGR) of 11.50% during 2025-2033. The market is witnessing robust growth due to rising organic farming, government support for sustainable agriculture, and increased awareness about soil health. Furthermore, growing demand from high-value crops and regional production capabilities further strengthen its position across key agricultural zones.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 86.8 Million |

| Market Forecast in 2033 | USD 231.2 Million |

| Market Growth Rate 2025-2033 | 11.50% |

Mexico Biofertilizer Market Trends:

Government Push for Sustainable Agriculture

The Mexican government has been actively promoting sustainable agriculture through programs that encourage organic farming and reduced dependence on chemical fertilizers. These initiatives are contributing significantly to the rising Mexico biofertilizers market share, as farmers are incentivized to adopt eco-friendly alternatives. Subsidies, technical support, and regulatory guidelines focused on sustainable inputs are helping to build trust in biofertilizer products. For instance, in March 2024, Mexico is taking significant steps to create a regulatory framework for bio-inputs, including biofertilizers, aimed at promoting sustainable agriculture. The initiative emphasizes reducing reliance on synthetic chemicals, enhancing soil health, and fostering innovation while ensuring safety and efficiency, ultimately supporting a transition to environmentally friendly farming practices. Programs under agencies such as SAGARPA (Secretariat of Agriculture) emphasize soil health and crop productivity through biological inputs, driving awareness and usage at the farm level. Additionally, sustainability goals linked to climate resilience and environmental conservation are pushing both smallholder and commercial farms toward organic practices. Public campaigns and agricultural extension services are also playing a role in educating farmers about the long-term benefits of microbial-based fertilizers. These aligned policy efforts continue to fuel Mexico biofertilizers market growth across multiple crop categories.

Strong Demand from Horticulture and Cash Crops

High-value crops such as tomatoes, avocados, and berries are seeing increasing adoption of biofertilizers in Mexico, as growers seek to improve soil health, nutrient efficiency, and crop quality. These crops are often export-oriented and highly sensitive to input quality, making biological alternatives more attractive. The shift is also influenced by market demand for residue-free produce, which favors the use of non-chemical inputs. In regions like Michoacán and Baja California, where these crops are intensively cultivated, farmers are integrating biofertilizers into their regular nutrient management plans to enhance yield and soil microbiome balance. Biofertilizers also help reduce dependency on synthetic fertilizers, lowering production costs in the long run. With the horticulture and cash crop segment expanding rapidly and sustainability becoming a key priority, the Mexico biofertilizers market outlook remains favorable and poised for continued acceleration.

Expansion of Organic Farming Practices

The growing demand for organic produce in both domestic and export markets is significantly influencing farming practices across Mexico. Consumers are becoming more conscious about food safety, environmental impact, and chemical residues, prompting farmers to transition toward organic methods. This shift has directly increased the adoption of biofertilizers, which play a vital role in enriching soil naturally and meeting organic certification standards. Farmers cultivating fruits, vegetables, and grains are increasingly using microbial and plant-based inputs to improve soil fertility and crop resilience without relying on synthetic chemicals. The availability of biofertilizers tailored to specific crop and soil conditions is also supporting this trend. Regions with concentrated organic farming activities, such as Chiapas and Oaxaca, are seeing strong uptake of biofertilizer products. As organic agriculture gains further traction, bio-based inputs are expected to remain central to production strategies, boosting market demand nationwide.

Mexico Biofertilizer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, crop, microorganism, and mode of application.

Type Insights:

- Nitrogen-Fixing Biofertilizers

- Phosphate-Fixing Biofertilizers

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes nitrogen-fixing biofertilizers, phosphate-fixing biofertilizers, and others.

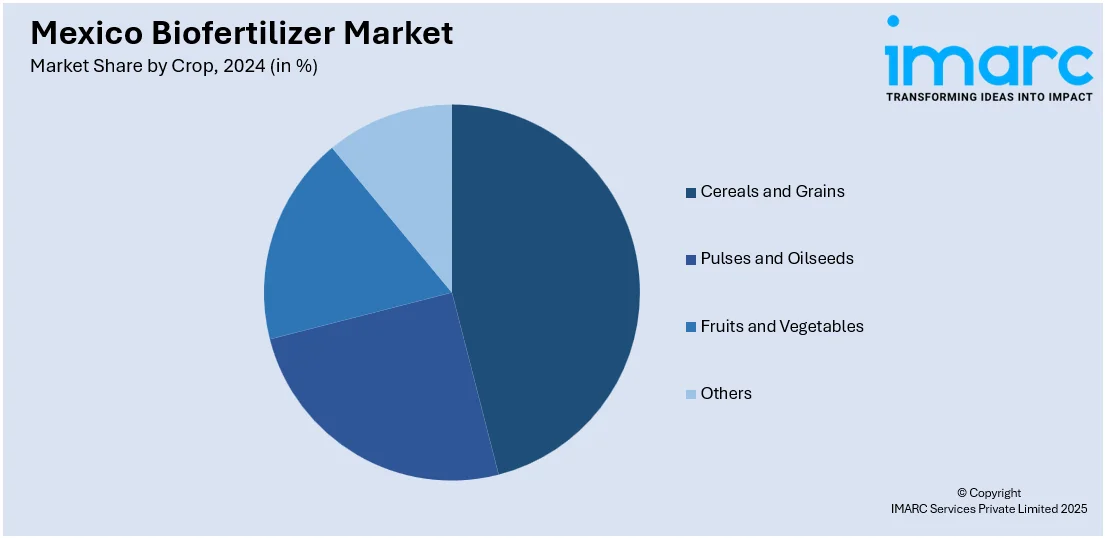

Crop Insights:

- Cereals and Grains

- Pulses and Oilseeds

- Fruits and Vegetables

- Others

A detailed breakup and analysis of the market based on the crop have also been provided in the report. This includes cereals and grains, pulses and oilseeds, fruits and vegetables, and others.

Microorganism Insights:

- Cyanobacter

- Rhizobium

- Phosphate Solubilizing Bacteria

- Azotobacter

- Others

A detailed breakup and analysis of the market based on the microorganism have also been provided in the report. This includes Cyanobacter, Rhizobium, Phosphate Solubilizing Bacteria, Azotobacter, and others.

Mode of Application Insights:

- Seed Treatment

- Soil Treatment

- Others

A detailed breakup and analysis of the market based on the mode of application have also been provided in the report. This includes seed treatment, soil treatment, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Biofertilizer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Nitrogen-Fixing Biofertilizers, Phosphate-Fixing Biofertilizers, Others |

| Crops Covered | Cereals and Grains, Pulses and Oilseeds, Fruits and Vegetables, Others |

| Microorganisms Covered | Cyanobacter, Rhizobium, Phosphate Solubilizing Bacteria, Azotobacter, Others |

| Mode of Applications Covered | Seed Treatment, Soil Treatment, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico biofertilizer market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico biofertilizer market on the basis of type?

- What is the breakup of the Mexico biofertilizer market on the basis of crop?

- What is the breakup of the Mexico biofertilizer market on the basis of microorganism?

- What is the breakup of the Mexico biofertilizer market on the basis of mode of application?

- What is the breakup of the Mexico biofertilizer market on the basis of region?

- What are the various stages in the value chain of the Mexico biofertilizer market?

- What are the key driving factors and challenges in the Mexico biofertilizer?

- What is the structure of the Mexico biofertilizer market and who are the key players?

- What is the degree of competition in the Mexico biofertilizer market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico biofertilizer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico biofertilizer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico biofertilizer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)