Mexico Biofuel Market Size, Share, Trends and Forecast by Type, Feedstock, and Region, 2026-2034

Mexico Biofuel Market Overview:

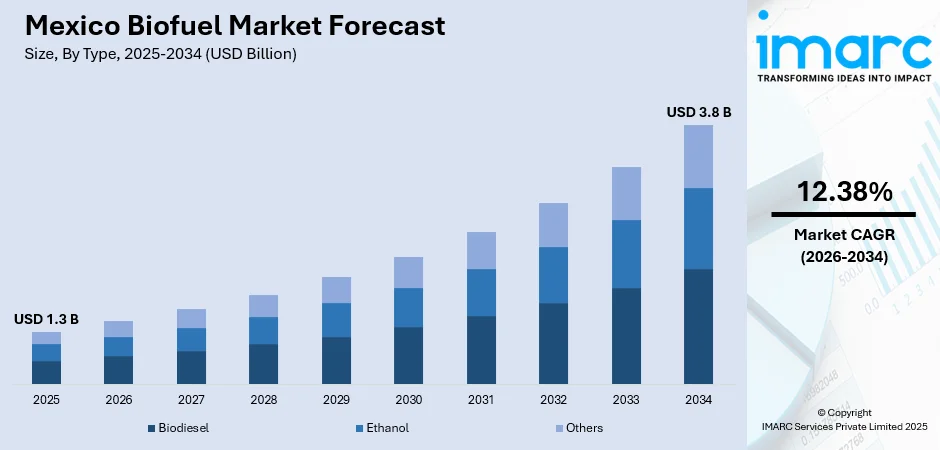

The Mexico biofuel market size reached USD 1.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 3.8 Billion by 2034, exhibiting a growth rate (CAGR) of 12.38% during 2026-2034. Government policies promoting renewable energy, rising environmental concerns, increasing demand for energy independence, and advancements in biofuel technology are some of the factors contributing to Mexico biofuel market share. Additionally, the agricultural sector's growth and international trade opportunities contribute to expanding biofuel production and consumption.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.3 Billion |

| Market Forecast in 2034 | USD 3.8 Billion |

| Market Growth Rate 2026-2034 | 12.38% |

Access the full market insights report Request Sample

Mexico Biofuel Market Trends:

Bioethanol’s Role in the Sustainable Transportation Shift

Mexico is increasingly focusing on biofuels as a key solution for decarbonizing its transportation sector. With the potential for large-scale bioethanol production from surplus sugarcane, the country aims to reduce its reliance on fossil fuels while achieving significant environmental, economic, and social benefits. Bioethanol is seen as an effective tool to meet global sustainability commitments, contributing to cleaner air and reduced carbon emissions. The adoption of bioethanol is also being integrated into national sustainability plans, enhancing Mexico’s energy security and supporting local economies. As bioethanol production ramps up, it could play a pivotal role in Mexico’s broader efforts to create a more sustainable and low-carbon transportation infrastructure. These factors are intensifying the Mexico biofuel market growth. For example, in April 2024, the Mexican Biofuel Mobility Association (Biomovilidad) urged PEMEX to align with global trends and develop a decarbonization strategy for the transportation sector, focusing on biofuels. Biomovilidad highlighted Mexico's potential for bioethanol production from sugarcane surplus, advocating for its inclusion in PEMEX’s Sustainability Plan. Bioethanol's environmental, economic, and social benefits were emphasized, citing its role in reducing fossil fuel reliance and meeting global sustainability goals.

To get more information on this market Request Sample

Biofuels at the Forefront of Green Mobility Plans

Mexico is advancing efforts to reduce the carbon intensity of transportation fuels through a new policy initiative. This strategy encourages the use of renewable fuels like biofuels, aiming to create a cleaner, low-carbon transportation sector. By adopting a technology-neutral approach, the policy opens opportunities for biofuels and strengthens their role in the country’s energy mix. This move supports Mexico's broader sustainability goals and aligns with global efforts to decarbonize the transport sector. As the policy unfolds, it is expected to foster growth in the biofuels market, benefiting both the environment and local industries while promoting long-term sustainability. Based on an article published in November 2024, New Mexico is advancing its Clean Transportation Fuel Standard (CTFS), modeled after programs in California, Oregon, and Washington. The CTFS aims for a 20% reduction in transportation fuel carbon intensity by 2030 and 30% by 2040. By creating a technology-neutral standard, the program opens new opportunities for biofuels, expanding the state's biofuels market and supporting the broader transition to low-carbon fuels, following the successes of other states.

Mexico Biofuel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and feedstock.

Type Insights:

- Biodiesel

- Ethanol

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes biodiesel, ethanol, and others.

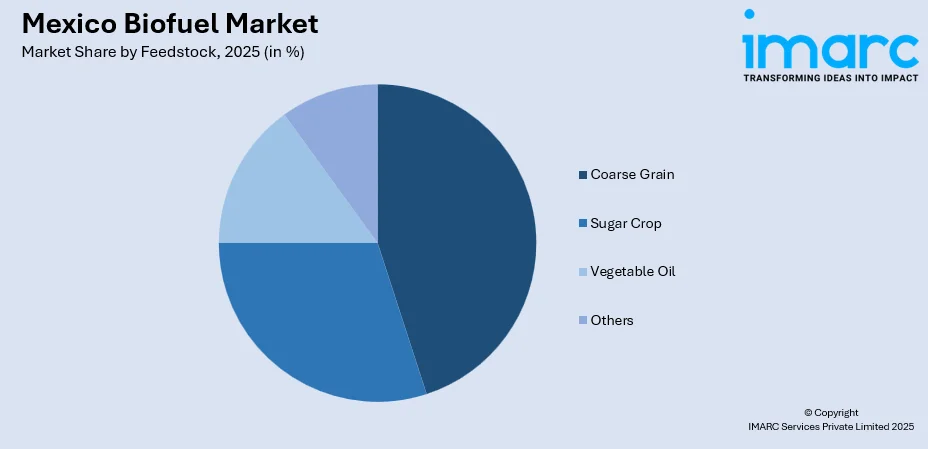

Feedstock Insights:

To get detailed segment analysis of this market Request Sample

- Coarse Grain

- Sugar Crop

- Vegetable Oil

- Others

A detailed breakup and analysis of the market based on the feedstock have also been provided in the report. This includes coarse grain, sugar crop, vegetable oil, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Biofuel Market News:

- In November 2024, GE Aerospace announced plans to begin tests using 100% biofuels at its sustainable aviation fuel (SAF) laboratory in Mexico. The initiative is part of GE’s broader efforts to develop cleaner aviation solutions, supporting the global transition to sustainable aviation. The tests aim to assess the viability of biofuels for future commercial aircraft operations, marking a significant step forward in the advancement of biofuel technology in Mexico.

Mexico Biofuel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Biodiesel, Ethanol, Others |

| Feedstocks Covered | Coarse Grain, Sugar Crop, Vegetable Oil, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico biofuel market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico biofuel market on the basis of type?

- What is the breakup of the Mexico biofuel market on the basis of feedstock?

- What is the breakup of the Mexico biofuel market on the basis of region?

- What are the various stages in the value chain of the Mexico biofuel market?

- What are the key driving factors and challenges in the Mexico biofuel market?

- What is the structure of the Mexico biofuel market and who are the key players?

- What is the degree of competition in the Mexico biofuel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico biofuel market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico biofuel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico biofuel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)