Mexico Biologics Market Size, Share, Trends and Forecast by Source, Product, Disease, Manufacturing, and Region, 2025-2033

Mexico Biologics Market Overview:

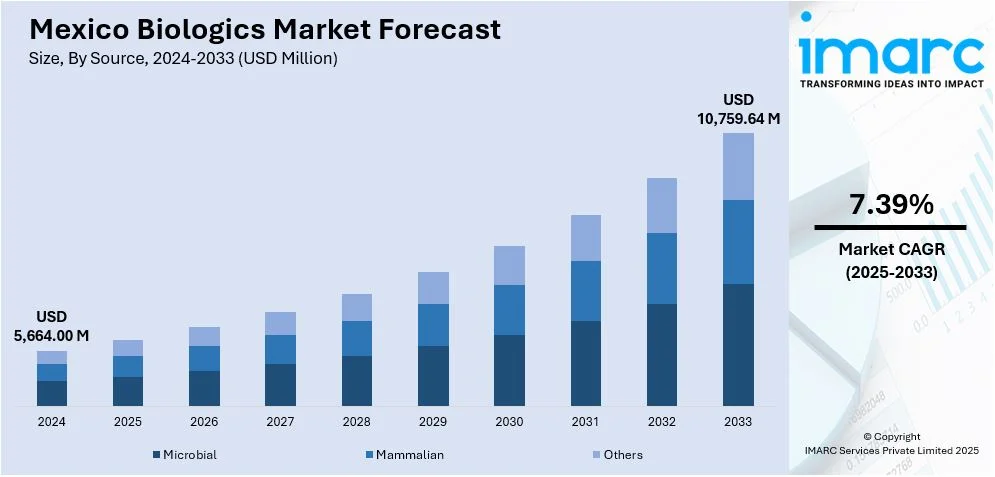

The Mexico biologics market size reached USD 5,664.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 10,759.64 Million by 2033, exhibiting a growth rate (CAGR) of 7.39% during 2025-2033. Advancements in cold chain logistics and distribution, including modernized storage facilities and temperature-controlled transportation, are enhancing the accessibility of biologics in Mexico. In addition, the government’s healthcare modernization efforts, such as improving public health services, adopting digital technologies, and expanding access in rural areas, are facilitating broader adoption of biologics. These initiatives ensure timely, efficient biologic treatments across the country, increasing the Mexico biologics market share and improving healthcare delivery nationwide.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5,664.00 Million |

| Market Forecast in 2033 | USD 10,759.64 Million |

| Market Growth Rate 2025-2033 | 7.39% |

Mexico Biologics Market Trends:

Increased Focus on Healthcare System Modernization

The advancement of Mexico’s healthcare system is a crucial factor for growth in the biologics market, with recent reforms focused on enhancing infrastructure and broadening access to sophisticated medical treatments. Notably, the governing body is improving public health services and integrating digital health technologies to enhance patient care and coordination, thereby increasing access to biologic treatments. The implementation of electronic health records (EHRs) and telemedicine platforms are allowing healthcare professionals to optimize care, guaranteeing that patients can access timely biological therapies, even in distant areas. In 2024, President Claudia Sheinbaum announced five key healthcare initiatives aimed at further modernizing the system, scheduled for implementation in 2025. The strategy involved initiatives to broaden vaccination efforts, modernize hospitals, strengthen the IMSS-Bienestar program, optimize medicine distribution networks, and standardize healthcare access throughout Mexico, with a special emphasis on neglected and rural communities. These changes seek to close the healthcare divide and enhance access to biologic therapies, guaranteeing that biologics are included in treatment plans across the country. As the healthcare system keeps progressing, these initiatives are anticipated to greatly enhance the uptake and market infiltration of biologics, thus making them more accessible to Mexico’s varied population. The continual evolution of the healthcare industry is vital for fostering the development of biologic treatments in both urban and rural areas.

Advances in Cold Chain Logistics and Distribution

Improvements in cold chain logistics and distribution are greatly enhancing the availability of biologics in Mexico, particularly those needing stringent temperature regulation during transport and storage. With the increasing demand for biologic therapies, a focused initiative is emerging to enhance the infrastructure needed for the secure and effective delivery of these treatments. Updated cold storage systems, temperature-regulated transport, and improved monitoring technologies are crucial for making sure biologics arrive at healthcare facilities nationwide in prime condition. These enhancements reduce the risks of biological degradation that may happen from inadequate temperature management, thereby ensuring a steadier and more dependable supply of these essential medications. A prime illustration of this change is the 2025 introduction of new cold chain facilities by UPS Healthcare in Mexico City. The IATA CEIV Pharma certified facilities are specially constructed to manage temperature-sensitive pharmaceutical shipments, able to accommodate products from ambient to frozen conditions. Such advancement not only emphasizes the growing significance of temperature-sensitive logistics within the biologics sector but also demonstrates how international logistics firms are investing in resources to ensure the secure and prompt delivery of biologic products. As these facilities grow and develop, they will improve Mexico’s capacity to distribute biologics effectively, guaranteeing broader access to these essential therapies nationwide. These improvements are central to driving the Mexico biologics market growth, ensuring that biologic therapies reach more patients with greater reliability and efficiency.

Mexico Biologics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on source, product, disease, and manufacturing.

Source Insights:

- Microbial

- Mammalian

- Others

The report has provided a detailed breakup and analysis of the market based on the source. This includes microbial, mammalian, and others.

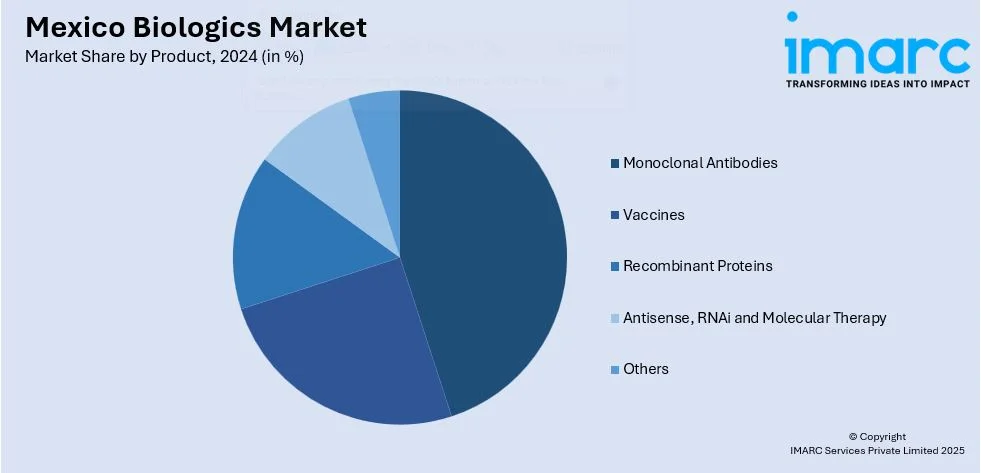

Product Insights:

- Monoclonal Antibodies

- Vaccines

- Recombinant Proteins

- Antisense, RNAi and Molecular Therapy

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes monoclonal antibodies, vaccines, recombinant proteins, antisense, rnai and molecular therapy, and others.

Disease Insights:

- Oncology

- Immunological Disorders

- Cardiovascular Disorders

- Hematological Disorders

- Others

The report has provided a detailed breakup and analysis of the market based on the disease. This includes oncology, immunological disorders, cardiovascular disorders, hematological disorders, and others.

Manufacturing Insights:

- Outsourced

- In-House

A detailed breakup and analysis of the market based on the manufacturing have also been provided in the report. This includes outsourced and in-house.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Biologics Market News:

- In February 2024, Mexico’s COFEPRIS announced a strategic biosimilar development plan to boost local production and regulatory certainty. The plan included two expert units to streamline approvals and foster industry collaboration. Health analysts view it as a regional model with potential long-term economic and public health benefits.

Mexico Biologics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Microbial, Mammalian, Others |

| Products Covered | Monoclonal Antibodies, Vaccines, Recombinant Proteins, Antisense, RNAi and Molecular Therapy, Others |

| Diseases Covered | Oncology, Immunological Disorders, Cardiovascular Disorders, Hematological Disorders, Others |

| Manufacturings Covered | Outsourced, In-House |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico biologics market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico biologics market on the basis of source?

- What is the breakup of the Mexico biologics market on the basis of product?

- What is the breakup of the Mexico biologics market on the basis of disease?

- What is the breakup of the Mexico biologics market on the basis of manufacturing?

- What is the breakup of the Mexico biologics market on the basis of region?

- What are the various stages in the value chain of the Mexico biologics market?

- What are the key driving factors and challenges in the Mexico biologics?

- What is the structure of the Mexico biologics market and who are the key players?

- What is the degree of competition in the Mexico biologics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico biologics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico biologics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico biologics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)