Mexico Biomass Market Size, Share, Trends and Forecast by Feedstock, Application, and Region, 2025-2033

Mexico Biomass Market Overview:

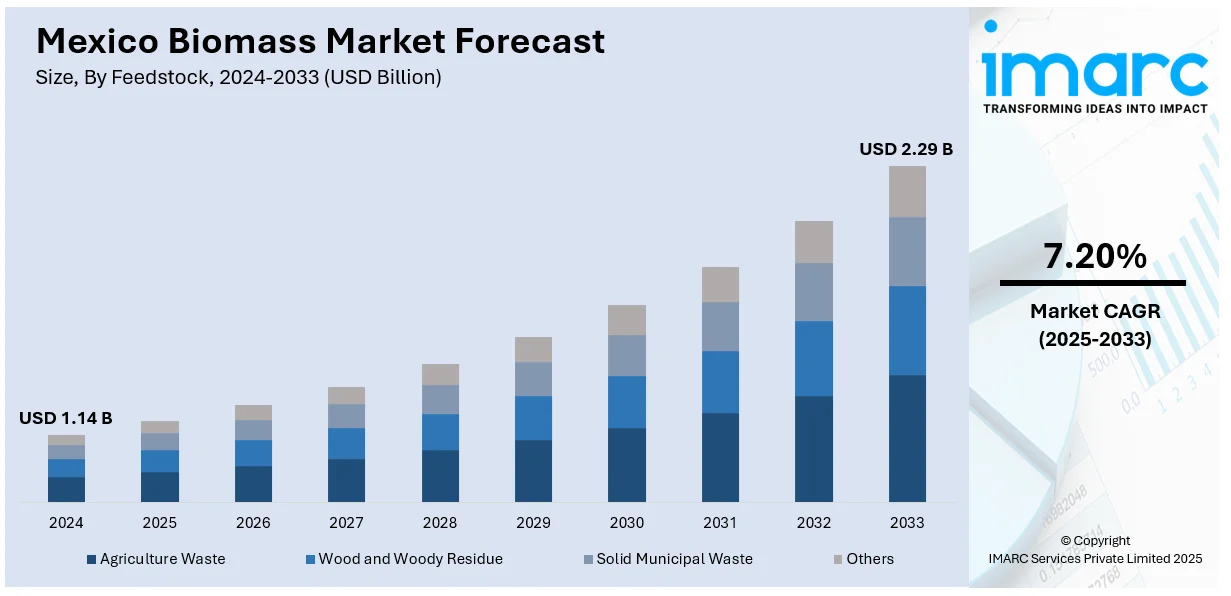

The Mexico biomass market size reached USD 1.14 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.29 Billion by 2033, exhibiting a growth rate (CAGR) of 7.20% during 2025-2033. The implementation of policies and incentives in the renewable energy sector to support the climate goal in line with global agreements is impelling the market growth. Moreover, Mexico is utilizing its agricultural and forestry industries to supply a constant source of raw materials for biomass energy production. This, along with the growing shift of industries towards sustainable practices, is expanding the Mexico biomass market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.14 Billion |

| Market Forecast in 2033 | USD 2.29 Billion |

| Market Growth Rate 2025-2033 | 7.20% |

Mexico Biomass Market Trends:

Increasing Government Support and Policy Implementation

The Mexican biomass industry is experiencing significant growth driven by the implementation of policies and incentives in the renewable energy sector to support climate goal in line with global agreements. Authorities are now providing subsidies, tax relief, and regulatory schemes that are making it increasingly viable financially to undertake biomass energy projects. Mexico's National Renewable Energy Program and Energy Transition Law are repeatedly underlining the need to use biomass for diversifying the energy mix. In addition to this, governments at the state level are establishing pilot programs and public-private ventures that are showcasing biomass viability by regions. This is also empowering rural and farming communities to make money out of organic waste, boosting regional economies. By coordinating policy objectives with market forces, the government is lowering entry barriers for private investors, making biomass energy scalable. As the government keeps building its institutional backing and long-term vision for decarbonization, the biomass market is getting steady momentum through organized support and positive legislation. The Government of Mexico has submitted to congress the Plan for Strengthening and Expansion of the National Electric System 2025-2030 of state-owned electricity firm Federal Electricity Commission (CFE). The plan comprises 51 electricity assignments with a total investment estimated at US$22.3bn to achieve a power generation capacity of 22,674 MW. To achieve this, the CFE is going to build 7 wind farms, 9 solar photovoltaic power plants (673 MW), 5 natural gas-fired combined cycle gas turbine power plants and one internal combustion project (240 MW) within a period of six years.

Abundant Agricultural and Forestry Residue Availability

Mexico is utilizing its agricultural and forestry industries to supply a constant source of raw materials for biomass energy production. Having a significant percentage of the economy reliant on agriculture, the nation is constantly producing significant quantities of crop residues like sugarcane bagasse, corn stalks, and agave wastes. At the same time, forest activities are continually generating sawdust, wood chips, and other lignocellulosic materials perfectly suited for bioenergy conversion. Waste streams once unused or incinerated in fields are now being transformed into high-value fuel sources. Businesses and cooperatives are creating supply chains to gather, haul, and process this organic waste, diverting landfill space and reducing carbon footprints. By incorporating these residues into the circular economy, Mexico is improving energy security and minimizing dependence on imported fossil fuels. The IMARC Group predicts that the Mexico bio agriculture size is expected to reach USD 707.76 Million by 2033.

Rising Demand for Sustainable Energy from Industrial and Commercial Sectors

Industries in Mexico are increasingly shifting toward sustainable practices, and biomass energy is emerging as a preferred alternative to fossil fuels. Manufacturing plants, food processing units, and agribusinesses are adopting biomass-powered systems to reduce their carbon footprint and meet environmental standards, thereby impelling the Mexico biomass market growth. This demand is driven by environmental, social, and governance (ESG) targets that are now influencing operational strategies. Firms are installing biomass boilers and cogeneration units that are running on agricultural waste, enabling them to lower energy costs and improve waste management simultaneously. Export-oriented companies are also facing pressure from global partners to reduce emissions across the supply chain, and biomass energy is offering a cost-effective route. Additionally, hotels and commercial establishments are implementing biomass-based heating systems to meet green certification requirements. As industrial and commercial users are prioritizing sustainability and energy efficiency, they are actively investing in biomass infrastructure. In 2024, Solvay opened a cutting-edge biodigester at its Ciudad Juarez manufacturing facility in Mexico. The energy transition initiative produced biomethane from locally treated organic waste to substitute for some of the natural gas required to fuel the site's boiler and kiln processes.

Mexico Biomass Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on feedstock and application.

Feedstock Insights:

- Agriculture Waste

- Wood and Woody Residue

- Solid Municipal Waste

- Others

The report has provided a detailed breakup and analysis of the market based on the feedstock. This includes agriculture waste, wood and woody residue, solid municipal waste, and others.

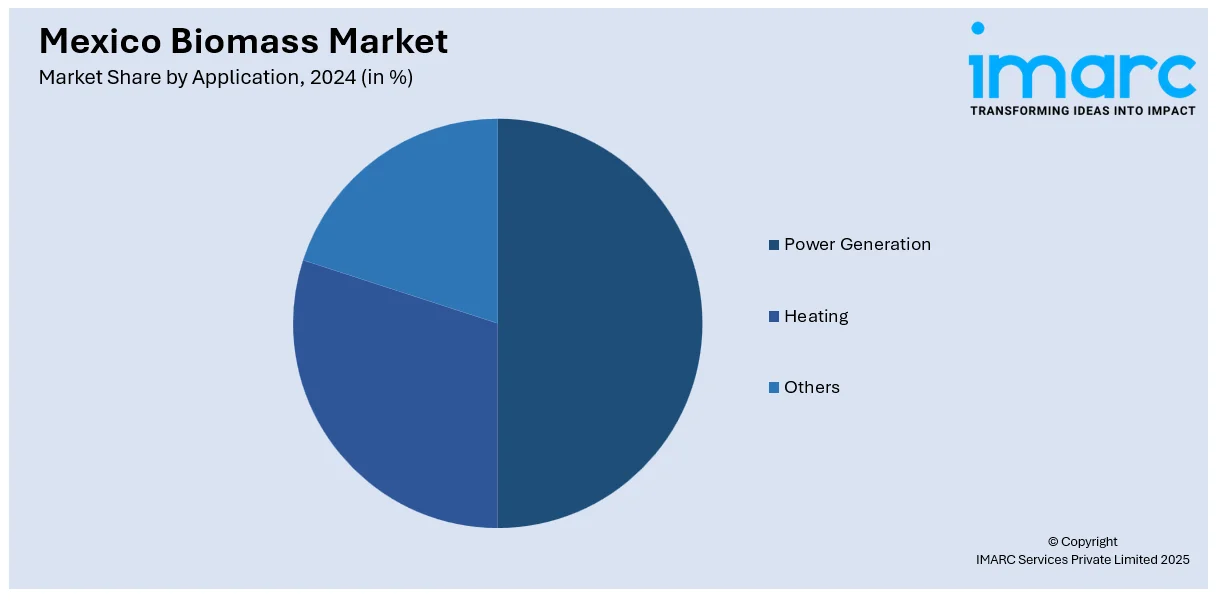

Application Insights:

- Power Generation

- Heating

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes power generation, heating, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Biomass Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Feedstocks Covered | Agriculture Waste, Wood and Woody Residue, Solid Municipal Waste, Others |

| Applications Covered | Power Generation, Heating, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico biomass market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico biomass market on the basis of feedstock?

- What is the breakup of the Mexico biomass market on the basis of application?

- What is the breakup of the Mexico biomass market on the basis of region?

- What are the various stages in the value chain of the Mexico biomass market?

- What are the key driving factors and challenges in the Mexico biomass market?

- What is the structure of the Mexico biomass market and who are the key players?

- What is the degree of competition in the Mexico biomass market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico biomass market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico biomass market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico biomass industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)