Mexico Biometrics Market Size, Share, Trends and Forecast by Technology, Functionality, Component, Authentication, End User and Region, 2025-2033

Mexico Biometrics Market Overview:

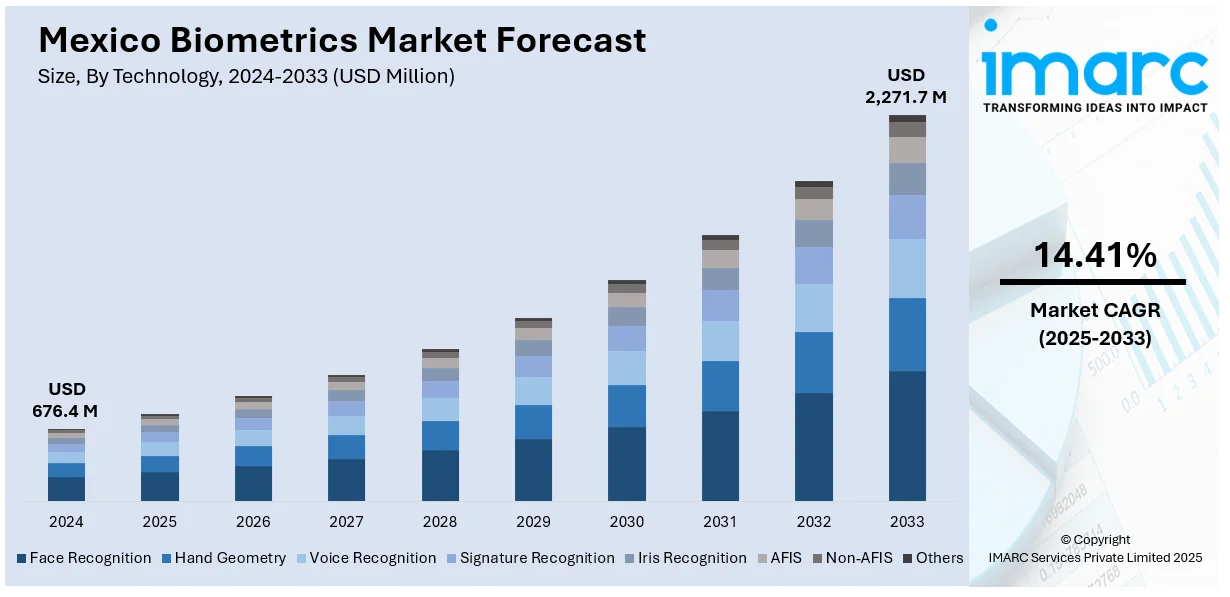

The Mexico biometrics market size reached USD 676.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,271.7 Million by 2033, exhibiting a growth rate (CAGR) of 14.41% during 2025-2033. The market is characterized by growing security issues, government plans for digital ID systems, growing adoption in the banking and financial industries, and technological developments. Moreover, enhanced demand for contactless authentication in healthcare, transportation, and mobile applications, as well as identity verification regulations, also contribute to the Mexico biometrics market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 676.4 Million |

| Market Forecast in 2033 | USD 2,271.7 Million |

| Market Growth Rate 2025-2033 | 14.41% |

Mexico Biometrics Market Trends:

Growing Adoption of Contactless Biometrics

In Mexico, the trend toward contactless biometric technology has grown significantly due to the requirements of increased convenience and hygiene. During and after the pandemic, there has been increased demand for non-contact authenticators, especially among public organizations, transportation systems, and the financial sector. Solutions such as facial recognition and iris scanning have seen increased acceptance based on the promise to offer end-to-end seamless and secure user experiences with zero physical interaction. This trend also finds support with the growing access to smartphones and devices with native facial recognition facilities, serving the needs of consumer and enterprise customers. The private sector and the government are increasingly adopting contactless biometric technologies to enhance security, prevent fraud, and facilitate user engagement with different services. As concerns over privacy increase, contactless biometrics will continue to grow in use, further establishing Mexico as a trendsetter in advanced biometric solutions for public and private sectors.

Integration of Biometrics in Financial Services

Mexico's banking industry is witnessing a fast transition towards biometric authentication to combat security concerns pertaining to online banking. Banks are increasingly implementing biometric technology such as fingerprint and facial recognition to provide added security for online banking, mobile transactions, and ATM usage. As fraud is on the increase, biometrics offers a more secure and convenient option compared to the use of PINs and passwords. Mexican government efforts, especially the initiatives of financial inclusion and digitalization of financial services, also support the adoption of biometric systems by banks and fintech firms. These systems assist in the reduction of identity theft, the avoidance of fraud, and improving customer experience through faster, more dependable authentication. The increasing confidence in biometric systems, along with regulatory assistance, is anticipated to propel further use in Mexico's financial system, enhancing access to efficient and secure banking services, particularly among the unbanked and underbanked.

Government Initiatives and Digital ID Programs

Mexico's government is leading the adoption of biometric technologies with numerous initiatives focused on increasing national security and enhancing public services. The most visible program is the rollout of digital identification schemes, where biometrics are employed to authenticate citizens for a range of services such as voting, social security, and health care access. The Federal Government has also rolled out biometric-enabled identification cards that seek to offer increased security against fraud and more effective service delivery. The programs are in line with Mexico's wider digital transformation strategy, which seeks to bring modernity to public sector services while retaining high levels of security and privacy. In addition to these programs, there is growing investment in biometric infrastructure, including facial recognition and fingerprint scanner technologies, to enhance border, airport, and government building security. Continued funding and expansion of these initiatives are expected to continue driving biometric use nationwide.

Mexico Biometrics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on technology, functionality, component, authentication, and end user.

Technology Insights:

- Face Recognition

- Hand Geometry

- Voice Recognition

- Signature Recognition

- Iris Recognition

- AFIS

- Non-AFIS

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes face recognition, hand geometry, voice recognition, signature recognition, iris recognition, AFIS, non-AFIS, and others.

Functionality Insights:

- Contact

- Non-contact

- Combined

A detailed breakup and analysis of the market based on the functionality have also been provided in the report. This includes contact, non-contact, and combined.

Component Insights:

- Hardware

- Software

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware and software.

Authentication Insights:

- Single-Factor Authentication

- Multifactor Authentication

A detailed breakup and analysis of the market based on the authentication has also been provided in the report. This includes single-factor authentication and multifactor authentication.

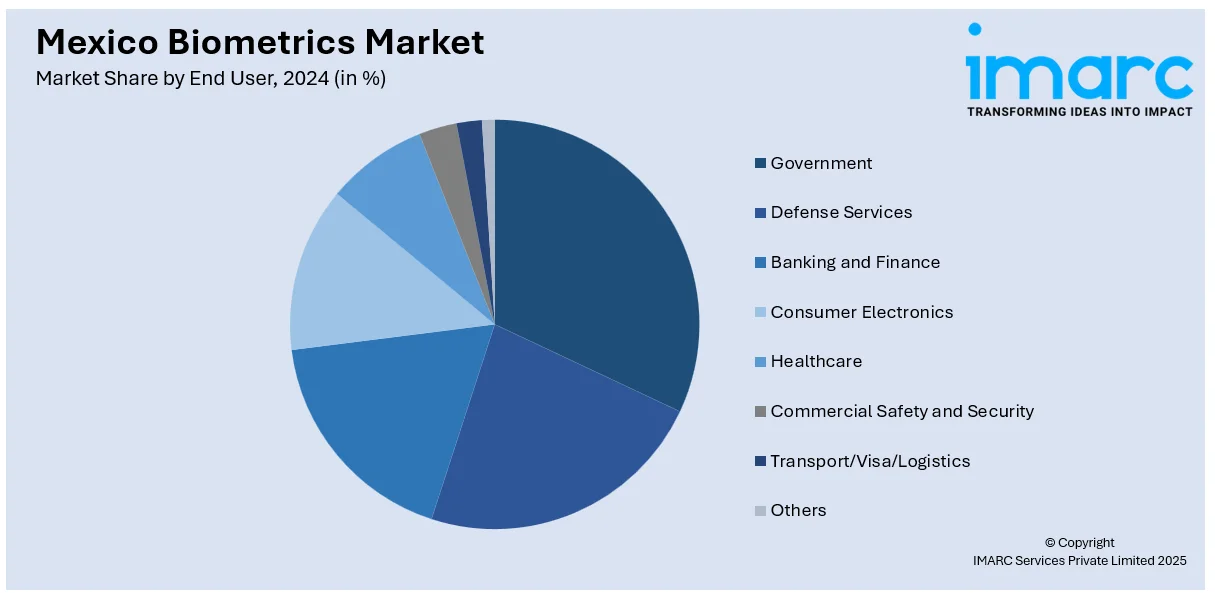

End User Insights:

- Government

- Defense Services

- Banking and Finance

- Consumer Electronics

- Healthcare

- Commercial Safety and Security

- Transport/Visa/Logistics

- Others

A detailed breakup and analysis of the market based on the end user has also been provided in the report. This includes government, defense services, banking and finance, consumer electronics, healthcare, commercial safety and security, transport/visa/logistics, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Biometrics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Face Recognition, Hand Geometry, Voice Recognition, Signature Recognition, Iris Recognition, AFIS, Non-AFIS, Others |

| Functionalities Covered | Contact, Non-contact, Combined |

| Components Covered | Hardware, Software |

| Authentications Covered | Single-Factor Authentication, Multifactor Authentication |

| End Users Covered | Government, Defense Services, Banking and Finance, Consumer Electronics, Healthcare, Commercial Safety and Security, Transport/Visa/Logistics, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico biometrics market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico biometrics market on the basis of technology?

- What is the breakup of the Mexico biometrics market on the basis of functionality?

- What is the breakup of the Mexico biometrics market on the basis of component?

- What is the breakup of the Mexico biometrics market on the basis of authentication?

- What is the breakup of the Mexico biometrics market on the basis of end user?

- What is the breakup of the Mexico biometrics market on the basis of region?

- What are the various stages in the value chain of the Mexico biometrics market?

- What are the key driving factors and challenges in the Mexico biometrics market?

- What is the structure of the Mexico biometrics market and who are the key players?

- What is the degree of competition in the Mexico biometrics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico biometrics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico biometrics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico biometrics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)