Mexico Biopharmaceutical Packaging Market Size, Share, Trends and Forecast by Material, Packaging Type, Application, and Region, 2025-2033

Mexico Biopharmaceutical Packaging Market Overview:

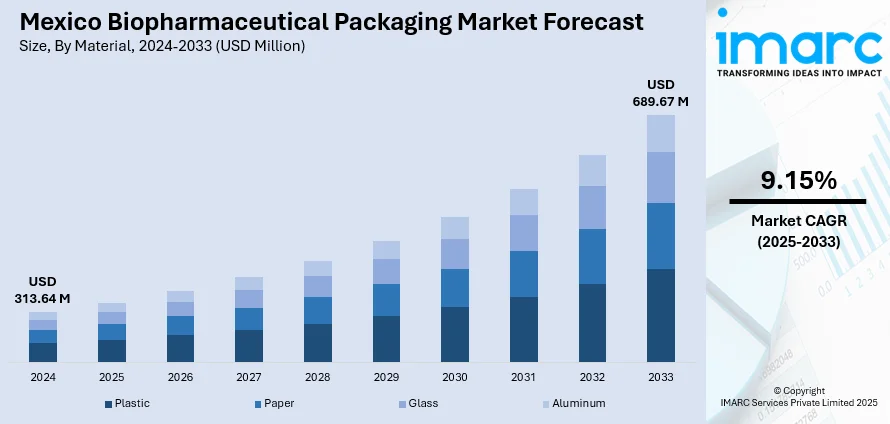

The Mexico biopharmaceutical packaging market size reached USD 313.64 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 689.67 Million by 2033, exhibiting a growth rate (CAGR) of 9.15% during 2025-2033. The expanding pharmaceutical industry, bolstered by increased production of vaccines and biologics, necessitates advanced packaging solutions to ensure product integrity and compliance with stringent regulatory standards is impelling the market growth. Innovations in drug delivery systems, such as prefilled syringes and autoinjectors, are also influencing packaging requirements, emphasizing the need for materials that ensure dosage accuracy and patient safety. Additionally, the growing demand for generic drugs and the emphasis on sustainable, eco-friendly packaging materials are surging the Mexico biopharmaceutical packaging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 313.64 Million |

| Market Forecast in 2033 | USD 689.67 Million |

| Market Growth Rate 2025-2033 | 9.15% |

Mexico Biopharmaceutical Packaging Market Analysis:

- Major Market Drivers: Mexico biopharmaceutical packaging market demand is growing as a result of greater biologic production, expansion in healthcare expenditure, and more stringent safety regulations. Sterilization-assuring packaging innovations that provide product stability and extended shelf life are becoming mandatory to address domestic and export pharmaceutical needs.

- Key Market Trends: Trending developments include the use of sustainable and recyclable packaging materials, intelligent labeling with track-and-trace functionality, and the growth of prefilled syringes and vials. Firms are also making steps forward in barrier materials for protection of biologics, as well as mirroring the worldwide march toward safer, greener, and more efficient solutions.

- Competitive Landscape: Mexico biopharmaceutical packaging industry trends demonstrate intense competition among multinational and local companies, with sterile containers, blister packs, and flexible packaging innovations. Strategic alliances with pharma manufacturers and new technology investments are enhancing efficiency and allowing for better biosimilars packaging positioning.

- Opportunities and Challenges: Challenges encompass regulatory compliance expense, large investments in sterile packaging, and complicated supply chains. Opportunities, however, are available through personalized medicine, biologics expansion, and green packaging innovation, making Mexico a strategic location for biopharmaceutical packaging in Latin America.

Mexico Biopharmaceutical Packaging Market Trends:

Rise of Prefilled Syringes and Single-Dose Formats

Mexican biopharmaceutical firms are turning towards convenience- and safety-oriented packaging solutions. Prefilled syringes and single-dose vials are gaining popularity, particularly for injectable pharmaceuticals and biologics. Patients who are managing chronic diseases can appreciate these formats' convenience in administration, reduced risk of contamination, and enhanced compliance. Convenient packaging is becoming increasingly important as self-medication and home care are increasingly given prominence. Companies are also seeking ways to combine tamper-evident and child-resistant elements, which are essential for regulatory clearance and patient safety. This development is part of a larger trend toward patient-centric healthcare, wherein packaging not only serves to maintain product integrity but also plays a part in the delivery of therapies. To meet the increasing demand for efficient, sterile, and user-friendly drug delivery systems, companies are being pushed by this trend to make investments in innovation, automation, and improved design. The growing adoption of these solutions is strengthening the overall Mexico biopharmaceutical packaging market share as companies adapt to patient-focused needs.

To get more information on this market, Request Sample

Shift Toward Sustainable Packaging Solutions

Environmental responsibility is reshaping how biopharmaceutical packaging is developed in Mexico. The market is driven by evolving regulations and rising consumer demand, companies are shifting toward recyclable, biodegradable, and low-impact materials. Innovations such as mono-material designs, eco-friendly inks, and energy-efficient production aim to meet strict pharmaceutical standards while minimizing environmental harm. A standout example is Envases Universales de México, which reported that 98.2% of its plastic packaging was recyclable or compostable as of 2020. In 2021, it launched Mexico’s largest PET bottle-to-bottle recycling facility, with a 60,000-ton annual capacity, targeting 25% recycled content by 2025. These initiatives reflect broader efforts across the industry to reduce waste, lower energy use, and redesign supply chains. Sustainable packaging supports global environmental goals and boosts operational efficiency and brand value, positioning companies for long-term success in a greener future. These trends are shaping a more competitive and sustainable future for the Mexico biopharmaceutical packaging market analysis.

Adoption of Smart Packaging Technologies

In Mexico's biopharmaceutical industry, packaging is no longer merely a container it's becoming a means of communication and quality control. Intelligent packaging technologies such as quick response (QR) codes, radio frequency identification (RFID) tags, and embedded sensors are being implemented to enhance traceability, guarantee drug authenticity, and track storage conditions in real time. These technologies assist in safeguarding against counterfeiting and supply chain mistakes by offering transparency and information at each point. For temperature-sensitive medications, intelligent features can indicate whether a drug has been stored properly during distribution. These technologies also enable patient engagement by providing access to dosage information, reminders, and product authentication via smartphones. As the healthcare system becomes more modernized, adding intelligence to packaging improves patient safety and facilitates regulatory compliance further strengthening the Mexico biopharmaceutical packaging market growth.

Mexico Biopharmaceutical Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on material, packaging type, and application.

Material Insights:

- Plastic

- Paper

- Glass

- Aluminum

The report has provided a detailed breakup and analysis of the market based on the material. This includes plastic, paper, glass, and aluminum.

Packaging Type Insights:

- Vials

- Bottles

- Ampoules

- Syringes

- Cartridges

A detailed breakup and analysis of the market based on the packaging type have also been provided in the report. This includes vials, bottles, ampoules, syringes, and cartridges.

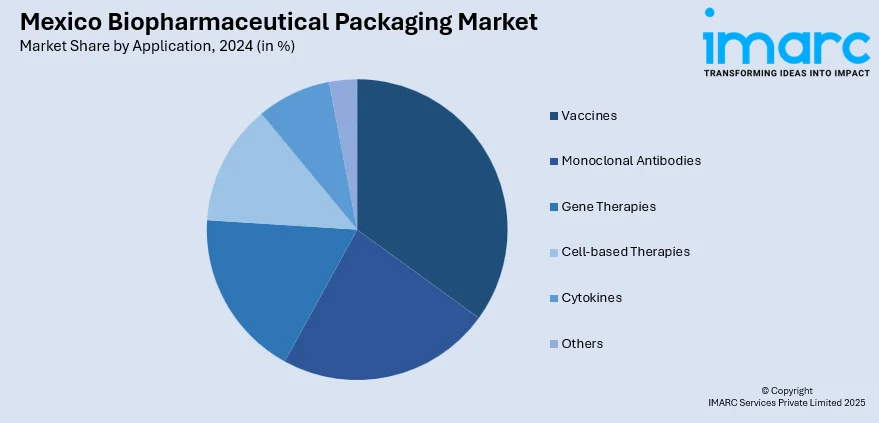

Application Insights:

- Vaccines

- Monoclonal Antibodies

- Gene Therapies

- Cell-based Therapies

- Cytokines

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes vaccines, monoclonal antibodies, gene therapies, cell-based therapies, cytokines, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Biopharmaceutical Packaging Market News:

- December 2024 – Gerresheimer invested €100 million to expand its Skopje, North Macedonia facility with a 7,600 m² hall dedicated to glass syringe manufacturing. The plant unites glass and plastic capacities under one roof, allowing for integrated pharmaceutical packaging solutions, sophisticated inspection systems, and ready-to-fill syringe lines.

- July 2024 – Aluflexpack launched its 4∞ Form fully recyclable blister pack, specifically for the pharmaceutical market. Composed wholly of lacquered aluminium, the technology offers enhanced barrier protection, longer shelf life, and sustains environmental concerns by displacing multimaterial alternatives and leading the company to the forefront of environmentally friendly pharmaceutical packaging.

Mexico Biopharmaceutical Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Plastic, Paper, Glass, Aluminum |

| Packaging Types Covered | Vials, Bottles, Ampoules, Syringes, Cartridges |

| Applications Covered | Vaccines, Monoclonal Antibodies, Gene Therapies, Cell-based Therapies, Cytokines, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico biopharmaceutical packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico biopharmaceutical packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico biopharmaceutical packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The biopharmaceutical packaging market in Mexico was valued at USD 313.64 Million in 2024.

The Mexico biopharmaceutical packaging market is projected to exhibit a (CAGR) of 9.15% during 2025-2033, reaching a value of USD 689.67 Million by 2033.

The packaging market is driven by amplifying demand for advanced drug delivery systems, growing investments in pharmaceutical manufacturing, and regulatory emphasis on patient safety and product integrity. Heightening adoption of sustainable materials and innovative packaging technologies further supports market expansion, catering to evolving healthcare and biopharma industry needs.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)