Mexico Bioplastics Market Size, Share, Trends and Forecast by Product, Application, Distribution Channel, and Region, 2025-2033

Mexico Bioplastics Market Overview:

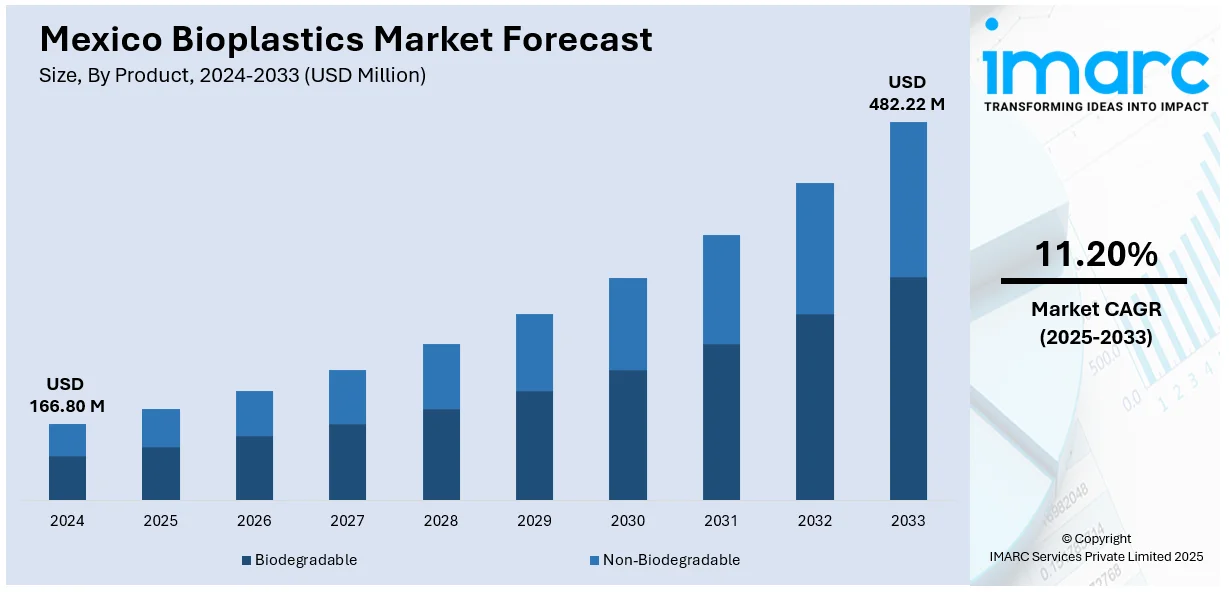

The Mexico bioplastics market size reached USD 166.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 482.22 Million by 2033, exhibiting a growth rate (CAGR) of 11.20% during 2025-2033. The market is driven by regulatory pressure and sustainable packaging mandates. Also, continual technological advancements and the diversification of applications are fueling the product adoption. Additionally, growing consumer awareness and implementation of corporate sustainability initiatives are increasing bioplastics usage. Government regulations, industry innovation, and environmental consciousness are further expanding the Mexico bioplastics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 166.80 Million |

| Market Forecast in 2033 | USD 482.22 Million |

| Market Growth Rate 2025-2033 | 11.20% |

Mexico Bioplastics Market Trends:

Regulatory Pressure and Sustainable Packaging Mandates

Mexico's legislative landscape is increasingly favoring biodegradable and bio-based materials, particularly within the packaging sector. The 2020 ban on single-use plastics in Mexico City, encompassing items such as bags, straws, and utensils, has catalyzed a shift toward sustainable alternatives. This regulatory momentum has prompted manufacturers and retailers to adopt bioplastics to comply with environmental mandates. The packaging industry, being among the largest consumers of plastics, is now adding bioplastics to food packaging, shopping bags, and wrapping films. This transition is also compelled by the need for sustainable products from consumers, which is pressurizing firms to follow along with sustainability targets, and these regulatory measures and consumer trends are propelling the Mexico bioplastics market growth, as industries transform to abide by new green regulations.

Technological Advancements and Diversification of Applications

Many new technologies for producing bioplastics are leading to the broadening of their use in many industries in Mexico. Polymer science has improved to create bioplastics with improved properties, including higher durability and thermal stability, which can be used in automotive components, electronics enclosures, and agricultural films. The car industry, for example, is integrating bioplastics into interior parts to save weight and enhance fuel efficiency. In agriculture, biodegradable mulch films are applied to build a healthier soil and minimize plastic waste. Such technological advancements not only expand the range of bioplastics applications but also enhance their competitiveness with traditional plastics. As companies look for sustainable materials that satisfy performance standards, the use of advanced bioplastics will grow, solidifying their position in Mexico's industrial sector.

Consumer Awareness and Corporate Sustainability Initiatives

Rising environmental consciousness among consumers in Mexico is influencing purchasing behaviors, leading to increased demand for products made from sustainable materials. This shift is prompting companies to integrate bioplastics into their product lines to meet consumer expectations and corporate sustainability targets. Retailers are offering biodegradable packaging options, while consumer goods manufacturers are developing bioplastic-based products to appeal to environmentally conscious buyers. Corporate commitments to reduce carbon footprints and enhance brand image are driving investments in bioplastics research and development. These initiatives are not only meeting consumer demand but also positioning companies as leaders in sustainability. As corporate and consumer priorities align toward environmental responsibility, the integration of bioplastics into various products is expected to accelerate, contributing to the market's expansion.

Mexico Bioplastics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, application, and distribution channel.

Product Insights:

- Biodegradable

- Polylactic Acid

- Starch Blends

- Polybutylene Adipate Terephthalate (PBAT)

- Polybutylene Succinate (PBS)

- Others

- Non-Biodegradable

- Polyethylene

- Polyethylene Terephthalate

- Polyamide

- Polytrimethylene Terephthalate

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes biodegradable (polylactic acid, starch blends, polybutylene adipate terephthalate (PBAT), polybutylene succinate (PBS), and others) and non-biodegradable (polyethylene, polyethylene terephthalate, polyamide, polytrimethylene terephthalate, and others).

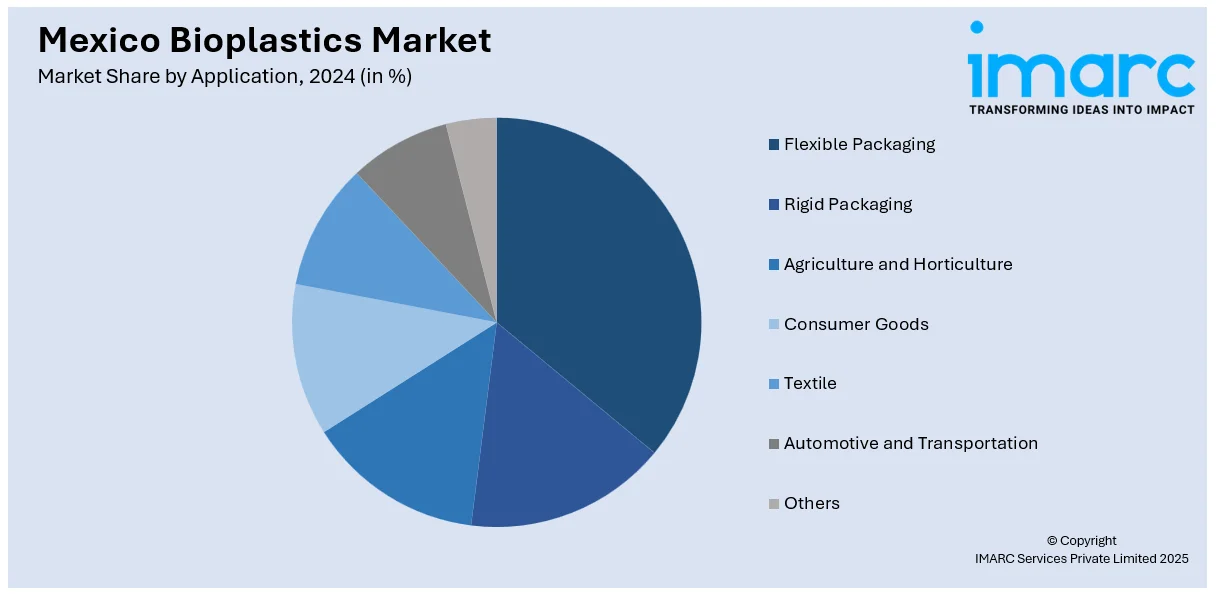

Application Insights:

- Flexible Packaging

- Rigid Packaging

- Agriculture and Horticulture

- Consumer Goods

- Textile

- Automotive and Transportation

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes flexible packaging, rigid packaging, agriculture and horticulture, consumer goods, textile, automotive and transportation, and others.

Distribution Channel Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online and offline.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has provided a comprehensive analysis of all major regional markets. This includes Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Bioplastics Market News:

- On 30 April 2025, AORA Mexico announced its achievement of plastic-negative certification through its partnership with rePurpose Global, removing twice as much plastic waste from the environment as it uses in packaging. The company is now incorporating bio-based materials into its product lines, targeting a full transition to sustainable alternatives while maintaining packaging performance standards. This initiative aligns with Mexico's broader move toward circularity and innovation in bioplastics, especially in the consumer goods and personal care sectors.

Mexico Bioplastics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Applications Covered | Flexible Packaging, Rigid Packaging, Agriculture and Horticulture, Consumer Goods, Textile, Automotive and Transportation, Others |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico bioplastics market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico bioplastics market on the basis of product?

- What is the breakup of the Mexico bioplastics market on the basis of application?

- What is the breakup of the Mexico bioplastics market on the basis of distribution channel?

- What is the breakup of the Mexico bioplastics market on the basis of region?

- What are the various stages in the value chain of the Mexico bioplastics market?

- What are the key driving factors and challenges in the Mexico bioplastics market?

- What is the structure of the Mexico bioplastics market and who are the key players?

- What is the degree of competition in the Mexico bioplastics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico bioplastics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico bioplastics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico bioplastics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)