Mexico Biscuits Market Size, Share, Trends and Forecast by Product Type, Ingredient, Packaging Type, Distribution Channel, and Region, 2025-2033

Mexico Biscuits Market Overview:

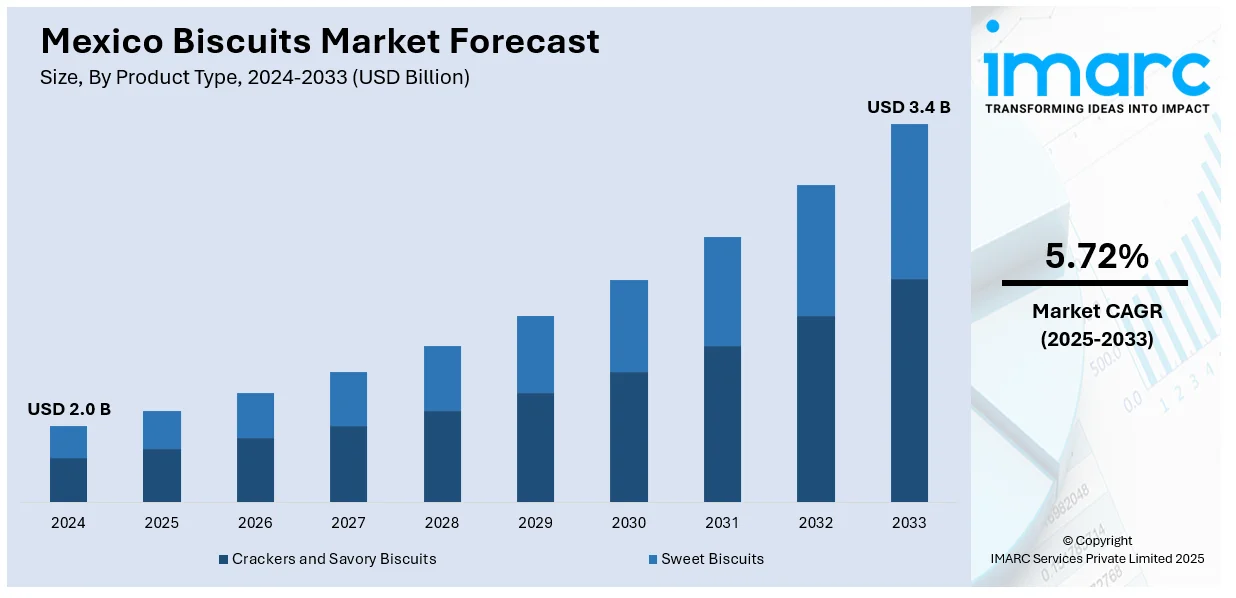

The Mexico biscuits market size reached USD 2.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.4 Billion by 2033, exhibiting a growth rate (CAGR) of 5.72% during 2025-2033. The market is witnessing steady growth as a result of mounting consumer demand for packaged convenience foods, increasing urbanization, greater disposable incomes, and changing eating habits, fueled by broader availability of products in modern retail channels and growing digital sales channels.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.0 Billion |

| Market Forecast in 2033 | USD 3.4 Billion |

| Market Growth Rate 2025-2033 | 5.72% |

Mexico Biscuits Market Trends:

Rise in Health-Oriented Biscuit Preferences

Wellness and health trends are influencing food purchases across food categories in Mexico, including biscuits. Buyers are more concerned with nutritional information, seeking out biscuits containing whole grains, less sugar, and functional ingredients such as oats, seeds, and plant-based options. This trend mirrors a wider recognition of lifestyle diseases and eating habits. Companies have reacted by creating formulations appealing to calorie-aware and digestive health-oriented consumers. For example, In August 2024, OREO and Coca-Cola introduced limited-edition Coca-Cola® OREO™ Zero Sugar and OREO® Coca-Cola™ cookies in Mexico and other markets, combining global branding with local biscuit creativity and themed experiences. Moreover, there is increased uptake of gluten-free and vegan versions, especially in urban centers where awareness is high. This shifting consumer behavior is impacting shelf life in supermarkets and convenience stores, with healthier types experiencing quicker restocking cycles. The Mexico biscuits market outlook suggests tremendous potential for expansion in this health-conscious segment. Since the consumer continues to put increasing stress on physical wellness, biscuits targeted towards health will be predicted to gain momentum and maintain their spot in regular snacking culture throughout various income and age brackets.

Premiumization and Artisanal Appeal in Biscuit Offerings

Mexican shoppers are intensely turning towards premium and artisanal biscuit products that provide unique taste, texture, and packaging. As per the sources, in April 2024, Paris Baguette North America made its foray into Mexico through a master franchise model with 100+ bakery-cafés selling premium pastries, artisanal breads, sandwiches, salads, and specialty coffee. Moreover, the trend is part of a larger cultural trend to appreciate craftsmanship and authenticity in food. Small-batch products that incorporate natural ingredients or heritage recipes are becoming highly prominent in boutique shops and artisan bakeries. Flavors such as almond, fig, and spiced chocolate are breaking through, appealing to a segment looking for originality rather than mass-produced competition. In addition, appealing packaging and limited-batch flavors are driving impulse purchasing behavior. These brands are commonly purchased based on gifting moments, special indulgence, or lifestyle fit versus routine consumption. With disposable income on the upswing and food serving as an expression of self, the premium biscuit market continues to grow. The Mexican biscuits market share is being increasingly determined by the need for premium, specialty products that distinguish on the basis of quality, appearance, and a perceived association with local or gourmet food traditions.

Digital Retail Expansion Boosting Biscuit Accessibility

Online shopping channels are becoming an increasingly important avenue for biscuit distribution in Mexico. Initially adopted as a convenience during the pandemic, this shift has evolved into a lasting change in consumer behavior. Today, shoppers want their favorite brands of biscuits made available through digital platforms, be it through supermarket apps, third-party marketplaces, or directly owned digital channels by brands. Convenience in digital form is particularly appealing to city consumers who are looking for speedy access, subscription services, and tailored recommendations. Small manufacturers have also utilized social media channels to provide direct-to-consumer (D2C) opportunities, allowing access to local and artisanal biscuits beyond regional constraints. Special promotions, offers, and bundling strategies have further accelerated online purchasing momentum. Mexico biscuits market growth is highly being supported by this multi-channel retail strategy. As increasingly more consumers turn to digital solutions for grocery and food purchases, businesses are spending on last-mile delivery, listings optimization, and digital advertising to cement their presence in this fast-growing sales channel.

Mexico Biscuits Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, ingredient, packaging type, and distribution channel.

Product Type Insights:

- Crackers and Savory Biscuits

- Plain Crackers

- Flavored Crackers

- Sweet Biscuits

- Plain Biscuits

- Cookies

- Sandwich Biscuits

- Chocolate-coated Biscuits

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes crackers and savory biscuits (plain crackers, flavored crackers), and sweet biscuits (plain biscuits, cookies, sandwich biscuits, chocolate-coated biscuits, others)

Ingredient Insights:

- Wheat

- Oats

- Millets

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes wheat, oats, millets, and others.

Packaging Type Insights:

- Pouches/Packets

- Jars

- Boxes

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes pouches/packets, jars, boxes, and others.

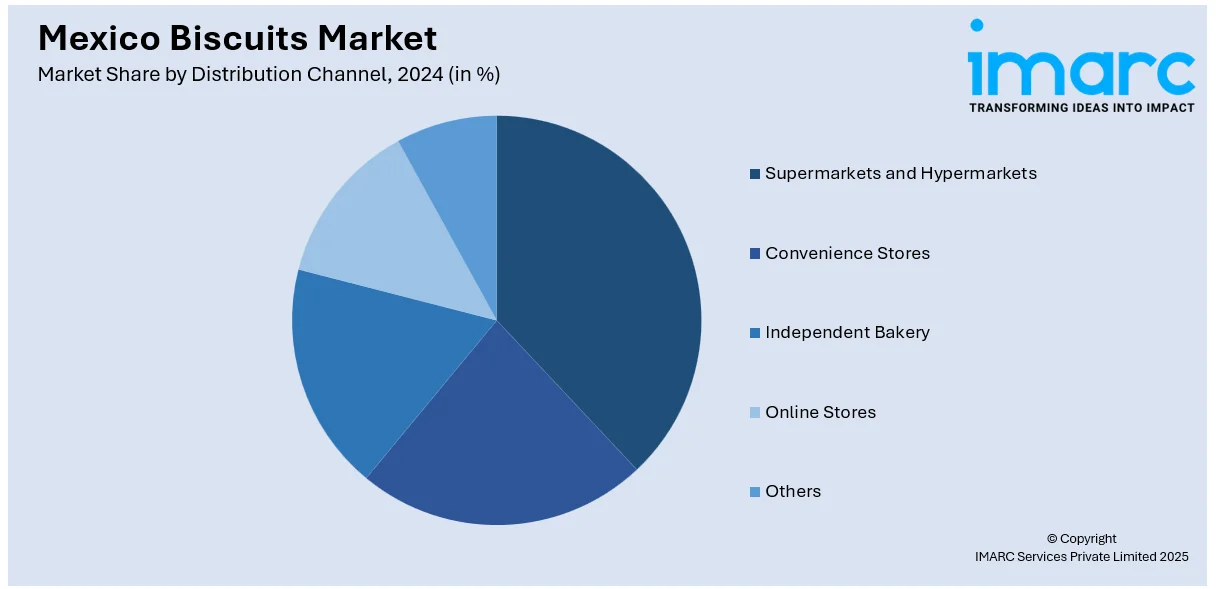

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Independent Bakery

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, independent bakery, online stores, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Biscuits Market News:

- In January 2025, La Monarca Bakery rolled out its flagship Wedding Cookies at all of Costco's Mexico stores. As a brand synonymous with genuine Hispanic baked goods, the U.S.-based company returns to its heritage. The move underscores La Monarca's dedication to spreading traditional Mexican tastes to an expanded global market.

- In August 2024, La Monarca Bakery introduced its Crunchy Cinnamon Churro Cookies to celebrate Hispanic Heritage Month. Mid-September launches at 59 Southern California Costco warehouses, the baked goods redefine classic churros with a crunchy twist, extending the brand's commitment to share the "Sweet Flavor of Mexico™" with authentic ingredients.

Mexico Biscuits Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Ingredients Covered | Wheat, Oats, Millets, Others |

| Packaging Types Covered | Pouches/Packets, Jars, Boxes, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Independent Bakery, Online Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico biscuits market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico biscuits market on the basis of product type?

- What is the breakup of the Mexico biscuits market on the basis of ingredient?

- What is the breakup of the Mexico biscuits market on the basis of packaging type?

- What is the breakup of the Mexico biscuits market on the basis of distribution channel?

- What is the breakup of the Mexico biscuits market on the basis of region?

- What are the various stages in the value chain of the Mexico biscuits market?

- What are the key driving factors and challenges in the Mexico biscuits?

- What is the structure of the Mexico biscuits market and who are the key players?

- What is the degree of competition in the Mexico biscuits market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico biscuits market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico biscuits market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico biscuits industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)